UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

November

, 2018

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F

X

Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes

No

X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

.)

|

|

Results for the third quarter 2018

|

|

Ticker:

EDN

Ratio: 20 Class B = 1 ADR

Share Cap. Net of repurchases:

886 million shares | 44.3 million ADRs

Market Cap. net of repurchases:

ARS 39 billion | USD 1.1 billion

|

Investor Relations Contacts:

Leandro Montero

Chief Financial Officer

Federico Mendez

Planning and Investor Relations Manager

|

|

www.edenor.com |

investor@edenor.com

Tel: +54 (11) 4346 -5510 / 5519

|

Buenos Aires, Argentina, November 9, 2018.

Empresa Distribuidora y Comercializadora Norte S.A. (NYSE: EDN; BYMA: EDN) (“EDENOR” or “the Company”), Argentina’s largest electricity distributor both in terms of number of customers and energy sales, announces its results for the third quarter of 2018. All figures are stated in Argentine Pesos and have been prepared in accordance with International Financing Reporting Standards (“IFRS”).

RELEVANT EVENTS

Contractual Resolution of Real Estate Asset

In order to replace our headquarters, concentrating centralized functions and, reducing rental costs, Edenor acquired to Ribera Desarrollos S.A. (“RDSA”) a real estate asset to be constructed, for the amount of USD 46 million, equivalent to ARS 439.3 million,

at the exchange rate in effect at the time of acquisition. To guarantee the payment of the indemnity contractually agreed upon in the event of termination due to the seller's breach, the Company received a surety bond for up to USD 46 million with a Badlar interest rate in dollars plus 2%.

On June 1, 2018 the term for the delivery of the real estate asset terminated, being the milestone broken by the developer. Therefore, the Company served the seller the notice of default, notifying the situation to the insurance company issuing the surety bond and collected the fines accrued during the term of the purchase agreement and duly deposited in escrow by the seller, due to its lack of compliance with the construction milestones foreseen in the contract.

Later, upon the expiration of the legal terms stipulated in the agreement, on August 27, 2018, Edenor notified RDSA of its termination, demanding payment of the contractually agreed compensation. Likewise, on September 3, 2018, the Company filed the corresponding claim with the insurance company and subsequently delivered the additional information and documentation that was required.

As of September 30, 2018, the recorded receivables’ fair value amounts to $ 2,068.7 million, which does not exceed its estimated recoverable value. Income generated by this transaction amounts to $ 1,629.4 million before tax.

As of the issuance of this Earnings Release, we are undertaking the necessary judicial and extrajudicial actions to collect the above-mentioned receivable.

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

2

|

Restatement of financial information

International Accounting Standard (IAS) 29 - “Financial Reporting in Hyperinflationary Economies” requires the financial statements of an entity with a functional currency of a high inflation economy to be restated in terms of the measuring unit current at the end of the reporting period. As Argentina is a hyperinflationary economy under this standard, the defined restatement criteria should apply for periods ending on or after July 1, 2018.

Furthermore, on July 24, 2018, the Argentine Federation of Professional Councils in Economic Sciences (FACPCE) issued a communication confirming the previous requirement. However, taking into consideration that as of the date hereof Executive Decree No. 664/03, which prohibits the presentation of restated financial statements to the National Securities Commission (CNV), is still in force, the Company's management has not applied IAS 29 in the preparation of its financial statements as of September 30, 2018.

Regularization of pending obligations arising during the Transition Period

On September 15, 2018, the Secretariat of Electric Energy extended the term to regularize outstanding liabilities for the Transition Period it had announced it would start to resolve last July 31.

Likewise, on September 28, 2018, the Under-secretariat of Electric Energy required the Company to update the information presented in a timely manner by virtue of the regularization process of the reciprocal obligations arising during the Transition Period,

being complied by the Company on date.

To date, all the proceedings are still pending.

Seasonal Price of Electricity Programming

On October 26, 2018, the Under-secretariat of Electric Energy approved through Disposition No 97/2018 the Wholesale Electricity Market Seasonal Programming elevated by CAMMESA, corresponding to the period from November 1, 2018 to April 30, 2019. By doing this, power capacity, energy and transport prices previously established by Disposition No 75/2018 were extended for the mentioned period. Finally, the criteria regarding subsidies to users under the Social Tariff category and discounts for savings remained effective.

Change in S&P Global Ratings

On September 3, 2018, S&P Global Ratings issued a report modifying Argentine companies’ global debt ratings. The downgrading is accounted for by the higher sovereign risk resulting from the weakening of the peso and the rise in inflation. Edenor’s ratings changed from “B” with a positive outlook to “B” with a stable outlook.

Furthermore, on September 4, it also modified Edenor’s local ratings from “raA+” with a “positive” outlook to “raA” with a “stable” outlook. This change is mainly explained by the national economic downturn and the imbalance between Edenor’s peso inflows and its dollar-denominated debt.

Controlling company’s merger process

On August 15, 2018, under Pampa Energía and its subsidiaries’ absorption process, Pampa became Edenor’s direct controlling company. Pursuant to this process, EASA (former Edenor’s controlling company) and IEASA (former EASA’s controlling company) were absorbed into Central Térmica Loma de la Lata (CTLL), and the latter was absorbed by Pampa as the absorbing and continuing company.

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

3

|

MAIN RESULTS FOR THE THIRD QUARTER 2018

|

|

9 Months

|

3rd Quarter

|

|

In millon of Pesos

|

2018

|

2017

|

∆%

|

2018

|

2017

|

∆%

|

|

Revenue from sales

|

34,726.6

|

17,576.4

|

97.6%

|

13,460.7

|

6,458.1

|

108.4%

|

|

Energy purchases

|

(19,307.7)

|

(9,237.8)

|

109.0%

|

(7,995.5)

|

(3,427.3)

|

133.3%

|

|

Gross margin

|

15,418.9

|

8,338.6

|

84.9%

|

5,465.2

|

3,030.8

|

80.3%

|

|

Operating expenses

|

(9,326.0)

|

(5,948.6)

|

56.8%

|

(3,646.5)

|

(2,027.3)

|

79.9%

|

|

Other operating expenses

|

(669.5)

|

(541.7)

|

23.6%

|

(253.1)

|

(270.6)

|

(6.5%)

|

|

Net operating income

|

5,423.4

|

1,848.3

|

193.4%

|

1,565.6

|

732.9

|

113.6%

|

|

Financial Results, net

|

(2,356.4)

|

(927.7)

|

154.0%

|

(314.9)

|

(340.2)

|

(7.4%)

|

|

Income Tax

|

(966.4)

|

(260.7)

|

270.7%

|

(403.3)

|

(101.6)

|

297.0%

|

|

Net income

|

2,100.6

|

659.9

|

218.3%

|

847.4

|

291.2

|

191.0%

|

Revenue from sales

increased by 108.4%, to ARS 13,460.7 million, in the third quarter of 2018, against ARS 6,458.1 million in the third quarter of 2017, mainly on account of the entry into effect of all VAD updates provided for by ENRE Resolution No. 63/2017 and resulting from the Comprehensive Tariff Review (RTI) process, together with the bi-annual adjustments corresponding to Own Distribution Costs (CPD) increases. Between the comparison periods, two 18% VAD updates were applied, the last one being effective as from February 1, 2018 pursuant to ENRE Resolution No. 33/2018, thus completing the total update stipulated under the RTI and granted in three stages. As regards CPD adjustments related to cost increases, the 11.6%, 11.9% and 7.9% updates corresponding to the first three semesters following the implementation of the RTI were applied. The last adjustment, effective as from August 1, 2018, was granted in two stages: 50 % as from that date, and the remaining 50%, as from February, 2019. The difference in revenues generated during the August 2018 - January 2019 period will be recoverable through revenue in six installments as from February 2019, and updated according to the adjustment in the CPD. If the full increase in CPD had been recorded, sales in the third quarter 2018 would have increased by an additional ARS 308.2 million. Moreover, under the deferred income recoverable in 48 installments and accrued during the February 2017 - January 2018 period, ARS 540.0 million were accounted for in the third quarter of 2018.

This increase in Revenue from sales was accompanied, although to a lesser extent, by a slight 0.7% increase in the

volume of energy sales

, which reached 5,626 GWh in the third quarter of 2018, against 5,587 GWh in the same period of 2017. This rise was mainly due to an increase of 2.5% for residential users and 30.9% for low-income neighborhoods and shantytowns, which was partially offset by decreases of 3.5% for large users (industrial users and the wheeling system) and 0.9% for medium and small commercial users. The residential demand increased as a result of the lower temperatures recorded in July and August compared to the same period of the previous year, and was partially offset in September as a result of the higher temperatures compared to the previous year and the impact of tariff increases. In the case of low-income neighborhoods and shantytowns, lower temperatures, added to the zero impact of the tariff increase on account of its consumption being covered by the Framework Agreement, resulted in a strong increase in demand. Furthermore, small and medium commercial users were adversely affected by the lower commercial activity and large users, by the lower industrial activity, which is reflected in the fall in the industrial production index (IPI). Furthermore, Edenor’s customer base increased by 2.9%. Specifically, the increase in residential customers was mainly due to regularizations resulting from the implemented market discipline actions.

|

|

3Q 2018

|

3Q 2017

|

Variation

|

|

|

GWh

|

Part. %

|

Customers

|

GWh

|

Part. %

|

Customers

|

% GWh

|

% Customers

|

|

Residential *

|

2,526

|

44.9%

|

2,644,011

|

2,464

|

43.8%

|

2,553,412

|

2.5%

|

3.5%

|

|

Small commercial

|

458

|

8.1%

|

323,322

|

455

|

8.1%

|

329,019

|

0.6%

|

(1.7%)

|

|

Medium commercial

|

414

|

7.4%

|

32,427

|

424

|

7.5%

|

33,777

|

(2.6%)

|

(4.0%)

|

|

Industrial

|

913

|

16.2%

|

6,871

|

912

|

16.2%

|

6,859

|

0.1%

|

0.2%

|

|

Wheeling System

|

922

|

16.4%

|

705

|

986

|

17.5%

|

708

|

(6.5%)

|

(0.4%)

|

|

Others

|

|

|

|

|

|

|

|

|

|

Public lighting

|

200

|

3.5%

|

21

|

197

|

3.5%

|

21

|

1.0%

|

0.0%

|

|

Shantytowns and others

|

194

|

3.4%

|

450

|

148

|

2.6%

|

419

|

30.9%

|

7.4%

|

|

Total

|

5,626

|

100%

|

3,007,807

|

5,587

|

99%

|

2,924,215

|

0.7%

|

2.9%

|

|

|

|

|

|

|

|

|

|

|

|

* 564,837 customers have the benefit of Social Tariff

|

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

4

|

|

|

Energy purchases

increased by 133.3%, to ARS 7,995.5 million, in the third quarter of 2018, against ARS 3,427.3 million for the same period in 2017, mainly due to an approximate 122.1% increase in the average price of purchases resulting from the entry into effect in December 2017, February 2018 and August 2018 of the new reference seasonal prices for electricity set forth by Resolution No. 1,091/2017 and Disposition No 75/2018 of the former Secretariat of Electric Energy (“SEE”) and considering the effects of the application of the social tariff to 21.4% of residential customers. Despite this increase, the reference seasonal price is still subsidized by the National Government, especially in the case of residential customers, where the subsidy reached approximately

50

% of the system’s average generation cost. Additionally, the energy loss rate increased from 18.4% in 3Q17 to 20.4% in 3Q18, and was mainly generated by an increase in the demand by residential customers, which is the segment with the highest rate of clandestine connections as a result of the lower temperatures recorded in July and August 2018 and the impact of the tariff increases. In turn, costs associated with these losses increased by 147.0%, mainly on account of the application of the new seasonal price for its determination.

Operating expenses

increased by 79.9%, reaching ARS 3,646.5 million in 3Q18, against ARS 2,027.3 million in 3Q17. This is mainly explained by: (1) a ARS 586.1 million increase in penalties, mainly as a result of changes in the calculation methodology introduced by ENRE Note No. 125,248 in March 2017 and the application of new penalties set by ENRE Resolution No. 170/18 in the amount of ARS 105.0 million for deviating from the 2017 annual investment plan in relation to that presented in the RTI; (2) a ARS 279.5 million increase in fees for third-party services, mainly explained by a higher number of market discipline works associated with the losses reduction plan, higher expenses in preventive and corrective maintenance works such as pruning, changes of posts, the gathering of data on anomalies, street safety works and the repair of sidewalks, as well as higher expenses associated with the distribution of bills and physical surveillance costs, and new hired IT services related to new applications implemented as WOM Project and Success Factors; (3) a ARS 232.8 million increase in the allowance for the impairment of trade and other receivables due to a change in accounting standards resulting from the application of IFRS 9 and a higher bad debt. (4) a ARS 204.2 million increase in salaries and social security charges on account of salary increases totaling 29.4%; and (5) lastly, a ARS 190.7 million increase in taxes and charges.

|

|

9 Months

|

3rd Quarter

|

|

In million of pesos

|

2018

|

2017

|

∆%

|

2018

|

2017

|

∆%

|

|

Salaries, social security taxes

|

(3,477.0)

|

(3,002.0)

|

15.8%

|

(1,247.7)

|

(1,043.5)

|

19.6%

|

|

Pensions Plans

|

(112.7)

|

(79.0)

|

42.6%

|

(37.6)

|

(28.7)

|

31.0%

|

|

Communications expenses

|

(208.4)

|

(167.2)

|

24.7%

|

(77.3)

|

(57.2)

|

35.2%

|

|

Allowance for the impairment of trade and other receivables

|

(649.4)

|

(206.0)

|

215.3%

|

(314.4)

|

(81.6)

|

285.4%

|

|

Supplies consumption

|

(372.3)

|

(261.7)

|

42.2%

|

(155.1)

|

(101.2)

|

53.3%

|

|

Leases and insurance

|

(105.8)

|

(83.6)

|

26.5%

|

(38.3)

|

(29.1)

|

31.8%

|

|

Security service

|

(146.7)

|

(121.3)

|

20.9%

|

(52.0)

|

(45.9)

|

13.2%

|

|

Fees and remuneration for services

|

(1,932.8)

|

(1,206.1)

|

60.2%

|

(726.4)

|

(446.9)

|

62.6%

|

|

Public relations and marketing

|

(10.2)

|

(18.4)

|

(44.4%)

|

(5.3)

|

(9.2)

|

(42.7%)

|

|

Advertising and sponsorship

|

(5.3)

|

(9.5)

|

(44.4%)

|

(2.7)

|

(4.7)

|

(42.7%)

|

|

Reimbursements to personnel

|

(0.4)

|

(0.5)

|

(21.1%)

|

(0.1)

|

(0.1)

|

19.8%

|

|

Depreciation of property, plant and equipment

|

(412.4)

|

(310.4)

|

32.9%

|

(148.7)

|

(110.5)

|

34.6%

|

|

Directors and Supervisory Committee members’ fees

|

(12.8)

|

(9.4)

|

36.0%

|

(4.3)

|

(3.2)

|

34.2%

|

|

ENRE penalties

|

(1,399.2)

|

(272.1)

|

414.3%

|

(573.2)

|

12.9

|

NA

|

|

Taxes and charges

|

(476.8)

|

(192.0)

|

148.4%

|

(262.0)

|

(71.3)

|

267.7%

|

|

Other

|

(3.9)

|

(9.3)

|

(58.4%)

|

(1.4)

|

(7.3)

|

(81.1%)

|

|

Total

|

(9,326.0)

|

(5,948.6)

|

56.8%

|

(3,646.5)

|

(2,027.3)

|

79.9%

|

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

5

|

Financial results

experienced a 7.4% decrease in losses, with ARS 314.9 million losses in the third quarter of 2018, against ARS 340.2 million losses for the same period in 2017. The positive effects were mainly the update in the value of the receivable associated to the real estate asset in the amount of ARS 1,629.4 million, the increase in the fair value of financial assets for ARS 175.4 million, and higher commercial and financial interest for ARS 86.1 million. These effects were partially offset by an acceleration in the domestic currency depreciation rate against the U.S. dollar’s net position, which caused a total negative impact in the amount of ARS 1,334.3 million on account of foreign exchange rate variations; higher commercial interest from the debt with CAMMESA in the amount of ARS 318.2 million; and a ARS 196.3 million increase in interest as a result of the increase in the exchange rate.

Net income

shows a ARS 556.2 million increase, reporting profits for ARS 847.4 million profit in the third quarter of 2018, against a ARS 291.2 million profit for the same period in 2017. This is mainly accounted for by an improvement in gross margins as a result of the tariff increases established in the RTI, which was partially offset by the previously described higher operating expenses. Financial results have not suffered any significant changes as losses resulting from a higher devaluation of the peso were offset by the revaluation of the receivable associated to the real estate asset.

Adjusted EBITDA

The adjusted EBITDA increased to a profit of ARS 1,876.9 million in the third quarter of 2018, ARS 1,033.6 million higher than in the same period in 2017, which reflects the reconstruction of the economic and financial equation of the utility under concession with the implementation of the three stages of adjustment programed in the RTI. Adjustments correspond to penalties for deviating from the 2017 investment plan, and commercial interest.

|

In millon of Pesos

|

3Q 2018

|

3Q 2017

|

|

∆ %

|

|

Net operating income

|

1,565.6

|

732.9

|

|

114%

|

|

Depreciation of property, plant and equipment

|

148.7

|

110.5

|

|

35%

|

|

EBITDA

|

1,714.3

|

843.4

|

|

103%

|

|

Penalties - SAPIA*

|

105.0

|

(26.3)

|

|

NA

|

|

Commercial Interests

|

57.6

|

26.2

|

|

120%

|

|

Adjusted EBITDA

|

1,8

76

.9

|

1,151

.

5

|

|

63

%

|

|

|

|

|

|

|

|

* Corresponds to penalties for deviations in the 2017 investment plan

|

|

Note: Deferred income from the Aug-18' CPD adj

, not included in the adj EBITDA, amounts ARS 308.2 million in the third quarter 2018

|

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

6

|

Capital Expenditures

Edenor’s capital expenditures during the third quarter of 2018 totaled ARS 2,145.0 million, compared to ARS 1,108.8 million in the third quarter of 2017. Our investments mainly consisted of the following:

·

ARS 269.2 million in new connections;

·

ARS 987.2 million in grid enhancements;

·

ARS 558.8 million in maintenance;

·

ARS 24.0 million in legal requirements;

·

ARS 122.8 million in communications and telecontrol;

·

ARS 183.0 million in other investment projects.

The increase in investments results from the ambitious plan devised by Edenor for the 2017-2021 period, which focuses on investments optimizing service quality levels in accordance with the quality curves required in the RTI by the regulatory agency

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

7

|

Energy Losses

In the third quarter of 2018, energy losses experienced a 20.4% increase, against 18.4% for the same period in 2017. Tariff increases for 2017 and 2018 generate a greater incentive to fraud by certain customers. This effect, alongside with the impact of lower average temperatures in July and August, generated a 187 GWh increase in the level of losses in physical units. Likewise, the rise in the average energy purchase price increases the value in pesos of these losses.

Furthermore, in 3Q18 the Company continued taking different actions to reduce energy losses on two fronts: on the one hand, Market Discipline actions (DIME) were intensified aiming to detect and normalize irregular connections and electricity theft and frauds and, on the other hand, there was an increase in the installation of Inclusion Meters (Energy Integrated Meter, MIDE) to foster consumption self-management and the integration of users not having a regular income, at the same time encouraging consumption reduction and the prevention of irregular connections having an impact on the safety of customers. The company expects to intensify these actions until reaching expected levels with the purpose of meeting the outlined loss reduction goals.

Indebtedness

As of September 30, 2018, the outstanding principal of our dollar-denominated financial debt amounts to USD 226.4 million, while the net debt amounts to USD 27.5 million. The financial debt consists of USD 176.4 million corresponding to Corporate Bonds maturing in 2022 (USD 0.7 million of which are held by the company), and USD 50 million to the bank loan taken out with the Industrial and Commercial Bank of China Dubai (ICBC) Branch for a term of 36 months. Subsequent to the end of the quarter, the Company purchased in different market operations Corporate Bonds for a total face value of USD 3.3 million.

On April 12, 2018, the Company entered into a hedge transaction with Citibank London branch with the purpose of locking the financial cost of the loan granted by ICBC, which is subject to a variable rate, during the October 2018-October 2020 interest payment period. Thus, all the Company’s financial liabilities are disclosed at a fixed rate.

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

8

|

About Edenor

Empresa Distribuidora y Comercializadora Norte S.A. (Edenor) is the largest electricity distribution company in Argentina in terms of number of customers and electricity sold (in GWh). Through a concession, Edenor distributes electricity exclusively to the northwestern zone of the greater Buenos Aires metropolitan area and the northern part of the City of Buenos Aires, which has a population of approximately 8.5 million people and an area of 4,637 sq. km. In 2017, Edenor sold 22,503 GWh of energy and purchased 25,950 GWh (including wheeling system demands), with revenue from sales of approximately ARS 24 billion and net income of ARS 682 million.

This press release may contain forward-looking statements. These statements are not historical facts, and are based on management’s current view and estimates of future economic circumstances, industry conditions, Company performance and financial results. The words “anticipates”, “believes”, “estimates”, “expects”, “plans” and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties, including those identified in the documents filed by the Company with the U.S. Securities and Exchange Commission. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

Edenor S.A.

Avenida del Libertador 6363, Piso 4º

(C1428ARG) Buenos Aires, Argentina

Tel: 5411.4346.5510

investor@edenor.com

www.edenor.com

Conference Call Information

There will be a conference call to discuss Edenor’s quarterly results on Monday, November 12, 2018, at 12:00 p.m. Buenos Aires time / 10:00 a.m. New York time. For those interested in participating, please dial + 1(877) 317-6776 in the United States or, if outside the United States, +1(412) 317-6776 or 0800-444-2930 in Argentina. Participants should use conference ID “Edenor” and dial in five minutes before the call is set to begin. There will also be a live audio webcast of the conference at www.edenor.com in the Investor Relations section.

For additional information on the Company please access:

www.edenor.com

;

www.cnv.gob.ar

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

9

|

|

|

Condensed Interim Statements of Financial Position

as of September 30, 2018 and December 31, 2017

|

In million of Argentine Pesos

|

09.30.2018

|

|

12.31.2017

|

|

|

09.30.2018

|

|

12.31.2017

|

|

AR$

|

AR$

|

|

AR$

|

AR$

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

Share capital

|

886.0

|

|

898.7

|

|

Property, plant and equipment

|

18,404.3

|

|

14,812.0

|

|

Adjustment to share capital

|

394.1

|

|

399.5

|

|

Interest in joint ventures

|

0.4

|

|

0.4

|

|

Additional paid-in capital

|

39.3

|

|

31.6

|

|

Deferred tax asset

|

1,863.1

|

|

1,187.0

|

|

Treasury stock

|

20.4

|

|

7.8

|

|

Other receivables

|

2,105.9

|

|

42.4

|

|

Adjustment to treasury stock

|

13.9

|

|

8.6

|

|

Total non-current assets

|

22,373.7

|

|

16,041.9

|

|

Adquisition cost of own shares

|

(728.0)

|

|

-

|

|

|

|

|

|

|

Legal reserve

|

73.3

|

|

73.3

|

|

Current assets

|

|

|

|

|

Opcional reserve

|

176.1

|

|

176.1

|

|

Inventories

|

834.7

|

|

391.9

|

|

Other comprehensive loss

|

(28.1)

|

|

(28.1)

|

|

Other receivables

|

248.6

|

|

200.6

|

|

Accumulated losses

|

1,534.0

|

|

(506.5)

|

|

Trade receivables

|

9,223.9

|

|

5,678.9

|

|

TOTAL EQUITY

|

2,381.1

|

|

1,060.9

|

|

Financial assets at fair value through profit or loss

|

5,029.5

|

|

2,897.3

|

|

|

|

|

|

|

Financial assets at amortized cost

|

229.9

|

|

11.5

|

|

|

|

|

|

|

Cash and cash equivalents

|

2,897.4

|

|

82.9

|

|

Non-current liabilities

|

|

|

|

|

Total current assets

|

18,464.0

|

|

9,263.0

|

|

|

|

|

|

|

|

|

|

|

|

Trade payables

|

267.3

|

|

240.9

|

|

|

|

|

|

|

Other payables

|

7,219.9

|

|

6,034.2

|

|

TOTAL ASSETS

|

40,837.7

|

|

25,304.9

|

|

Borrowings

|

9,290.7

|

|

4,191.7

|

|

|

|

|

|

|

Deferred revenue

|

277.3

|

|

194.6

|

|

|

|

|

|

|

Salaries and social security payable

|

143.8

|

|

119.7

|

|

|

|

|

|

|

Benefit plans

|

362.9

|

|

323.6

|

|

|

|

|

|

|

Provisions

|

919.8

|

|

598.1

|

|

|

|

|

|

|

Total non-current liabilities

|

18,481.7

|

|

11,702.7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Trade payables

|

14,960.8

|

|

9,195.3

|

|

|

|

|

|

|

Other payables

|

903.3

|

|

370.4

|

|

|

|

|

|

|

Borrowings

|

350.3

|

|

71.2

|

|

|

|

|

|

|

Derivative financial instruments

|

-

|

|

0.2

|

|

|

|

|

|

|

Deferred revenue

|

4.8

|

|

3.4

|

|

|

|

|

|

|

Salaries and social security payable

|

1,210.6

|

|

1,220.1

|

|

|

|

|

|

|

Benefit plans

|

31.4

|

|

31.4

|

|

|

|

|

|

|

Tax payable

|

1,303.0

|

|

466.7

|

|

|

|

|

|

|

Tax liabilities

|

1,034.0

|

|

1,053.5

|

|

|

|

|

|

|

Provisions

|

176.8

|

|

129.3

|

|

|

|

|

|

|

Total current liabilities

|

19,974.9

|

|

12,541.3

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

38,456.7

|

|

24,244.0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND EQUITY

|

40,837.7

|

|

25,304.9

|

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

10

|

Condensed Interim Statements of Comprehensive Income (Loss)

for the nine-month period ended el September 30, 2018 and 2017

|

In millon of Argentine Pesos

|

09.30.2018

|

|

09.30.2017

|

|

AR$

|

AR$

|

|

|

|

|

|

|

Continuing operations

|

|

|

|

|

Revenue

|

34,726.6

|

|

17,576.4

|

|

Electric power purchases

|

(19,307.7)

|

|

(9,237.8)

|

|

Subtotal

|

15,418.9

|

|

8,338.6

|

|

Transmission and distribution expenses

|

(5,314.9)

|

|

(3,473.2)

|

|

Gross loss

|

10,104.0

|

|

4,865.4

|

|

Selling expenses

|

(2,608.4)

|

|

(1,459.7)

|

|

Administrative expenses

|

(1,402.7)

|

|

(1,015.7)

|

|

Other operating expense, net

|

(669.5)

|

|

(541.7)

|

|

Operating Loss (Profit)

|

5,423.4

|

|

1,848.3

|

|

Financial income

|

358.3

|

|

181.5

|

|

Financial expenses

|

(1,948.0)

|

|

(1,098.4)

|

|

Other financial expense

|

(766.6)

|

|

(10.8)

|

|

Net financial expense

|

(2,356.4)

|

|

(927.7)

|

|

Loss (profit) before taxes

|

3,067.1

|

|

920.6

|

|

|

|

|

|

|

Income tax

|

(966.4)

|

|

(260.7)

|

|

Loss (Profit) for the period

|

2,100.6

|

|

660.0

|

|

|

|

|

|

|

Basic and diluted earnings Loss (Profit) per share:

|

|

|

|

|

Basic and diluted earnings (loss) profit per share

|

2.35

|

|

0.73

|

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

11

|

|

|

Condensed Interim Statements of Cash Flows

for the nine-month periods ended September 30, 2018 and 2017

|

In millon of Argentine Pesos

|

|

09.30.2018

|

|

09.30.2017

|

|

AR$

|

AR$

|

|

|

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

Loss (Profit) for the period

|

|

2,100.6

|

|

660.0

|

|

Adjustments to reconcile net (loss) profit to net cash flows provided by operating activities:

|

|

4,911.4

|

|

2,053.1

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

Increase in trade receivables

|

|

(3,813.1)

|

|

(994.8)

|

|

Dencrease in trade payables

|

|

4,423.8

|

|

599.1

|

|

Income Tax Payment

|

|

(636.5)

|

|

(233.9)

|

|

Others

|

|

346.1

|

|

-4.1

|

|

|

|

|

|

|

|

Net cash flows provided by operating activities

|

|

7,332.3

|

|

2,079.4

|

|

|

|

|

|

|

|

Net cash flows used in investing activities

|

|

(3,797.2)

|

|

(2,135.9)

|

|

|

|

|

|

|

|

Net cash flows used in financing activities

|

|

(936.6)

|

|

(132.9)

|

|

|

|

|

|

|

|

Net (decrease) increase in cash and cash equivalents

|

|

2,598.6

|

|

(189.4)

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of year

|

|

82.9

|

|

258.6

|

|

Exchange differences in cash and cash equivalents

|

|

216.0

|

|

(1.4)

|

|

Net decrease in cash and cash equivalents

|

|

2,598.5

|

|

(189.4)

|

|

Cash and cash equivalents at the end of period

|

|

2,897.4

|

|

67.8

|

|

|

|

|

|

|

|

Supplemental cash flows information

|

|

|

|

|

|

Non-cash operating, investing and financing activities

|

|

|

|

|

|

Financial costs capitalized in property, plant and equipment

|

|

(458.3)

|

|

(201.6)

|

|

Acquisitions of property, plant and equipment through increased trade payables

|

|

(384.5)

|

|

(169.1)

|

|

|

Investor Relations Contacts:

Leandro Montero

Chief Financial Officer

Federico Mendez

Planning and Investor Relations Manager

|

|

investor@edenor.com |

Tel: +54 (11) 4346 -5510 / 5519

|

|

Edenor S.A. – 3Q ‘18 Earnings Release

|

12

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Empresa Distribuidora y Comercializadora Norte S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Leandro Montero

|

|

|

Leandro Montero

|

|

|

Chief Financial Officer

|

Date:

November 8

, 2018

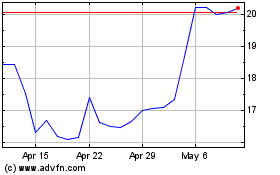

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

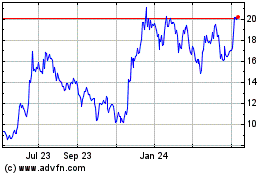

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Apr 2023 to Apr 2024