SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

Report of

Foreign Issuer

Pursuant to Rule

13a-16

or

15d-16

of the Securities Exchange Act of 1934

For the month of November, 2018

Commission File Number:

001-12102

YPF Sociedad Anónima

(Exact name of registrant as specified in its charter)

Macacha

Güemes 515

C1106BKK Buenos Aires, Argentina

(Address of principal executive office)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F:

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7):

Yes ☐ No ☒

YPF Sociedad Anónima

TABLE OF CONTENTS

ITEM

1 Third Quarter 2018 Earnings Presentation.

3rd QUARTER 2018 EARNINGS WEBCAST November

12th, 2018

Safe harbor statement under the US Private

Securities Litigation Reform Act of 1995. This document contains statements that YPF believes constitute forward-looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995. These forward-looking statements may

include statements regarding the intent, belief, plans, current expectations or objectives of YPF and its management, including statements with respect to YPF’s future financial condition, financial, operating, reserve replacement and other

ratios, results of operations, business strategy, geographic concentration, business concentration, production and marketed volumes and reserves, as well as YPF’s plans, expectations or objectives with respect to future capital expenditures,

investments, expansion and other projects, exploration activities, ownership interests, divestments, cost savings and dividend payout policies. These forward-looking statements may also include assumptions regarding future economic and other

conditions, such as future crude oil and other prices, refining and marketing margins and exchange rates. These statements are not guarantees of future performance, prices, margins, exchange rates or other events and are subject to material risks,

uncertainties, changes and other factors which may be beyond YPF’s control or may be difficult to predict. YPF’s actual future financial condition, financial, operating, reserve replacement and other ratios, results of operations,

business strategy, geographic concentration, business concentration, production and marketed volumes, reserves, capital expenditures, investments, expansion and other projects, exploration activities, ownership interests, divestments, cost savings

and dividend payout policies, as well as actual future economic and other conditions, such as future crude oil and other prices, refining margins and exchange rates, could differ materially from those expressed or implied in any such forward-looking

statements. Important factors that could cause such differences include, but are not limited to, oil, gas and other price fluctuations, supply and demand levels, currency fluctuations, exploration, drilling and production results, changes in

reserves estimates, success in partnering with third parties, loss of market share, industry competition, environmental risks, physical risks, the risks of doing business in developing countries, legislative, tax, legal and regulatory developments,

economic and financial market conditions in various countries and regions, political risks, wars and acts of terrorism, natural disasters, project delays or advancements and lack of approvals, as well as those factors described in the filings made

by YPF and its affiliates with the Securities and Exchange Commission, in particular, those described in “Item 3. Key Information—Risk Factors” and “Item 5. Operating and Financial Review and Prospects” in YPF’s

Annual Report on Form 20-F for the fiscal year ended December 31, 2017 filed with the US Securities and Exchange Commission. In light of the foregoing, the forward-looking statements included in this document may not occur. Except as required by

law, YPF does not undertake to publicly update or revise these forward-looking statements even if experience or future changes make it clear that the projected performance, conditions or events expressed or implied therein will not be realized.

These materials do not constitute an offer to sell or the solicitation of any offer to buy any securities of YPF S.A. in any jurisdiction. Securities may not be offered or sold in the United States absent registration with the U.S. Securities and

Exchange Commission or an exemption from such registration. Cautionary Note to U.S. Investors — The United States Securities and Exchange Commission permits oil and gas companies, in their filings with the SEC, to separately disclose proved,

probable and possible reserves that a company has determined in accordance with the SEC rules. We may use certain terms in this presentation, such as resources, that the SEC’s guidelines strictly prohibit us from including in filings with the

SEC. U.S. Investors are urged to consider closely the disclosure in our Form 20-F, File No. 1-12102 available on the SEC website www.sec.gov. Our estimates of EURs, included in our Development Costs, are by their nature more speculative than

estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized, particularly in areas or zones where there has been limited history. Actual locations drilled and quantities

that may be ultimately recovered from our concessions will differ substantially. Ultimate recoveries will be dependent upon numerous factors including actual encountered geological conditions and the impact of future oil and gas pricing. Important

notice

Q3 2018: Financial highlights Operating

cash flow of Ps 32.2 billion (+137.7%) Revenues of Ps 121.2 billion (+83.5%) Adj. EBITDA1 of Ps 36.8 billion (+116.0%) CAPEX of Ps 27.2 billion (+71.2%) Hydrocarbon production down 4.3% Net income of Ps 13.2 billion (1) See description of Adj.

EBITDA in footnote (2) on page 4.

REVENUES (1) (In Millions of USD) YPF

financial statement values based on IFRS converted to USD using average exchange rate of Ps 17.23 and Ps 32.02 per U.S $1.00 for Q3 2017 and Q3 2018, respectively. Adjusted EBITDA = Operating income + Depreciation and impairment of property, plant

and equipment and intangible assets + Amortization of intangible assets + unproductive exploratory drillings. ADJ. EBITDA (1) (2) (In Millions of USD) CAPEX (In Millions of USD) -1.2% +16.3% -7.8% ADJ. EBITDA MEASURED IN USD INCREASED BY 16%, WHILE

CASH COSTS REMAINED ESSENTIALLY FLAT, LEADING TO AN EXPANSION IN MARGINS

ADJ. EBITDA (In Millions of PS) Includes

depreciation of property, plant and equipment, amortization of intangible assets and unproductive exploratory drillings. (1) (1) ADJ. EBITDA INCREASED, BOOSTED BY HIGHER CRUDE OIL PRICES AND LOWER COSTS IN THE UPSTREAM BUSINESS

CONSOLIDATED STATEMENT OF ADJUSTED CASH

FLOW (In Millions of PS) FREE CASH FLOW (1) (Cumulative, In Millions of PS) Cumulative Free Cash Flow = Cash Flow from Operations minus CAPEX. Includes Ps 15,868 million of changes in exchange rates and Ps 4,113 million of other investment

activities. (2) STRONG CASH GENERATION PERFORMANCE DERIVED IN POSITIVE FREE CASH FLOW

FINANCIAL DEBT AMORTIZATION SCHEDULE (1)

(2) (In Millions of USD) As of September 30, 2018. Converted to USD using the September 30, 2018 exchange rate of Ps 41.15 to U.S $1.00. Includes cash & equivalents, including Argentine sovereign bonds BONAR 2020 and BONAR 2021. Net debt to

Recurring LTM Adj. EBITDA calculated in USD. Net debt at period end exchange rate of Ps 41.15 to U.S $1.00 and Recurring LTM Adj. EBITDA calculated as sum of quarters. Recurring LTM Adj. EBITDA = Adjusted EBITDA excluding the profit by revaluation

of YPF S.A.'s investment in YPF Energía Eléctrica (YPF EE) for Ps 12.0 billion in Q1 2018. USD denominated debt Peso denominated debt 89.8% denominated in USD and 10.2% in Argentine Pesos Average interest rates of 7.34% in USD and 36.70%

in Pesos Average life of 6.3 years Net Debt /Recurring LTM Adj. EBITDA 1.7x (3)(4)(5) (3) DETAILS OUR CASH POSITION IS ENOUGH TO COVER NEXT 12 MONTHS DEBT MATURITIES

TOTAL IFR # of people injured for each

million hours worked 2008 - 2018 SAFETY AS A CORE VALUE

PRODUCTION BREAKDOWN (KBOE/D) TOTAL

PRODUCTION (KBOE/D) TOTAL PRODUCTION DECREASED BY -4.3% DRIVEN BY NGL PRODUCTION DECREASE AND NATURAL GAS DEMAND RESTRICTIONS

CONVENTIONAL PRODUCTION (KBOE/D)

MANAGING DECLINE OF CONVENTIONAL FIELDS TO EXTRACT MAXIMUM VALUE Includes natural gas curtailment of approximately 8.2 kboe/d in Q3 2018. (1)

SHALE OIL DEVELOPMENT COST - LOMA

CAMPANA (USD/BOE) NET SHALE O&G PRODUCTION(1) (KBOE/D) Total production (Loma Campana + El Orejano + Bandurria Sur + La Amarga Chica + Narambuena + Bajo del Toro + Bajada de Añelo + Aguada Pichana + Rincón del Mangrullo + Loma La Lata

– Sierra Barbosa + Aguada de la Arena + Aguada Pichana Este + Lindero Atravesado). +58.3% SHALE OIL OPEX COST - LOMA CAMPANA (USD/BOE) NET SHALE PRODUCTION INCREASED 58% WHILE CONTINUING TO FOCUS ON COST REDUCTIONS

AVERAGE CUMULATIVE OIL PRODUCTION (KBOE)

35% increase in EUR 40% increase in IP 270 Cum. Production + 40% (2016 - 2018) + 35% Months AND A CONTINUOUS INCREASE IN WELL PRODUCTIVITY

LOMA CAMPANA PHASE 2 DEVELOPMENT acres

97,600 Loma Campana PHASE 2 METRICS Gross production +150% Base curve Incremental production ~4 to 5 rigs ~300 wells 2019-23 120 KBOE/D gross production by 2023 ~680 MUSD gross capex per year ~550 ~ 50% Remaining acreage 2023+ Remaining locations

2023+

CRUDE PROCESSED (KBBL/D) -4.6% SALES OF

REFINED PRODUCTS (KM 3) +0.2% +2.9% +8.7% DOMESTIC SALES OF MOST PRODUCTS INCREASED; CRUDE PROCESSED DECREASED DUE TO SCHEDULED MAINTENANCE STOPPAGES

MONTHLY DIESEL SALES (KM3) MONTHLY

GASOLINE SALES (KM3) 55.1% Gasoline Market Share 2017 56.7% Diesel Market Share 2017 55.7% 2018 59.1% 2018 54.8% 2016 56.1% 2016 +8.7% +2.9% STRONG GASOLINE AND DIESEL DEMAND PUSHED VOLUMES SOLD UP 2.9% AND 8.7%

F.O.B. REFINERY/TERMINAL PRICE (2)

USD/BBL DOWNSTREAM EBITDA(1) (USD per refined barrel) CRUDE OIL PRICES USD/BBL Amounts in Argentine Pesos converted to USD using the applicable FX rate on the date in which revenues and expenses were recognized. Please note that these figures may

differ from the EBITDA expressed in USD that is disclosed in table 5.5 of YPF’s Quarterly Consolidated Results report. Net of commissions, deductions, freights, turnover tax and other taxes. Downstream EBITDA excluding inventory revaluation

11.7 7.3 4.7 -32.8% -44.0% LOWER FUEL PRICES IN US DOLLARS CONTINUE TO PRESSURE DOWNSTREAM MARGIN PARTIALLY OFFSET BY HIGHER PRICES OF OTHER REFINED PRODUCTS AND A REDUCTION IN OPEX

FUELS BLENDED PRICE VS IMPORT PARITY(1)

(% VARIATION) Import parity includes international reference price for heating oil, RBOB and biofuels, each of them weighted by sales volumes of our regular and premium diesel and gasoline. Fuels blended prices and Import Parity prices based on

monthly average prices, except for November 2018 that refers to prices as of November 7, 2018. FUEL PRICES ALREADY IN LINE WITH IMPORT PARITY AFTER GRADUAL ADJUSTMENTS

Outlook Year 2018 Production guidance

for the year in the -3% to -4% range Gas curtailment and scheduled maintenance stoppages in Mega and its main client affecting production recovery Well positioned to launch competitive VM developments: Continued cost and productivity improvements

Expecting 3 shale oil FIDs before year end Ability to meet on financial targets despite challenging environment: Recovery of fuel prices Net debt / EBITDA 1.7x Targeting 10% increase in EBITDA by year-end Oil price environment and new developments

supporting proved reserves RRR>1

3rd Quarter Earnings Webcast Questions

and answers

3rd QUARTER 2018 EARNINGS WEBCAST

November 12th, 2018

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

YPF Sociedad Anónima

|

|

|

|

|

|

|

Date: November 13, 2018

|

|

|

|

By:

|

|

/s/ Diego Celaá

|

|

|

|

|

|

Name:

|

|

Diego Celaá

|

|

|

|

|

|

Title:

|

|

Market Relations Officer

|

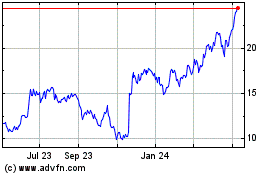

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Mar 2024 to Apr 2024

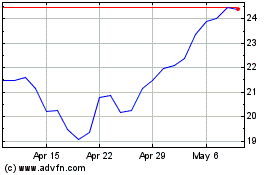

YPF Sociedad Anonima (NYSE:YPF)

Historical Stock Chart

From Apr 2023 to Apr 2024