Current Report Filing (8-k)

November 08 2018 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 2, 2018

TRANS-LUX CORPORATION

(Exact name of registrant as specified in its charter)

Delaware 1-2257 13-1394750

(State or other jurisdiction (Commission (IRS Employer

of incorporation) File Number) Identification No.)

135 East 57

th

Street, 14

th

Floor, New York, NY 10022

(Address of principal executive offices) (zip code)

Registrant

’

s telephone number, including area code:

(800) 243-5544

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

1

Item 1.01

Entry into Material Definitive Agreement;

Item 3.02

Unregistered Sale of Equity Securities;

As previously disclosed in the public filings of Trans-Lux Corporation (the

“

Company

”

), the Company lacked adequate liquidity to operate its business over the next 12 months and the audit report in the Company

’

s audited Consolidated Financial Statements for the fiscal year ended December 31, 2017 contained a going concern qualification. Accordingly, on November 2, 2018, the Company entered into a Securities Purchase Agreement (the

“

SPA

”

) with Unilumin North America Inc. (

“

Unilumin

”

), pursuant to which Unilumin purchased 1,315,789 shares of the Company

’

s Common Stock, par value $0.001 per share (

“

Common Stock

”

), for a purchase price of $1,500,000 (the

“

Purchase

”

), or a per share purchase price of $1.14. The SPA requires that the proceeds of the Purchase are to be utilized for mutually agreed purposes. In connection with the SPA, the Company issued warrants (the

“

Warrants

”

) to purchase 5,670,103 shares of the Company

’

s Common Stock to Unilumin at an exercise price of $0.97 per share. The exercise price of the Warrants is automatically adjusted to $0.75 per share if the Company is unable to complete a financing of $2,500,000 through a rights offering by June 1, 2019 (the

“

Rights Offering

”

). The exercise price of the Warrants will also be decreased to the same price as the exercise price of the rights issued in the Rights Offering if the exercise price of such rights is less than $1.00 per share.

The Warrants are exercisable until November 2, 2020, provided that they are mandatorily exercisable upon completion of the Rights Offering if in excess of 90% of the Company

’

s currently issued and outstanding Series B Convertible Preferred Stock (

“

Preferred Stock

”

) converts into Common Stock. In connection with any such Preferred Stock conversion, Unilumin acknowledged that the conversion price of the Preferred Stock may be decreased, subject to stockholder approval. In addition, Unilumin has the right to appoint to two Directors to the Company

’

s Board of Directors. Unilumin has designated Yang Liu and Nicholas Fazio and the Company will amend this Form 8-K to provide the information required under Item 5.02 (d) of Form 8-K.

If all or a significant portion of the Warrants are exercised, Unilumin would own in excess of fifty percent of the Company

’

s outstanding Common Stock on a fully diluted basis, even if the Rights Offering is completed.

The Shares and Warrants were issued and granted to Unilumin pursuant to the exemption from registration contained in Section 4(2) of the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

Exhibit 10.1

Securities Purchase Agreement dated as of November 2, 2018 by and between the Company and Unilumin, filed herewith.

Exhibit 10.2

Warrant, dated as of November 2, 2018, issued to Unilumin, filed herewith.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| |

|

Date: November 8, 2018

|

TRANS-LUX CORPORATION

|

|

|

|

|

|

|

|

|

By:

|

/s/ Todd Dupee

|

|

|

|

Name:

|

Todd Dupee

|

|

|

|

Title:

|

Senior Vice President and

Chief Accounting Officer

|

3

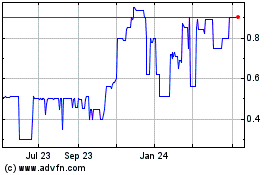

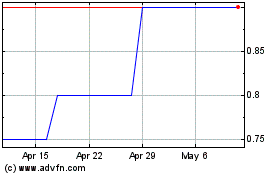

Trans Lux (PK) (USOTC:TNLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trans Lux (PK) (USOTC:TNLX)

Historical Stock Chart

From Apr 2023 to Apr 2024