Route1 Reports Record Results in Third Quarter of 2018

November 06 2018 - 6:36PM

Route1 Inc. (OTCQB: ROIUF and TSXV: ROI) (the “Company” or

“Route1”), North America's most advanced provider of

industrial-grade data intelligence, user authentication and

ultra-secure mobile workforce solutions, today announced its

third quarter (Q3) financial results for the three and nine months

ended September 30, 2018.

| Statement

of operationsIn 000s of CAD dollars |

Q3 2018 |

Q2 2018 |

Q1 2018 |

Q42017 |

Q3 2017 |

Q2 2017 |

| Revenue |

|

|

|

|

|

|

|

Subscription revenue and services |

1,684 |

1,633 |

1,264 |

1,263 |

1,177 |

1,347 |

| Devices

and appliances |

13,207 |

3,936 |

388 |

109 |

159 |

24 |

|

Other |

4 |

7 |

32 |

48 |

2 |

- |

| Total revenue |

14,895 |

5,577 |

1,684 |

1,420 |

1,338 |

1,371 |

| Cost of revenue |

12,311 |

3,620 |

585 |

331 |

362 |

298 |

| Gross profit |

2,584 |

1,957 |

1,100 |

1,089 |

976 |

1,073 |

| Operating expenses |

2,150 |

1,891 |

1,136 |

1,164 |

1,131 |

1,151 |

| Operating profit (loss) 1 |

434 |

65 |

(36) |

(75) |

(155) |

(78) |

| Total other expenses 2 |

192 |

(144) |

114 |

170 |

183 |

157 |

| Net income gain (loss) |

242 |

209 |

(150) |

(245) |

(338) |

(235) |

1 Before stock based compensation and patent

litigation2 Includes stock based compensation, AirWatch litigation,

gain on acquisition and foreign exchange

|

Subscription revenue and servicesin 000s of CAD

dollars |

Q3 2018 |

Q2 2018 |

Q1 2018 |

Q4 2017 |

Q32017 |

Q2 2017 |

|

Application software |

1,193 |

1,181 |

1,260 |

1,263 |

1,177 |

1,347 |

|

Technology as a service (TaaS) |

288 |

266 |

- |

- |

- |

- |

|

Other services |

203 |

186 |

4 |

- |

- |

- |

|

Total |

1,684 |

1,633 |

1,264 |

1,263 |

1,177 |

1,347 |

| Adjusted

EBITDAin 000s of CAD dollars |

Q32018 |

Q22018 |

Q12018 |

Q42017 |

Q32017 |

Q22017 |

|

Gross Profit |

2,584 |

1,957 |

1,100 |

1,089 |

976 |

1,073 |

|

Adjusted EBITDA 3 |

627 |

272 |

46 |

24 |

(46) |

16 |

|

Amortization |

193 |

207 |

82 |

99 |

109 |

94 |

|

Operating profit (loss) |

434 |

65 |

(36) |

(75) |

(155) |

(78) |

3 Adjusted EBITDA is defined as earnings before

interest, income taxes, depreciation and amortization, stock-based

compensation, patent litigation, restructuring and other costs.

Adjusted EBITDA does not have any standardized meaning prescribed

under IFRS and is therefore unlikely to be comparable to similar

measures presented by other companies. Adjusted EBITDA allows

Route1 to compare its operating performance over time on a

consistent basis.

Route1 generated cash from operating activities

of approximately $0.5 million during Q3 2018 compared with cash

used in operating activities of $0.2 million in Q3 2017.

Non-cash working capital of $1.0 million was generated in Q3 2018

compared to $0.5 million of cash used in the same period a year

earlier. Net cash generated from the day–to-day operations

for the three months ended September 30, 2018 was $1.5 million

compared to cash used of $0.6 million in Q3 2017.

| Balance sheet

extractsIn 000s of CAD dollars |

Sep

302018 |

Jun 302018 |

Mar 312018 |

Dec 312017 |

Sep 302017 |

Jun 302017 |

|

Cash |

2,289 |

1,084 |

600 |

1,037 |

1,408 |

2,080 |

|

Total current assets |

5,998 |

4,989 |

6,292 |

2,035 |

2,856 |

2,924 |

|

Total current liabilities |

5,559 |

4,863 |

6,292 |

1,829 |

2,534 |

2,396 |

|

Net working capital |

439 |

126 |

- |

206 |

322 |

528 |

|

Total assets |

8,198 |

7,356 |

8,646 |

3,171 |

4,081 |

4,213 |

|

Bank debt |

- |

- |

- |

- |

- |

- |

|

Total shareholders’ equity |

2,402 |

2,322 |

2,256 |

1,236 |

1,432 |

1,720 |

“I am pleased with the operating and financial

performance the GroupMobile team delivered during our recently

completed third quarter. The strong quarterly financial

results reflect the high quality execution of our Group Mobile

Int’l integration plan, closure on the July 2018 US $5.9 million

purchase order for Getac rugged devices from a US based integrated

energy company engaged primarily in electric power production and

retail distribution operations, delivering to the market cutting

edge software applications for data analytics and data security,

and the start of realizing on the inherent business value that

falls out of acquisition of Group Mobile Int’l earlier this year,”

said Tony Busseri CEO of Route1. “Of note is the positive

impact the addition of the rugged device resale business that we

purchased earlier this year. Results will vary from quarter

to quarter, as device sales can be influenced by one-time large

orders similar to the impact the US $5.9 million had on this third

quarter.

“We started our business pivot towards being an

advanced provider of solutions for the ultra-secure mobile

workforce, user authentication and data intelligence in mid-2017

and the plan is now producing better than expected results at this

point in the business model’s maturity. We expect GroupMobile

to grow organically and through acquisition over the next year and

continue to aggressively move forward on realizing on the embedded

value in our intellectual property.”

Investor Conference Call and

Webcast

Route1 will hold a conference call and web cast

to discuss the Company’s financial results and provide a business

update on Wednesday, November 7, 2018 at 9 a.m. eastern.

Participants should dial Toll-Free: 1-866-548-4713 or

Toll/International: 1-323-794-2093 at least 10 minutes prior

to the conference, pass code 1767112 . For those unable to

attend the call, a replay will be available on November 7,

2018 after 12:00 p.m. at Toll-Free 1-844-512-2921 or

Toll/International 1-412-317-6671, pass code 1767112 until 11:59 pm

on November 21, 2018.

The webcast will be presented live at

http://public.viavid.com/index.php?id=131797.

About Route1 Inc.Route1,

operating under the trade name GroupMobile, is North America's most

advanced provider of industrial-grade data intelligence, user

authentication, and ultra-secure mobile workforce solutions.

The Company helps all manner of organizations, from government and

military to private sector, to make intelligent use of devices and

data for immediate process improvements while maintaining the

highest level of cyber security. Route1 is listed on the

OTCQB in the United States under the symbol ROIUF and in Canada on

the TSX Venture Exchange under the symbol ROI. For more

information, visit: www.route1.com.

For More Information, Contact:

Tony BusseriCEO, Route1 Inc.+1 416

814-2635tony.busseri@groupmobile.com

This news release, required by applicable

Canadian laws, does not constitute an offer to sell or a

solicitation of an offer to buy any of the securities in the United

States. The securities have not been and will not be registered

under the United States Securities Act of 1933, as amended (the

"U.S. Securities Act") or any state securities laws and may not be

offered or sold within the United States or to U.S. Persons unless

registered under the U.S. Securities Act and applicable state

securities laws or an exemption from such registration is

available.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

© 2018 Route1 Inc. All rights reserved. No part

of this document may be reproduced, transmitted or otherwise used

in whole or in part or by any means without prior written consent

of Route1 Inc. See

https://www.route1.com/terms-of-use/ for notice of Route1’s

intellectual property.

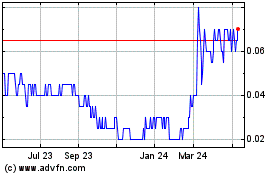

Route 1 (TSXV:ROI)

Historical Stock Chart

From Mar 2024 to Apr 2024

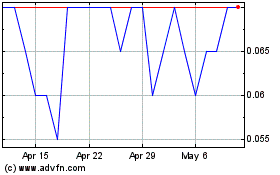

Route 1 (TSXV:ROI)

Historical Stock Chart

From Apr 2023 to Apr 2024