FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to rule 13a-16 or 15d-16 of

The Securities Exchange Act of 1934

For the month of

November, 2018

National Bank of Greece S.A.

(Translation of registrant’s name into English)

86 Eolou Street, 10232 Athens, Greece

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.]

Form 20-F

x

Form 40-F

o

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.]

Yes

o

No

x

[If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ]

|

|

NBG Group

|

Q3 Results 2018

|

PRESS RELEASE

NBG Group: Q3.18 results highlights

·

Domestic NPE stock reduction continues for 10 straight quarters

·

NPE stock down €2.4bn during the past 12 months

·

Net NPE reduction of €5.6bn since end-Q4.15 reflects organic negative formation (€2.1bn) and write-offs (€3.5bn), c€2bn of which subsequently sold

·

NPE and NPL coverage of 60% and 84% combined with NPE and NPL ratios of 43% and 30% in Greece; total coverage including collateral is well above 100% across all business lines

·

Q3.18 domestic CoR sustained at 109bps compared with an adjusted for one offs Q2.18 CoR of 107bps

·

Domestic deposits reach €40bn

·

Domestic deposits continued to increase in Q3.18, driving L:D ratio to 71% in Greece

·

Zero impact on liquidity and funding cost from ECB’s waiver removal on the back of NBG issued investment grade covered bonds replacing sovereign bonds

·

Eurosystem funding at just €2.3bn from €2.8bn in Q2.18, following the repayment of €0.5bn of TLTRO-I in September

·

LCR and NSFR ratios at 124% and 103% respectively, exceeding the 100% regulatory threshold

·

CET1 ratio at 16.4%

·

CET1 ratio at 16.4% including Banca Romaneasca (BROM) impairment charge

·

Pro forma for the 9M.18 PAT and the reduction in RWAs following the completion of South African Bank of Athens (SABA) sale in October, CET1 at 16.6% and 13.1%, taking into account the IFRS 9 full impact

·

Group PAT from continuing operations at €48m in 9M.18 against losses of €103m in 9M.17

·

Operating profit of €62m in Greece against losses of €100m in 9M.17 is driven by CoR de-escalation (-143bps yoy), fully offsetting core revenue reduction

·

Q3.18 domestic NII troughs at €253m (-1% qoq); 9M.18 NII at €776m (-22% yoy) on the back of the IFRS 9 FTA impact, the repricing of part of the mortgage book linked with Greek 12-month T-bills during 1H, as well as restructurings and deleveraging on the retail book

·

9M.18 OpEx at €658m in Greece (+3% yoy), driven by G&As (+7% yoy). The ongoing VRS (>500 FTEs in 2018) is expected to reduce personnel expenses by at least €25m in FY.19

·

Loan impairments at €233m in 9M.18 (-60% yoy) in Greece, implying a CoR of 108bps

·

Domestic PAT from continuing operations at €33m vs losses of €122m in 9M.17

Athens November 29, 2018

1

Economic conditions are steadily improving in Greece, and these developments should support NBG’s organic profitability as well as organic NPE reduction going forward. It will also facilitate NPE sales, especially as these will include loans with real estate collaterals. Indeed, house prices are up by 3.7% yoy in Q3.18. In this environment NBG’s comparative advantage of a high provision coverage of 60% will allow it to be more aggressive. NBG submitted recently a new NPE strategy to the SSM, committing to a reduction of €10bn by the end of 2021.

Our operating profitability performance in the 9M.18 stood at €84m, contrasting sharply with a loss of €75m in the 9M.17. This notable improvement has been achieved due to a sustainable reduction in credit risk charges to c110bps, after achieving high provision coverage ratios. Following a sharp drop in NII, due to both deleveraging as well as new accounting standards, NII reached a trough in the past two quarters and is expected to begin to recover as corporate lending disbursements accelerate in 4Q to a level in excess of €1bn. At the same time, NII quality has improved retaining a limited reliance on NPE interest. Operating costs will quickly benefit from the ongoing VRS, which will exceed 500 FTEs in 2018 as well as the ongoing programme of branch footprint optimization. Looking ahead, the implementation of the Transformation Programme — to be announced in Q1.19 — will lead profitability to substantially higher levels.

Athens, November 29, 2018

Paul Mylonas

Chief Executive Officer, NBG

2

Key Financial Data

P&L |

Group

|

€ m

|

|

9M.18

|

|

9M.17

|

|

yoy

|

|

Q3.18

|

|

Q2.18

|

|

qoq

|

|

|

NII(1)

|

|

838

|

|

1 062

|

|

-21

|

%

|

274

|

|

276

|

|

-1

|

%

|

|

Net fees & commissions

|

|

181

|

|

174

|

|

+4

|

%

|

59

|

|

59

|

|

+0

|

%

|

|

Core income

|

|

1 019

|

|

1 236

|

|

-18

|

%

|

333

|

|

335

|

|

-0

|

%

|

|

Trading & other income(1)

|

|

17

|

|

(29

|

)

|

n/m

|

|

8

|

|

(16

|

)

|

n/m

|

|

|

Income

|

|

1 036

|

|

1 207

|

|

-14

|

%

|

342

|

|

319

|

|

+7

|

%

|

|

Operating expenses

|

|

(713

|

)

|

(694

|

)

|

+3

|

%

|

(245

|

)

|

(238

|

)

|

+3

|

%

|

|

Core PPI

|

|

306

|

|

542

|

|

-44

|

%

|

88

|

|

97

|

|

-9

|

%

|

|

PPI

|

|

323

|

|

513

|

|

-37

|

%

|

97

|

|

81

|

|

+20

|

%

|

|

Provisions

|

|

(239

|

)

|

(588

|

)

|

-59

|

%

|

(81

|

)

|

(38

|

)

|

>100

|

%

|

|

Operating profit

|

|

84

|

|

(75

|

)

|

n/m

|

|

16

|

|

44

|

|

-64

|

%

|

|

Other impairments

|

|

(9

|

)

|

(5

|

)

|

+67

|

%

|

1

|

|

(11

|

)

|

n/m

|

|

|

PBT

|

|

75

|

|

(80

|

)

|

n/m

|

|

17

|

|

33

|

|

-48

|

%

|

|

Taxes

|

|

(27

|

)

|

(23

|

)

|

+18

|

%

|

(9

|

)

|

(12

|

)

|

-22

|

%

|

|

PAT (continuing operations)

|

|

48

|

|

(103

|

)

|

n/m

|

|

8

|

|

21

|

|

-62

|

%

|

|

PAT (discontinued operations)(2)

|

|

55

|

|

(49

|

)

|

n/m

|

|

17

|

|

14

|

|

+24

|

%

|

|

Minorities

|

|

(27

|

)

|

(26

|

)

|

+4

|

%

|

(8

|

)

|

(10

|

)

|

-18

|

%

|

|

One-offs (VRS cost)

|

|

(40

|

)

|

—

|

|

n/m

|

|

—

|

|

(40

|

)

|

n/m

|

|

|

PAT (reported)

|

|

36

|

|

(178

|

)

|

n/m

|

|

17

|

|

(15

|

)

|

n/m

|

|

(1) For comparability reasons, NII & trading income have been restated in the previous periods to reclassify the interest income of the loan to the Greek State from NII to trading income under IFRS 9

(2) 9M.17 PAT (discontinued operations) includes the impairments on Romania and Serbia reflecting agreements to sell below book (€151m)

Balance Sheet(1) | Group

|

€ m

|

|

Q3.18

|

|

Q2.18

|

|

Q1.18

|

|

Q4.17(2)

|

|

Q3.17

|

|

Q2.17

|

|

Q1.17

|

|

|

Total assets

|

|

63 153

|

|

62 854

|

|

61 554

|

|

61 404

|

|

65 843

|

|

69 873

|

|

75 557

|

|

|

Loans (Gross)

|

|

40 091

|

|

40 416

|

|

41 024

|

|

42 103

|

|

42 972

|

|

43 545

|

|

44 275

|

|

|

Provisions

|

|

(9 950

|

)

|

(10 118

|

)

|

(10 439

|

)

|

(11 135

|

)

|

(10 868

|

)

|

(10 937

|

)

|

(11 144

|

)

|

|

Net loans

|

|

30 141

|

|

30 298

|

|

30 585

|

|

30 896

|

|

32 103

|

|

32 608

|

|

33 131

|

|

|

Securities

|

|

8 598

|

|

8 068

|

|

8 130

|

|

9 221

|

|

11 996

|

|

15 322

|

|

16 634

|

|

|

Deposits

|

|

42 012

|

|

41 228

|

|

40 311

|

|

40 265

|

|

38 568

|

|

38 098

|

|

37 904

|

|

|

Equity

|

|

5 051

|

|

5 088

|

|

5 159

|

|

5 149

|

|

6 757

|

|

6 762

|

|

6 913

|

|

|

Tangible Equity

|

|

4 905

|

|

4 952

|

|

5 028

|

|

5 017

|

|

6 635

|

|

6 640

|

|

6 798

|

|

(1)

Group Balance Sheet has been adjusted for planned divestments of Ethniki Insurance, Banca Romaneasca and SABA that have been classified as non-current assets held for sale and liabilities associated with non-current assets held for sale

(2) Group Balance Sheet in Q4.17 is pro forma for IFRS 9 accounting standards

Key Ratios

| Group

|

|

|

9M.18

|

|

Q3.18

|

|

Q2.18

|

|

Q1.18

|

|

FY.17

|

|

9M.17

|

|

Q3.17

|

|

|

Liquidity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans-to-Deposits ratio(1)

|

|

72

|

%

|

72

|

%

|

74

|

%

|

76

|

%

|

77

|

%

|

83

|

%

|

83

|

%

|

|

ELA exposure (€ bn)

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2.3

|

|

2.3

|

|

|

LCR ratio

|

|

124

|

%

|

124

|

%

|

86

|

%

|

66

|

%

|

41

|

%

|

n/a

|

|

n/a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profitability

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NIM(2) (bps)

|

|

273

|

|

263

|

|

270

|

|

287

|

|

312

|

|

310

|

|

310

|

|

|

Cost of Risk (bps)(3)

|

|

123

|

|

107

|

|

105

|

|

156

|

|

243

|

|

238

|

|

192

|

|

|

Risk adjusted NIM(2)

|

|

150

|

|

156

|

|

165

|

|

131

|

|

69

|

|

72

|

|

118

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset quality

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NPE ratio

|

|

42.0

|

%

|

42.0

|

%

|

42.1

|

%

|

42.7

|

%

|

43.7

|

%

|

45.2

|

%

|

45.2

|

%

|

|

NPE coverage ratio(1)

|

|

59.8

|

%

|

59.8

|

%

|

60.2

|

%

|

60.2

|

%

|

61.2

|

%

|

55.9

|

%

|

55.9

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CET1 ratio

|

|

16.4

|

%

|

16.4

|

%

|

16.2

|

%

|

16.5

|

%

|

17.0

|

%

|

16.6

|

%

|

16.6

|

%

|

|

RWAs (€ bn)

|

|

35.0

|

|

35.0

|

|

36.1

|

|

36.2

|

|

37.3

|

|

38.5

|

|

38.5

|

|

(1)

FY.17 Loans-to-deposits and NPE coverage ratios are adjusted for IFRS 9

(2) NIM is adjusted for IFRS 9 / Risk adjusted NIM = NIM minus CoR

(3) Q2/9M.18 CoR is adjusted for the one-offs related to NPL sales; reported CoR at 50bps in Q2.18 & 104bps in 9M.18

3

P&L | Greece

|

€ m

|

|

9M.18

|

|

9M.17

|

|

yoy

|

|

Q3.18

|

|

Q2.18

|

|

qoq

|

|

|

NII(1)

|

|

776

|

|

992

|

|

-22

|

%

|

253

|

|

255

|

|

-1

|

%

|

|

Net fees & commissions

|

|

164

|

|

158

|

|

+4

|

%

|

54

|

|

54

|

|

+1

|

%

|

|

Core income

|

|

940

|

|

1 149

|

|

-18

|

%

|

307

|

|

308

|

|

-0

|

%

|

|

Trading & other income(1)

|

|

13

|

|

(28

|

)

|

n/m

|

|

9

|

|

(17

|

)

|

n/m

|

|

|

Income

|

|

953

|

|

1 121

|

|

-15

|

%

|

316

|

|

291

|

|

+9

|

%

|

|

Operating expenses

|

|

(658

|

)

|

(639

|

)

|

+3

|

%

|

(226

|

)

|

(220

|

)

|

+3

|

%

|

|

Core PPI

|

|

282

|

|

510

|

|

-45

|

%

|

81

|

|

88

|

|

-8

|

%

|

|

PPI

|

|

295

|

|

482

|

|

-39

|

%

|

90

|

|

72

|

|

+25

|

%

|

|

Provisions

|

|

(233

|

)

|

(582

|

)

|

-60

|

%

|

(78

|

)

|

(35

|

)

|

>100

|

%

|

|

Operating profit

|

|

62

|

|

(100

|

)

|

n/m

|

|

12

|

|

37

|

|

-68

|

%

|

|

Other impairments

|

|

(8

|

)

|

(4

|

)

|

>100

|

%

|

1

|

|

(10

|

)

|

n/m

|

|

|

PBT

|

|

54

|

|

(104

|

)

|

n/m

|

|

13

|

|

27

|

|

-52

|

%

|

|

Taxes

|

|

(21

|

)

|

(18

|

)

|

16

|

%

|

(8

|

)

|

(8

|

)

|

-5

|

%

|

|

PAT (continuing operations)

|

|

33

|

|

(122

|

)

|

n/m

|

|

5

|

|

18

|

|

-72

|

%

|

|

PAT (discontinued operations)

|

|

52

|

|

52

|

|

+0

|

%

|

12

|

|

15

|

|

-19

|

%

|

|

Minorities

|

|

(26

|

)

|

(25

|

)

|

+5

|

%

|

(7

|

)

|

(9

|

)

|

-20

|

%

|

|

One-offs (VRS cost)

|

|

(40

|

)

|

—

|

|

n/m

|

|

—

|

|

(40

|

)

|

n/m

|

|

|

PAT (reported)

|

|

19

|

|

(95

|

)

|

n/m

|

|

10

|

|

(16

|

)

|

n/m

|

|

(1) For comparability reasons, NII & trading income have been restated in the previous periods to reclassify the interest income of the loan to the Greek State from NII to trading income under IFRS 9

P&L | SEE & Other

|

€ m

|

|

9M.18

|

|

9M.17

|

|

yoy

|

|

Q3.18

|

|

Q2.18

|

|

qoq

|

|

|

NII

|

|

62

|

|

70

|

|

-11

|

%

|

21

|

|

21

|

|

-1

|

%

|

|

Net fees & commissions

|

|

17

|

|

17

|

|

+0

|

%

|

6

|

|

6

|

|

-1

|

%

|

|

Core income

|

|

79

|

|

87

|

|

-9

|

%

|

27

|

|

27

|

|

-2

|

%

|

|

Trading & other income(1)

|

|

4

|

|

0

|

|

n/m

|

|

-1

|

|

1

|

|

n/m

|

|

|

Income

|

|

83

|

|

87

|

|

-5

|

%

|

26

|

|

28

|

|

-6

|

%

|

|

Operating expenses

|

|

(55

|

)

|

(55

|

)

|

-0

|

%

|

(19

|

)

|

(18

|

)

|

+7

|

%

|

|

Core PPI

|

|

24

|

|

32

|

|

-25

|

%

|

7

|

|

9

|

|

-18

|

%

|

|

PPI

|

|

28

|

|

32

|

|

-12

|

%

|

7

|

|

10

|

|

-29

|

%

|

|

Provisions

|

|

(5

|

)

|

(6

|

)

|

-9

|

%

|

(3

|

)

|

(3

|

)

|

+3

|

%

|

|

Operating profit

|

|

23

|

|

26

|

|

-12

|

%

|

4

|

|

7

|

|

-45

|

%

|

|

Other impairments

|

|

(1

|

)

|

(2

|

)

|

-50

|

%

|

(0

|

)

|

(1

|

)

|

-80

|

%

|

|

PBT

|

|

22

|

|

24

|

|

-10

|

%

|

4

|

|

6

|

|

-42

|

%

|

|

Taxes

|

|

(6

|

)

|

(5

|

)

|

+20

|

%

|

(1

|

)

|

(3

|

)

|

-65

|

%

|

|

PAT (continuing operations)

|

|

16

|

|

19

|

|

-18

|

%

|

2

|

|

3

|

|

-14

|

%

|

|

PAT (discontinued operations)(1)

|

|

3

|

|

(101

|

)

|

n/m

|

|

5

|

|

(1

|

)

|

n/m

|

|

|

Minorities

|

|

(2

|

)

|

(2

|

)

|

0

|

%

|

(1

|

)

|

(1

|

)

|

+20

|

%

|

|

PAT (reported)

|

|

17

|

|

(83

|

)

|

n/m

|

|

7

|

|

1

|

|

>100

|

%

|

(1) 9M.17 PAT (discontinued operations) includes the impairments on Romania and Serbia reflecting agreements to sell below book (€151m)

4

Asset Quality

NPE reduction continues in Q3.18, driven by marginally negative organic

NPE formation

and reduced write offs. The NPE stock (SSM perimeter) amounted to €15.9bn in Q3.18, with the total NPE reduction achieved since the beginning of the SSM program amounting to €5.6bn. The latter is a function of organic actions driving an NPE reduction of €2.1bn, as well as fully provided write offs (€3.5bn), c€2bn of which were subsequently sold.

The

NPE ratio

in Greece decreased by 10bps qoq to 42.5% in Q3.18, due to sustained deleveraging, with

NPE coverage

settling at 59.8%.

Domestic

90dpd formation

(SSM perimeter) remained in negative territory in Q3.18 (-€53m from -€199m in Q2.18). Domestic

90dpd ratio

settled at 30.4% (flat qoq) on

coverage

of 83.5% (82.4% at the Group level).

In SE Europe(1), the 90dpd ratio settled at 31.3% on coverage of 63.5%.

|

Domestic 90dpd ratios and coverage

|

Domestic NPE ratios and coverage

|

|

|

|

|

|

|

Domestic NPE stock movement

(1)

SE Europe includes the Group’s businesses in Cyprus and the Former Yugoslav Republic of Macedonia

5

Liquidity

Group deposits

increased by 1.9% qoq to €42.0bn in Q3.18, driven by the domestic market. Deposits in Greece amounted to €40.0bn on quarterly inflows of €757m. In SE Europe(1), deposits were up by 1.4% qoq to €2.0bn. On an annual basis, Group deposits grew by 8.9% yoy, reflecting deposit inflows of €3.3bn in Greece, despite continuous capital control uplifts.

As a result, NBG’s

L:D ratio

settled at 71% in Greece (73% in Q2.18) and 72% at the Group level.

Eurosystem

amounts to €2.3bn currently from €2.8bn at end-Q2.18, comprising of TLTRO funding from the ECB, with the Bank enjoying a large liquidity buffer. In 9M.18 our LCR and NSFR ratios settled at 124% and 103% respectively, exceeding the minimum regulatory requirement of 100%.

The removal of ECB’s waiver in August 2018 had zero impact on liquidity and funding cost on the back of NBG issued investment grade covered bonds replacing Greek sovereign paper.

Eurosystem funding (€bn)

NBG domestic deposit flows per quarter (€ bn)

6

Capital

CET1 ratio of 16.4% in Q3.18, including the impairment charge for the sale of Banca Romaneasca, stands comfortably above regulatory requirements.

Pro forma for the 9M.18 PAT and the reduction in RWAs following the completion of SABA sale in October, CET1 stands at 16.6% and 13.1%, taking into account the IFRS 9 full impact.

CET1 ratio

7

Profitability

Greece:

PAT from continued operations

amounted to €33m in 9M.18 against sizable losses of €122m in 9M.17, reflecting mainly the sharp de-escalation in CoR (-143bps yoy), which brought operating result to positive territory (€62m) vs losses in 9M.17 (€100m).

NII

amounted to €253m in Q3.18 from €255m the previous quarter, with the impact of restructurings and deleveraging in the retail book largely offset by higher average corporate balances and bond NII.

NIM

decreased by 7bps qoq to 260bps, reflecting further lending yield drop. In 9M.18, NII declined by 22% yoy to €776m, negatively affected by the IFRS 9 adoption and the one-off impact from the repricing of part of the mortgage book linked with Greek 12-month T-bills during H1.18, as well as the impact of restructurings and deleveraging on the retail book.

Net fee and commission income

remained flat qoq at €54m. On an annual basis, net fees grew by 4% yoy, driven by the elimination of ELA-related fees.

Trading income

rebounded to €17m in Q3.18 vs the losses of €9m in Q2.18, due to gains of €9m from derivatives vs losses of €4m in Q2.18. In 9M.18, the trading line was positive, generating gains of €43m.

Q3.18

operating expenses

amounted to €226m from €220m in Q2.18, reflecting the 6.9% qoq rise in G&As, mainly on increased consulting fees. Personnel expenses remained broadly stable at €137m (+1.0% qoq). On an annual basis, OpEx settled at €658m (+3.0% yoy), driven by G&As (+7.2% yoy) again on higher costs related to professional services. Personel expenses were also up 2.1% yoy, yet incorporated €6.7m arising from the one-off performance-based pay for Special units and a retrospective salary payment. Operating expenses are expected to return to negative growth rates post the completion of the ongoing Voluntary Exit Scheme (VES) benefiting personnel expenses in FY.19, with the full cost borne in Q2.18.

Loan impairments

amounted to €78m in Q3.18 from €35m the previous quarter, as the latter was aided by recoveries related to the €2bn unsecured NPL disposal.

CoR

settled at 109bps from 48bps in Q2.18, yet was stable qoq on a like-for-like basis. 9M.18 CoR settled at 108bps from 251bps in 9M.17, constituting the key driver for our return to operating profitability.

SE Europe:

(1)

In SE Europe(1),

PAT from continued operations

reached €2m in Q3.18 (€3m in Q2.18). At the end of September 2018, PAT from continued operations amounted to €16m from €19m in 9M.17.

(1) SE Europe includes the Group’s businesses in Cyprus and the Former Yugoslav Republic of Macedonia

8

|

Name

|

|

Abbreviation

|

|

Definition

|

|

Common Equity Tier 1 Ratio

|

|

CET1 ratio

|

|

CET1 capital as defined by Regulation No 575/2013, with the application of the regulatory transitional arrangements for IFRS 9 impact (H1.18) over RWAs

|

|

Common Equity Tier 1 Ratio Fully Loaded

|

|

CET1 CRD IV FL

|

|

CET1 capital as defined by Regulation No 575/2013, without the application of the regulatory transitional arrangements for IFRS 9 impact (H1.18) over RWAs

|

|

Core Deposits

|

|

|

|

Consist of current, sight and other deposits, as well as savings accounts, and exclude repos and time deposits

|

|

Core Income

|

|

CI

|

|

Net Interest Income (“NII”) + Net fee and commission income

|

|

Core Operating Result (Profit / (Loss))

|

|

—

|

|

Core income less operating expenses and provisions (credit provisions and other impairment charges)

|

|

Core Pre-Provision Income

|

|

Core PPI

|

|

Core Income less operating expenses

|

|

Cost of Risk / Provisioning Rate

|

|

CoR

|

|

Credit provisions of the period annualized over average net loans

|

|

Cost-to-Core Income Ratio

|

|

C:CI

|

|

Operating expenses over core Income

|

|

Cost-to-Income Ratio

|

|

C:I

|

|

Operating expenses over total income

|

|

Equity / Book Value

|

|

BV

|

|

Equity attributable to NBG shareholders

|

|

Funding cost / Cost of funding

|

|

—

|

|

The blended cost of deposits, ECB refinancing, repo transactions, ELA funding (until late November, 2017), as well as covered bond and securitization transactions

|

|

Gross Loans

|

|

—

|

|

Loans and advances to customers before allowance for impairment

|

|

Liquidity Coverage Ratio

|

|

LCR

|

|

The LCR refers to the liquidity buffer of High Quality Liquid Assets (HQLAs) that a Financial Institution holds, in order to withstand net liquidity outflows over a 30 calendar-day stressed period

|

|

Loans-to-Deposits Ratio

|

|

L:D

|

|

Net loans over total deposits, period end

|

|

Net Interest Margin

|

|

NIM

|

|

NII annualized over average interest earning assets. The latter include all assets with interest earning potentials and includes cash and balances with central banks, due from banks, financial assets at fair value through profit or loss (excluding Equity securities and mutual funds units), loans and advances to customers and investment securities (excluding equity securities and mutual funds units).

|

|

Net Stable Funding Ratio

|

|

NSFR

|

|

The NSFR refers to the portion of liabilities and capital expected to be sustainable over the time horizon considered by the NSFR over the amount of stable funding that must be allocated to the various assets, based on their liquidity characteristics and residual maturities

|

|

Net Loans

|

|

—

|

|

Loans and advances to customers

|

|

Non-Performing Exposures

|

|

NPEs

|

|

Non-performing exposures are defined according to EBA ITS technical standards on Forbearance and Non-Performing Exposures as exposures that satisfy either or both of the following criteria: (a) material exposures which are more than 90 days past due, (b) the debtor is assessed as unlikely to pay its credit obligations in full without realization of collateral, regardless of the existence of any past due amount or of the number of days past due

|

|

Non-Performing Exposures Coverage Ratio

|

|

NPE coverage

|

|

Stock of provisions (allowance for impairment for loans and advances to customers) over non-performing exposures excluding loans mandatorily classified as FVTPL, period end

|

|

Non-Performing Exposures Formation

|

|

NPE formation

|

|

Net increase / (decrease) of NPEs, before write-offs

|

|

Non-Performing Exposures Ratio

|

|

NPE ratio

|

|

Non-performing exposures over gross loans, period end

|

|

Non-Performing Loans

|

|

NPLs

|

|

Loans and advances to customers in arrears for 90 days or more

|

|

90 Days Past Due Coverage Ratio

|

|

90dpd coverage

|

|

Stock of provisions over loans and advances to customers in arrears for 90 days or more excluding loans mandatorily classified as FVTPL, period end

|

|

90 Days Past Due Formation

|

|

90dpd formation

|

|

Net increase / (decrease) of loans and advances to customers in arrears for 90 days or more, before write-offs and after restructurings

|

|

90 Days Past Due Ratio

|

|

90dpd / NPL ratio

|

|

Loans and advances to customers in arrears for 90 days or more over gross loans, period end

|

|

Operating Expenses

|

|

OpEx, costs

|

|

Personnel expenses + General, administrative and other operating expenses (“G&As”) + Depreciation and amortisation on investment property, property & equipment and software & other intangible assets. For H1.18, operating expenses excludes the VES cost of €40m.

|

|

Operating Profit / (Loss)

|

|

—

|

|

Total income less operating expenses and provisions (credit provisions and other impairment charges)

|

|

Pre-Provision Income

|

|

PPI

|

|

Total income less operating expenses, before provisions (credit provisions and other impairment charges)

|

|

PAT (Continuing Operations)

|

|

—

|

|

Profit for the period from continuing operations. For H1.18, PAT (continuing operations) excludes the VES cost of €40m.

|

|

Risk Weighted Assets

|

|

RWAs

|

|

Assets and off-balance-sheet exposures, weighted according to risk factors based on Regulation (EU) No 575/2013

|

|

Tangible Equity / Book Value

|

|

TBV

|

|

Common equity less goodwill & intangibles (goodwill, software and other intangible assets)

|

|

Total deposits

|

|

—

|

|

Due to customers

|

9

Disclaimer

No representation or warranty, express or implied, is or will be made in relation to, and no responsibility is or will be accepted by National Bank of Greece (the “Group”) as to the accuracy or completeness of the information contained in this announcement and nothing in this announcement shall be deemed to constitute such a representation or warranty.

Although the statements of fact and certain industry, market and competitive data in this announcement have been obtained from and are based upon sources that are believed to be reliable, their accuracy is not guaranteed and any such information may be incomplete or condensed. All opinions and estimates included in this announcement are subject to change without notice. The Group is under no obligation to update or keep current the information contained herein.

In addition, certain of these data come from the Group’s own internal research and estimates based on knowledge and experience of management in the market in which it operates. Such research and estimates and their underlying methodology have not been verified by any independent source for accuracy or completeness. Accordingly, you should not place undue reliance on them.

Certain statements in this announcement constitute forward-looking statements. Such forward looking statements are subject to risks and uncertainties that may cause actual results to differ materially. These risks and uncertainties include, among other factors, changing economic, financial, business or other market conditions. As a result, you are cautioned not to place any reliance on such forward-looking statements. Nothing in this announcement should be construed as a profit forecast and no representation is made that any of these statement or forecasts will come to pass. Persons receiving this announcement should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecast periods, which reflect the Group’s view only as of the date hereof.

10

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

National Bank of Greece S.A.

|

|

|

|

|

|

|

|

|

/s/ Ioannis Kyriakopoulos

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

Date: November 29, 2018

|

|

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

/s/ George Angelides

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

Date: November 29, 2018

|

|

|

|

|

|

|

Director, Financial Division

|

11

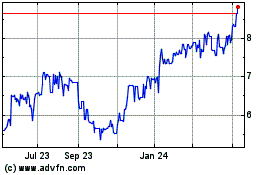

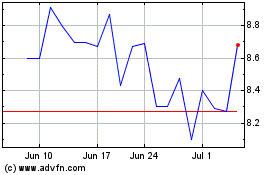

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Apr 2023 to Apr 2024