Current Report Filing (8-k)

November 28 2018 - 8:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

|

|

|

|

|

|

Date of Report (Date of earliest event reported)

|

November 27, 2018

|

|

|

|

|

|

AquaBounty Technologies, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Delaware

|

001-36426

|

04-3156167

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

2 Mill & Main Place, Suite 395, Maynard, Massachusetts

|

01754

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

|

|

|

|

Registrant’s telephone number, including area code

|

978-648-6000

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) On November 28, 2018, AquaBounty Technologies, Inc. (the “Company”) announced that Dr. Ronald Stotish will be stepping down as Chief Executive Officer and President of the Company, effective as of January 1, 2019, to focus on his role in

the Company’s research and regulatory affairs efforts. Dr. Stotish will remain an executive member of the Board of Directors of the Company (the “Board”). Dr. Stotish’s resignation as Chief Executive Officer and President of the Company is not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies, or practices.

(c) On November 27, 2018, the Board appointed Sylvia Wulf, 61, as the Chief Executive Officer and President of the Company, effective as of January 1, 2019. Ms. Wulf currently serves as a Senior Vice President of US Foods, Inc., where she has been President of the Manufacturing Division since June 2011. Prior to US Foods, Ms. Wulf held senior positions in Tyson Foods, Inc, Sara Lee Corporation, and Bunge Corp. She is also currently on the Board of Directors and the Executive Committee of the National Fisheries Institute. Ms. Wulf was chosen for her experience in the food industry in North America, including its fish sector. Ms. Wulf received a B.S. in Finance from Western Illinois University and an MBA from DePaul University.

As of November 27, 2018, the Company and Ms. Wulf entered into an Executive Employment Agreement (the “Employment Agreement”) pursuant to which Ms. Wulf will work for the Company on a full-time basis starting January 1, 2019. The Employment Agreement provides for (i) a base annual salary of $375,000; (ii) an annual cash bonus of up to 50% of that base salary, based on achievement of primary business goals and financial targets; (iii) a one-time restricted stock grant of $350,000 worth of the Company’s common stock, par value $0.001 per share (“Common Stock”), that will fully vest on November 27, 2019; (iv) a grant of an option to purchase 150,000 shares of Common Stock, which option will vest on the first anniversary of the grant date; (v) in the event of Ms. Wulf’s death or permanent disability, the payment of a portion of the annual bonus that would have been earned for the then-current fiscal year, pro rata by number of days of full-time service during that year; (vi) in the event of termination of Ms. Wulf’s employment without “Cause” or for “Good Reason” (as those terms are defined in the Employment Agreement), the payment of the pro rata bonus described in clause (v), plus a severance payment equal to one year of base salary; and (vii) the offer of benefits generally available to employees of the Company. If Ms. Wulf’s employment is terminated without Cause or for Good Reason within twelve months after a “Change in Control” of the Company, as that term is defined in the Employment Agreement, all then-unvested equity compensation, if any, shall immediately vest. Ms. Wulf will also enter into the Company’s standard form of indemnification agreement for its directors and officers, effective January 1, 2019.

Except for the arrangements described in this Current Report on Form 8-K, there are no existing or currently proposed transactions to which the Company or any of its subsidiaries is a party and in which Ms. Wulf has a direct or indirect material interest. There are no family relationships between Ms. Wulf and any of the Company’s directors or executive officers.

The foregoing summary of the Employment Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Employment Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

(d) On November 27, 2018, the Board appointed Sylvia Wulf as an executive member of the Board, effective as of January 1, 2019, to fill a vacancy created by the Board’s decision to increase the number of directors to eight in accordance with the Company’s Amended and Restated Bylaws. Ms. Wulf will serve for a term ending on the date of the Company’s 2019 annual meeting of shareholders, and until her successor is duly elected and qualified, or until her earlier resignation, death, or removal. Ms. Wulf will receive no compensation as a Board member.

Item 7.01 Regulation FD Disclosure.

On November 28, 2018, the Company issued a press release regarding the matters described under Item 5.02 above. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information included in this Current Report on Form 8-K pursuant to Item 7.01, including Exhibit 99.1 attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

†Management contract or compensatory plan or arrangement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

AquaBounty Technologies, Inc.

|

|

|

|

(Registrant)

|

|

November 28, 2018

|

|

/s/ David A. Frank

|

|

|

|

David A. Frank

|

|

|

|

Chief Financial Officer

|

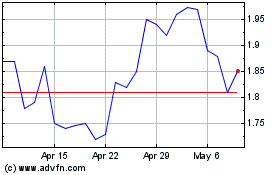

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Mar 2024 to Apr 2024

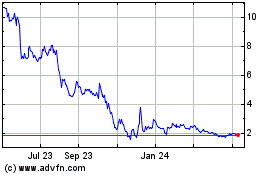

AquaBounty Technologies (NASDAQ:AQB)

Historical Stock Chart

From Apr 2023 to Apr 2024