Home Depot Ratchets Up Fiscal-Year Guidance -- 2nd Update

November 13 2018 - 12:39PM

Dow Jones News

By Allison Prang

Home Depot Inc. reported third-quarter earnings that rose

sharply from a year earlier and again raised its full-year guidance

as the retailer benefited from strong demand in the

home-improvement business.

However, the company said it will continue to face tougher

comparisons because of last year's hurricanes, which prompted a

surge in sales related to rebuilding areas damaged by storms.

Home Depot's profit rose 32% to $2.87 billion, or $2.51 a share.

Analysts polled by Refinitiv were expecting earnings of $2.26 a

share. The retailer's provision for income taxes fell by about $489

million from a year earlier, which helped bolster profit.

Net sales grew 5.1% to $26.3 billion, helped by an increase in

customer transactions and average price per customer transaction.

Analysts polled by Refinitiv were expecting $26.26 billion.

Same-store sales grew 4.8%, ahead of the 4.7% expected from

analysts polled by Consensus Metrix.

Chief Executive Craig Menear said on the company's earnings call

Tuesday that "overall the environment for home improvement is

solid" but noted that comparisons for the U.S. Gulf region were

harder this quarter because of Hurricane Harvey, the storm that hit

the Texas area in 2017.

"While this quarter brought hurricanes Florence and Michael, the

scope of devastation was more compact from a geographical

perspective," he said.

Home Depot's Chief Financial Officer Carol Tomé said the company

logged about $282 million in hurricane-related sales in the third

quarter last year, compared with about $150 million this year. In

the fourth quarter, the company will be competing against about

$380 million in hurricane sales it made in the fourth quarter a

year ago, she said.

"While we do expect to get hurricane-related sales in the fourth

quarter, we don't expect to get $400 million worth of

hurricane-related sales," she said.

Home Depot said it now expects full-year sales to grow by about

7.2% from a year earlier -- or 5.5% when excluding the 53rd week in

the current fiscal year. The company had expected sales to rise

about 7%, or about 5.3% excluding the extra week. The company

expects profit for the year to be $9.75 a share, compared with its

prior forecast of $9.42 a share.

The higher earnings guidance includes stronger activity around

share buybacks. Home Depot said Tuesday it now expects about $8

billion in share repurchases for the year. The company had expected

to complete $6 billion in share buybacks.

Shares of Home Depot, down 7% year to date, were down 1.7% late

Monday morning.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

November 13, 2018 12:24 ET (17:24 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

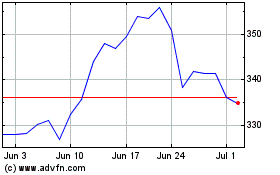

Home Depot (NYSE:HD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2023 to Apr 2024