Current Report Filing (8-k)

November 20 2018 - 4:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_______________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 16, 2018

_______________________________

NanoString Technologies, Inc.

(Exact name of registrant as specified in its charter)

________________________________

|

|

|

|

|

|

|

Delaware

|

001-35980

|

20-0094687

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

530 Fairview Avenue North

Seattle, Washington 98109

(Address of principal executive offices, including zip code)

(206) 378-6266

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

Emerging Growth Company

|

ý

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act).

¨

Item 1.01 Entry into a Material Definitive Agreement.

On November 16, 2018, the Company, as borrower, entered into an Amended and Restated Loan and Security Agreement (the “SVB Agreement”), by and between the Company and Silicon Valley Bank (“SVB”). The SVB Agreement amends and restates the existing Loan and Security Agreement between the Company and SVB dated as of January 5, 2018 (the “Prior Agreement”) to, among other things, increase the size of the revolving loan facility under the SVB Agreement to $20.0 million and include eligible inventory in the Company’s borrowing base. The SVB Agreement matures on November 16, 2021, at which time the outstanding principal will become due and payable. Interest on borrowings is payable monthly. Amounts drawn accrue interest at a yearly rate equal to the greater of (i) the prime rate, as reported in the Wall Street Journal, plus 0.50% and (ii) 4.75% (the “Applicable Rate”). During an event of default, amounts drawn accrue interest at a yearly rate equal to the Applicable Rate plus 4.0% per annum. The Company’s obligations under the agreement are secured by its cash and cash equivalents, accounts receivable and proceeds thereof, and inventory and proceeds from the sale thereof.

The SVB Agreement contains various customary representations and warranties, conditions to borrowing, events of default, including a cross default to the Amended and Restated Term Loan Agreement, by and among the Company, the lenders party thereto (the “Lenders”), and CRG Servicing LLC, as administrative and collateral agent for the Lenders, dated as of October 12, 2018, and covenants, including financial covenants requiring the maintenance of minimum annual revenue and liquidity.

As of the date of this Current Report on Form 8-K, the Company had not incurred any borrowings under either the Prior Agreement or the SVB Agreement.

The foregoing description of the SVB Agreement is not complete and is qualified in its entirety by reference to the full text of such agreement. A copy of the SVB Agreement will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2018.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 above is hereby incorporated by reference into this Item 2.03.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

NanoString Technologies, Inc.

|

|

|

|

|

|

|

Date:

|

November 20, 2018

|

By:

|

/s/ Thomas Bailey

|

|

|

|

|

Thomas Bailey

|

|

|

|

|

Chief Financial Officer

|

NanoString Technologies (NASDAQ:NSTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

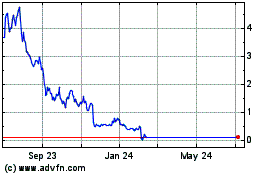

NanoString Technologies (NASDAQ:NSTG)

Historical Stock Chart

From Apr 2023 to Apr 2024