Prospectus Filed Pursuant to Rule 424(b)(5) (424b5)

December 07 2018 - 4:04PM

Edgar (US Regulatory)

Amendment No. 5 to Prospectus

Supplement dated March 10, 2017

(to Prospectus dated February 23, 2017)

|

|

Filed pursuant to Rule 424(b)(5)

File No. 333-216191

|

ZION OIL & GAS, INC.

This Amendment No. 5

to the Prospectus Supplement amends the Prospectus Supplement dated March 10, 2017 (“Original Prospectus Supplement”).

This Amendment No. 5 to Prospectus Supplement should be read in conjunction with the Original Prospectus Supplement and the base

Prospectus effective March 10, 2017. This Amendment No. 5 is incorporated by reference into the Original Prospectus Supplement.

This Amendment No. 5 is not complete without, and may not be delivered or utilized except in connection with, the Original Prospectus

Supplement, including any amendments or supplements thereto.

Investing in our common

stock is risky. See "Risk Factors" commencing at page 22 of the Prospectus Supplement,

our

most recent Annual Report on Form 10-K and our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K,

to read about the risks that you should consider before buying shares of our stock. Further, the market price for the common stock

has, since November 21, 2018, traded at a price which is less than $1.00 per share and that, pursuant to Nasdaq Rule 5450(a)(1),

we must maintain a minimum bid price of $1.00 per share in order for our common stock to maintain its listing on the Nasdaq Global

Market. If the bid price of our common stock remains at less than $1.00 per share for 30 consecutive trading days, Nasdaq may give

us notice that we are not in compliance with the minimum bid price requirement, in which event the Company may have up to 180 days

to remedy such non-compliance. Our failure to maintain our Nasdaq listing or any action that we may take in order that the minimum

bid price be at least $1.00 per share may have a material adverse effect upon the market price for, and the market for, our common

stock.

Neither the U.S.

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if the prospectus or any prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

Unit Option under the Unit Program

Under our Dividend Reinvestment and Common

Stock Purchase Plan (the “Plan”), we are providing a Unit Option under Amendment No. 5. Our Unit Program consists

of the combination of Common Stock and warrants with basic Unit Program features, conditions and terms outlined in the Prospectus

Supplement. Amendment No. 5 provides the option time period, unit price and the number of shares of Common Stock and warrants

per unit. The Unit Option begins on December 10, 2018 and is scheduled to terminate on January 23, 2019. The Unit Option consists

of Units of our securities where each Unit (priced at $250.00 each) is comprised of (i) two hundred and fifty (250) shares of

Common Stock and (ii) Common Stock purchase warrants to purchase an additional two hundred and fifty (250) shares of Common Stock

at a per share exercise price of $0.01. The participant’s Plan account will be credited with the number of shares of the

Company’s Common Stock and Warrants that are acquired under the Units purchased. Each warrant affords the participant the

opportunity to purchase one share of our Common Stock at a warrant exercise price of $0.01. The warrant shall have the company

notation of “ZNWAK.” The warrants will not be registered in the NASDAQ Stock Market or any other stock market. For

Plan participants who enroll into the Unit Program with the purchase of at least one Unit and also enroll in the separate Automatic

Monthly Investments (“AMI”) program at a minimum of $50.00 per month or more, will receive an additional fifty (50)

Warrants at an exercise price of $0.01 during this Unit Option Program. The fifty (50) additional warrants are for enrolling into

the AMI program. Existing subscribers to the AMI are entitled to the additional fifty (50) warrants, if they purchase at least

one (1) Unit.

Checks, bank wire payments, or electronic

bank payments for purchases received by the Plan Agent, or at the offices of the Company, before 4 p.m. (EST) on a business day

generally will be recorded as purchased on the same business day (the “Purchase Date”). Checks, bank wire payments,

or electronic bank payments for purchases received by the Plan Agent, or at the offices of Company, after 4 p.m. (EST) on a business

day generally will be recorded as purchased on the next business day for the Purchase Date. Electronic bank payments are treated

as received and recorded on the date of receipt of the funds into the Plan Agent’s or the Company’s bank account. Under

the AMI program, all optional cash payments will be invested in our Common Stock on the 20

th

day of each calendar month

and if such day falls on a holiday or a weekend, then on the next trading day.

The warrants will become

exercisable on February 25, 2019, which is the first trading day after the 31

st

day following the Unit Option Termination

Date (i.e., on January 23, 2019) and continue to be exercisable through February 25, 2020 (1 year) at a per share exercise price

of $0.01.

Accordingly, all references in the Original

Prospectus Supplement concerning the Unit Option Program continue, except for the substitution of the Unit Option Program details

under Amendment No. 5. All other Plan features, conditions and terms remain unchanged.

The date of this Amendment

No. 5 to the Prospectus Supplement is December 7, 2018.

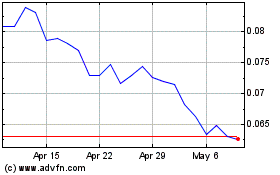

Zion Oil and Gas (QB) (USOTC:ZNOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

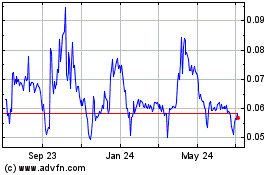

Zion Oil and Gas (QB) (USOTC:ZNOG)

Historical Stock Chart

From Apr 2023 to Apr 2024