PG&E Stock Tanks on Wildfire Liability Concerns

November 14 2018 - 4:11PM

Dow Jones News

By Maria Armental

PG&E's stock had its largest single-day plunge since the

early 2000s after the utility warned it could face massive

liabilities related to California's devastating Camp Fire, which

has killed at least 48 people and burned through 135,000 acres,

destroying at least 8,817 homes.

The company said Tuesday it could face liabilities exceeding its

insurance coverage if an apparent malfunction in its electrical

equipment is determined to have started the wildfire.

The disclosure, made in a Securities and Exchange Commission

filing, raised questions about whether PG&E -- already on the

hook for billions of dollars in damages tied to 2017 fires in the

state -- can withstand potential liabilities from the recent

fires.

San Francisco-based PG&E, one of California's largest

utilities, said it had $1.4 billion of insurance coverage for

wildfires occurring between Aug. 1, 2018 and July 31, 2019.

It also said that it had completely drawn down two revolving

credit facilities worth a combined $3.3 billion and was using some

of the cash to pay off coming debt maturities. The company said it

had roughly $3.5 billion in cash.

PG&E contacted the California Public Utilities Commission to

report a power failure in a Butte County transmission line at 6:15

a.m. Pacific Standard Time on Nov. 8, the day the so-called Camp

Fire was reported.

State records indicate the Camp Fire started around 6:30

a.m.

Shares recently traded Wednesday at $24.51, down 25% for the day

and on track for their largest percentage decline since 2001,

according to FactSet data. Shares had fallen as much as 46% in

regular trading Wednesday. The company's stock has fallen nearly

40% so far this week.

Fire investigators have also linked PG&E's equipment to 17

wildfires in Northern California last year, the company said in a

Nov. 7 securities filing. Some analysts have pegged PG&E's

potential liability from the 2017 fires at as much as $15

billion.

PG&E bonds have also suffered sharp declines in recent days.

In heavy trading, the company's 6.05% notes due 2034 traded

Wednesday afternoon at 91 cents on the dollar, down from around 105

cents Friday, according to MarketAxess. Its yield premium to

Treasurys has climbed to around 3.67 percentage points from 2.08

percentage points Friday, an extremely large jump for an

investment-grade bond.

California issued an emergency declaration last week, and

President Trump followed suit on Monday, opening the door for

federal relief funds to potentially flow into affected areas.

On Wednesday, PG&E said it had about 900 workers on site to

help restore service in the Camp Fire--affected area. Where service

can't be restored, the company said, PG&E "is looking at a

longer term rebuild of the system wherever and whenever customers

rebuild their homes."

"Right now, our primary focus is on the communities and

supporting first responders as they work to contain the fire,"

chief executive Geisha Williams said. "We're getting our crews

positioned and ready to respond when we get access, so that we can

safely restore gas and electricity to our customers."

California was hit by an energy crisis in 2000 that sent retail

electricity prices in Southern California to record levels, and

generation-capacity shortages forced temporary power outages. State

and federal officials stepped in to ensure that suppliers would

continue selling electricity to California. PG&E's Pacific Gas

& Electric unit went bankrupt in April 2001 after running out

of cash to cover soaring electricity costs. At the time, it

represented the biggest utility bankruptcy in U.S. history.

--Ira Iosebashvili and Sam Goldfarb contributed to this

article.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

November 14, 2018 15:56 ET (20:56 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

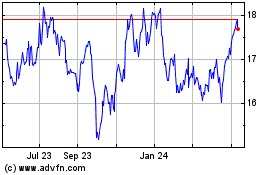

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

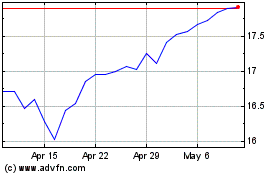

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024