Income Opportunity Realty Investors, Inc. (NYSE American:IOR), a

Dallas-based real estate investment company, today reported results

of operations for the third quarter ended September 30, 2018. For

the three months ended September 30, 2018, we reported a net income

applicable to common shares of $5.9 million or $1.44 per diluted

share for the three months ended September 30, 2018, as compared to

net income of $0.6 million or $0.15 per diluted share for the same

period ended 2017.

Our primary business is investing in real estate and mortgage

note receivables. Land held for development or sale has been our

sole operating segment.

Revenues

Land held subject to a sales contract has been our sole

operating segment. There was no operating revenue generated from

this segment for the three months ended September 30, 2018, as well

as the similar period in 2017. As of September 30, 2018, all land

was sold and in the three months ended September 30, 2018 a gain in

the amount of $7.3 million was recognized.

Expenses

There were no property operating expenses for the three months

ended September 30, 2018 as well as in the similar period in

2017.

General and administrative expenses were $83,000 for the three

months ended September 30, 2018. This represents a decrease of

$10,000, as compared to the prior period general and administrative

expenses of $93,000. This decrease was primarily due to an increase

in audit fees and cost reimbursements to our Advisor of

approximately $2,000 offset by a decrease in legal fees of

approximately $12,000.

Advisory fees were $168,000 for the three months ended September

30, 2018 compared to $166,000 for the same period of 2017 for an

increase of $2,000. Advisory fees are computed based on a gross

asset fee of 0.0625% per month (0.75% per annum) of the average of

the gross asset value.

Net income fee to related party increased $330,000 to $383,000

for the three months ended September 30, 2018 compared to the prior

period. The net income fee paid to our Advisor is calculated at

7.5% of net income.

Other income (expense)

Interest income increased to $1.2 million for the three months

ended September 30, 2018 compared to $0.9 million for the same

period of 2017. The increase of $0.3 million was due primarily to

increase in advisory fee balance.

About Income Opportunity Realty Investors, Inc.

Income Opportunity Realty Investors, Inc., a Dallas-based real

estate investment company, holds a portfolio of equity real estate

in Texas, including undeveloped land. The Company invests in real

estate through direct equity ownership and partnerships. For more

information, visit the Company’s website at www.incomeopp-realty.com.

INCOME OPPORTUNITY REALTY

INVESTORS, INC. CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) Three Months Ended September 30, Nine

Months Ended September 30, 2018

2017 2018 2017

(dollars in thousands, except per share amounts)

Revenues: Rental and other property revenues $ - $ - $ - $ -

Expenses: Property operating expenses - - - - General

and administrative (including $67 and $63 for the three months and

$201 and $174 for the nine months ended 2018 and 2017,

respectively, to related parties) 83 93 359 342 Net income fee to

related party 383 53 489 189 Advisory fee to related party

168 166 500 493

Total operating expenses 634 312

1,348 1,024 Net operating loss (634 ) (312 )

(1,348 ) (1,024 )

Other income (expenses): Interest

income from related parties 1,201 924 3,324 3,133 Other Income

- - - 250

Total other income 1,201 924

3,324 3,383 Income before gain on sale of real

estate land 567 612 1,976 2,359 Gain on sale of real estate land

7,323 - 7,323 -

Income before taxes 7,890 612 9,299 2,359 Income tax

(expense) - current (1,902 ) - (1,902 )

- Net income $ 5,988 $ 612 $ 7,397

$ 2,359

Earnings per share - basic and

diluted Net income $ 1.44 $ 0.15 $ 1.77 $

0.57 Weighted average common shares used in computing

earnings per share 4,168,214 4,168,214 4,168,214 4,168,214

INCOME OPPORTUNITY REALTY INVESTORS, INC.

CONSOLIDATED BALANCE SHEETS September 30,

December 31, 2018 2017

(unaudited) (audited) (dollars in

thousands, except par value amount) Assets Real estate

land holdings subject to sales contract, at cost $ - $

22,717 Total real estate - 22,717 Notes and interest

receivable from related parties 13,577 14,030

Total notes and interest receivable 13,577 14,030 Cash and

cash equivalents 1 2 Receivable and accrued interest from related

parties 81,720 49,631 Other assets - 1,517

Total assets $ 95,298 $ 87,897

Liabilities and Shareholders’ Equity Liabilities: Accounts

payable and other liabilities $ 14 $ 10 Total

liabilities 14 10 Shareholders’ equity: Common stock, $0.01 par

value, authorized 10,000,000 shares; issued 4,173,675 and

outstanding 4,168,214 shares in 2018 and 2017 42 42 Treasury stock

at cost, 5,461 shares in 2018 and 2017 (39 ) (39 ) Paid-in capital

61,955 61,955 Retained earnings 33,326 25,929

Total shareholders' equity 95,284

87,887 Total liabilities and shareholders' equity $ 95,298

$ 87,897

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181113006204/en/

Income Opportunity Realty Investors, Inc.Investor

RelationsGene Bertcher (800)

400-6407investor.relations@incomeopp-realty.com

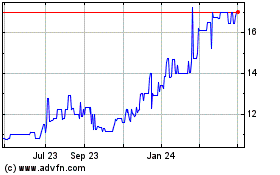

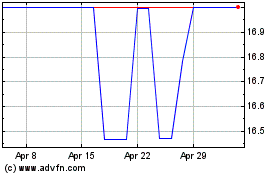

Income Opportunity Realt... (AMEX:IOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Income Opportunity Realt... (AMEX:IOR)

Historical Stock Chart

From Apr 2023 to Apr 2024