- Completes Acquisition Financing

-- Establishes 2018 Fourth Quarter and Revises

Full Year Guidance -- Completes Acquisition of the

Real Estate Assets of Tropicana Entertainment and the Acquisitions

and Lease Modifications to Accommodate the Acquisition of Pinnacle

Entertainment, Inc. by Penn National Gaming,

Inc. in October -

Gaming and Leisure Properties, Inc. (NASDAQ: GLPI) (the

“Company”), the first gaming-focused real estate investment trust

(“REIT”) in North America, today announced results for

the quarter ended September 30, 2018.

Financial Highlights

|

|

|

Three Months Ended

September 30, |

|

(in millions, except per share data) |

|

2018 Actual |

|

2018Guidance (1) |

|

2017Actual |

|

Total Revenue |

|

$ |

254.1 |

|

|

$ |

255.2 |

|

|

$ |

244.5 |

|

Net Income |

|

$ |

104.8 |

|

|

$ |

106.1 |

|

|

$ |

97.0 |

|

Funds From Operations (2) |

|

$ |

129.4 |

|

|

$ |

130.5 |

|

|

$ |

122.7 |

|

Adjusted Funds From Operations (3) |

|

$ |

164.1 |

|

|

$ |

165.1 |

|

|

$ |

170.5 |

|

Adjusted EBITDA (4) |

|

$ |

222.2 |

|

|

$ |

222.8 |

|

|

$ |

223.4 |

|

|

|

|

|

|

|

|

|

Net income, per diluted common share |

|

$ |

0.49 |

|

|

$ |

0.49 |

|

|

$ |

0.45 |

(1) The

guidance figures in the tables above present the guidance provided

on August 1, 2018 for the three months ended

September 30, 2018.

(2) Funds from operations (“FFO”) is net income,

excluding (gains) or losses from sales of property and real estate

depreciation as defined by NAREIT.

(3) Adjusted funds from operations (“AFFO”) is FFO,

excluding stock based compensation expense, amortization of debt

issuance costs, bond premiums and original issuance discounts,

other depreciation, amortization of land rights, straight-line rent

adjustments, direct financing lease adjustments, losses on debt

extinguishment and retirement costs, reduced by capital maintenance

expenditures.

(4) Adjusted EBITDA is net income, excluding

interest, taxes on income, depreciation, (gains) or losses from

sales of property, stock based compensation expense, straight-line

rent adjustments, direct financing lease adjustments, the

amortization of land rights, losses on debt extinguishment and

retirement costs.

Chief Executive Officer, Peter M. Carlino, commented, “While our

real estate portfolio continued to perform as expected during the

quarter, we remained focused on the execution of our previously

announced acquisitions. On September 26, 2018 we completed a

very successful $1.1 billion note offering, with the benefit of our

recently achieved investment grade credit rating. On October

1, 2018 we announced the completion of our acquisition of the real

property assets of Tropicana Entertainment Inc. (“Tropicana”) and

on October 15, 2018 we announced the completion of the transactions

related to the acquisition of Pinnacle Entertainment, Inc. (NASDAQ:

PNK) by Penn National Gaming, Inc. (NASDAQ: PENN). In

aggregate these transactions increased our annual real estate

income by approximately $155 million, while expanding and

diversifying our geographic footprint and tenant roster.

These transactions are immediately accretive as demonstrated by our

announcement on October 15, 2018 of our fourth quarter dividend of

$0.68 per common share, which is an 8% increase from the prior

quarter.”

Mr. Carlino continued, “Today we are happy to celebrate the five

year anniversary of our spin from PENN and reflect on our

substantial accomplishments. We have completed transactions

worth approximately $6.8 billion, growing our real estate revenue

by over $580 million annually and increasing our dividend by 31%

since our first quarter as a REIT. In the process our

portfolio has grown from 20 assets in 12 states to 46 assets in 16

states and we have expanded from one tenant to four tenants.

To fund these acquisitions, we have successfully issued

approximately 90 million shares of common stock and completed $3.5

billion in note offerings. Notably, we have achieved all this

with a commitment to accretion and stability. In the next

five years, we anticipate building upon our success with further

opportunities to grow our business and create value for

shareholders.”

The Company's third quarter net income as compared to guidance

was primarily impacted by the following variances:

- Income from rental activities had an unfavorable variance of

$0.5 million, primarily due to performance at PENN's Hollywood

Casino Columbus and Hollywood Casino Toledo; and

- Net interest had an unfavorable variance of $0.5 million as the

Company took advantage of favorable long-term interest rates prior

to closing on its acquisitions.

Portfolio Update

GLPI owns over 4,300 acres of land and approximately 15 million

square feet of building space, which was 100% occupied as of

September 30, 2018. At the end of the third quarter of 2018,

the Company owned the real estate associated with 38 casino

facilities and leases 20 of these facilities to PENN, 15 of these

facilities to PNK and one to Casino Queen in East St.

Louis, Illinois. Two of the gaming facilities, located in

Baton Rouge, Louisiana and Perryville, Maryland, are owned and

operated by a subsidiary of GLPI, GLP Holdings, Inc.,

(collectively, the “TRS Properties”).

Capital maintenance expenditures for the Company were $1.0

million for the three months ended September 30, 2018.

Balance Sheet Update

The Company had $1,162.8 million of unrestricted cash and $5.4

billion in total debt at September 30, 2018. On

September 26, 2018, the Company issued $1,100.0 million of

notes. The net proceeds from the sale of the notes together

with $386.0 million drawn on its revolver were used during October

2018 to (i) finance GLPI’s acquisition of the real property

assets of Plainridge Park Casino from PENN and its issuance of a

secured mortgage loan to Boyd Gaming Corporation (NYSE: BYD) in

connection with BYD’s acquisition of the real property assets of

Belterra Park Gaming & Entertainment Center, (ii) finance

GLPI’s acquisition of substantially all the real property assets of

five gaming facilities owned by Tropicana and its issuance of a

mortgage loan to Eldorado Resorts, Inc. (NASDAQ: ERI) in connection

with ERI’s acquisition of the real property assets of Lumière

Place, and (iii) pay the estimated transaction fees and

expenses associated with the transactions.

The Company’s debt structure as of September 30, 2018 was

as follows:

|

|

|

As of September 30,

2018 |

|

|

|

Interest Rate |

|

Balance |

|

|

|

|

|

(in thousands) |

|

Unsecured Term Loan A-1 (1) |

|

3.665 |

% |

|

$ |

525,000 |

|

|

Unsecured $1,100 Million Revolver (1) |

|

— |

% |

|

— |

|

|

Senior Unsecured Notes Due 2018 |

|

4.375 |

% |

|

— |

|

|

Senior Unsecured Notes Due 2020 |

|

4.875 |

% |

|

1,000,000 |

|

|

Senior Unsecured Notes Due 2021 |

|

4.375 |

% |

|

400,000 |

|

|

Senior Unsecured Notes Due 2023 |

|

5.375 |

% |

|

500,000 |

|

|

Senior Unsecured Notes Due 2025 |

|

5.250 |

% |

|

850,000 |

|

|

Senior Unsecured Notes Due 2026 |

|

5.375 |

% |

|

975,000 |

|

|

Senior Unsecured Notes Due 2028 |

|

5.750 |

% |

|

500,000 |

|

|

Senior Unsecured Notes Due 2029 |

|

5.300 |

% |

|

750,000 |

|

|

Capital Lease |

|

4.780 |

% |

|

1,142 |

|

|

Total long-term debt |

|

|

|

$ |

5,501,142 |

|

|

Less: unamortized debt issuance costs, bond premiums and original

issuance discounts |

|

|

|

(51,995 |

) |

|

Total long-term debt, net of unamortized debt issuance

costs, bond premiums and original issuance discounts |

|

|

|

$ |

5,449,147 |

|

(1) The

rate on the term loan facility and revolver is LIBOR plus 1.50%.

The Company's revolver matures on May 21, 2023 and the incremental

term loan of $525.0 million matures on April 28, 2021.

As of September 30, 2018, the Company had $213.7 million

remaining for issuance under the ATM Program and had not entered

into any forward sale agreements. No shares were issued under the

ATM Program during the quarter ended September 30, 2018.

As of September 30, 2018, the Company had 214,717,803

weighted average diluted shares outstanding.

Dividends

On July 31, 2018, the Company’s Board of Directors declared

the third quarter 2018 dividend. Shareholders of record on

September 7, 2018 received $0.63 per common share, which was

paid on September 21, 2018. On October 12, 2018,

the Company declared its fourth quarter 2018 dividend of $0.68 per

common share, payable on December 28, 2018 to shareholders of

record on December 14, 2018.

Guidance

The table below sets forth current guidance targets for

financial results for the 2018 fourth quarter and full year, based

on the following assumptions:

- Includes the impact of the transactions closed on October 1,

2018, to acquire the real estate assets of Tropicana and the impact

of the transaction closed on October 15, 2018 with PENN, PNK, and

BYD;

- Reflects estimated accounting treatment of the completed

transactions;

- Reported revenue from real estate of approximately $924.6

million for the year and $274.6 million for the fourth quarter,

consisting of:

| |

|

|

|

|

|

(in millions) |

|

Fourth Quarter |

|

Full Year |

|

Cash Revenue from Real Estate |

|

|

|

|

|

PENN |

|

$ |

189.3 |

|

|

$ |

536.3 |

|

|

PNK |

|

15.6 |

|

|

322.8 |

|

|

ERI |

|

27.5 |

|

|

27.5 |

|

|

BYD |

|

22.2 |

|

|

22.2 |

|

|

Casino Queen |

|

3.6 |

|

|

14.5 |

|

|

PENN non-assigned land lease |

|

(0.7 |

) |

|

(2.8 |

) |

|

Total Cash Revenue from Real Estate |

|

$ |

257.5 |

|

|

$ |

920.5 |

|

|

|

|

|

|

|

|

Non-Cash Adjustments |

|

|

|

|

|

Straight-line rent |

|

$ |

(12.7 |

) |

|

$ |

(61.9 |

) |

|

PNK direct financing lease |

|

(1.2 |

) |

|

(38.4 |

) |

|

Property taxes paid by tenants |

|

25.4 |

|

|

89.4 |

|

|

Land leases paid by tenants |

|

5.6 |

|

|

15.0 |

|

|

Total Revenue from Real Estate as Reported |

|

$ |

274.6 |

|

|

$ |

924.6 |

|

| |

|

|

|

|

|

|

|

|

- Cash revenue from real estate includes incremental escalator on

the PENN building rent component effective November 1, 2018, which

increases 2018 annual rent by $0.9 million;

- Five year variable rent reset on the PENN lease effective

November 1, 2018, which reduces 2018 annual revenue from real

estate by $1.9 million;

- Adjusted EBITDA from the TRS Properties of approximately $32.8

million for the year and $6.3 million for the fourth quarter;

- Blended income tax rate at the TRS Properties of 33%;

- LIBOR is based on the forward yield curve; and

- The basic share count is approximately 213.7 million shares for

the year and 214.0 million shares for the fourth quarter and the

fully diluted share count is approximately 214.8 million shares for

the year and 215.0 million shares for the fourth quarter.

|

|

|

|

|

|

|

|

|

Three Months Ended December

31, |

|

Full Year Ending

December 31, |

|

(in millions, except per share data) |

|

2018Guidance |

|

2017Actual |

|

Revised2018Guidance |

|

Prior 2018Guidance

(4) |

|

2017Actual |

|

Total Revenue |

|

$ |

304.7 |

|

|

$ |

240.7 |

|

|

$ |

1,057.1 |

|

|

$ |

1,018.9 |

|

|

$ |

971.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

$ |

105.6 |

|

|

$ |

93.3 |

|

|

$ |

399.2 |

|

|

$ |

412.2 |

|

|

$ |

380.6 |

|

|

Losses from dispositions of property |

|

— |

|

|

— |

|

|

0.4 |

|

|

0.2 |

|

|

0.5 |

|

|

Real estate depreciation |

|

50.7 |

|

|

25.3 |

|

|

124.8 |

|

|

98.6 |

|

|

100.6 |

|

|

Funds From Operations (1) |

|

$ |

156.3 |

|

|

$ |

118.6 |

|

|

$ |

524.4 |

|

|

$ |

511.0 |

|

|

$ |

481.7 |

|

|

Straight-line rent adjustments |

|

12.7 |

|

|

16.6 |

|

|

61.9 |

|

|

51.9 |

|

|

66.0 |

|

|

Direct financing lease adjustments |

|

1.2 |

|

|

18.6 |

|

|

38.4 |

|

|

45.2 |

|

|

73.1 |

|

|

Other depreciation |

|

2.9 |

|

|

2.9 |

|

|

11.5 |

|

|

11.5 |

|

|

12.9 |

|

|

Amortization of land rights |

|

3.4 |

|

|

2.7 |

|

|

11.5 |

|

|

10.9 |

|

|

10.4 |

|

|

Amortization of debt issuance costs, bond premiums and original

issuance discounts |

|

2.9 |

|

|

3.3 |

|

|

12.2 |

|

|

12.1 |

|

|

13.0 |

|

|

Stock based compensation |

|

3.3 |

|

|

3.7 |

|

|

11.2 |

|

|

11.2 |

|

|

15.6 |

|

|

Losses on debt extinguishment |

|

— |

|

|

— |

|

|

3.5 |

|

|

3.5 |

|

|

— |

|

|

Retirement costs |

|

— |

|

|

— |

|

|

13.1 |

|

|

13.1 |

|

|

— |

|

|

Capital maintenance expenditures |

|

(1.3 |

) |

|

(1.0 |

) |

|

(4.2 |

) |

|

(4.3 |

) |

|

(3.2 |

) |

|

Adjusted Funds From Operations (2) |

|

$ |

181.4 |

|

|

$ |

165.4 |

|

|

$ |

683.5 |

|

|

$ |

666.1 |

|

|

$ |

669.5 |

|

|

Interest, net |

|

75.8 |

|

|

53.5 |

|

|

244.5 |

|

|

226.1 |

|

|

215.1 |

|

|

Income tax expense |

|

0.8 |

|

|

3.4 |

|

|

5.0 |

|

|

5.0 |

|

|

9.8 |

|

|

Capital maintenance expenditures |

|

1.3 |

|

|

1.0 |

|

|

4.2 |

|

|

4.3 |

|

|

3.2 |

|

|

Amortization of debt issuance costs, bond premiums and original

issuance discounts |

|

(2.9 |

) |

|

(3.3 |

) |

|

(12.2 |

) |

|

(12.1 |

) |

|

(13.0 |

) |

|

Adjusted EBITDA (3) |

|

$ |

256.4 |

|

|

$ |

220.0 |

|

|

$ |

925.0 |

|

|

$ |

889.4 |

|

|

$ |

884.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income, per diluted common share |

|

$ |

0.49 |

|

|

$ |

0.43 |

|

|

$ |

1.86 |

|

|

$ |

1.92 |

|

|

$ |

1.79 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

FFO is net income, excluding (gains) or losses from sales of

property and real estate depreciation as defined by NAREIT.

(2) AFFO is FFO, excluding stock based compensation

expense, amortization of debt issuance costs, bond premiums and

original issuance discounts, other depreciation, amortization of

land rights, straight-line rent adjustments, direct financing lease

adjustments, losses on debt extinguishment and retirement costs,

reduced by capital maintenance expenditures.

(3) Adjusted EBITDA is net income, excluding

interest, taxes on income, depreciation, (gains) or losses from

sales of property, stock based compensation expense, straight-line

rent adjustments, direct financing lease adjustments, the

amortization of land rights, losses on debt extinguishment and

retirement costs.

(4) The guidance figures in the tables above present

the guidance provided on August 1, 2018 for the year ended

December 31, 2018.

Conference Call Details

The Company will hold a conference call on November 1, 2018

at 11:00 a.m. (Eastern Time) to discuss its financial results,

current business trends and market conditions.

Webcast

The conference call will be available in the Investor Relations

section of the Company's website at www.glpropinc.com. To listen to

a live broadcast, go to the site at least 15 minutes prior to the

scheduled start time in order to register, download and install any

necessary audio software. A replay of the call will also be

available for 90 days on the Company’s website.

To Participate in the Telephone

Conference Call:Dial in at least five minutes prior to

start time.Domestic: 1-877-407-0784International:

1-201-689-8560

Conference Call

Playback:Domestic: 1-844-512-2921International:

1-412-317-6671Passcode: 13683829The playback can be accessed

through November 8, 2018

Disclosure Regarding Non-GAAP Financial

Measures

Funds From Operations (“FFO”), Adjusted Funds From Operations

(“AFFO”) and Adjusted EBITDA, which are detailed in the

reconciliation tables that accompany this release, are used by the

Company as performance measures for benchmarking against the

Company’s peers and as internal measures of business operating

performance, which is used for a bonus metric. The Company

believes FFO, AFFO, and Adjusted EBITDA provide a meaningful

perspective of the underlying operating performance of the

Company’s current business. This is especially true since

these measures exclude real estate depreciation, and we believe

that real estate values fluctuate based on market conditions rather

than depreciating in value ratably on a straight-line basis over

time. In addition, in order for the Company to qualify as a REIT,

it must distribute 90% of its REIT taxable income annually.

The Company adjusts AFFO accordingly to provide our investors an

estimate of taxable income for this distribution requirement.

Direct financing lease adjustments represent the portion of cash

rent we receive from tenants that is applied against our lease

receivable and thus not recorded as revenue and the amortization of

land rights represents the non-cash amortization of the value

assigned to the Company's assumed ground leases.

FFO, AFFO and Adjusted EBITDA are non-GAAP financial measures,

that are considered a supplemental measure for the real estate

industry and a supplement to GAAP measures. NAREIT defines FFO

as net income (computed in accordance with generally accepted

accounting principles), excluding (gains) or losses from sales of

property and real estate depreciation. We have defined AFFO

as FFO excluding stock based compensation expense, amortization of

debt issuance costs, bond premiums and original issuance discounts,

other depreciation, amortization of land rights, straight-line rent

adjustments, direct financing lease adjustments, losses on debt

extinguishment and retirement costs, reduced by capital maintenance

expenditures. Finally, we have defined Adjusted EBITDA as net

income excluding interest, taxes on income, depreciation, (gains)

or losses from sales of property, stock based compensation expense,

straight-line rent adjustments, direct financing lease adjustments,

the amortization of land rights, losses on debt extinguishment and

retirement costs.

FFO, AFFO and Adjusted EBITDA are not recognized terms under

GAAP. Because certain companies do not calculate FFO, AFFO,

and Adjusted EBITDA in the same way and certain other companies may

not perform such calculation, those measures as used by other

companies may not be consistent with the way the Company calculates

such measures and should not be considered as alternative measures

of operating profit or net income. The Company’s presentation

of these measures does not replace the presentation of the

Company’s financial results in accordance with GAAP.

About Gaming and Leisure Properties

GLPI is engaged in the business of acquiring, financing, and

owning real estate property to be leased to gaming operators in

triple-net lease arrangements, pursuant to which the tenant is

responsible for all facility maintenance, insurance required in

connection with the leased properties and the business conducted on

the leased properties, taxes levied on or with respect to the

leased properties and all utilities and other services necessary or

appropriate for the leased properties and the business conducted on

the leased properties. GLPI expects to grow its portfolio by

pursuing opportunities to acquire additional gaming facilities to

lease to gaming operators. GLPI also intends to diversify its

portfolio over time, including by acquiring properties outside the

gaming industry to lease to third parties. GLPI elected to be taxed

as a REIT for United States federal income tax purposes commencing

with the 2014 taxable year and is the first gaming-focused REIT in

North America.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act and

Section 21E of the Securities Exchange Act of 1934, as

amended, including statements regarding our financial outlook for

the fourth quarter of 2018 and the full 2018 fiscal year; our

expectations regarding future acquisitions, the expected impact of

recently announced acquisitions and expected 2019 dividend

payments. Forward looking statements can be identified by the use

of forward looking terminology such as “expects,” “believes,”

“estimates,” “intends,” “may,” “will,” “should” or “anticipates” or

the negative or other variation of these or similar words, or by

discussions of future events, strategies or risks and

uncertainties. Such forward looking statements are inherently

subject to risks, uncertainties and assumptions about GLPI and its

subsidiaries, including risks related to the following: the

availability of and the ability to identify suitable and attractive

acquisition and development opportunities and the ability to

acquire and lease those properties on favorable terms; the ability

to receive, or delays in obtaining, the regulatory approvals

required to own and/or operate its properties, or other delays or

impediments to completing GLPI’s planned acquisitions or projects;

GLPI's ability to maintain its status as a REIT; our ability to

access capital through debt and equity markets in amounts and at

rates and costs acceptable to GLPI, including through GLPI's

existing ATM program; the impact of our substantial indebtedness on

our future operations; changes in the U.S. tax law and other state,

federal or local laws, whether or not specific to REITs or to the

gaming or lodging industries; and other factors described in GLPI’s

Annual Report on Form 10-K for the year ended

December 31, 2017, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K, each as filed with the Securities and

Exchange Commission. All subsequent written and oral

forward-looking statements attributable to GLPI or persons acting

on GLPI’s behalf are expressly qualified in their entirety by the

cautionary statements included in this press release. GLPI

undertakes no obligation to publicly update or revise any

forward-looking statements contained or incorporated by reference

herein, whether as a result of new information, future events or

otherwise, except as required by law. In light of these risks,

uncertainties and assumptions, the forward looking events discussed

in this press release may not occur.

Additional Information

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the U.S.

Securities Act of 1933, as amended. In connection with the

establishment of its ATM Program, the Company filed with the SEC a

prospectus supplement dated August 9, 2016 to the prospectus

contained in its effective Registration Statement on Form S-3 (No.

333-210423), filed with the SEC on March 28, 2016. This

communication is not a substitute for the filed Registration

Statement/prospectus or any other document that the Company may

file with the SEC or send to its shareholders in connection with

the proposed transactions. INVESTORS AND SECURITY HOLDERS ARE URGED

TO READ THE REGISTRATION STATEMENT AND PROSPECTUS THAT HAVE BEEN

FILED WITH THE SEC AND OTHER RELEVANT DOCUMENTS THAT WILL BE FILED

WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY

CONTAIN, OR WILL CONTAIN, IMPORTANT INFORMATION. You may obtain

free copies of the registration statement/prospectus and other

relevant documents filed by the Company with the SEC at the SEC’s

website at www.sec.gov. Copies of the documents filed with the SEC

by the Company are available free of charge on the Company’s

investor relations website at investors.glpropinc.com or by

contacting the Company’s investor relations representative at (610)

378-8396.

Contact

Investor Relations – Gaming and Leisure

Properties, Inc.Hayes CroushoreT: 610-378-8396Email:

Hcroushore@glpropinc.com

GAMING AND LEISURE PROPERTIES, INC. AND

SUBSIDIARIESConsolidated Statements of

Operations(in thousands, except per share data)

(unaudited)

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Revenues |

|

|

|

|

|

|

|

| Rental income |

$ |

170,276 |

|

|

$ |

169,030 |

|

|

$ |

509,546 |

|

|

$ |

501,954 |

|

| Income from direct financing lease |

30,843 |

|

|

19,037 |

|

|

76,448 |

|

|

55,377 |

|

| Real estate taxes paid by tenants |

21,270 |

|

|

21,422 |

|

|

64,031 |

|

|

63,982 |

|

|

Total rental revenue and income from direct financing lease |

222,389 |

|

|

209,489 |

|

|

650,025 |

|

|

621,313 |

|

| Gaming, food, beverage and other |

31,750 |

|

|

35,017 |

|

|

102,385 |

|

|

109,297 |

|

|

Total revenues |

254,139 |

|

|

244,506 |

|

|

752,410 |

|

|

730,610 |

|

|

Operating expenses |

|

|

|

|

|

|

|

| Gaming, food, beverage and other |

18,962 |

|

|

19,890 |

|

|

59,027 |

|

|

61,635 |

|

| Real estate taxes |

21,586 |

|

|

21,751 |

|

|

64,981 |

|

|

64,806 |

|

| Land rights and ground lease expense |

6,484 |

|

|

6,417 |

|

|

19,460 |

|

|

17,627 |

|

| General and administrative |

15,006 |

|

|

15,117 |

|

|

56,272 |

|

|

45,829 |

|

| Depreciation |

27,267 |

|

|

28,632 |

|

|

82,744 |

|

|

85,312 |

|

|

Total operating expenses |

89,305 |

|

|

91,807 |

|

|

282,484 |

|

|

275,209 |

|

|

Income from operations |

164,834 |

|

|

152,699 |

|

|

469,926 |

|

|

455,401 |

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses) |

|

|

|

|

|

|

|

| Interest expense |

(60,341 |

) |

|

(54,493 |

) |

|

(171,464 |

) |

|

(163,099 |

) |

| Interest income |

1,418 |

|

|

492 |

|

|

2,790 |

|

|

1,443 |

|

|

Losses on debt extinguishment |

— |

|

|

— |

|

|

(3,473 |

) |

|

— |

|

|

Total other expenses |

(58,923 |

) |

|

(54,001 |

) |

|

(172,147 |

) |

|

(161,656 |

) |

|

|

|

|

|

|

|

|

|

|

Income from operations before income taxes |

105,911 |

|

|

98,698 |

|

|

297,779 |

|

|

293,745 |

|

|

Income tax expense |

1,096 |

|

|

1,684 |

|

|

4,194 |

|

|

6,406 |

|

|

Net income |

$ |

104,815 |

|

|

$ |

97,014 |

|

|

$ |

293,585 |

|

|

$ |

287,339 |

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share: |

|

|

|

|

|

|

|

|

Basic earnings per common share |

$ |

0.49 |

|

|

$ |

0.46 |

|

|

$ |

1.37 |

|

|

$ |

1.37 |

|

|

Diluted earnings per common share |

$ |

0.49 |

|

|

$ |

0.45 |

|

|

$ |

1.37 |

|

|

$ |

1.35 |

|

GAMING AND LEISURE PROPERTIES, INC. AND

SUBSIDIARIESOperations(in thousands)

(unaudited)

|

|

|

|

|

|

|

TOTAL REVENUES |

|

ADJUSTED EBITDA |

|

|

Three Months Ended

September 30, |

|

Three Months Ended

September 30, |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Real estate |

$ |

222,389 |

|

|

$ |

209,489 |

|

|

$ |

214,656 |

|

|

$ |

214,204 |

|

|

GLP Holdings, LLC (TRS) |

31,750 |

|

|

35,017 |

|

|

7,495 |

|

|

9,201 |

|

|

Total |

$ |

254,139 |

|

|

$ |

244,506 |

|

|

$ |

222,151 |

|

|

$ |

223,405 |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL REVENUES |

|

ADJUSTED EBITDA |

|

|

Nine Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Real estate |

$ |

650,025 |

|

|

$ |

621,313 |

|

|

$ |

642,120 |

|

|

$ |

634,428 |

|

|

GLP Holdings, LLC (TRS) |

102,385 |

|

|

109,297 |

|

|

26,504 |

|

|

30,192 |

|

|

Total |

$ |

752,410 |

|

|

$ |

730,610 |

|

|

$ |

668,624 |

|

|

$ |

664,620 |

|

GAMING AND LEISURE PROPERTIES, INC. AND

SUBSIDIARIESGeneral and Administrative

Expenses(in thousands) (unaudited)

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Real estate general and administrative expenses (1) |

$ |

10,009 |

|

|

$ |

9,081 |

|

|

$ |

40,077 |

|

|

$ |

28,605 |

|

|

GLP Holdings, LLC (TRS) general and administrative expenses

(1) |

4,997 |

|

|

6,036 |

|

|

16,195 |

|

|

17,224 |

|

|

Total |

$ |

15,006 |

|

|

$ |

15,117 |

|

|

$ |

56,272 |

|

|

$ |

45,829 |

|

(1) General and administrative expenses include

payroll related expenses, insurance, utilities, professional fees

and other administrative costs.

Reconciliation of Net income (GAAP) to FFO, FFO

to AFFO, and AFFO to Adjusted EBITDAGaming and Leisure Properties,

Inc. and SubsidiariesCONSOLIDATED(in thousands)

(unaudited)

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Net income |

$ |

104,815 |

|

|

$ |

97,014 |

|

|

$ |

293,585 |

|

|

$ |

287,339 |

|

|

Losses from dispositions of property |

129 |

|

|

421 |

|

|

354 |

|

|

515 |

|

|

Real estate depreciation |

24,406 |

|

|

25,301 |

|

|

74,155 |

|

|

75,312 |

|

|

Funds from operations |

$ |

129,350 |

|

|

$ |

122,736 |

|

|

$ |

368,094 |

|

|

$ |

363,166 |

|

|

Straight-line rent adjustments |

15,917 |

|

|

16,617 |

|

|

49,150 |

|

|

49,355 |

|

|

Direct financing lease adjustments |

8,002 |

|

|

18,614 |

|

|

37,241 |

|

|

54,459 |

|

|

Other depreciation (1) |

2,861 |

|

|

3,331 |

|

|

8,589 |

|

|

10,000 |

|

|

Amortization of land rights |

2,727 |

|

|

2,727 |

|

|

8,182 |

|

|

7,627 |

|

|

Amortization of debt issuance costs, bond premiums and original

issuance discounts |

2,982 |

|

|

3,257 |

|

|

9,278 |

|

|

9,770 |

|

|

Stock based compensation |

3,275 |

|

|

3,695 |

|

|

7,878 |

|

|

11,951 |

|

|

Losses on debt extinguishment |

— |

|

|

— |

|

|

3,473 |

|

|

— |

|

|

Retirement costs |

— |

|

|

— |

|

|

13,149 |

|

|

— |

|

|

Capital maintenance expenditures (2) |

(970 |

) |

|

(460 |

) |

|

(2,954 |

) |

|

(2,187 |

) |

|

Adjusted funds from operations |

$ |

164,144 |

|

|

$ |

170,517 |

|

|

$ |

502,080 |

|

|

$ |

504,141 |

|

|

Interest, net |

58,923 |

|

|

54,001 |

|

|

168,674 |

|

|

161,656 |

|

|

Income tax expense |

1,096 |

|

|

1,684 |

|

|

4,194 |

|

|

6,406 |

|

|

Capital maintenance expenditures (2) |

970 |

|

|

460 |

|

|

2,954 |

|

|

2,187 |

|

|

Amortization of debt issuance costs, bond premiums and original

issuance discounts |

(2,982 |

) |

|

(3,257 |

) |

|

(9,278 |

) |

|

(9,770 |

) |

|

Adjusted EBITDA |

$ |

222,151 |

|

|

$ |

223,405 |

|

|

$ |

668,624 |

|

|

$ |

664,620 |

|

(1) Other depreciation includes both real

estate and equipment depreciation from the Company's taxable REIT

subsidiaries as well as equipment depreciation from the REIT

subsidiaries.

(2) Capital maintenance expenditures are expenditures to

replace existing fixed assets with a useful life greater than one

year that are obsolete, worn out or no longer cost effective to

repair.

Reconciliation of Net income (GAAP) to FFO, FFO

to AFFO, and AFFO to Adjusted EBITDAGaming and Leisure Properties,

Inc. and SubsidiariesREAL ESTATE and CORPORATE

(REIT)(in thousands) (unaudited)

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Net income |

$ |

103,126 |

|

|

$ |

95,089 |

|

|

$ |

285,712 |

|

|

$ |

279,458 |

|

|

Losses from dispositions of property |

129 |

|

|

— |

|

|

120 |

|

|

— |

|

|

Real estate depreciation |

24,406 |

|

|

25,301 |

|

|

74,155 |

|

|

75,312 |

|

|

Funds from operations |

$ |

127,661 |

|

|

$ |

120,390 |

|

|

$ |

359,987 |

|

|

$ |

354,770 |

|

|

Straight-line rent adjustments |

15,917 |

|

|

16,617 |

|

|

49,150 |

|

|

49,355 |

|

|

Direct financing lease adjustments |

8,002 |

|

|

18,614 |

|

|

37,241 |

|

|

54,459 |

|

|

Other depreciation (1) |

522 |

|

|

519 |

|

|

1,560 |

|

|

1,558 |

|

|

Amortization of land rights |

2,727 |

|

|

2,727 |

|

|

8,182 |

|

|

7,627 |

|

|

Amortization of debt issuance costs, bond premiums and original

issuance discounts |

2,982 |

|

|

3,257 |

|

|

9,278 |

|

|

9,770 |

|

|

Stock based compensation |

3,275 |

|

|

3,695 |

|

|

7,878 |

|

|

11,951 |

|

|

Losses on debt extinguishment |

— |

|

|

— |

|

|

3,473 |

|

|

— |

|

|

Retirement costs |

— |

|

|

— |

|

|

13,149 |

|

|

— |

|

|

Capital maintenance expenditures (2) |

— |

|

|

— |

|

|

(51 |

) |

|

— |

|

|

Adjusted funds from operations |

$ |

161,086 |

|

|

$ |

165,819 |

|

|

$ |

489,847 |

|

|

$ |

489,490 |

|

|

Interest, net (2) |

56,323 |

|

|

51,400 |

|

|

160,872 |

|

|

153,854 |

|

|

Income tax expense |

229 |

|

|

242 |

|

|

628 |

|

|

854 |

|

|

Capital maintenance expenditures (2) |

— |

|

|

— |

|

|

51 |

|

|

— |

|

|

Amortization of debt issuance costs, bond premiums and original

issuance discounts |

(2,982 |

) |

|

(3,257 |

) |

|

(9,278 |

) |

|

(9,770 |

) |

|

Adjusted EBITDA |

$ |

214,656 |

|

|

$ |

214,204 |

|

|

$ |

642,120 |

|

|

$ |

634,428 |

|

(1) Other depreciation includes both real

estate and equipment depreciation from the Company's taxable REIT

subsidiaries as well as equipment depreciation from the REIT

subsidiaries.

(2) Interest expense, net is net of intercompany

interest eliminations of $2.6 million and $7.8 million for both the

three and nine months ended September 30, 2018 and 2017.

Reconciliation of Net income (GAAP) to FFO, FFO

to AFFO, and AFFO to Adjusted EBITDAGaming and Leisure Properties,

Inc. and SubsidiariesGLP HOLDINGS, LLC (TRS)(in

thousands) (unaudited)

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

|

2018 |

|

2017 |

|

2018 |

|

2017 |

|

Net income |

$ |

1,689 |

|

|

$ |

1,925 |

|

|

$ |

7,873 |

|

|

$ |

7,881 |

|

|

Losses from dispositions of property |

— |

|

|

421 |

|

|

234 |

|

|

515 |

|

|

Real estate depreciation |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Funds from operations |

$ |

1,689 |

|

|

$ |

2,346 |

|

|

$ |

8,107 |

|

|

$ |

8,396 |

|

|

Straight-line rent adjustments |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Direct financing lease adjustments |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Other depreciation (1) |

2,339 |

|

|

2,812 |

|

|

7,029 |

|

|

8,442 |

|

|

Amortization of land rights |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Amortization of debt issuance costs, bond premiums and original

issuance discounts |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Stock based compensation |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Losses on debt extinguishment |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Retirement costs |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Capital maintenance expenditures (2) |

(970 |

) |

|

(460 |

) |

|

(2,903 |

) |

|

(2,187 |

) |

|

Adjusted funds from operations |

$ |

3,058 |

|

|

$ |

4,698 |

|

|

$ |

12,233 |

|

|

$ |

14,651 |

|

|

Interest, net |

2,600 |

|

|

2,601 |

|

|

7,802 |

|

|

7,802 |

|

|

Income tax expense |

867 |

|

|

1,442 |

|

|

3,566 |

|

|

5,552 |

|

|

Capital maintenance expenditures (2) |

970 |

|

|

460 |

|

|

2,903 |

|

|

2,187 |

|

|

Amortization of debt issuance costs, bond premiums and original

issuance discounts |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Adjusted EBITDA |

$ |

7,495 |

|

|

$ |

9,201 |

|

|

$ |

26,504 |

|

|

$ |

30,192 |

|

(1) Other depreciation includes both real estate

and equipment depreciation from the Company's taxable REIT

subsidiaries as well as equipment depreciation from the REIT

subsidiaries.

(2) Capital maintenance expenditures are expenditures to

replace existing fixed assets with a useful life greater than one

year that are obsolete, worn out or no longer cost effective to

repair.

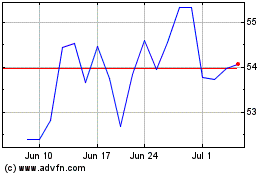

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Boyd Gaming (NYSE:BYD)

Historical Stock Chart

From Apr 2023 to Apr 2024