Current Report Filing (8-k)

December 14 2018 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 14, 2018

BRIGHTCOVE INC.

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

DELAWARE

|

|

001-35429

|

|

20-1579162

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

290 Congress Street, Boston, MA

|

|

02210

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (888)

882-1880

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17

CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On December 14, 2018, Brightcove Inc. (the “Company”) entered into a Second Amended and Restated Loan and Security Agreement (the “Second

Restated Loan Agreement”) with Silicon Valley Bank (the “Bank”). The Second Restated Loan Agreement amends and restates the Amended and Restated Loan and Security Agreement, dated as of November 19, 2015, by and between the

Company and the Bank (the “Prior Loan Agreement”).

The Second Restated Loan Agreement provides for a revolving line of credit of up to

$30,000,000 which replaces the Company’s existing revolving line of credit of up to $20,000,000. Borrowings under the Second Restated Loan Agreement accrue interest at either (at the Company’s option): (i) the greater of (A) the prime

rate; and (B) 4.0%; or (ii) the greater of (A) LIBOR plus 2.25%; or (B) 4.0%, and are secured by substantially all of the Company’s assets, excluding its intellectual property. As of December 14, 2018, no amounts were outstanding

under the Prior Loan Agreement. As of December 14, 2018, no amounts are outstanding under the Second Restated Loan Agreement. The revolving line of credit provided to the Company under the Second Restated Loan Agreement terminates on

December 14, 2021.

The Second Restated Loan Agreement also contains certain financial covenants, including (i) a minimum Adjusted Quick Ratio

(as defined in the Second Restated Loan Agreement) of at least 1.25 to 1.0, tested monthly and (ii) Minimum Adjusted

non-GAAP

Net Income (as defined in the Second Restated Loan Agreement) of at least

$1.00, tested quarterly only when the principal amount outstanding under the Second Restated Loan Agreement is at least $15,000,000. The Second Restated Loan Agreement contains customary representations and warranties, as well as certain

non-financial

covenants, including limitations on the Company’s ability to change the principal nature of its business, engage in any change of control transaction, incur additional indebtedness or liens, pay

dividends, make investments or acquisitions and engage in transactions with affiliates.

The foregoing description of the Second Restated Loan Agreement

is qualified in its entirety by reference to the full text of the Second Restated Loan Agreement, which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement of a Registrant.

|

The information set forth in response to

Item 1.01 of Form

8-K

above regarding the Second Restated Loan Agreement is incorporated by reference in response to this Item 2.03 of Form

8-K.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: December 14, 2018

|

|

|

|

Brightcove Inc.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Robert Noreck

|

|

|

|

|

|

|

|

Robert Noreck

|

|

|

|

|

|

|

|

Chief Financial Officer

|

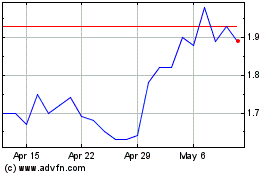

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

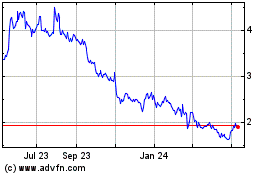

Brightcove (NASDAQ:BCOV)

Historical Stock Chart

From Apr 2023 to Apr 2024