UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. 1)

Filed

by the Registrant [X]

Filed

by a Party other than the Registrant [ ]

Check

the appropriate box:

|

[X]

|

Preliminary

Proxy Statement

|

|

|

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

[ ]

|

Definitive

Proxy Statement

|

|

|

|

|

[ ]

|

Definitive

Additional Materials

|

|

|

|

|

[ ]

|

Soliciting

Material under §240.14a-12

|

IMMUNE

THERAPEUTICS, INC.

(Name

of Registrant As Specified In Its Charter)

Payment

of Filing Fee (Check the Appropriate Box):

|

[X]

|

No

fee required.

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title

of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate

number of securities to which transaction applies:

|

|

|

(3)

|

Per

unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed

maximum aggregate value of transaction:

|

|

|

(5)

|

Total

fee paid:

|

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

(1)

|

Amount

Previously Paid:

|

|

|

(2)

|

Form,

Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing

Party:

|

|

|

(4)

|

Date

Filed:

|

IMMUNE

THERAPEUTICS, INC.

37

North Orange Ave, Suite 607, Orlando, FL 32801

IMPORTANT

NOTICE REGARDING INTERNET AVAILABILITY OF

PROXY

MATERIALS FOR IMMUNE THERAPEUTICS, INC.

To

the Shareholders of Immune Therapeutics, Inc.:

NOTICE

IS HEREBY GIVEN to you as a stockholder of Immune Therapeutics, Inc., a Florida corporation (which we refer to in this Notice

as the “Company,” “we,” “us” or “our”), that the Company is soliciting the votes

of shareholders by written consent (“written consent”) to approve certain actions proposed by the Company’s

Board of Directors, as more fully described in the accompanying proxy statement and its Amendment No. 1 (collectively, the “Proxy

Statement”). This notice presents only an overview of the more complete Proxy Statement that is available to you on the

internet or, upon request, by mail. We encourage you to access and review all of the important information contained in the Proxy

Statement and other proxy materials.

Written

consents are being solicited on the Company’s behalf by certain of its officers in person, by telephone and electronic communication

for the following corporate actions:

|

|

●

|

Authorize

the Company to issue up to 10,000,000 shares of preferred stock (“the Preferred Authorization”), and designate

1,000,000 of such preferred shares as Series D Preferred Stock (“Series D Designation”) (Proposal No. 1);

|

|

|

|

|

|

|

●

|

Effect

a reverse stock split (the “Reverse Split”) at a ratio between 800-to-1 and 1,000-to-1, to be determined by the

Company’s Board of Directors (Proposal No. 2);

|

|

|

|

|

|

|

●

|

Change

the Company’s name to Forte Biotechnology, Inc. (the “Name Change”) (Proposal No. 3);

|

Written

consents must be received no later than December 31, 2018; however, once the requisite number of written consents has been received,

the Company will no longer solicit written consents and the actions will be deemed approved.

On

behalf of the Board of Directors,

|

|

/s/

Noreen Griffin

|

|

|

|

Name: Noreen

Griffin

|

|

|

|

Chief

Executive Officer and Director

|

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

PROXY

STATEMENT PURSUANT TO SECTION 14(a)

OF

THE SECURITIES EXCHANGE ACT OF 1934

AND

RULE 14A PROMULGATED THERETO

IMMUNE

THERAPEUTICS, INC.

37

North Orange Ave, Suite 607, Orlando, FL 32801

PROXY

STATEMENT

AMENDMENT NO. 1

(PRELIMINARY)

[NOTICE

DATE]

A

NOTICE OF THE INTERNET AVAILABILITY OF THIS PROXY STATEMENT IS BEING MAILED ON OR ABOUT [NOTICE DATE] TO STOCKHOLDERS OF RECORD

ON NOVEMBER 25, 2018.

EXPLANATORY

NOTE

This

Amendment No. 1 to Schedule 14A (“Amendment No. 1”) is being filed to amend the preliminary proxy statement filed

on November 27, 2018 (“Proxy Statement”) by Immune Therapeutics, Inc. (the “Company”), in order to correct

the statement on page 4 under “What are the Actions for which written consent is being sought?” regarding the change

of the Company’s name. The Proxy Statement indicated that the Company intends to solicit written consents to change its

name to One Immune, Inc.; however, the Proxy Statement should have indicated that the Company is soliciting written consents to

change its name to Forte Biotechnology, Inc. Accordingly, the Proxy Statement is hereby amended to reflect the correct Name Change

to Forte Biotechnology Inc. Thus, each instance in the Proxy Statement that refers to the Name Change should be read as referring

to changing the Company’s name to Forte Biotechnology, Inc. We have also updated the written consent to reflect the foregoing.

This

Amendment No. 1 to Schedule 14A amends only the items of the Proxy Statement and written consent as specified above and amends

those items solely to reflect the changes described above. There are no other changes to the Proxy Statement or the written consent.

Appendix

A

WRITTEN

CONSENT OF THE

SHAREHOLDERS

OF IMMUNE THERAPEUTICS, INC.

The

undersigned, being the Shareholders (the “

Shareholders

”) of Immune Therapeutics, Inc., a Florida corporation

(the “

Company

”) holding the number of shares required to approve the below actions, pursuant to the Florida

Business Corporation Act and the Bylaws of the Company, hereby consent to the following actions and hereby adopt and approve the

following recitals and resolutions by written consent.

WHEREAS

,

the Shareholders believe it is in the best interest of the Company to authorize the Company to issue up to 10,000,000 shares of

preferred stock, par value $0.0001, with the rights and privileges as designated by the Directors, and to designate 1,000,000

of such preferred shares as Series D Preferred Stock, with the rights and privileges as included in the attached “

Certificate

of Designation

” (Proposal 1);

WHEREAS

,

the Shareholders believe it in the best interest of the Company to effectuate a reverse stock split of the Company’s common

stock (“

Reverse Split

”) at a ratio between 800-to-1 and 1,000-to-1, as determined by the Directors;

provided,

however

, that the Reverse Split must be consummated prior to December 31, 2019 (Proposal 2); and

WHEREAS

,

the Shareholders wish the Company to change its name to Forte Biotechnology, Inc. (“

Name Change

”) (Proposal

3);

NOW,

THEREFORE, BE IT RESOLVED

, that the Company shall be authorized to issue up to 10,000,000 shares of preferred stock, par value

$0.0001.

FURTHER

RESOLVED

, that from the 10,000,000 authorized shares of preferred stock, 1,000,000 shares will be designated as Series D Preferred

Stock, with the rights and privileges as included in the attached Certificate of Designation, which each Shareholder acknowledges

it has read and approves.

FURTHER

RESOLVED

, that

from the undesignated shares

of preferred stock, the Company’s Board of Directors is authorized to, by written resolution, (1) designate wholly unissued

series of preferred stock, (2) direct the issuance of the preferred stock in one or more series, (3) fix the dividend rate, conversion

or exchange rights, redemption price and liquidation preference, of any wholly unissued series of the preferred stock, (4) fix

the number of shares for any wholly unissued series of preferred stock, and (5) increase or decrease the number of shares of any

wholly unissued series of preferred stock.

FURTHER

RESOLVED

,

that

the Reverse Split is approved.

FURTHER

RESOLVED

, the Name Change is approved.

FURTHER

RESOLVED

, that the officers of the Company be, and each of them hereby is, authorized and directed to take all such further

actions and to execute and deliver, in the name of and on behalf of the Company, any and all such further documents, agreements,

certificates, instruments and undertakings, and to incur all such fees and expenses, as they or any of them may deem necessary

or advisable to carry out the purpose of the foregoing resolution and that the taking of each such action, the execution and delivery

of each such document or instrument, and the payment of each such expense shall be conclusive evidence of its necessity and advisability.

FURTHER

RESOLVED

, that any and all actions taken by the officers of the Company prior to the date hereof and contemplated by the foregoing

resolutions are hereby adopted and approved as the acts and deeds of the Company.

The

undersigned hereby agrees that this written consent may be executed in one or more counterparts, each of which shall be deemed

an original, and all of which, when taken together, shall be deemed one action.

IN

WITNESS WHEREOF

, the undersigned Shareholder, by his/her/its signature hereunder, waives any requirement of notice required

by law or the Company’s Bylaws, and executes this written consent as of the ___ day of _____________________, 2018 to approve

the following Proposals (check all that apply).

Proposal

1

Proposal

2

Proposal

3

Follow

Board Recommendations

|

Shareholder

Signature

|

|

Signature

of spouse, partner, or joint tenant

|

|

|

|

|

|

|

|

|

Printed:

Shares

Held:

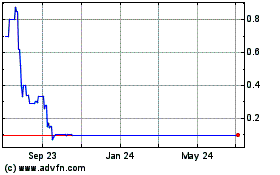

Immune Therapeutics (PK) (USOTC:IMUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Immune Therapeutics (PK) (USOTC:IMUN)

Historical Stock Chart

From Apr 2023 to Apr 2024