J&J Pulled Into Court Fight -- WSJ

December 14 2018 - 3:02AM

Dow Jones News

At issue is how much freedom shareholders have to file lawsuits

against companies

By Dave Michaels

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 14, 2018).

WASHINGTON -- Johnson & Johnson Inc. is being drawn into a

battle over how much freedom shareholders have to sue companies, in

a bid by lawsuit opponents to force regulators to pick sides over

investors' access to the courts.

Hal Scott, a Harvard University professor who represents a trust

that owns J&J shares, filed a shareholder proposal with the

company that would push shareholder disputes into private

arbitration hearings, instead of federal court. J&J doesn't

want to bring the proposal up for a shareholder vote, and this week

the health-care products company asked the Securities and Exchange

Commission for permission to reject it.

Supporters of mandatory arbitration say it would save companies

money and time, arguing arbitration would be faster and less

expensive than grinding out federal lawsuits involving thousands of

investors. Proponents argue that class-action access to the courts

is vital for holding corporations and executives accountable to

shareholders.

"This is an important issue for the capital markets," Mr. Scott

said in an interview. "It affects whether private companies want to

go public, and whether foreign companies want to list [here]."

About 8.5% of all U.S. exchange-listed companies are projected

to be targets of class-action lawsuits in 2018, according to

Cornerstone Research, a litigation and economic consulting firm.

That is well above the 20-year average of 2.9%, Cornerstone

said.

Securities class-action lawsuits typically focus on claims that

public companies either misled investors about important facts or

events, or failed to disclose important information that would have

altered shareholders' investment decisions.

Much of the expense is born by existing shareholders, with other

shareholders sometimes benefiting from a settlement or judgment.

Research into whether such judgments deter future wrongdoing has

been inconclusive, said Donald Langevoort, a securities-law expert

at Georgetown University.

Mr. Scott is seeking to list his proposal for a bylaw change

that would require mandatory arbitration on J&J's 2019 proxy

statement. J&J shareholders would vote on the measure next

year.

J&J wrote the SEC this week asking permission to exclude the

proposal from its ballot. Forcing investors into arbitration would

violate parts of federal law that forbid asking investors to waive

their legal rights, J&J's attorneys wrote. The SEC rules every

year on whether companies can omit different shareholder proposals.

While public companies could benefit from arbitration, some fear it

would offend investors if they were to push too aggressively for

it.

A J&J spokesman declined comment beyond the company's

letter.

SEC Chairman Jay Clayton has said he wants to avoid a brawl over

mandatory arbitration that would pit business groups against

investors and likely splinter the five-member commission along

party lines.

Some Republican commissioners say arbitration should be given a

shot if stockholders agree with it.

"As far as I can see, the SEC does not have statutory grounds to

substitute its judgment for that of shareholders and the companies

they own," Commissioner Hester Peirce, a Republican member, said in

September.

Robert Jackson Jr., a Democratic commissioner, said in February

that curbs on shareholder lawsuits should be debated only through a

federal rulemaking process. That would allow for analysis by the

agency's economists and lawyers as well as public comments from

investors and companies.

The speedy nature of arbitration probably isn't well suited to

sorting out allegations of market fraud, Mr. Langevoort said.

Federal courts allow both sides to take depositions, determine

witnesses' credibility, and draw on outside experts. "Arbitration

is not really meant for that," he said.

Another downside is that arbitration is private, said Hillary

Sale, also a law professor at Georgetown University.

"We won't have a good understanding of when companies are

committing fraud or in fact behaving in an above-board manner," Ms.

Sale said.

Mr. Scott said mandatory arbitration wouldn't dilute

shareholders' rights, and would only affect where a dispute is

heard, and not whether shareholders can mount a claim.

"All the SEC should decide is the legality of doing this under

federal law," he said.

If the commission decides the proposal can go before J&J's

stockholders, "the roadblock has been lifted," Mr. Scott added.

"Then a number of companies could do this."

Write to Dave Michaels at dave.michaels@wsj.com

(END) Dow Jones Newswires

December 14, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

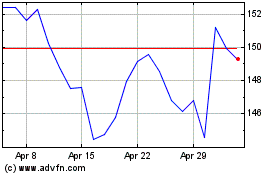

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

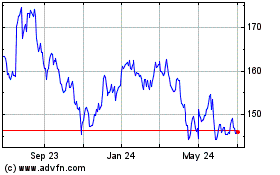

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024