FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated November 5, 2018

BRASILAGRO – COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

(Exact Name as Specified in its Charter)

BrasilAgro – Brazilian Agricultural Real Estate Company

U

(Translation of Registrant’s Name)

1309 Av. Brigadeiro Faria Lima, 5th floor, São Paulo, São Paulo 01452-002, Brazil

U

(Address of principal executive offices)

Gustavo Javier Lopez,

Administrative Officer and Investor Relations Officer,

Tel. +55 11 3035 5350, Fax +55 11 3035 5366, ri@brasil-agro.com

1309 Av. Brigadeiro Faria Lima, 5

th

floor

São Paulo, São Paulo 01452-002, Brazil

U

(

Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

U

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

U

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

o

No

x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

For the quarter ended September 30, 2018

São Paulo, November 5, 2018 –

BrasilAgro (B3: AGRO3) (NYSE: LND)

, the Brazilian leader in acquiring, developing and selling rural properties that offer high potential for price appreciation in Brazil, announces its consolidated results for the quarter ended September 30, 2018 (“1Q19”). The consolidated quarterly information is prepared in accordance with International Financial Reporting Standards (IFRS).

1Q19 Conference Call

November 6, 2018

Portuguese with simultaneous English translation

2:00 p.m. (Brasília)

11:00 a.m. (NY)

Phone Brazil: +55 (11) 3127 4971

Phone U.S.: +1 929 378 3440

Password: BrasilAgro

|

www.brasil-agro.com

|

2

|

BRASILAGRO 1Q19

|

|

PRICE

|

CONTACTS

|

|

AGRO3: R$ 15.18

LND: US$ 4.06

|

+ 55 (11) 3035 5374

ri@brasil-agro.com

|

|

|

|

|

Gustavo Javier Lopez

IRO

|

|

|

|

Ana Paula Zerbinati Ribeiro Gama

Elisa Cardoso Castelani

Investor Relations

|

|

www.brasil-agro.com

|

3

|

BRASILAGRO 1Q19

|

MESSAGE FROM MANAGEMENT

We ended the 2017/2018 harvest year with record results for the Company and we started the 2018/2019 harvest with equally motivating prospects. In 1Q19, we reached Net Revenue of R$270.7 million and Adjusted EBITDA of R$127 million, mainly reflecting the recognition of the sale of part of the Jatobá Farm as announced last July.

The estimated production area for the 2018/2019 harvest is 135,100 hectares in Brazil and Paraguay, an increase of 31.4% compared to the previous harvest, mainly due to the lease of the Parceria V Farm, announced in September, adding 23,600 hectares of mature land in the region of Mato Grosso and potential for second crop cultivation in up to 80% of this area.

In addition to soybean, corn and sugarcane crops and pasture, this year we began cultivating cotton in more than 1,500 hectares in Bahia. The cotton crop will allow us to capture the good current price levels and, mainly, to demonstrate the potential for cotton production of our lands in that region.

The lease of mature areas and the introduction of new crops reinforces our strategic plan to reduce the volatility of operating cash flow and achieve greater flexibility in the real estate portfolio management.

The planning of our agricultural operation, the development of new areas, added to the active management of real estate activities are factors that will certainly generate value for our shareholders. We remain confident that there is potential for new opportunities, relying on our strong cash position and prepared to make the best investments.

On October 16, the Annual Shareholders’ Meeting approved the distribution of R$41.0 million in dividends, equivalent to R$0.76 per share, generating a dividend yield of 5.3%, demonstrating our commitment to the return to our shareholders. Our entire team is committed to ensuring that the 2018/2019 harvest year brings good results and significantly contributes to the Company's growth.

|

www.brasil-agro.com

|

4

|

BRASILAGRO 1Q19

|

OPERATING PERFORMANCE

Definitions:

1Q18 and 1Q19 – quarters ended on September 30, 2017 and September 30, 2018, respectively | 2017/2018 Harvest Year – fiscal year started on July 1, 2017 and ended on June 30, 2018 | 2018/2019 Harvest Year – fiscal year started on July 1, 2018 and ended on June 30, 2019.

Property Portfolio

On the date of this release, the Company’s property portfolio consisted of 238,705 hectares across six Brazilian states and Paraguay.

|

|

FARMS

|

LOCATION

|

AQUISITION DATE

|

PROJECT

|

TOTAL AREA (ha)

|

ARABLE AREA (ha)

|

|

1

|

Jatobá Farm

|

Jaborandi / BA

|

mar/07

|

Grains and Pasture

|

21,197

|

16,740

|

|

2

|

Alto Taquari Farm

|

Alto Taquari / MT

|

aug/07

|

Sugarcane

|

5,394

|

3,774

|

|

3

|

Araucária Farm

|

Mineiros / GO

|

apr/07

|

Sugarcane

|

5,534

|

4,124

|

|

4

|

Chaparral Farm

|

Correntina / BA

|

nov/07

|

Grains and Cotton

|

37,182

|

26,444

|

|

5

|

Nova Buriti Farm

|

Bonito de Minas / MG

|

dec/07

|

Forest

|

24,212

|

17,846

|

|

6

|

Preferência Farm

|

Baianópolis / BA

|

sep/08

|

Grains and Pasture

|

17,799

|

12,410

|

|

7

|

Partnership II

(1)

|

Ribeiro Gonçalves / PI

|

nov/13

|

Grains

|

7,500

|

7,500

|

|

8

|

Morotí

(2)

(Paraguay)

|

Boquerón

|

dec/13

|

Grains and Pasture

|

59,490

|

29,745

|

|

9

|

Partnership III

(3)

|

Alto Taquari / MT

|

may/15

|

Sugarcane

|

4,263

|

4,263

|

|

10

|

Partnership IV

(4)

|

São Raimundo das Mangabeiras / MA

|

feb/17

|

Sugarcane

|

15,000

|

15,000

|

|

11

|

São José Farm

|

São Raimundo das Mangabeiras / MA

|

feb/17

|

Grains and Pasture

|

17,566

|

10,137

|

|

12

|

Partnership IV

(5)

|

São Félix do Araguaia / MT

|

aug/18

|

Grains

|

23,568

|

23,568

|

|

|

Total

|

|

|

|

238,705

|

171,551

|

|

1- BrasilAgro entered into an agricultural exploration partnership in the Parceria II Farm for up to 11 harvests, involving up to 10,000 hectares.

|

|

|

|

2- New social denomination of the operation in Paraguay.

|

|

|

|

|

|

3- BrasilAgro entered into an agricultural exploration partnership in the Parceria III Farm potentially up to March 31, 2026.

|

|

|

|

4- BrasilAgro entered into an agricultural exploration partnership in the Parceria IV Farm for 15 years of planting of sugarcane, with option of renewal for another 15 years.

|

|

|

5- BrasilAgro entered into na agricultural exploration partnership in the Parceria V Farm for up to 10 years.

|

|

|

|

With the incorporation of the Parceria V area, the Company’s total leased production areas increased to 43%. We believe that this mix between own and leased area leads to greater flexibility in portfolio management, reducing the volatility of the operating cash flow.

|

www.brasil-agro.com

|

5

|

BRASILAGRO 1Q19

|

Leasing

On September 3, we announced the leasing agreement to explore an agricultural area of 23,500 hectares in the municipality of São Félix do Araguaia, in the state of Mato Grosso. The new farm was named Parceria V.

The leasing agreement has a duration of up to 10 harvest years, and payment per harvest year will be a minimum of 9.39 soybean bags per hectare or 17% of the total production, whichever is greater.

The area will be cultivated with grains and is already in the process of planting for the 2018/2019 harvest. These areas are mature, with more than 5 years under production and are suitable for a second crop.

The agreement is part of the Company's business strategy aimed at the reduction of the volatility of agricultural operations results and maximization of the combination of the Company’s operating and real estate return.

Development of Areas

During the 2018/2019 harvest year, we intend to transform approximately 4,000 hectares in Bahia and Paraguay, totaling 127,500 hectares of transformed area in 11 years of operation, which represents an average growth of 29% in the portfolio transformation, which is the main valuation index of our properties.

Market Value of the Portfolio

We hired the independent consulting firm Deloitte Touche Tohmatsu to conduct a market valuation of our properties. According to their appraisal, as of June 30, 2018, the market value of the portfolio was

R$1.32 billion

.

We review the internal market value of our farms annually, and on June 30, 2018, when the valuation was conducted, the market value of our portfolio was R$1.26 billion.

In order to estimate the market value of our farms, we considered for each property: (i) its level of

development; (ii) soil quality and maturity; and (iii) agricultural aptitude and potential.

|

www.brasil-agro.com

|

6

|

BRASILAGRO 1Q19

|

The table below shows the internal market valuation of the portfolio performed by independent consulting firm Deloitte Touche Tohmatsu on June 30, 2017 and 2018, considering the sale of part of the Jatobá Farm:

|

FARM

|

LOCATION

|

2018 Area

|

Internally Appraise (R$ thousand)

|

Independent Valuation (R$ thousand)

|

|

06/30/2017

|

Period Sales

|

06/30/2018¹

|

06/30/2017

|

06/30/2018¹

|

|

Jatobá Farm

|

Bahia

|

21,197

|

321,802

|

177,900

|

215,127

|

360,758

|

220,050

|

|

Alto Taquari Farm

|

Mato Grosso

|

5,394

|

150,940

|

|

158,726

|

119,706

|

125,910

|

|

Araucária Farm

|

Goiás

|

5,534

|

166,352

|

|

137,796

|

172,327

|

135,170

|

|

Chaparral Farm

|

Bahia

|

37,182

|

291,751

|

|

312,256

|

352,391

|

397,500

|

|

Nova Buriti Farm

|

Minas Gerais

|

24,212

|

30,282

|

|

32,145

|

23,407

|

23,180

|

|

Preferência Farm

|

Bahia

|

17,799

|

54,680

|

|

58,171

|

64,392

|

61,510

|

|

São José Farm

|

Maranhão

|

17,566

|

148,255

|

|

156,798

|

156,981

|

168,260

|

|

Morotí² (Paraguay)

|

Chaco Paraguay

|

59,490

|

143,074

|

|

188,946

|

143,039

|

190,954

|

|

Total

|

|

188,374

|

1,307,136

|

177,900

|

1,259,965

|

1,393,001

|

1,322,534

|

|

¹ Numbers after the sale of Jatobá Farm, accounted on this quarter

|

|

|

|

|

|

² New social denomination of the operation in Paraguay, former Palmeiras

|

|

|

|

|

|

www.brasil-agro.com

|

7

|

BRASILAGRO 1Q19

|

Agricultural Operations

The table below shows the breakdown of the area to be cultivated by farm in the 2018/2019 Harvest:

|

Planted Area by Farm - Crop 18/19 (ha)

|

Ratoon Cane

|

Plant Cane

|

Soybean

|

Corn

|

Corn - 2nd Crop

|

Pasture

|

Cotton

|

Other

|

Total

|

|

Alto Taquari Farm

|

3,346

|

130

|

|

|

|

|

|

|

3,476

|

|

Araucária Farm

|

2,704

|

677

|

|

|

|

|

|

|

3,381

|

|

Partnership III Farm

|

4,194

|

1,324

|

990

|

|

|

|

|

|

6,508

|

|

São José Farm and Partnership IV Farm

|

16,266

|

4,018

|

5,475

|

|

|

|

|

|

25,759

|

|

Jatobá Farm

|

|

|

2,587

|

|

|

4,315

|

|

8,313

|

15,215

|

|

Chaparral Farm

|

|

|

7,522

|

1,391

|

|

4,253

|

1,579

|

4,924

|

19,669

|

|

Preferência Farm

|

|

|

|

|

|

6,344

|

|

134

|

6,478

|

|

Partnership II Farm

|

|

|

6,690

|

800

|

|

|

|

|

7,490

|

|

Partnership V Farm

|

|

|

23,568

|

|

10,540

|

|

|

|

34,108

|

|

Morotí¹ (Paraguay)

|

|

|

5,440

|

1,419

|

|

2,859

|

|

3,288

|

13,006

|

|

Total

|

26,510

|

6,149

|

52,272

|

3,610

|

10,540

|

17,771

|

1,579

|

16,659

|

135,090

|

|

¹ New social denomination of the operation in Paraguay, former Palmeiras.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Planted area by crop (ha)

|

|

Crop 17/18

|

Crop 18/19

|

Harvest Participation 18/19 (%)

|

Change (%)

|

|

Grains

|

|

35,207

|

66,422

|

49.2%

|

88.7%

|

|

Soybean

|

|

31,853

|

52,272

|

38.7%

|

64.1%

|

|

Corn and Corn 2nd Crop

|

|

3,354

|

14,150

|

10.5%

|

321.9%

|

|

Sugarcane

|

|

31,580

|

32,659

|

24.2%

|

3.4%

|

|

Pasture

|

|

19,787

|

17,771

|

13.2%

|

-10.2%

|

|

Cotton

|

|

-

|

1,579

|

1.2%

|

n.a.

|

|

Other

|

|

16,280

|

16,659

|

12.3%

|

2.3%

|

|

Total

|

|

102,854

|

135,090

|

100.0%

|

31.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

Planted area by Land Ownership (ha)

|

|

Crop 17/18

|

Crop 18/19

|

Harvest Participation 18/19 (%)

|

Change (%)

|

|

Ownn Area

|

|

74,706

|

71,225

|

52.7%

|

-4.7%

|

|

Operated by BrasilAgro

|

|

65,185

|

57,105

|

42.3%

|

-12.4%

|

|

Leased to third parties

|

|

9,521

|

14,120

|

10.5%

|

48.3%

|

|

Leased area

|

|

28,148

|

63,865

|

47.3%

|

126.9%

|

|

Total

|

|

102,854

|

135,090

|

100.0%

|

31.3%

|

GRAINS AND COTTON

|

Productivity per culture (tons)

|

Crop 17/18

Realized

|

Crop 18/19

Estimated

|

Change

(%)

|

|

Soybean

|

111,123

|

156,380

|

40.7%

|

|

Corn

|

21,220

|

22,138

|

4.3%

|

|

Corn - 2nd Crop

|

1,986

|

71,896

|

n.a.

|

|

Cotton

|

-

|

6,159

|

n.a.

|

|

Total

|

134,329

|

256,573

|

91.0%

|

The increase in the total production is mainly due to the lease of the Parceria V Farm.

In the 2018/2019 harvest we will begin the planting of cotton at the Chaparral Farm. The estimated area for this crop is 1,579 hectares.

The cotton crop will generate a significant cash flow due to the good margins in this harvest, and will allow the Company to demonstrate the potential for cotton production of this region.

SUGARCANE

The following table shows the sugarcane results appropriated in the sugarcane harvest year (April to November):

|

www.brasil-agro.com

|

8

|

BRASILAGRO 1Q19

|

|

Crop Year Result - Sugarcane

|

Crop 2018 Estimated

(01/apr to 30/nov)

(A)

|

Crop 2018 Realized

(01/apr to 30/sep)

(B)

|

Crop 2019 Estimated

(01/apr to 30/jun)

(C)

|

Change

B/A

(%)

|

Change

C/A

(%)

|

|

Tons harvested

|

1,845,578

|

1,353,198

|

2,164,999

|

-26.7%

|

17.3%

|

|

Hectares harvested

|

26,344

|

15,823

|

26,510

|

-39.9%

|

0.6%

|

|

TCH - Harvest tons per hectares

|

70.06

|

85.52

|

81.67

|

22.1%

|

16.6%

|

In April, we began harvesting sugarcane in the Alto Taquari, Araucária, Parceria III and Parceria IV Farms. We estimate to deliver 1.8 million tons until the end of the sugarcane harvest year. For the next harvest, we estimate to deliver 2.2 million tons, an increase of 17.3%, through investments and productivity increase in São José Farm.

CATTLE RAISING

We have 20,300 head of cattle in the Preferência and Jatobá Farms and in Paraguay, distributed in 10,714 hectares of already active pasture in Brazil and 3,236 hectares of already active pasture in Paraguay.

|

Livestock

|

Crop 17/18

Realized

(A)

|

Crop 18/19

Estimated

(B)

|

Crop 18/19

Realized (up to sep/30)

(C)

|

Change

C/A (%)

|

Change

C/B

(%)

|

|

Hectares

|

15,114

|

13,518

|

13,950

|

-7.7%

|

3.2%

|

|

Number of heads

|

20,993

|

22,461

|

20,385

|

-2.9%

|

-9.2%

|

|

Meat production (kg)

|

2,398,894

|

2,956,043

|

517,571

|

-78.4%

|

-82.5%

|

|

Weight Gain per Day

|

0.42

|

0.51

|

0.41

|

-1.7%

|

-19.6%

|

|

Weight Gain per hectare

|

158.72

|

218.67

|

37.10

|

-76.6%

|

-83.0%

|

In addition to the 13,518 hectares estimated for active pastures during the 2018/2019 harvest, the Company has 4,253 hectares of pastures without livestock at the Chaparral Farm, which represent areas still under development.

The drought period is concentrated between July and September (1Q19), which represents a lower weight gain for the period. This figure should increase non-linearly in the next quarters.

OTHERS

In order to improve the Company’s results, mitigate operating risks and as a real estate strategy we leased 14,120 hectares to third parties in the state of Bahia, in the Midwest region and in Paraguay. The areas were leased to local farmers and the contracts have a term of up to five harvests.

In addition, we have 2,539 hectares of grasses cover crops and sorghum, in order to increase the organic matter and accelerate the maturation of the soil.

|

www.brasil-agro.com

|

9

|

BRASILAGRO 1Q19

|

FINANCIAL PERFORMANCE

The consolidated financial statements were prepared and are being presented in accordance with International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board.

EBITDA and Adjusted EBITDA

EBITDA and Adjusted EBITDA are presented based on Net Income adjusted for interest, taxes, depreciation and amortization, pursuant to accounting standards.

Adjusted EBITDA was calculated by excluding biological assets in progress (sugarcane and grains planted) and adjusted for the harvest’s derivative results and depreciation expenses, including depreciation of fixed assets of the farms, developed areas and permanent crops.

|

EBITDA (R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Net Income

|

136,637

|

20,134

|

579%

|

|

Interest

|

(18,689)

|

(8,852)

|

111%

|

|

Taxes

|

13,317

|

11,222

|

19%

|

|

Depreciations and amortizations

|

11,624

|

8,093

|

44%

|

|

EBITDA

|

142,889

|

30,597

|

367%

|

|

|

|

|

|

|

Adjusted EBITDA (R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Net Income

|

136,637

|

20,134

|

579%

|

|

Interest

|

(18,689)

|

(8,852)

|

111%

|

|

Taxes

|

13,317

|

11,222

|

19%

|

|

Adjusted Depreciations and Amortizations

(1)

|

11,624

|

8,093

|

44%

|

|

Equity pick-up

|

47

|

741

|

-94%

|

|

Other operating income/expenses, net

(2)

|

(38)

|

(491)

|

-92%

|

|

Elimination of the effects of gains on biological assets (grains and sugarcane planted)

|

(13,742)

|

946

|

n.a.

|

|

Derivatives Results

|

(2,133)

|

996

|

n.a.

|

|

Adjusted EBITDA

|

127,023

|

32,789

|

287%

|

|

(1) Adjusted Depreciation includes depreciation of harvested grains and sugarcane.

|

|

(2) Includes Cresca's EBITDA

|

|

www.brasil-agro.com

|

10

|

BRASILAGRO 1Q19

|

Income Statement

NET REVENUE FROM SALES

|

Net Revenue (R$ thousand)

|

|

1Q19

|

1Q18

|

Change

|

|

Total

|

|

241,671

|

83,747

|

189%

|

|

Farms Sale

|

|

123,335

|

-

|

n.a.

|

|

Soybean

|

|

39,780

|

6,143

|

548%

|

|

Corn

|

|

1,883

|

2,754

|

-32%

|

|

Sugarcane

|

|

74,114

|

73,528

|

1%

|

|

Livestock

|

|

1,955

|

380

|

414%

|

|

Leasing

|

|

582

|

839

|

-31%

|

|

Others

|

|

22

|

103

|

n.a.

|

In 1Q19, the recorded net revenue from sales was R$241.7 million, 189.0% higher than the same period of the previous year. This is mainly due to the revenue of R$123.3 million (present value) from the sale of the Jatobá Farm.

SALE OF FARMs

In 1Q19, the Company recorded the sale of another plot of the Jatobá Farm, an agricultural property located in the municipality of Jaborandi, Bahia. A total of 9,784 hectares (7,485 arable hectares) were sold, corresponding to he nominal value of R$173.8 million (~R$23,767/arable hectare). There was no accounting of revenue from sales of properties in the same period of the previous year.

The table below shows the revenue from the sale of property in 1Q19:

|

R$ (thousand)

|

1Q19

|

|

Nominal Value of Sale

|

173,771

|

|

Present Value Adjustment

|

(50,436)

|

|

Revenue from Farms Sale

|

123,335

|

|

Sales Taxes

|

(4,502)

|

|

Selling Costs

|

(18,039)

|

|

Farm Sale Gain

|

100,794

|

|

www.brasil-agro.com

|

11

|

BRASILAGRO 1Q19

|

SALE OF AGRICULTURAL PRODUCTS

|

Net Revenue (R$ thousand)

|

|

1Q19

|

1Q18

|

Change

|

|

Total

|

|

118,336

|

83,747

|

41%

|

|

Soybean

|

|

39,780

|

6,143

|

548%

|

|

Corn

|

|

1,883

|

2,754

|

-32%

|

|

Sugarcane

|

|

74,114

|

73,528

|

1%

|

|

Livestock

|

|

1,955

|

380

|

414%

|

|

Leasing

|

|

582

|

839

|

-31%

|

|

Others

|

|

22

|

103

|

n.a.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quantity sold (tons)

|

|

1Q19

|

1Q18

|

Change

|

|

Total

|

|

885,051

|

904,699

|

-2%

|

|

Soybean

|

|

32,196

|

6,830

|

371%

|

|

Corn

|

|

3,845

|

8,460

|

-55%

|

|

Sugarcane

|

|

848,594

|

889,256

|

-5%

|

|

Livestock

|

|

416

|

153

|

172%

|

Net revenue from grains (soybean and corn) in 1Q19 increased R$32.8 million compared to the same period last year, from R$8.9 million, from the sale of 15,300 tons, to R$41.7 million, from the sale of 36,000 tons.

Soybean revenue increased by R$33.6 million in 1Q19 compared to the same period last year, from R$6.1 million, from the sale of 6,800 tons at R$899.41 per ton, to R$39.8 million, from the sale of 32,200 tons at R$1,235.56 per ton. The increase in sales of soybeans in 1Q19 compared to 1Q18 reflects the higher volume stored in the period.

Corn revenue in 1Q19 decreased by R$871 thousand compared to the same period of the previous year, from R$2.8 million from the sale of 8,500 tons at R$325.53 per ton, to R$1.9 million, from the sale of 3,800 tons at R$489.73 per ton.

Sugarcane revenue in 1Q19 increased by R$586 thousand compared to the same period of the previous year, from R$73.5 million from the sale of 889,300 tons at R$82.68 per ton, to R$74.1 million from the sale of 848,600 tons at R$87.34 per ton of sugarcane. The increase in per-ton sugarcane price was due to the higher price of the TRS (total recoverable sugar), which went from 0.574 R$/kg in 1Q18 to 0.628 R$/kg in 1Q19.

Cattle-raising revenue in 1Q19 increased by R$1.6 million compared to the same period of the previous year, from R$380 thousand from the sale of 205 head of cattle at R$4.66 per kilo, to R$1.9 million, which refers to the sale of 1,103 cattle to R$4.70 per kilo.

|

www.brasil-agro.com

|

12

|

BRASILAGRO 1Q19

|

Leasing revenue reached R$582 thousand in 1Q19 and refers to third-party leases of Farms. These lease contracts have a duration of up to 5 years with value of up to 18% of production, and the minimum value is 5 soybean bags per hectare.

In 1Q18, we had other revenues in the amount of R$103 thousand, and in 1Q19, other revenues totaled R$22 thousand. These amounts refer to the provision of storage services and sale of inputs and by-products.

GAINS OR LOSSES OF AGRICULTURAL PRODUCTS AND BIOLOGICAL ASSETS

|

Biological Assets and Agricultural Products (R$ thousand)

|

Soybean 18/19

|

Corn

(crop)

18/19

|

Corn

(crop)

17/18

|

Sugarcane

|

Livestock

|

Others

|

Gain / Loss 09/30/18

|

|

Gain and losses in agricultural products

|

-

|

-

|

348

|

16,309

|

(1,373)

|

-

|

15,284

|

|

Gain and losses in biological assets

|

2,749

|

113

|

50

|

10,252

|

-

|

578

|

13,742

|

|

Change in fair value of biological assets and agricultural products

|

2,749

|

113

|

398

|

26,561

|

(1,373)

|

578

|

29,026

|

Gains or losses from the variation in the fair value of agricultural products are determined by the difference between their harvested volume at market value (net of selling expenses and taxes) and the production costs incurred (direct and indirect costs, leasing and depreciation).

Harvested agricultural products are measured at their value at the time of harvest considering the market price of the area of each farm.

Biological assets corresponding to ratoons of sugarcane are measured at cost less depreciation (Accounting Standard IAS 16), while planted cane is measured at fair value (Accounting Standard IAS 41).

|

Agricultural Products

|

Corn

(crop)

17/18

|

Sugarcane

|

Livestock

|

Gain / Loss 09/30/18

|

|

Area (hectares)

|

350

|

10,801

|

13,950

|

25,101

|

|

Production (Tons)

|

1,992

|

919,024

|

518

|

921,534

|

|

Yield (Ton./ha)

|

5.69

|

85.09

|

0.04

|

36.71

|

|

Livestock - head of cattle

|

-

|

-

|

20,385

|

20,385

|

|

Production fair value (R$ thousand)

|

926

|

82,573

|

2,349

|

85,848

|

|

Production Cost (R$ thousand)

|

(578)

|

(66,264)

|

(3,722)

|

(70,564)

|

|

Gain and losses in agricultural products (R$ thousand)

|

348

|

16,309

|

(1,373)

|

15,284

|

Biological assets correspond to agricultural products in formation (not yet harvested) and cattle, measured at the net present value of the expected cash flow from these products. The calculation of fair value considers the best estimates in relation to sales prices, discount rates, direct and indirect costs, leasing, yields and selling expenses.

Cattle biological assets are measured at fair value and controlled in accordance with two methodologies: 12 to 15-month calves and steers (heifers) are controlled and valued by head, while

|

www.brasil-agro.com

|

13

|

BRASILAGRO 1Q19

|

older animals are controlled by weight.

|

Biological Assets - Livestock

|

Total Heads

|

Value (R$/thousand)

|

|

In June 30, 2018

|

20,993

|

34,053

|

|

Aquisition, Birth | Aquisition Expenses

|

560

|

1,135

|

|

Handling Expenses

|

-

|

3,465

|

|

Sales

|

(1,103)

|

(2,062)

|

|

Deaths

|

(65)

|

(118)

|

|

Exchange variation

|

-

|

369

|

|

Fair value variation

|

-

|

(1,373)

|

|

In September 30, 2018

|

20,385

|

35,469

|

Fair value variation is impacted by variations between fair value and cost, as well as by fair value variations between the periods.

Gains or losses from the variation in the fair value of grains and sugarcane biological assets are determined by the difference between their fair value and their book value. Book value includes investments and costs effectively incurred until the moment of appraisal, as well as write-offs arising from the harvesting of the agricultural products.

The table below shows the results of the sugarcane harvest in the fiscal year, including gains (losses) in the value of agricultural products and biological assets:

|

Period ended June 30, 2018

|

2017 Crop

|

2018 Crop

|

Total

|

|

Net Revenue

|

111,888

|

26,332

|

138,220

|

|

Cost of sales

|

(97,778)

|

(36,250)

|

(134,028)

|

|

Gain (loss) of agricultural products and biological assets value

|

37,297

|

6,655

|

43,952

|

|

Total

|

51,407

|

(3,263)

|

48,144

|

|

Produced Tons

|

1,378,554

|

434,174

|

1,812,728

|

|

|

|

|

|

|

Three months period ended September 30, 2018

|

2017 Crop

|

2018 Crop

|

Total

|

|

Net Revenue

|

|

74,114

|

74,114

|

|

Cost of sales

|

|

(66,807)

|

(66,807)

|

|

Gain (loss) of agricultural products and biological assets value

|

|

26,562

|

26,562

|

|

Total

|

|

33,869

|

33,869

|

|

Produced Tons

|

|

919,024

|

919,024

|

|

www.brasil-agro.com

|

14

|

BRASILAGRO 1Q19

|

IMPAIRMENT (REVERSAL OF PROVISIONS OF THE RECOVERABLE AMOUNT OF AGRICULTURAL PRODUCTS, NET)

A provision to adjust inventories at the net realized value of agricultural products is constituted when the fair value of the inventory is higher than the realized value. The realization value is the sales price estimated during the normal course of business less estimated selling expenses.

On September 30, 2018, there was no reversal of provisions of the recoverable amount of agricultural products.

COST OF PRODUCTION

|

Crop 17/18 (%)

|

Soybean

|

Corn

|

Sugarcane

|

Livestock

|

|

Variable costs

|

59%

|

57%

|

87%

|

27%

|

|

Seeds

|

8%

|

14%

|

0%

|

0%

|

|

Fertilizers

|

12%

|

16%

|

10%

|

0%

|

|

Defensive

|

18%

|

10%

|

8%

|

0%

|

|

Agricultural services

|

17%

|

13%

|

50%

|

0%

|

|

Fuels and Lubricants

|

3%

|

3%

|

19%

|

0%

|

|

Maintence of machines and instruments

|

0%

|

0%

|

0%

|

5%

|

|

Animal Feed

|

0%

|

0%

|

0%

|

13%

|

|

Others

|

1%

|

0%

|

0%

|

9%

|

|

Fixed costs

|

41%

|

43%

|

13%

|

73%

|

|

Labor

|

11%

|

9%

|

4%

|

36%

|

|

Depreciation and amortization

|

28%

|

31%

|

1%

|

21%

|

|

Leasing

|

0%

|

0%

|

3%

|

0%

|

|

Others

|

2%

|

3%

|

5%

|

16%

|

|

(R$ / ha)

|

|

Crop 17/18 Realized

|

Crop 18/19 Estimated

|

Change

%

|

|

Soybean

(1)

|

|

2,438

|

2,712

|

11.2%

|

|

Corn

(1)

|

|

2,432

|

2,791

|

14.8%

|

|

Corn 2nd Crop

|

|

-

|

1,566

|

n.a.

|

|

Cotton

|

|

-

|

8,307

|

n.a.

|

|

Sugarcane

|

|

4,212

|

5,833

|

38.5%

|

The estimated cost of production per hectare of sugarcane in the 2018 harvest was 38.5% higher compared to the cost incurred, because in 2018 harvest crop handling costs of the São José Farm started to be accounted by the Company, which didn’t exist in the previous harvest and also due to the raise in CCT – Cutting, Loading, and Transportation costs, related to the diesel fuel price increase.

|

www.brasil-agro.com

|

15

|

BRASILAGRO 1Q19

|

COST OF GOODS SOLD

|

(R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Cost of goods sold

|

(78,872)

|

(55,085)

|

43%

|

|

Soybean

|

(21,887)

|

(6,377)

|

243%

|

|

Corn

|

(1,632)

|

(3,486)

|

-53%

|

|

Sugarcane

|

(53,231)

|

(44,716)

|

19%

|

|

Livestock

|

(2,089)

|

(411)

|

408%

|

|

Others

|

(33)

|

(95)

|

-65%

|

|

|

|

|

|

|

(R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Ativos Biológicos Apropriados ao Custo

|

(26,197)

|

(11,724)

|

123%

|

|

Soybean

|

(12,590)

|

396

|

n.a.

|

|

Corn

|

(56)

|

566

|

n.a.

|

|

Sugarcane

|

(13,557)

|

(12,716)

|

7%

|

|

Livestock

|

-

|

-

|

n.a.

|

|

Others

|

6

|

30

|

-80%

|

|

|

|

|

|

|

(R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Total of cost of goods sold

|

(105,069)

|

(66,809)

|

57%

|

|

Soybean

|

(34,477)

|

(5,981)

|

476%

|

|

Corn

|

(1,688)

|

(2,920)

|

-42%

|

|

Sugarcane

|

(66,788)

|

(57,432)

|

16%

|

|

Livestock

|

(2,089)

|

(411)

|

408%

|

|

Others

|

(27)

|

(65)

|

-58%

|

Cost of goods sold (COGS) came to R$78.9 million in 1Q19. Due to the fair value adjustments of agricultural products, period changes in costs are directly linked to the market price of commodities at the time of harvest.

Soybean COGS increased by R$15.5 million in 1Q19 compared to the previous year, from R$6.4 million, from the sale of 6,800 tons at R$933.67 per ton, to R$21.9 million, from the sale of 32,200 tons at R$679.80 per ton. The decrease in cost per ton was due to the increase in volume produced.

Corn COGS decreased by R$1.9 million in 1Q19 versus the previous year, from R$3.5 million, from the sale of 8,500 tons at R$412.06 per ton, to R$1.6 million, from the sale of 3,800 tons at R$424.45 per ton.

Sugarcane COGS increased by R$8.5 million in 1Q19 versus the previous year, from R$44.7 million, from the sale of 889,300 tons at R$50.28 per ton, to R$53.2 million, from the sale of 848,600 tons at R$62.73 per ton of sugarcane. The increase in cost per ton is mainly due to expenses with crop handling in the São José Farm as of this quarter.

Cattle-raising COGS reached R$1.7 million in 1Q19 compared to the previous year, from R$411

|

www.brasil-agro.com

|

16

|

BRASILAGRO 1Q19

|

thousand form the sale cost of 205 head of cattle at R$1.9 thousand per head, to R$2.1 million from the sale cost of 1,103 head of cattle at R$1.8 thousand per head.

Other COGS in the amount of R$33,000 in 1Q19 mainly refers to the raw material inventory adjustment. In 1Q18, other COGS in the amount of R$95,000 refers to the sale of waste.

SELLING EXPENSES

|

(R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Selling expenses

|

(1,175)

|

(738)

|

59%

|

|

Freight

|

(281)

|

(137)

|

105%

|

|

Storage and Processing

|

(446)

|

(627)

|

-29%

|

|

Others

|

(448)

|

26

|

n.a.

|

In 1Q19, we recorded R$1.2 million in selling expenses, 59% higher compared to 1Q18, mainly due to the provision for doubtful accounts (PDD), as shown in the other selling expenses line.

GENERAL AND ADMINISTRATIVE EXPENSES

|

(R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

General and administrative expenses

|

(10,316)

|

(7,624)

|

35%

|

|

Depreciations and amortizations

|

(380)

|

(173)

|

120%

|

|

Personnel expenses

|

(6,972)

|

(4,841)

|

44%

|

|

Expenses with services providers

|

(1,127)

|

(1,288)

|

-13%

|

|

Leases and Rents

|

(176)

|

(106)

|

66%

|

|

Taxes

|

(961)

|

(944)

|

2%

|

|

Travel expenses

|

(151)

|

(148)

|

2%

|

|

Software expenses

|

(151)

|

(120)

|

26%

|

|

Other expenses

|

(398)

|

(4)

|

n.a.

|

In 1Q19, general and administrative expenses increased by 35% compared to the same period of the previous year, from R$7.6 million to R$10.3 million.

As of this quarter, we began to incorporate the depreciation and amortization of Morotí (operation in Paraguay), which impacts the Depreciation and Amortization line and explains the 120% increase compared to the last quarter.

The 44% increase in Personnel Expenses is due to the provision for the Long-Term Incentive Plan and the payment of bonuses.

The 66% in leases and rents in general is due to the grace period agreed in the renegotiation of lease contracts, which ended last quarter.

Other expenses include costs regarding telephony services, building maintenance, registry, insurances,

|

www.brasil-agro.com

|

17

|

BRASILAGRO 1Q19

|

shares listing and others. In 2017/2018 a significant amount of these annual expenses was accounted as of the second quarter.

OTHER OPERATING INCOME / EXPENSES

|

(R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Other operating income/expenses

|

(300)

|

(521)

|

-42%

|

|

Gain/Loss on sale of fixed assets

|

(130)

|

(35)

|

271%

|

|

Provisions for lawsuits

|

31

|

(320)

|

n.a.

|

|

Others

|

(201)

|

(166)

|

21%

|

The reduction in other operating expenses (income) is a result of the decrease in the provision for legal claims.

FINANCIAL RESULT

|

(R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Total

|

18,689

|

8,852

|

111%

|

|

Interest

(i)

|

(4,730)

|

8,103

|

-158%

|

|

Monetary variation

(ii)

|

-

|

27

|

n.a.

|

|

Exchange vartiation

(iii)

|

(931)

|

(1,580)

|

-41%

|

|

Unwind of present value adjustment

(iv)

|

23,969

|

671

|

n.a.

|

|

Results with derivatives

(v)

|

(1,221)

|

1,525

|

-180%

|

|

Other financial income / expenses

(vi)

|

1,602

|

106

|

n.a.

|

The consolidated financial result is composed of the following items: (i) interest on financing; (ii) the impact of the monetary variation on the amount payable from the acquisition of farms; (iii) the impact of the U.S. dollar exchange variation on the offshore account and also Cresca’s receivables in 1Q18; (iv) the present value of Araucária and Jatobá Farms’ sales receivables, fixed in soybean bags; (v) the result from hedge operations; and (vi) bank fees and expenses and returns on cash investments.

Interest variation is mainly due to interest on loans and financing in the amount of R$4.6 million in 1Q19 and the recognition of the financial revenue obtained from the Nova Buriti Farm renegotiation, in the amount of R$9.3 million in 1Q18

The realization of the present value of assets and liabilities, in the amount of R$24.0 million, shows the variation in the amount to be received due to the sales of the Araucária and Jatobá Farms, denominated in soybean bags. This variation is explained by the soybean price index, considering the Chicago Stock Exchange (CBOT), port premium (basis), exchange rate and interest rate (with reference to the CDI).

|

www.brasil-agro.com

|

18

|

BRASILAGRO 1Q19

|

The derivatives result reflects the commodities hedge operations result and the impact of the exchange variation on cash, which was partially dollarized in order to maintain purchasing power in regard to inputs, investments and new acquisitions, which have a positive correlation with the US currency. In 1Q19, the result of derivative transactions was a negative R$1.2 million, of which R$2.6 million (negative) are related to currency operations and R$1.4 million are related to operations with commodities. In 1Q18, derivative operations totaled R$1.5 million, of which R$1.1 million are a loss related to currency operations and R$396 thousand are in operations with commodities.

The rise in other financial income / expenses is due to the increase in the Company’s cash position, from an average cash flow of R$52.8 million in 1Q18 to R$93.2 million in 1Q19.

DERIVATIVE OPERATIONS

Our risk policy primarily aims to hedge the Company’s cash flow. In this context, we are concerned not only with the main components of our revenue, but also the main components of our production costs. We therefore monitor on a daily basis: a) the international prices of the main agricultural commodities produced by the Company, usually expressed in U.S. dollars; b) the base premium, i.e. the difference between the international and domestic commodity price; c) exchange rates; and d) the prices of the main components such as freight, fertilizers and chemicals, that can significantly impact costs.

The points analyzed when deciding on the price and margin hedging strategy and tools are listed below:

• Estimated gross margin based on the current price environment.

• Standard deviation from the estimated gross margin for different pricing strategy scenarios.

• Analysis of the estimated gross margin in stress scenarios for different hedge strategies.

• Comparison between current estimates and the Company’s budget.

• Comparison of the estimated gross margin and the historical average.

• Market expectations and trends.

• Tax aspects.

Hedge Position on October 29, 2018

|

www.brasil-agro.com

|

19

|

BRASILAGRO 1Q19

|

|

Crop

|

Soybean

|

FX

|

|

Volume

(1)

|

% of hedge

(2)

|

Price (USD/bu)

|

Volume (thousand)

|

% of hedge

(3)

|

BRL/USD

|

|

18/19

|

72,210 ton

|

49.7%

|

9.80

|

USD 32,436

|

64.8%

|

3.97

|

|

(1) Net estimated volume of production + farm sales receivables.

|

|

|

|

|

(2) % of the volume of soybean locked in tons.

|

|

|

|

|

|

(3) % of estimated revenue in USD.

|

|

|

|

|

|

|

www.brasil-agro.com

|

20

|

BRASILAGRO 1Q19

|

Balance Sheet

DISTRIBUTION OF DIVIDENDS

On October 16, the Company's Annual Shareholders' Meeting approved the distribution of dividends in the amount of R$0.76 per share. The payment will be made on November 6 and the Company's shares will be traded as “ex-dividends” from October 17, 2018.

NET ASSET VALUE – NAV

|

(R$ thousand)

|

September 30, 2018

|

|

Book

|

NAV

|

|

BrasilAgro's Equity

|

900,163

|

900,163

|

|

Properties appraisal

|

|

1,259,965

|

|

(-) Balance Sheet - Land Value

|

|

-551,895

|

|

NAV - Net Asset Value

|

900,163

|

1,608,233

|

|

Shares

|

56,889

|

56,889

|

|

NAV per share

|

15.82

|

28.27

|

CASH AND CASH EQUIVALENTS

|

Cash and Cash equivalents / Marketable Securities

|

09/30/2018

|

06/30/2018

|

Change

|

|

Cash and Cash equivalents

|

67,834

|

104,314

|

-35%

|

|

Cash and Banks

|

17,325

|

23,101

|

-25%

|

|

Repurchase agreements

|

4,510

|

15,242

|

-70%

|

|

Bank deposit certificates

|

9,913

|

33,137

|

-70%

|

|

Finance Lease bills

|

36,086

|

32,834

|

10%

|

|

Marketable securities

|

23,673

|

11,215

|

111%

|

|

Restricted financial investments

|

1,149

|

1,129

|

2%

|

|

Treasury financial bills

|

22,524

|

10,086

|

123%

|

|

Restricted Marketable securities

|

18,452

|

18,226

|

1%

|

|

Bank deposit certificates

|

9,693

|

9,588

|

1%

|

|

Banco do Nordeste (loan guarantees)

|

8,759

|

8,638

|

1%

|

|

Total

|

109,959

|

133,755

|

-18%

|

The Company ended the quarter with a cash position of R$110.0 million, a reduction of 18% over June 30, 2018, mainly due to the payment of a part of the loans.

|

www.brasil-agro.com

|

21

|

BRASILAGRO 1Q19

|

INVENTORY

|

(R$ thousand)

|

09/30/2018

|

06/30/2018

|

Change

|

|

Soybean

|

15,670

|

50,289

|

-69%

|

|

Corn

|

4,818

|

6,247

|

-23%

|

|

Livestock

|

35,469

|

34,053

|

4%

|

|

Other crops

|

285

|

1,153

|

-75%

|

|

Agricultural Products

|

56,242

|

91,742

|

-39%

|

|

Supplies

|

34,881

|

11,933

|

192%

|

|

Total

|

91,123

|

103,675

|

-12%

|

The Company ended 1Q19 with an inventory of 15,700 tons of soybean, 4,800 tons of corn – which will be sold in the next semester – and 20,300 head of cattle. At the end of the 2017/2018 harvest the Company's inventory was 50,300 tons of soybean, 6,300 tons of corn and 21,000 head of cattle.

INDEBTEDNESS

|

(R$ thousand)

|

Expiration

|

Annual Interest Tax - %

|

09/30/2018

|

06/30/2018

|

Change

|

|

Short term

|

|

|

|

|

|

|

Financing for Agricultural Funding

|

Jul-19

|

Pre 7.00

|

3,006

|

31,847

|

-91%

|

|

Financing for Agricultural Funding (USD)

|

Nov-18

|

Pre 8.30

|

11,769

|

11,486

|

2%

|

|

Financing of Projeto Bahia

|

Sep-19

|

Pre 4.00 to 9.00

|

6,040

|

3,131

|

93%

|

|

Machinery and Equipment Financing

|

Sep-19

|

TJLP + 3.73

Pre 9.00 to 11.00

|

1,611

|

630

|

156%

|

|

Sugarcane Financing

|

Sep-19

|

TJLP + 2.70

Pre 9.00 to 10.00

|

21,787

|

21,318

|

2%

|

|

Debentures

|

Jul-23

|

106.50 and 110.00 of CDI rate

|

559

|

-

|

n.a.

|

|

Sugarcane Plantation Leasing - Parceria III

|

Nov-18

|

6.62%

|

957

|

1,676

|

-43%

|

|

|

|

|

45,729

|

70,088

|

-35%

|

|

Long term

|

|

|

|

|

|

|

Sugarcane Financing

|

Dec-23

|

TJLP + 2.70

Pre 9.00 to 10.00

|

22,950

|

27,146

|

-15%

|

|

Machinery and Equipment Financing

|

Jun-24

|

TJLP + 3.73

Pre 9.00 to 11.00

|

4,323

|

5,411

|

-20%

|

|

Financing of Projeto Bahia

|

Aug-23

|

Pre 4.00 to 9.00

|

13,198

|

13,194

|

0%

|

|

Debentures

|

Jul-23

|

106.50 and 110.00 of CDI rate

|

144,084

|

141,642

|

2%

|

|

Sugarcane Plantation Leasing - Parceria IV

|

Jan-32

|

R$/kg 0.6462

|

18,457

|

18,539

|

0%

|

|

|

|

|

203,012

|

205,932

|

-1%

|

|

Total

|

|

|

248,741

|

276,020

|

-10%

|

On September 30, 2018 and June 30, 2018, the balance of loans and financing was R$248.7 million and R$276.0 million, respectively. The payment of interest and principal totaled R$34.4 million in 1Q19.

During the period, R$3.0 million were also disbursed to finance the cost of sugarcane, soybean and corn operations.

PROPERTIES FOR INVESTMENT

|

www.brasil-agro.com

|

22

|

BRASILAGRO 1Q19

|

The fundamental pillars of the Company’s business strategy are the acquisition, development, exploration and sale of rural properties suitable for agricultural activities. The Company acquires rural properties with significant potential for generating value, subsequently holding the assets and carrying out profitable agricultural activities on them.

Once we acquire our rural properties, we begin to implement high-value added crops and to transform these rural properties by investing in infrastructure and technology, while also entering into lease agreements with third parties. In line with our strategy, when we deem a rural property has reached its optimal value, we sell it to capture the capital gains.

The rural properties acquired by the Company are booked at their acquisition cost, which does not exceed their realized net value, and are recognized under “Non-Current Assets”.

Properties for investment are evaluated at their historical cost, plus investments in buildings, improvements and the clearing of new areas, less accrued depreciation, in accordance with the same criteria detailed for fixed assets.

|

|

Acquisition value

|

Buildings and improvements

|

Area

Opening

|

Construction in progress

|

Investment Properties

|

|

Initial Balance

|

425,079

|

32,252

|

49,474

|

50,347

|

557,152

|

|

In June 30, 2018

|

|

|

|

|

|

|

Acquisitions

|

-

|

79

|

-

|

7,788

|

7,867

|

|

Reductions

|

(9,902)

|

(1,693)

|

(5,473)

|

(569)

|

(17,637)

|

|

Transfers

|

-

|

4,160

|

32,770

|

(36,860)

|

70

|

|

(-) Depreciation/ Amortization

|

-

|

(719)

|

(1,791)

|

-

|

(2,510)

|

|

Cumulative Translation Adjustment

|

5,146

|

221

|

428

|

1,158

|

6,953

|

|

In September 30, 2018

|

420,323

|

34,300

|

75,408

|

21,864

|

551,895

|

On September 30, 2018, we recorded R$21.9 million in ongoing work, which refers to the clearance of areas not yet concluded and other investments in the Morotí (former Palmeiras), Chaparral and Araucária Farms.

CAPEX – AREA OPENING

|

(R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Maintenance

|

1,153

|

1,101

|

5%

|

|

Opening

|

3,436

|

4,544

|

-24%

|

|

Total

|

4,589

|

5,645

|

-19%

|

DEPRECIATION – AREA OPENING

|

www.brasil-agro.com

|

23

|

BRASILAGRO 1Q19

|

|

(R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Maintenance

|

(538)

|

(572)

|

-6%

|

|

Opening

|

(1,021)

|

(2,342)

|

-56%

|

|

Total

|

(1,559)

|

(2,914)

|

-46%

|

|

www.brasil-agro.com

|

24

|

BRASILAGRO 1Q19

|

CAPITAL MARKETS

The Company was the first agricultural production company to list its shares on the Novo Mercado segment of the B3 (São Paulo Stock Exchange) and was also the first Brazilian agribusiness company to list its ADRs (American Depositary Receipts) on NYSE (New York Stock Exchange).

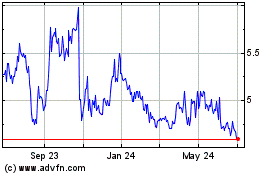

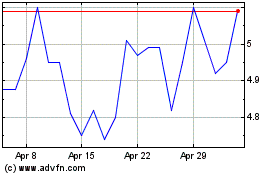

Share Performance

On November 1, 2018, BrasilAgro’s shares (AGRO3) were traded at R$15.01, resulting in a market cap of R$853.9 million, while its ADRs (LND) were traded at US$3.89.

|

HIGHLIGHTS - AGRO3

|

1Q19

|

1Q18

|

|

Average Daily Trade Volume (R$)

|

1,043,055

|

1,357,924

|

|

Maximun (R$ per share)

|

14.68

|

12.32

|

|

Mininum (R$ per share)

|

13.46

|

12.13

|

|

Average (R$ per share)

|

13.93

|

12.21

|

|

Closing Quote (R$ per share)

|

13.69

|

13.25

|

|

Variation in the period (%)

|

1.30%

|

7.81%

|

|

www.brasil-agro.com

|

25

|

BRASILAGRO 1Q19

|

|

Disclaimer

|

|

The statements contained in this document related to the prospects for BrasilAgro’s businesses, projected operating and financial income and growth are merely projections, and as such are based exclusively on management’s expectations. These expectations depend materially on market conditions, the performance of the Brazilian economy, the industry and international markets, and are therefore subject to change without prior notice.

|

WEIGHTS AND MEASURES USED IN AGRICULTURE

|

Weights and Measures used in Agriculture

|

|

|

1 ton

|

1,000 kg

|

|

|

1 Kilo

|

2.20462 pounds

|

|

|

1 pound

|

0.45359 kg

|

|

|

1 acre

|

0.1840 bushel

|

|

|

1 hectare (ha)

|

2.47105 acres

|

|

|

1 hectare (ha)

|

10,000 m2

|

|

|

1 bushel

|

5.4363 acres

|

|

|

|

|

|

|

Soybean

|

|

|

|

1 bushel of soybean

|

60 pounds

|

27.2155 kg

|

|

1 bags of soybean

|

60 kg

|

2.20462 bushels

|

|

1 bushel/acre

|

67.25 kg/ha

|

|

|

1.00 US$/bushel

|

2.3621 US$/saca

|

|

|

|

|

|

|

Corn

|

|

|

|

1 bushel of corn

|

56 pounds

|

25.4012 kg

|

|

1 bags of corn

|

60 kg

|

2.36210 bushels

|

|

1 bushel/acre

|

62.77 kg/ha

|

|

|

1.00 US$/bushel

|

2.3621 US$/saca

|

|

|

|

|

|

|

Cattle

|

|

|

|

1 arroba

|

~33.1 pounds

|

15 Kg

|

|

www.brasil-agro.com

|

26

|

BRASILAGRO 1Q19

|

INCOME STATEMENT

|

(R$ thousand)

|

1Q19

|

1Q18

|

Change

|

|

Revenues from Farm Sales

|

123,335

|

-

|

n.a.

|

|

Revenues from grains

|

42,569

|

9,277

|

359%

|

|

Revenues from sugarcane

|

75,687

|

75,409

|

0%

|

|

Revenues from leasing

|

1,566

|

1,050

|

49%

|

|

Revenues from Livestock

|

2,000

|

-

|

n.a.

|

|

Other revenues

|

71

|

445

|

-84%

|

|

Deductions from gross revenue

|

(3,556)

|

(2,435)

|

46%

|

|

Net Sales Revenue

|

241,672

|

83,746

|

189%

|

|

Change in fair value of biological assets and agricultural products

|

29,042

|

14,235

|

104%

|

|

Impairment

|

-

|

958

|

-100%

|

|

Net Revenue

|

270,714

|

98,939

|

174%

|

|

Cost of Farm Sale

|

(22,541)

|

-

|

n.a.

|

|

Cost of agricultural products sale

|

(105,069)

|

(66,811)

|

57%

|

|

Gross Profit

|

143,104

|

32,128

|

345%

|

|

Selling expenses

|

(1,174)

|

(737)

|

59%

|

|

General and administrative expenses

|

(10,318)

|

(7,625)

|

35%

|

|

Depreciations and amortizations

|

(380)

|

(173)

|

120%

|

|

Personnel expenses

|

(6,972)

|

(4,841)

|

44%

|

|

Expenses with services provider

|

(1,127)

|

(1,288)

|

-13%

|

|

Leases and Rents

|

(176)

|

(106)

|

66%

|

|

Others expenses

|

(1,663)

|

(1,217)

|

37%

|

|

Other operating income/expenses, net

|

(300)

|

(521)

|

-42%

|

|

Equity pick up

|

(47)

|

(741)

|

-94%

|

|

Financial result

|

18,689

|

8,852

|

111%

|

|

Financial income

|

135,031

|

20,080

|

572%

|

|

Interest on Financial Investments

|

2,059

|

790

|

161%

|

|

Interest on assets

|

111

|

10,026

|

-99%

|

|

Foreign exchange variations on liabilities

|

1,265

|

526

|

140%

|

|

Unwind of present value adjustment

|

75,433

|

2,942

|

2464%

|

|

Realized results with derivatives

|

13,421

|

1,970

|

581%

|

|

Unrealized results with derivatives

|

42,742

|

3,826

|

1017%

|

|

Financial expenses

|

(116,342)

|

(11,228)

|

936%

|

|

Interest expenses

|

(98)

|

(580)

|

-83%

|

|

Bank charges

|

(359)

|

(104)

|

245%

|

|

Interest on liabilities

|

(4,841)

|

(1,923)

|

152%

|

|

Monetary variations

|

-

|

27

|

-100%

|

|

Foreign exchange variations on liabilities

|

(2,196)

|

(2,106)

|

4%

|

|

Unwind of present value adjustment

|

(51,464)

|

(2,271)

|

2166%

|

|

Realized results with derivatives

|

(16,776)

|

(1,281)

|

1210%

|

|

Unrealized results with derivatives

|

(40,608)

|

(2,990)

|

1258%

|

|

Profit (loss) before income and social contribution taxes

|

149,954

|

31,356

|

378%

|

|

Income and social contribution taxes

|

(13,317)

|

(11,222)

|

19%

|

|

Profit (loss) for the period

|

136,637

|

20,134

|

579%

|

|

Outstanding shares at the end of the period

|

56,888,916

|

56,888,916

|

0%

|

|

Basic earnings (loss) per share - R$

|

2.40

|

0.35

|

579%

|

|

www.brasil-agro.com

|

27

|

BRASILAGRO 1Q19

|

BALANCE SHEET – ASSETS

|

Assets (R$ thousand)

|

09/30/2018

|

06/30/2018

|

Change

|

|

Current assets

|

|

|

|

|

Cash and Cash equivalents

|

67,834

|

104,314

|

-35.0%

|

|

Marketable securities

|

23,673

|

11,215

|

111.1%

|

|

Trade accounts receivable

|

34,459

|

28,299

|

21.8%

|

|

Inventories

|

134,532

|

95,176

|

41.4%

|

|

Biologial assets

|

55,654

|

69,622

|

-20.1%

|

|

Derivative financial instruments

|

78,887

|

61,993

|

27.3%

|

|

Transactions with related parties

|

1,694

|

1,660

|

2.0%

|

|

|

396,733

|

372,279

|

6.6%

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

Biological assets

|

35,469

|

34,053

|

4.2%

|

|

Marketable securities

|

18,452

|

18,226

|

1.2%

|

|

Diferred taxes

|

51

|

4,053

|

-98.7%

|

|

Derivative financial instruments

|

25,061

|

32,742

|

-23.5%

|

|

Accounts receivable and sundry credits

|

189,451

|

74,775

|

153.4%

|

|

Investment properties

|

551,895

|

557,152

|

-0.9%

|

|

Investments

|

89

|

86

|

3.5%

|

|

Property, plant and equipment

|

83,949

|

84,830

|

-1.0%

|

|

Intangible assets

|

1,318

|

1,403

|

-6.1%

|

|

|

905,735

|

807,320

|

12.2%

|

|

|

|

|

|

|

Total assets

|

1,302,468

|

1,179,599

|

10.4%

|

|

www.brasil-agro.com

|

28

|

BRASILAGRO 1Q19

|

BALANCE SHEET – LIABILITIES

|

Liabilities (R$ thousand)

|

09/30/2018

|

06/30/2018

|

Change

|

|

Current liabilities

|

|

|

|

|

Trade accounts payable and other obligations

|

103,966

|

106,445

|

-2.3%

|

|

Loans and financing

|

45,729

|

70,088

|

-34.8%

|

|

Labor obligations

|

17,788

|

14,300

|

24.4%

|

|

Derivative financial instruments

|

9,941

|

10,489

|

-5.2%

|

|

Transactions with related parties

|

1,860

|

1,831

|

1.6%

|

|

|

179,284

|

203,153

|

-11.7%

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

Trade accounts payable and other obligations

|

18,615

|

11,298

|

64.8%

|

|

Loans and financing

|

203,012

|

205,932

|

-1.4%

|

|

Derivative financial instruments

|

218

|

2,145

|

0.0%

|

|

Provision for legal claims

|

1,176

|

1,207

|

-2.6%

|

|

|

223,021

|

220,582

|

1.1%

|

|

Total liabilities

|

402,305

|

423,735

|

-5.1%

|

|

|

|

|

|

|

Equity

|

|

|

|

|

Capital

|

584,224

|

584,224

|

n.a.

|

|

Capital reserves

|

2,523

|

1,997

|

26.3%

|

|

Treasury shares

|

(35,208)

|

(35,208)

|

0.0%

|

|

Profits reserves

|