Current Report Filing (8-k)

November 21 2018 - 4:41PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 20, 2018

Spirit AeroSystems Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-33160

|

|

20-2436320

|

|

(State or other jurisdiction of

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

incorporation)

|

|

|

|

|

|

3801 South Oliver, Wichita, Kansas 67210

|

|

|

(Address of principal executive offices) (Zip Code)

|

|

Registrant’s telephone number, including area code:

(316) 526-9000

Not Applicable

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On November 20, 2018, Sanjay Kapoor announced his retirement as Executive Vice President and Chief Financial Officer of Spirit AeroSystems Holdings, Inc. (the “Company”), effective on January 7, 2019, or such later date as may be mutually agreed by the Company and Mr. Kapoor. Subsequently, Mr. Kapoor will remain with the Company as Senior Financial Advisor until March 31, 2019, when he will formally retire from the Company (the “Retirement Date”). For one (1) year following the Retirement Date (the “Consulting Term”), Mr. Kapoor will provide consulting services to the Company. The Company will name a successor for Mr. Kapoor at a later date. A copy of the press release dated November 21, 2018, announcing Mr. Kapoor’s retirement is attached as Exhibit 99.1 to this report.

On November 20, 2018, the Company and Mr. Kapoor entered into a Retirement Agreement and General Release (the “Agreement”). Under the terms of the Agreement and in consideration of Mr. Kapoor’s cooperation in the transition and provision of consulting services, release of claims, and compliance with certain obligations, including confidentiality, non-competition, non-solicitation, and non-disparagement covenants, Mr. Kapoor will receive separation payments comprised of the following: (i) 12,000 shares of restricted stock vesting in 12 equal monthly installments over the Consulting Term; (ii) a sum of $650,000, which is equal to one year of Mr. Kapoor’s current annual base salary, vesting in 12 equal monthly installments over the Consulting Term, (iii) a payment based on actual achievement of 2018 performance under the Short-Term Incentive Program (the “STIP”) under the 2014 Omnibus Plan, as amended (the “Omnibus Plan”), (iv) a pro-rata payment of his target 2019 STIP award under the Omnibus Plan for the portion of the 2019 plan year prior to the Retirement Date, (v) a sum of $250,000 to cover Mr. Kapoor’s relocation expenses, and (vi) COBRA coverage through the first anniversary of the Retirement Date. In addition, until his Retirement Date, Mr. Kapoor will continue to vest as an active employee in his outstanding awards under the Company’s Long-Term Incentive Plan under the Omnibus Plan in accordance with their terms, including, in the case of performance-based grants, the satisfaction of applicable performance criteria. Following the Retirement Date, Mr. Kapoor will be entitled to receive his account balance and accrued benefit, as applicable, under the Company’s Retirement and Savings Plan in accordance with the terms of such plan.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

*

Filed herewith.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SPIRIT AEROSYSTEMS HOLDINGS, INC.

|

|

|

|

|

|

Date: November 21, 2018

|

By:

|

/s/ Stacy Cozad

|

|

|

|

Name:

|

Stacy Cozad

|

|

|

|

Title:

|

Senior Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer

|

3

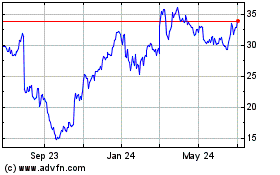

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

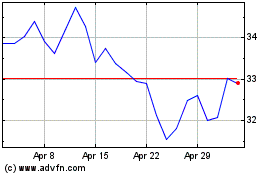

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

From Apr 2023 to Apr 2024