Current Report Filing (8-k)

December 10 2018 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 6, 2018

uniQure N.V.

(Exact Name of Registrant as Specified in Charter)

|

The Netherlands

|

|

001-36294

|

|

N/A

|

|

(State or Other

Jurisdiction of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

Paasheuvelweg 25a,

1105 BP Amsterdam, The Netherlands

|

|

N/A

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

+31-20-566-7394

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

x

Item 1.01.

Entry into a Material Definitive Agreement.

On December 6, 2018, we signed an amendment to the Second Amended and Restated Loan and Security Agreement with Hercules Technology Growth Capital Inc. (“Hercules”) that both refinanced our existing $20 million credit facility and provided us with an additional commitment of $30 million (of which $15 million is subject to the discretion of Hercules) (the “Amended Facility”). At signing, we drew down an additional $15 million. We are able to draw another $15 million through June 30, 2020 subject to the terms of the Amended Facility.

The Amended Facility extends the loan’s maturity date until June 1, 2023. This includes extending the interest-only period from November 2018 to January 1, 2021, or in the event that we raise more than $90 million in a corporate transaction public offering or complete a phase 3 pivotal study of AMT-061 in patients with Hemophilia B with clinical results that support a new drug application with the U.S. Food and Drug Administration, to January 1, 2022. We are required to repay the facility in equal monthly installments of principal and interest between the end of the interest-only period and the maturity date. The interest rate continues to be adjustable and is the greater of (i) 8.85% or (ii) 8.85% plus the prime rate less 5.50%. Under the Amended Facility, we have paid a facility fee of 0.50% of the $35,000,000 outstanding as of signing and will owe a back-end fee of 4.95% of the outstanding debt.

The foregoing summary of the Amended Facility does not purport to be complete and is qualified in its entirety by reference to the Amended Facility, which is attached as Exhibit 10.1 to this Form 8-K and is incorporated by reference herein.

Item 9.01

Financial Statements and Exhibits

(d)

Exhibits

|

10.1

|

Amendment No. 1 to Second Amended and Restated Loan and Security Agreement dated December 6, 2018

|

2

EXHIBIT INDEX

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

UNIQURE N.V.

|

|

|

|

|

|

|

|

Date: December 10, 2018

|

By:

|

/S/ MATTHEW KAPUSTA

|

|

|

|

Matthew Kapusta

|

|

|

|

Chief Executive Officer and interim Chief Financial Officer

|

4

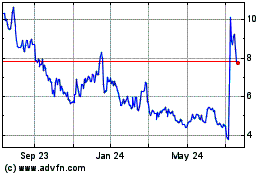

uniQure NV (NASDAQ:QURE)

Historical Stock Chart

From Mar 2024 to Apr 2024

uniQure NV (NASDAQ:QURE)

Historical Stock Chart

From Apr 2023 to Apr 2024