Report of Foreign Issuer (6-k)

November 07 2018 - 4:44PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

November 7, 2018

PROQR THERAPEUTICS N.V.

Zernikedreef 9

2333 CK Leiden

The Netherlands

Tel: +31 88 166 7000

(Address, Including ZIP Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

Furnished as Exhibit 99.1 to this Report on Form 6-K are the unaudited financial statements of ProQR Therapeutics N.V. (the “Company”) for the three and nine month periods ended September 30, 2018 and furnished as Exhibit 99.2 to this Report on Form 6-K is a press release of ProQR Therapeutics N.V. dated November 7, 2018, announcing the Company’s results for the three and nine month periods ended September 30, 2018.

In addition, on November 7, 2018, the Company, entered into a Sales Agreement (the “ATM Facility”) with H.C. Wainwright & Co., LLC (the “Agent”) to implement an “at the market offering” program under which the Company, from time to time, may offer and sell its ordinary shares, nominal value €0.04 per share, having an aggregate offering price of up to $75,000,000 (the “Shares”) through the Agent. Pursuant to the ATM Facility, the Agent will use its commercially reasonable efforts to sell the Shares from time to time, based upon the Company’s instructions. The Company has no obligation to sell any of the Shares, and may at any time suspend sales under the ATM Facility or terminate the ATM Facility in accordance with its terms. The Company has provided the Agent with customary indemnification rights, and the Agent will be entitled to a fixed commission of 3.0% of the aggregate gross proceeds from the Shares sold. The ATM Facility contains customary representations and warranties, and the Company is required to deliver customary closing documents and certificates in connection with sales of the Shares. Sales under the ATM Facility will be made in transactions that are deemed to be an “at the market offering” as defined in Rule 415(a)(4) under the Securities Act of 1933, as amended, including sales made directly on the Nasdaq Global Market at market prices, in negotiated transactions at market prices prevailing at the time of sale, or at prices relating to such prevailing market prices, and/or any other method permitted by law.

The description of the ATM Facility set forth herein does not purport to be complete and is qualified in its entirety by reference to the full text thereof, which will be filed as an exhibit to the registration statement covering the sale of the Shares, and incorporated by reference herein. This Form 6-K shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities law of any such state or jurisdiction.

In addition, the Company has notified Cantor Fitzgerald & Co., the sales agent under the Company’s Controlled Equity Offering Sales Agreement, dated as of October 2, 2015 (the “Prior ATM Facility”), of its intention to terminate the Prior ATM Facility in connection with the third anniversary of the effective date of the Company’s registration statement on Form F-3 (File No. 333-207245), under which the Company originally established the Prior ATM Facility.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

PROQR THERAPEUTICS N.V.

|

|

|

|

|

|

|

|

|

|

Date: November 7, 2018

|

By:

|

/s/ Smital Shah

|

|

|

|

Smital Shah

|

|

|

|

Chief Financial Officer

|

3

INDEX TO EXHIBITS

|

Number

|

|

Description

|

|

|

|

|

|

99.1

|

|

Unaudited financial statements of ProQR Therapeutics N.V. for the three and nine month periods ended September 30, 2018.

|

|

|

|

|

|

99.2

|

|

Press Release of ProQR Therapeutics N.V. dated November 7, 2018, announcing the Company’s results for the three and nine month periods ended September 30, 2018.

|

4

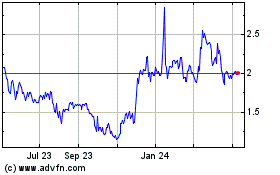

ProQR Therapeutics NV (NASDAQ:PRQR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ProQR Therapeutics NV (NASDAQ:PRQR)

Historical Stock Chart

From Apr 2023 to Apr 2024