- Q3 revenue totaled $105.6 million,

growing 58% year-over-year; subscription revenue grew 58%

year-over-year

- Q3 operating cash flow margin improved

over 20 points year-over-year

- Positive free cash flow for the

quarter

Okta, Inc. (NASDAQ: OKTA), the leading independent provider of

identity for the enterprise, today announced financial results for

its third fiscal quarter ended October 31, 2018.

“We had a record third quarter with 58% year-over-year growth

for both revenue and billings, which was driven by increased

momentum in the enterprise. We saw 55% growth in customers with

over $100,000 annual recurring revenue, representing a record 100

net new adds in a quarter,” said Todd McKinnon, CEO of Okta. “We

are also pleased to report that we were free cash flow positive for

the first time in the third quarter. Our continued strength is a

testament to the growing pervasiveness of identity and we believe

we are well positioned to further benefit from these tailwinds as

organizations continue their move to the cloud, while digitally

transforming and securing their businesses.”

Third Quarter Fiscal 2019 Financial Highlights:

- Revenue: Total revenue was

$105.6 million, an increase of 58% year-over-year. Subscription

revenue was $97.7 million, an increase of 58% year-over-year.

- Operating Loss: GAAP operating

loss was $28.5 million, or 27.0% of total revenue, compared to

$34.5 million, or 51.6% of total revenue, in the third quarter of

fiscal 2018. Non-GAAP operating loss was $6.5 million, or 6.1% of

total revenue, compared to $19.4 million, or 28.9% of total

revenue, in the third quarter of fiscal 2018.

- Net Loss: GAAP net loss was

$29.5 million, compared to $33.1 million in the third quarter of

fiscal 2018. GAAP net loss per share was $0.27, compared to $0.35

in the third quarter of fiscal 2018. Non-GAAP net loss was $3.9

million, compared to $17.9 million in the third quarter of fiscal

2018. Non-GAAP net loss per share was $0.04, compared to $0.19 in

the third quarter of fiscal 2018.

- Cash Flow: Net cash provided by

operations was $6.4 million, or 6.1% of total revenue, compared to

cash used in operations of $9.5 million, or negative 14.2% of total

revenue, in the third quarter of fiscal 2018. Free cash flow was

positive $1.4 million, or 1.3% of total revenue, compared to

negative $11.2 million, or negative 16.8% of total revenue, in the

third quarter of fiscal 2018.

- Cash, cash equivalents and

short-term investments were $546.0 million as of

October 31, 2018.

The section titled "Non-GAAP Financial Measures" below contains

a description of the non-GAAP financial measures and

reconciliations between historical GAAP and non-GAAP information

are contained in the tables below.

Financial Outlook:

For the fourth quarter of fiscal 2019, the Company currently

expects:

- Total revenue of $107 to $108 million,

representing a growth rate of 39% to 40% year-over-year

- Non-GAAP operating loss of $12.5 to

$11.5 million

- Non-GAAP net loss per share of $0.09 to

$0.08, assuming shares outstanding of approximately 110

million

For the full fiscal 2019, the Company now expects:

- Total revenue of $391 to $392 million,

representing a growth rate of 52% to 53% year-over-year

- Non-GAAP operating loss of $49 to $48

million

- Non-GAAP net loss per share of $0.37 to

$0.36, assuming shares outstanding of approximately 107

million

These statements are forward-looking and actual results may

differ materially. Refer to the Forward-Looking Statements safe

harbor below for information on the factors that could cause our

actual results to differ materially from these forward-looking

statements.

Okta has not reconciled its expectations as to non-GAAP

operating loss and non-GAAP net loss per share to their most

directly comparable GAAP measure because certain items are out of

Okta’s control or cannot be reasonably predicted. Accordingly, a

reconciliation for forward-looking non-GAAP operating loss and

non-GAAP net loss per share is not available without unreasonable

effort.

Conference Call Information:

Okta will host a conference call and live webcast for analysts

and investors at 2:00 p.m. Pacific Time on December 5, 2018.

The news release with the financial results will be accessible from

the Company’s website at investor.okta.com prior to the conference

call. Interested parties can access the call by dialing (888)

256-1007 or (323) 994-2093 and using the passcode 1069664.

A live webcast of the conference call will be accessible from

the Okta investor relations website at investor.okta.com. A

telephonic replay of the conference call will be available through

December 19, 2018 and may be accessed by dialing (888) 203-1112 or

(719) 457-0820, conference ID: 1069664.

Supplemental Financial and Other Information:

Supplemental financial and other information can be accessed

through the Company’s investor relations website at

investor.okta.com.

Non-GAAP Financial Measures:

This press release and the accompanying tables contain the

following non-GAAP financial measures: non-GAAP gross profit,

non-GAAP gross margin, non-GAAP operating loss, non-GAAP operating

margin, non-GAAP net loss, non-GAAP net loss per share, free cash

flow, current calculated billings and calculated billings. The

accompanying tables present and define calculated billings

consistent with ASC 606. Certain of these non-GAAP financial

measures exclude stock-based compensation, amortization of debt

discount, charitable contributions, and amortization of intangible

assets.

Okta believes that non-GAAP financial information, when taken

collectively, may be helpful to investors because it provides

consistency and comparability with past financial performance and

assists in comparisons with other companies, some of which use

similar non-GAAP financial information to supplement their GAAP

results. The non-GAAP financial information is presented for

supplemental informational purposes only, and should not be

considered a substitute for financial information presented in

accordance with GAAP, and may be different from similarly-titled

non-GAAP measures used by other companies.

The principal limitation of these non-GAAP financial measures is

that they exclude significant expenses and income that are required

by GAAP to be recorded in the Company’s financial statements. In

addition, they are subject to inherent limitations as they reflect

the exercise of judgment by the Company's management about which

expenses and income are excluded or included in determining these

non-GAAP financial measures. A reconciliation is provided below for

each non-GAAP financial measure to the most directly comparable

financial measure stated in accordance with GAAP.

Okta encourages investors to review the related GAAP financial

measures and the reconciliation of these non-GAAP financial

measures to their most directly comparable GAAP financial measures,

which it includes in press releases announcing quarterly financial

results, including this press release, and not to rely on any

single financial measure to evaluate the Company’s business.

Please see the reconciliation tables at the end of this release

for the reconciliation of GAAP and non-GAAP results.

Forward-Looking Statements:

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding our financial outlook and market

positioning. These forward-looking statements are made as of the

date they were first issued and were based on current expectations,

estimates, forecasts and projections as well as the beliefs and

assumptions of management. Words such as “expect,” “anticipate,”

“should,” “believe,” “hope,” “target,” “project,” “goals,”

“estimate,” “potential,” “predict,” “may,” “will,” “might,”

“could,” “intend,” “shall” and variations of these terms or the

negative of these terms and similar expressions are intended to

identify these forward-looking statements. Forward-looking

statements are subject to a number of risks and uncertainties, many

of which involve factors or circumstances that are beyond Okta’s

control. Okta’s actual results could differ materially from those

stated or implied in forward-looking statements due to a number of

factors, including but not limited to, risks detailed in the

Company's filings and reports with the Securities and Exchange

Commission (SEC), including our Form 10-Q for the fiscal

quarter ended July 31, 2018, as well as other filings and

reports that may be filed by the Company from time to time with

the SEC. In particular, the following factors, among others,

could cause results to differ materially from those expressed or

implied by such forward-looking statements: the market for our

products may develop more slowly than expected or than it has in

the past; quarterly and annual operating results may fluctuate more

than expected; variations related to our revenue recognition may

cause significant fluctuations in our results of operations and

cash flows; assertions by third parties that we violate their

intellectual property rights could substantially harm our business;

any unreleased products, features or functionality referenced in

this or other presentations, press releases or public statements

are not currently available and may not be delivered on time or at

all; a network or data security incident that allows unauthorized

access to our network or data or our customers’ data could harm our

reputation, create additional liability and adversely impact our

financial results; the risk of interruptions or performance

problems, including a service outage, associated with our

technology; intense competition in our market; weakened global

economic conditions may adversely affect our industry; the risk of

losing key employees; changes in foreign exchange rates; general

political or destabilizing events, including war, conflict or acts

of terrorism; our ability to successfully identify and integrate

acquisitions, strategic investments, partnerships or alliances; our

ability to pay off our convertible senior notes when due; and other

risks and uncertainties. Past performance is not necessarily

indicative of future results. The forward-looking statements

included in this press release represent Okta’s views as of the

date of this press release. The Company anticipates that subsequent

events and developments will cause its views to change. Okta

undertakes no intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. These forward-looking statements should

not be relied upon as representing Okta’s views as of any date

subsequent to the date of this press release.

About Okta

Okta is the leading independent provider of identity for

the enterprise. The Okta Identity Cloud enables organizations to

both secure and manage their extended enterprise, and transform

their customers’ experiences. With over 5,500 pre-built

integrations to applications and infrastructure

providers, Okta customers can easily and securely adopt

the technologies they need to fulfill their missions. Over 5,600

organizations, including 20th Century

Fox, JetBlue, Nordstrom, Slack, Teach for America

and Twilio, trust Okta to securely connect their

people and technology.

OKTA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share data)

(unaudited)

Three Months EndedOctober 31, Nine

Months EndedOctober 31, 2018 2017

2018 2017 As Adjusted (1) As

Adjusted (1) Revenue: Subscription $ 97,698 $

61,863 $ 262,393 $ 165,459 Professional services and other 7,878

5,048 21,390 14,036 Total revenue

105,576 66,911 283,783 179,495 Cost of revenue: Subscription (2)

20,265 13,553 55,808 37,401

Professional services and other (2)

9,435 7,570 26,227 20,867 Total cost of

revenue 29,700 21,123 82,035 58,268

Gross profit 75,876 45,788 201,748 121,227 Operating expenses:

Research and development (2) 27,596 19,190 72,354 51,472 Sales and

marketing (2) 56,911 47,567 165,408 120,761 General and

administrative (2) 19,848 13,546 55,873 37,133

Total operating expenses 104,355 80,303

293,635 209,366 Operating loss (28,479 ) (34,515 )

(91,887 ) (88,139 ) Other income (expense), net (1,705 ) 509

(4,682 ) 872 Loss before provision for (benefit from) income

taxes (30,184 ) (34,006 ) (96,569 ) (87,267 ) Provision for

(benefit from) income taxes (667 ) (940 ) (1,883 ) (463 ) Net loss

$ (29,517 ) $ (33,066 ) $ (94,686 ) $ (86,804 ) Net loss per

share attributable to common stockholders, basic and diluted $

(0.27 ) $ (0.35 ) $ (0.89 ) $ (1.13 ) Weighted-average

shares used to compute net loss per share attributable to common

stockholders, basic and diluted 108,776 95,474

106,587 76,950

___________________________________

(1) The condensed consolidated statement

of operations for the prior periods presented above have been

adjusted to reflect the adoption of ASC 606.

(2) Amounts include share-based

compensation expense as follows (in thousands):

Three Months EndedOctober 31, Nine Months

EndedOctober 31, 2018 2017 2018

2017 Cost of subscription revenue $ 2,383 $ 1,421 $

5,813 $ 3,163 Cost of professional services and other revenue 1,305

979 3,277 2,186 Research and development 6,291 5,174 15,776 12,913

Sales and marketing 6,228 3,894 15,852 9,290 General and

administrative 5,335 2,940 13,181 7,740

Total share-based compensation expense $ 21,542 $ 14,408

$ 53,899 $ 35,292

OKTA, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands)

(unaudited)

October 31,2018

January 31,2018

As Adjusted (1) Assets Current assets:

Cash and cash equivalents $ 195,898 $ 127,949 Short-term

investments 350,105 101,765 Accounts receivable, net of allowances

of $1,425 and $1,472 70,136 52,248 Deferred commissions 21,695

17,755 Prepaid expenses and other current assets 20,280

17,781 Total current assets 658,114 317,498

Property and equipment, net 44,251 12,540 Deferred commissions,

noncurrent 47,756 40,755 Intangible assets, net 14,989 11,761

Goodwill 18,074 6,282 Other assets 13,525 10,427

Total assets $ 796,709 $ 399,263

Liabilities and stockholders’ equity Current liabilities:

Accounts payable $ 12,085 $ 9,566 Accrued expenses and other

current liabilities 6,305 6,187 Accrued compensation 20,250 12,374

Deferred revenue 206,146 159,816 Total current

liabilities 244,786 187,943 Convertible senior notes,

net 267,665 — Deferred revenue, noncurrent 4,977 4,963 Other

liabilities, noncurrent 34,778 7,017 Total

liabilities 552,206 199,923 Commitments and

contingencies Stockholders’ equity: Preferred stock — — Class A

common stock 10 7 Class B common stock 1 3 Additional paid-in

capital 706,810 565,653 Accumulated other comprehensive income

(loss) (918 ) 391 Accumulated deficit (461,400 ) (366,714 ) Total

stockholders’ equity 244,503 199,340

Total

liabilities and stockholders’ equity $ 796,709 $ 399,263

(1) The condensed consolidated balance

sheet for the prior period has been adjusted to reflect the

adoption of ASC 606.

OKTA, INC.

SUMMARY OF CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(unaudited)

Nine Months Ended October 31, 2018

2017 As Adjusted (1) Cash flows from

operating activities: Net loss $ (94,686 ) $ (86,804 )

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: Stock-based compensation 53,899 35,292

Depreciation, amortization and accretion 5,824 5,111 Amortization

of debt discount and issuance costs 10,315 — Amortization of

deferred commissions 14,963 10,911 Deferred income taxes (2,269 )

(960 ) Non-cash charitable contributions 1,008 708 Other 153 997

Changes in operating assets and liabilities, net of business

combination: Accounts receivable (17,539 ) (12,742 ) Deferred

commissions (25,907 ) (16,230 ) Prepaid expenses and other assets

(4,238 ) (2,353 ) Accounts payable 1,354 6,255 Accrued compensation

7,973 5,931 Accrued expenses and other liabilities 8,182 (1,545 )

Deferred revenue 46,036 30,034 Net cash provided by

(used in) operating activities 5,068 (25,395 )

Cash flows

from investing activities: Capitalization of internal-use

software costs (2,329 ) (4,072 ) Purchases of property and

equipment (14,253 ) (5,570 ) Purchases of securities available for

sale (478,138 ) (95,344 ) Proceeds from maturities of securities

available for sale 219,650 21,985 Proceeds from sales of securities

available for sale 12,470 1,538 Payments for business acquisition,

net of cash acquired (15,616 ) — Net cash used in investing

activities (278,216 ) (81,463 )

Cash flows from financing

activities: Proceeds from initial public offering, net of

underwriters' discounts and commissions — 199,948 Proceeds from

issuance of convertible senior notes, net of issuance costs 334,980

— Purchase of convertible senior notes hedge (80,040 ) — Proceeds

from issuance of warrants related to convertible notes 52,440 —

Payments of deferred offering costs — (4,038 ) Proceeds from stock

option exercises, net of repurchases 28,524 25,800 Proceeds from

shares issued in connection with employee stock purchase plan 6,654

— Other (206 ) (343 ) Net cash provided by financing activities

342,352 221,367 Effects of changes in foreign

currency exchange rates on cash and cash equivalents (990 ) 53

Net increase in cash, cash equivalents and restricted cash

68,214 114,562 Cash, cash equivalents and restricted cash at

beginning of period 136,233 23,282

Cash, cash

equivalents and restricted cash at end of period $ 204,447

$ 137,844

(1) The condensed consolidated statement

of cash flows for the prior period has been adjusted to reflect the

adoption of ASC 606.

OKTA, INC.

Reconciliation of GAAP to Non-GAAP

Data

(In thousands, except percentages and per

share data)

(unaudited)

Three Months Ended October 31, 2018 GAAP

Stock-basedcompensation

Amortizationof

acquiredintangibles

Amortizationof

debtdiscount

Non-GAAP Cost of revenue: Cost of subscription

services $ 20,265 $ (2,383 ) $ (449 ) $ — $ 17,433 Cost of

professional services 9,435 (1,305 ) — — 8,130 Gross profit 75,876

3,688 449 — 80,013 Gross margin 71.9

%

3.4 % 0.5 % — % 75.8

%

Operating expenses: Research and development 27,596 (6,291 ) — —

21,305 Sales and marketing 56,911 (6,228 ) — — 50,683 General and

administrative 19,848 (5,335 ) — — 14,513 Operating loss (28,479 )

21,542 449 — (6,488 ) Operating margin (27.0 )% 20.5 % 0.4 % — %

(6.1 )% Other income (expense), net (1,705 ) — — 3,604 1,899 Net

loss $ (29,517 ) $ 21,542 $ 449 $ 3,604 $ (3,922 ) Net loss per

share (1) $ (0.27 ) $ 0.20 $ — $ 0.03 $ (0.04 )

(1) GAAP and Non-GAAP net loss per common

share calculated based upon 108,776 basic and diluted

weighted-average shares of common stock.

Three Months Ended October 31, 2017

GAAP (2)

Stock-basedcompensation

Charitablecontributions

Non-GAAP (2) Cost of revenue: Cost of

subscription services $ 13,553 $ (1,421 ) $ — $ 12,132 Cost of

professional services 7,570 (979 ) — 6,591 Gross profit 45,788

2,400 — 48,188 Gross margin 68.4

%

3.6 % — 72.0

%

Operating expenses: Research and development 19,190 (5,174 ) —

14,016 Sales and marketing 47,567 (3,894 ) — 43,673 General and

administrative 13,546 (2,940 ) (754 ) 9,852 Operating loss (34,515

) 14,408 754 (19,353 ) Operating margin (51.6 )% 21.6 % 1.1 % (28.9

)% Other income (expense), net 509 — — 509 Net loss $ (33,066 ) $

14,408 $ 754 $ (17,904 ) Net loss per share (1) $ (0.35 ) $ 0.15 $

0.01 $ (0.19 )

(1) GAAP and Non-GAAP net loss per common

share calculated based upon 95,474 basic and diluted

weighted-average shares of common stock.

(2) Financial information for prior period

presented above has been adjusted to reflect the adoption of ASC

606.

OKTA, INC.

Reconciliation of GAAP to Non-GAAP

Data

(In thousands, except percentages and per

share data)

(unaudited)

Nine Months Ended October 31, 2018 GAAP

Stock-basedcompensation

Charitablecontributions

Amortizationof

acquiredintangibles

Amortizationof

debtdiscount

Non-GAAP Cost of revenue: Cost of subscription

services $ 55,808 $ (5,813 ) $ — $ (449 ) $ — $ 49,546 Cost of

professional services 26,227 (3,277 ) — — — 22,950 Gross profit

201,748 9,090 — 449 — 211,287 Gross margin 71.1

%

3.2 % — % 0.2 % — % 74.5

%

Operating expenses: Research and development 72,354 (15,776 ) — — —

56,578 Sales and marketing 165,408 (15,852 ) — — — 149,556 General

and administrative 55,873 (13,181 ) (1,008 ) — — 41,684 Operating

loss (91,887 ) 53,899 1,008 449 — (36,531 ) Operating margin (32.4

)% 18.9 % 0.4 % 0.2 % — % (12.9 )% Other income (expense), net

(4,682 ) — — — 9,539 4,857 Net loss (94,686 ) 53,899 1,008 449

9,539 (29,791 ) Net loss per share (1) $ (0.89 ) $ 0.51 $ 0.01 $ —

$ 0.09 $ (0.28 )

(1) GAAP and Non-GAAP net loss per common

share calculated based upon 106,587 basic and diluted

weighted-average shares of common stock.

Nine Months Ended October 31, 2017 GAAP

(2)

Stock-basedcompensation

Charitablecontributions

Amortizationof

acquiredintangibles

Non-GAAP (2) Cost of revenue: Cost of

subscription services $ 37,401 $ (3,163 ) $ — $ (4 ) $ 34,234 Cost

of professional services 20,867 (2,186 ) — — 18,681 Gross profit

121,227 5,349 — 4 126,580 Gross margin

67.5

%

3.0 % — % — % 70.5

%

Operating expenses: Research and development 51,472 (12,913 ) — —

38,559 Sales and marketing 120,761 (9,290 ) — — 111,471 General and

administrative 37,133 (7,740 ) (754 ) — 28,639 Operating loss

(88,139 ) 35,292 754 4 (52,089 ) Operating margin (49.1 )% 19.7 %

0.4 % — % (29.0 )% Other income (expense), net 872 — — — 872 Net

loss $ (86,804 ) $ 35,292 $ 754 $ 4 $ (50,754 ) Net loss per share

(1) $ (1.13 ) $ 0.46 $ 0.01 $ — $ (0.66 )

(1) GAAP and Non-GAAP net loss per common

share calculated based upon 76,950 basic and diluted

weighted-average shares of common stock.

(2) Financial information for prior period

presented above has been adjusted to reflect the adoption of ASC

606.

OKTA, INC.

Reconciliation of GAAP to Non-GAAP

Financial Measures

(In thousands)

(unaudited)

Free Cash Flow Three

Months EndedOctober 31, Nine Months

EndedOctober 31, 2018 2017 2018

2017 Net cash provided by (used in) operating activities $

6,439 $ (9,471 ) $ 5,068 $ (25,395 ) Less: Purchases of property

and equipment (4,463 ) (414 ) (14,253 ) (5,570 ) Capitalization of

internal-use software costs (604 ) (1,329 ) (2,329 ) (4,072 ) Free

Cash Flow $ 1,372 $ (11,214 ) $ (11,514 ) $ (35,037 ) Net

cash used in investing activities (10,545 ) (1,161 ) (278,216 )

(81,463 ) Net cash provided by financing activities 7,469 21,814

342,352 221,367 Free Cash Flow Margin 1.3 % (16.8 )% (4.1 )% (19.5

)%

Calculated Billings

Three Months EndedOctober 31, Nine Months

EndedOctober 31,

2018

2017 (1)

2018

2017 (1)

Total revenue $ 105,576 $ 66,911 $ 283,783 $ 179,495 Add: Unbilled

receivables, current (beginning of period) 818 498 809 1,537

Deferred revenue, current (end of period) 206,146 135,010 206,146

135,010 Less: Unbilled receivables, current (end of period) (1,581

) (902 ) (1,581 ) (902 ) Deferred revenue, current (beginning of

period) (186,427 ) (122,173 ) (159,816 ) (102,966 ) Current

calculated billings 124,532 79,344 329,341 212,174 Add: Deferred

revenue, noncurrent (end of period) 4,977 2,145 4,977 2,145 Less:

Deferred revenue, noncurrent (beginning of period) (5,471 ) (2,929

) (4,963 ) (4,154 ) Calculated billings $ 124,038 $ 78,560

$ 329,355 $ 210,165

(1) Current calculated billings and

calculated billings for the three and nine months ended October 31,

2017 presented above have been modified to conform with the

adoption of ASC 606, which now includes unbilled receivables.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181205005192/en/

Investor Contact:Catherine

Buaninvestor@okta.com415-604-3346

Media Contact:Jenna Kozelpress@okta.com888-722-7871

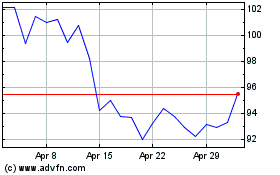

Okta (NASDAQ:OKTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Okta (NASDAQ:OKTA)

Historical Stock Chart

From Apr 2023 to Apr 2024