In Selling It's Fintur Shares, Turkcell is Further Focused on Global Growth Through Digital Services

December 12 2018 - 2:02PM

Business Wire

Turkcell (NYSE:TKC) (BIST:TCELL) has taken another big step in

its vision of becoming the world’s leading digital operator.

Company’s transformation strategy from an infrastructure provider

to an international experience provider reached another milestone

today, with the signing of a binding agreement with respect to the

transfer of its shares in its 41.45% owned subsidiary Fintur

Holdings B.V. ("Fintur") to Sonera Holding B.V. The transfer of

shares is expected to be completed following the transfer of

Fintur's subsidiary Kcell JSC to Kazakhtelecom and obtainment of

other regulatory approvals. The final value of the transaction will

be finalized following the respective adjustments. Based on the

calculation over Fintur's financials as of November 30, 2018, the

value of the transaction is anticipated to be approximately EUR 350

million. Following the transaction, Turkcell will continue focusing

on investments providing growth through digital services in the

global arena.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20181212005759/en/

From left, Turkcell CFO Osman Yilmaz,

Chairman of the Board of Kazakhtelecom Kuanyshbek Yessekeev,

Turkcell CEO Kaan Terzioglu, Telia Company Senior Vice President

and Head of Cluster Lithuania, Estonia and Denmark, and Region

Eurasia Emil Nilsson.(Photo: Business Wire)

“An important step to become the world’s leading digital

operator”

Turkcell CEO Kaan Terzioglu stated the following: "Here

in Astana, we announce an important milestone towards our Company's

focus on digital services and strong balance sheet strategies. We

have been working for over one year on the divestment of Fintur, in

which we are a minority shareholder. As a first step, Fintur sold

Kcell. Following that, as Turkcell we signed a binding agreement

with respect to the transfer of our shares in our 41.45% owned

subsidiary Fintur to our partner Telia for approximately EUR 350

million. We anticipate that the cash proceeds from this

transaction, which is expected to be completed in January 2019,

will lower our Net Debt/EBITDA ratio below 1.5 times and our

limited short FX position will turn into a long position. Subject

to the FX rates and balance sheet position on the closing date, the

contribution of this transaction to Turkcell's profitability is

expected to be approximately TRY 850 million. We will continue

investing in accordance with our digital services and growth focus

with the proceeds generated through this transaction. We’ve been

adopting ourselves to this new vision for almost 4 years. And this

vision made us one of the fastest growing operators in the global

market. In addition to our brand; our technology, digital services

portfolio, human capital and our stronger than ever balance sheet

will support our vision to become the world’s leading digital

operator."

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181212005759/en/

Ali KarakayaTurkcell Corporate Communications

Managerali.karakaya@turkcell.com.tr+90 532 210 00 23orBurak

MergenTurkcell Corporate

Communicationsburak.mergen@turkcell.com.tr+90 532 210 60 20orBugra

KayaTurkcell Corporate Communicationsbugra.kaya@turkcell.com.tr+90

532 210 19 75

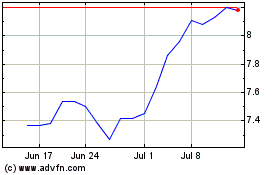

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Mar 2024 to Apr 2024

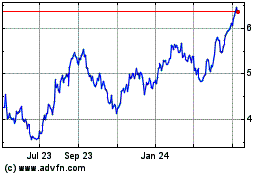

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Apr 2023 to Apr 2024