SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section

14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

|

☐

|

Preliminary Information Statement

|

|

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)2))

|

|

|

|

|

☒

|

Definitive Information Statement

|

CANNAWAKE CORPORATION

(Name of Registrant as Specified in Charter)

Payment of Filing Fee (Check the appropriate

box):

|

☒

|

No fee required

|

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

|

|

|

|

|

1.

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2.

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

3.

|

Per unit price or other underlying value of transaction, computed pursuant to Exchange Act Rule O-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4.

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

5.

|

Total fee paid:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided

by Exchange Act Rule O-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1.

|

Amount Previously Paid:

|

|

|

|

|

|

|

2.

|

Form Schedule or Registration Statement No.:

|

|

|

|

|

|

|

3.

|

Filing Party:

|

|

|

|

|

|

|

4.

|

Date Filed:

|

SCHEDULE 14C INFORMATION STATEMENT

Pursuant to Regulation 14C of the Securities

Exchange Act of 1934, as amended

CANNAWAKE CORPORATION

HC1 Box 360, 107355 Nipton Rd.,

Nipton, CA

Telephone: (720) 573-0102

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

This Information Statement is being furnished

to our stockholders on behalf of our board of directors pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of

1934, as amended, for the purpose of informing our stockholders of amendments to our Certificate of Incorporation to increase

the number of shares of common stock that the Company is authorized to issue from 250,000,000 shares of common stock, par value

$.0001 per share (“Common Stock”), to 950,000,000 shares of Common Stock, par value $.0001 per share. This Information

Statement is being furnished to the stockholders of record of our Common Stock, on the record date as determined by our board

of directors to be the close of business on November 16, 2018.

Our board of directors approved the amendments

to our Certificate of Incorporation to increase our authorized Common Stock from 250,000,000 shares to 950,000,000 shares on November

1, 2018. Our Company also received on November 1, 2018, the written consent from a stockholder of our Company who holds a majority

of the voting power of the Company’s Common Stock. Upon the expiration of the 20-day period required by Rule 14c-2 and in

accordance with the provisions of the

General Corporation Law

of the State of Delaware, our Company intends to file a Certificate

of Amendment to our Certificate of Incorporation to effect the amendment to increase our authorized Common Stock.

The proposed Certificate of Amendment,

attached hereto as Exhibit A, will become effective when it has been accepted for filing by the Secretary of State of the State

of Delaware. We anticipate that our Company will file the Certificate of Amendment 20 days after this Information Statement is

first mailed to our stockholders.

The entire cost of furnishing this Information

Statement will be borne by our Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties

to forward this Information Statement to the beneficial owners of our Common Stock held on the record date.

Our board of directors has fixed the close

of business on November 16, 2018, as the record date for determining the holders of our Common Stock who are entitled to receive

this Information Statement. As of November 16, 2018, there were 43,915,132 shares of our Common Stock issued and outstanding.

We anticipate that this Information Statement will be mailed on or about November 26, 2018, to our stockholders of record.

PLEASE NOTE THAT THIS IS NOT A REQUEST

FOR YOUR VOTE OR A PROXY, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU OF THE AMENDMENT TO OUR CERTIFICATE OF INCORPORATION.

INTEREST OF CERTAIN PERSONS IN OR

OPPOSITION TO MATTERS TO BE ACTED UPON

Except as disclosed elsewhere in this Information

Statement, none of the following persons have any substantial interest, direct or indirect, by security holdings or otherwise in

any matter to be acted upon:

|

1.

|

any director or officer of our company since January 1, 2017, being the commencement of our last completed audited financial year; or

|

|

|

|

|

2.

|

any associate or affiliate of any of the foregoing persons.

|

PRINCIPAL STOCKHOLDERS AND SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth information,

as of November 1, 2018, with respect to the beneficial ownership of the Company’s Common Stock by each person known by the Company

to be the beneficial owner of more than five percent (5%) of the outstanding Common Stock and by directors and officers of the

Company, both individually and as a group:

|

Class

|

|

Name and Address of Beneficial Owner*

|

|

Number of Shares Owned

Beneficially

|

|

|

Percentage**

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Green Inc.

|

|

|

|

|

|

|

|

|

|

|

|

11011 S. 48th St, Suite 106

|

|

|

|

|

|

|

|

|

|

|

|

Phoenix, AZ 85044 (1)

|

|

|

160,000,000

|

|

|

|

78.46

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Santiago Peralta (2)

|

|

|

6,713,850

|

|

|

|

15.29

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pablo Peralta (2)

|

|

|

6,500,000

|

|

|

|

14.80

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Malcolm W. Sherman (3)

|

|

|

572,801

|

|

|

|

1.30

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott Stoegbauer

|

|

|

-0-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Officers and Directors as a Group (2 persons)

|

|

|

572,801

|

|

|

|

1.30

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A Preferred Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Green, Inc.

|

|

|

160,000

|

|

|

|

100

|

%

|

* Unless otherwise stated in the table,

the address of each of the stockholders shown in the table is c/o Cannawake, HC1 Box 360, 107355 Nipton Rd., Nipton, CA 92364.

** Based on 43,915,132 shares outstanding

on November 1, 2018

(1) At the closing of the purchase of Nipton,

Inc. by the Company, we issued American Green, Inc. 160,000 shares of the Company’s Series A Convertible Preferred Stock,

convertible into 160,000,000 shares of common stock. David Gwyther is the Chief Executive Officer of American Green, Inc.

(2) Egani, Inc., of which Santiago Peralta,

a former director of the Company, and Pablo Peralta, his brother, each owns 50% of the outstanding stock, owns 13,000,001 shares

directly. Santiago Peralta owns 13,800 shares directly and holds a warrant, expiring December 14, 2018 to purchase 200,000 shares

of common stock at an exercise price of $0.20 per share. The addresses of Egani, Inc., and of Santiago and Pablo Peralta, is

c/o

Cannawake, HC1 Box 360, 107355 Nipton Rd., Nipton, CA 92364.

(3) Mr. Sherman owns beneficially 572,801

shares owned by Security Systems International, Inc. of which Mr. Sherman is the president and a director and the majority stockholder.

The address of Security Systems International, Inc. is 10250 N. 117th. Place, Scottsdale, AZ 85259.

AMENDMENT TO OUR COMPANY’S CERTIFCATE OF INCORPORATION

Increase in Authorized Common Stock

As of the record date,

there were 43,915,132 shares of Common Stock issued and outstanding, in the capital of our Company. Each share of our company’s

Common Stock is entitled to one vote.

The board of directors

of the Company on November 1, 2018, adopted a resolution approving and recommending to the Company’s stockholders for their approval

an amendment to the Company’s Certificate of Incorporation to provide for an increase of the number of shares of Common Stock that

the Company is authorized to issue from 250,000,000 to 950,000,000.

The board of directors

recommends the proposed increase in the authorized number of shares of Common Stock since the Company’s estimate that there

is not a sufficient number of authorized and unissued shares available (i) to provide for conversion shares for our convertible

preferred stock and convertible debt outstanding at the date of this Information Statement; (ii) to raise additional capital for

the operations of the Company; and (iii) to make options and shares available to employees, future non-employee directors and consultants

of the Company as an incentive for services provided to the Company. Holders of the Company’s Common Stock do not have preemptive

rights.

As of November 1, 2018,

with 250,000,000 shares of Common Stock authorized, we had 43,915,132 shares of Common Stock issued and outstanding, which leaves

206,084,868 authorized but unissued shares. The Company has reserved 160,000,000 shares of Common Stock for possible issuance pursuant

to conversion of the outstanding 160,000 shares of Series A Preferred Stock; 2,340,624 shares of Common Stock for issuance upon

conversion of outstanding warrants; and 9,750,000 shares reserved at June 30, 2018 for outstanding convertible debt. We will need

up to $5,000,000 for working capital and development financing over the next year in connection with development of our projects

in Nipton, California.

The Company has barely

enough unissued authorized shares (206,084,868 shares) to cover full issuance for conversion of the outstanding preferred stock

(160,000,000) and for conversion of all outstanding convertible debt and exercise of outstanding warrants (12,090,624 shares),

much less unissued authorized shares that would be required to effect any significant equity financing.

Therefore, as of November

1, 2018, we do not have sufficient unreserved authorized but unissued shares available for other corporate purposes. The price

of our Common Stock in the over-the-counter market on November 13, 2018, closed at $0.725. There are currently no set plans or

arrangements relating to the possible issuance of any additional shares of Common Stock except for the issuance of shares under

the terms of Series A Preferred Stock, and the outstanding convertible notes and warrants. We are not party to any agreements

or understandings regarding any acquisitions, nor are any acquisitions under negotiation.

STOCKHOLDER APPROVAL OF PROPOSED

AMENDMENT

Section 228 of the

Delaware General Corporation Law permits stockholder action by written consent, without a meeting, prior notice or a vote, by the

stockholders holding not less than the minimum number of votes required to authorize the action. On November 1, 2018 our Company

obtained stockholder approval by written consent for the amendment to increase the number of shares of our Common Stock that we

are authorized to issue from 250,000,000 shares to 950,000,000 shares, from American Green, Inc., which as of November 1, 2018,

held 160,000 shares of Series A Preferred Stock with voting rights of 160,000,000 shares of Common Stock, representing in total

78.46% of the outstanding common stock voting power at November 1, 2018, conversion shares of the voting holder of Series A Preferred

Stock being counted as outstanding for computing the percentage of the vote attributable to the holder of the Series A Preferred

Stock consenting to the corporate action.

The amendment authorizing

the increase in our Common Stock will not become effective until (i) we have filed the Definitive Information Statement with the

Securities and Exchange Commission; (ii) at least 20 days after we deliver the Information Statement to our stockholders of record

we file the Certificate of Amendment; and (iii) the Certificate of Amendment has been accepted for filing by the Secretary of

State of the State of Delaware.

DISSENTERS’ RIGHTS

Pursuant to the

General

Corporation Law

of the State of Delaware, stockholders of our Common Stock are not entitled to dissenters’ rights of

appraisal with respect to the authorization of the increase in our authorized Common Stock.

FINANCIAL AND OTHER INFORMATION

For more detailed information

on our Company, including financial statements, you may refer to our Form 10-K and other periodic reports filed with the Securities

and Exchange Commission from time to time. Copies are available on the Securities and Exchange Commission’s EDGAR database

located at www.sec.gov.

Pursuant to the requirements

of the Securities Exchange Act of 1934, CannAwake Corporation has duly caused this Information Statement to be signed by the undersigned

hereunto authorized.

November 26, 2018

|

CANNAWAKE CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ Scott Stoegbauer

|

|

|

|

Scott Stoegbauer

|

|

|

|

President and Chief Executive Officer

|

|

EXHIBIT A

CERTIFICATE OF AMENDMENT

OF

CERTIFICATE OF INCORPORATION

OF

CANNAWAKE CORPORATION

Pursuant to Section

242 of the General Corporation Law of the State of Delaware, CannAwake Corporation (the “corporation”), a corporation

organized and existing under the General Corporation Law of the State of Delaware, does hereby certify:

FIRST:

That

the Board of Directors of the corporation on July , 2018, adopted resolutions proposing and declaring advisable the

following amendment to the Certificate of Incorporation of the corporation:

RESOLVED, that the Board of Directors adopts

and approves the following amended first paragraph of Article FOURTH to replace, in its entirety, the first paragraph of Article

FOURTH of the corporation’s Certificate of Incorporation:

“FOURTH: The corporation is authorized

to issue two classes of shares of stock, designated “Common Stock” and “Preferred Stock”. The total number

of shares that the corporation is authorized to issue is Nine Hundred Sixty Million (960,000,000) shares. The number of shares

of Common Stock authorized is Nine Hundred Fifty Million (950,000,000) shares, $0.0001 par value per share. The number of shares

of Preferred Stock authorized is Ten Million (10,000,000) shares, $0.0001 par value per share.”

SECOND:

That

said amendments were duly adopted in accordance with the provisions of Section 242 and Section 228 of the General Corporation Law

of Delaware.

IN WITNESS WHEREOF, the corporation has

caused this Certificate of Amendment of Certificate of Incorporation to be signed by its President this ____ day of ______, 2018.

|

|

CannAwake Corporation

|

|

|

|

|

|

By:

|

|

|

|

|

President

|

Cannawake (CE) (USOTC:CANX)

Historical Stock Chart

From Mar 2024 to Apr 2024

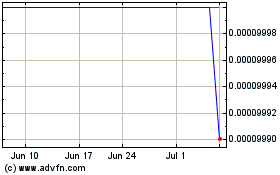

Cannawake (CE) (USOTC:CANX)

Historical Stock Chart

From Apr 2023 to Apr 2024