Current Report Filing (8-k)

November 28 2018 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 21, 2018

TEXAS PACIFIC LAND TRUST

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Not Applicable

(State or Other Jurisdiction of

Incorporation)

|

1-737

(Commission File Number)

|

75-0279735

(IRS Employer Identification Number)

|

1700 Pacific Avenue, Suite 2770, Dallas, Texas 75201

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code:

214-969-5530

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

¨

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

¨

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

¨

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

¨

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On November 21, 2018, Texas Pacific Land Trust (the “Trust”) entered into a Purchase and Sale Agreement (the “Sale Agreement”), pursuant to which the Trust agreed to sell approximately 14,000 surface acres of land in Loving and Reeves Counties, Texas for an aggregate purchase price of $100,000,000 (the “Sale”) as may be adjusted based on the terms and conditions of the agreement. The Sale excludes any mineral interest in the lands to be conveyed.

The Sale is subject to a number of closing conditions, including the buyer’s due diligence investigation and option to reduce the acreage to be conveyed by as much as 1,920 acres with a corresponding reduction of the purchase price. The Sale Agreement contains standard representations and warranties related to each party, and may be terminated prior to the closing under certain circumstances. The Trust anticipates that the closing of the Sale will occur during the first quarter of 2019.

The Trust intends to use proceeds of the Sale to acquire like kind properties.

The foregoing description of the Sale Agreement is qualified in its entirety by reference to such agreement, which will be filed in accordance with SEC regulations.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Trust has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

TEXAS PACIFIC LAND TRUST

|

|

Date: November 28, 2018

|

By:

|

/s/ Robert J. Packer

|

|

|

|

Robert J. Packer

|

|

|

|

General Agent and Chief Financial Officer

|

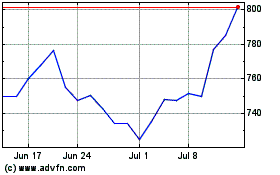

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

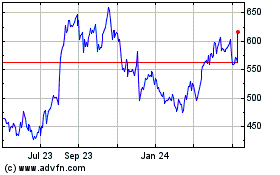

Texas Pacific Land (NYSE:TPL)

Historical Stock Chart

From Apr 2023 to Apr 2024