Dynex Capital, Inc. (NYSE: DX) reported its third quarter 2018

results today. As previously announced, the Company's quarterly

conference call to discuss these results is today at 10:00 a.m.

Eastern Time and may be accessed via telephone in the U.S. at

1-866-393-4306 (internationally at 1-734-385-2616) using conference

ID 4066216 or by live webcast, which includes a slide presentation,

under “Investor Center” on the Company's website

(www.dynexcapital.com).

Third Quarter 2018

Highlights

- Comprehensive income of $0.01 per

common share and net income of $0.39 per common share

- Core net operating income, a non-GAAP

measure, of $0.19 per common share

- Book value per common share of $6.75 at

September 30, 2018 compared to $6.93 at June 30,

2018

- Leverage including TBA dollar roll

positions increased to 6.7x shareholders’ equity at

September 30, 2018 compared to 6.1x at June 30, 2018 due to

growth in the investment portfolio

- Net interest spread and adjusted net

interest spread of 1.08% and 1.41%, respectively, for the third

quarter of 2018 compared to 1.07% and 1.51%, respectively, for the

prior quarter

Management's Remarks

Byron Boston, President and CEO commented, “Core net operating

income improved this quarter as we increased our investment

portfolio and benefited from the diversification of our investment

strategy in residential and commercial investments. In particular,

our CMBS IO portfolio continues to outperform on a total return

basis. Total economic return to common shareholders was flat for

the quarter as rising interest rates and a flattening yield curve

led to a reduction in our book value, offsetting our common stock

dividend.”

Mr. Boston continued, “We believe that the Federal Reserve is

getting closer to the end of this policy tightening cycle with

global markets already experiencing the negative impact of higher

interest rates. In our view, as we have noted before,

gathering macroeconomic headwinds from rapidly increasing amounts

of global debt, emerging stress in financial markets, and fiscal

policy concerns will ultimately limit how high interest rates in

the U.S. may go on a sustained basis. Nonetheless, in the

short-term we might see upward pressure on rates based on evolving

economic data and technical factors. With this backdrop, we believe

the higher liquidity of an Agency MBS portfolio is preferable for

generating attractive shareholder returns. As the interest rate

environment becomes more favorable, we expect return opportunities

to further improve."

Book Value Per Common

Share

Book value per common share decreased $(0.18), or (2.0%), to

$6.75 at September 30, 2018 from $6.93 at June 30, 2018

primarily due to the impact of higher interest rates on the fair

value of the Company's investments versus its hedging portfolio.

The decline in shareholders' equity since June 30, 2018 resulting

from unrealized losses on MBS was partially offset by raising

capital of $13.4 million during the third quarter. The Company has

a year-to-date total economic loss on book value per common share

of (0.7)%.

Third Quarter 2018 Earnings

Summary

Comprehensive income to common shareholders was $0.7 million for

the third quarter of 2018 versus comprehensive income to common

shareholders of $3.0 million for the second quarter of 2018. Higher

interest rates principally drove the decline in comprehensive

income as unrealized losses on MBS increased while gains on related

hedges decreased. Net income to common shareholders increased $9.9

million to $22.6 million for the third quarter compared to $12.7

million for the second quarter of 2018 due primarily to lower loss

on sales of investments. Net interest income increased $0.4 million

from the second quarter of 2018 to the third quarter of 2018 due to

improved yields on investments as a result of recent purchases of

higher yielding fixed rate MBS and increased prepayment penalty

compensation earned on CMBS IO.

Core net operating income to common shareholders, a non-GAAP

measure, was $10.8 million for the third quarter of 2018 versus

$10.4 million for the second quarter of 2018 due to an increase in

adjusted net interest income of $0.5 million during the third

quarter. Adjusted net interest income, a non-GAAP measure,

increased for the third quarter of 2018 compared to the prior

quarter from the improved investment yields noted above, and also

from a higher average volume of TBA dollar roll transactions that

generated an increase in TBA drop income, partially offset by a

lower benefit from net periodic interest on interest rate swaps for

the third quarter of 2018 compared to the prior quarter as

discussed further below.

Investments and

Financing

The following table provides details of our MBS including TBA

dollar roll positions as of September 30, 2018:

September 30, 2018 Type of Investment:

Par Amortized Cost Basis Fair

Market Value

($ in thousands) 30-year fixed-rate RMBS: 3.0% coupon $ 228,116 $

229,734 $ 218,671 4.0% coupon 1,339,668 1,386,905 1,356,169 4.5%

coupon 158,111 163,388 163,244 TBA dollar roll positions (4.0%

coupon) (1) (2) 211,000 214,365 213,060 TBA dollar roll positions

(4.5% coupon) (1) (2) 550,000 566,500 566,637 Total

30-year fixed-rate RMBS 2,486,895 2,560,892 2,517,781

Adjustable-rate RMBS: 4.1% coupon (3) 35,379 36,339 37,068

Agency CMBS 987,266 997,058 948,296 CMBS IO (4) n/a 562,327 564,826

Other non-Agency MBS 7,936 4,833 6,236

Total MBS

portfolio including TBA dollar roll positions $ 3,517,476

$ 4,161,449 $ 4,074,207

(1) Amortized cost basis and fair market

value for TBA dollar roll positions represent implied cost basis

and implied market value,

respectively, for the underlying Agency

MBS as if settled.

(2) The net carrying value of TBA dollar

roll positions, which is the difference between their implied

market value and implied cost basis,

was $(1.2) million as of

September 30, 2018 and is included on the consolidated balance

sheet within “derivative assets”.

(3) Represents the weighted average coupon

based on amortized cost.

(4) Includes both Agency and non-Agency IO

securities with a combined notional balance of $23.6 billion.

The Company's MBS portfolio including TBA dollar roll positions

as of September 30, 2018 increased 13% since June 30, 2018.

During the third quarter of 2018, we purchased $695.2 million of

investments which consisted primarily of higher coupon, higher

yielding 30-year fixed-rate Agency RMBS, and we sold $118.4 million

of Agency CMBS, CMBS IO, and U.S. Treasuries. The Company's

repurchase agreement borrowings including payables for unsettled

securities as of September 30, 2018 increased 14% to $2.9

billion compared to $2.5 billion at June 30, 2018, which resulted

in leverage including TBA dollar roll positions of 6.7 times

shareholder's equity compared to 6.1 times at June 30, 2018.

Net Interest Income and Spread

The following table provides details on the performance of our

investments and financing including hedging costs for the periods

indicated:

Three Months Ended September 30, 2018 June

30, 2018 ($ in thousands)

Income/Expense

Average Balance Effective Yield/Cost of Funds

Income/Expense Average Balance

Effective Yield/Cost of Funds Interest-earning

assets: Agency RMBS-fixed rate $ 11,561 $ 1,384,926 3.34 % $

9,190 $ 1,135,365 3.24 % Agency CMBS-fixed rate 7,362 1,002,661

2.81 % 7,267 1,011,945 2.80 % Agency RMBS-adjustable rate 283

37,634 3.12 % 1,332 254,850 2.14 % CMBS IO (1) 6,646 581,770 3.98 %

6,298 632,376 3.78 % Other non-Agency MBS 427 4,869 30.31 % 446

5,022 30.67 % U.S. Treasuries 45 6,302 2.83 % 1,001 156,420 2.57 %

Other investments 601 13,226 4.25 % 388 14,576

3.99 % Total $ 26,925 $ 3,031,388 3.33 % $ 25,922

$ 3,210,554 3.13 %

Interest-bearing

liabilities: Repurchase agreements $ 14,780 $ 2,564,863 2.25 %

$ 14,181 $ 2,716,097 2.07 % Non-recourse collateralized financing

37 4,260 3.01 % 42 5,002 2.73 % De-designated cash flow hedge

accretion (66 ) n/a (0.01 )% (48 ) n/a (0.01 )% Total $ 14,751

$ 2,569,123 2.25 % $ 14,175 $ 2,721,099 2.06 %

Net interest income/net interest spread

$ 12,174 1.08 % $

11,747 1.07 % Add: TBA drop income

4,262 0.06 % 3,619 0.10 % Add: net periodic interest benefit (2)

1,777 0.28 % 2,333 0.35 % Less: de-designated cash flow hedge

accretion (66 ) (0.01 )% (48 ) (0.01 )% Adjusted net interest

income/adjusted net interest spread (3)

$ 18,147

1.41 % $ 17,651

1.51 %

(1) CMBS IO includes Agency and non-Agency

securities.

(2) Amount represents net periodic

interest benefit of effective interest rate swaps outstanding

during the period and excludes realized and unrealized gains and

losses from changes in fair value of derivatives.

(3) Represents a non-GAAP measure.

Net interest income and net interest spread increased for the

third quarter of 2018 compared to the prior quarter due primarily

to having a larger average balance of higher yielding fixed-rate

Agency RMBS and higher prepayment compensation on CMBS IO, which

were almost entirely offset by higher cost of repurchase agreement

financing as a result of increasing short-term interest rates.

Adjusted net interest spread for the third quarter of 2018

decreased 10 basis points compared to the second quarter of 2018

primarily because the Company's net receive rate on its interest

rate swaps declined 8 basis points, resulting in a lower net

periodic interest benefit. In addition, although TBA drop income

was $0.6 million higher during the third quarter of 2018 compared

to the second quarter of 2018 as a result of a larger volume of TBA

dollar roll transactions, the implied financing rate on these

transactions increased approximately 37 basis points from the

second quarter of 2018 to the third quarter of 2018. As a result,

the net yield from TBA dollar roll transactions declined 32 basis

points to 1.61% for the third quarter of 2018 compared to 1.93% for

the prior quarter.

Hedging Summary

The Company's interest rate swaps had a positive net impact on

comprehensive income of $25.0 million during the third quarter of

2018. Interest rate swaps with a notional balance of $250.0 million

were terminated during the third quarter, resulting in a net

realized gain of $2.6 million, and interest rate swaps with a

notional balance of $380.0 million at a weighted average pay-fixed

rate of 2.94% were added during the third quarter. The following

table provides information related to the Company's average

borrowings outstanding and interest rate swaps effective for the

periods indicated:

Three Months Ended ($ in thousands)

September 30,

2018 June 30, 2018 Average repurchase agreement

borrowings outstanding $ 2,564,863 $ 2,716,097 Average net TBAs

outstanding - at cost (1) 982,665 722,005 Average

borrowings and net TBAs outstanding $ 3,547,528 $ 3,438,102 Average

notional amount of interest rate swaps outstanding (excluding

forward starting swaps) $ 2,502,609 $ 2,707,967 Ratio

of average interest rate swaps to average borrowings and net TBAs

outstanding (1) 0.7 0.8 Average interest rate swap net

pay-fixed rate (excluding forward starting swaps) (2) 2.09 % 1.83 %

Average interest rate swap net receive-floating rate (2) 2.32 %

2.15 % Average interest rate swap net pay/(receive) rate

(0.23)

%

(0.32)

%

(1) Because the Company executes TBA

dollar roll transactions, which economically represent the purchase

and financing of

fixed-rate Agency RMBS, the average TBAs

outstanding are included in the ratio calculation.

(2) Includes one receive-fixed interest

rate swap with a notional balance of $100.0 million at a rate of

1.70%.

During the third quarter of 2018, the Company incurred a loss of

$(0.2) million on Eurodollar futures used to hedge interest rate

risk. Eurodollar futures with a notional balance of $650.0 million

and a weighted average rate of 1.86% matured during the third

quarter of 2018, for which the Company realized a gain of $0.8

million over the life of contract. Management views Eurodollar

futures as economically similar to interest rate swaps, but unlike

interest rate swaps, Eurodollar futures do not incur periodic

interest or similar costs/benefits and therefore do not have an

impact on core net operating income to common shareholders. The

Company had no Eurodollar futures outstanding at September 30,

2018.

The aggregate notional amount of currently effective and

forward-starting interest rate swaps as of September 30, 2018

was $2.7 billion and $1.5 billion, respectively. The following

table summarizes the weighted average notional amount and rate of

interest rate hedges (including Eurodollar futures) held as of

September 30, 2018:

September 30, 2018 ($ in thousands)

Weighted

Average Notional Weighted Average

Pay-Fixed Rate

Remainder of 2018 $ 3,236,630 2.10% 2019 3,054,027 2.20%

2020 2,444,495 2.32% 2021 2,195,479 2.37% 2022 2,243,521 2.46% 2023

1,529,397 2.63% 2024 1,396,503 2.63% 2025 and thereafter 244,716

2.73%

Company Description

Dynex Capital, Inc. is an internally managed real estate

investment trust, or REIT, which invests in mortgage assets on a

leveraged basis. The Company invests in Agency and non-Agency

RMBS, CMBS, and CMBS IO. Additional information about Dynex

Capital, Inc. is available at www.dynexcapital.com.

Use of Non-GAAP Financial

Measures

In addition to the Company's operating results presented in

accordance with GAAP, this release includes certain non-GAAP

financial measures including core net operating income to common

shareholders (including per common share), adjusted interest

expense, adjusted net interest income and the related metrics

adjusted cost of funds and adjusted net interest spread. Because

these measures are used in the Company's internal analysis of

financial and operating performance, management believes that they

provide greater transparency to our investors of management's view

of our economic performance. Management also believes the

presentation of these measures, when analyzed in conjunction with

the Company's GAAP operating results, allows investors to more

effectively evaluate and compare the performance of the Company to

that of its peers, although the Company's presentation of its

non-GAAP measures may not be comparable to other similarly-titled

measures of other companies. Schedules reconciling core net

operating income to common shareholders, adjusted interest expense,

and adjusted net interest income to GAAP financial measures are

provided as a supplement to this release.

Management views core net operating income to common

shareholders as an estimate of the Company's financial performance

excluding changes in fair value of its investments and derivatives.

In addition to the non-GAAP reconciliation set forth in the

supplement to this release, which derives core net operating income

to common shareholders from GAAP net income to common shareholders

as the nearest GAAP equivalent measure, core net operating income

to common shareholders can also be determined by adjusting net

interest income to include interest rate swap periodic interest

costs, drop income on TBA dollar roll positions, general and

administrative expenses, and preferred dividends. Management

includes drop income, which is included in "gain (loss) on

derivatives instruments, net" on the Company's consolidated

statements of comprehensive income, in core net operating income

and in adjusted net interest income because TBA dollar roll

positions are viewed by management as economically equivalent to

holding and financing Agency RMBS using short-term repurchase

agreements. Management also includes periodic interest costs from

its interest rate swaps, which are also included in "gain (loss) on

derivatives instruments, net", in adjusted net interest expense,

and in adjusted net interest income because interest rate swaps are

used by the Company to economically hedge the impact of changing

interest rates on its borrowing costs from repurchase agreements,

and including periodic interest costs from interest rate swaps is a

helpful indicator of the Company’s total cost of financing in

addition to GAAP interest expense. However, these non-GAAP measures

do not provide a full perspective on our results of operations, and

therefore, their usefulness is limited. For example, these non-GAAP

measures do not include gains or losses from available-for-sale

investments, changes in fair value of and costs of terminating

interest rate swaps, as well as realized and unrealized gains or

losses from any instrument used by management to economically hedge

the impact of changing interest rates on its portfolio and book

value per common share, such as Eurodollar futures. As a result,

these non-GAAP measures should be considered as a supplement to,

and not as a substitute for, the Company's GAAP results as reported

on its consolidated statements of comprehensive income.

Forward Looking

Statements

This release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words “believe,” “expect,” “forecast,” “anticipate,”

“estimate,” “project,” “plan,” "may," "could," and similar

expressions identify forward-looking statements that are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Forward-looking statements in this release

may include, without limitation, statements regarding the Company's

financial performance in future periods, future interest rates,

future market credit spreads, our views on expected characteristics

of future investment environments, prepayment rates and investment

risks, future investment strategies, our future leverage levels and

financing strategies, the use of specific financing and hedging

instruments and the future impacts of these strategies, future

actions by the Federal Reserve, and the expected performance of our

investments. The Company's actual results and timing of certain

events could differ materially from those projected in or

contemplated by the forward-looking statements as a result of

unforeseen external factors. These factors may include, but are not

limited to, changes in general economic and market conditions,

including volatility in the credit markets which impacts asset

prices and the cost and availability of financing, changes in

monetary policy and in particular the impact of changes in balance

sheet reinvestment policy of the Federal Reserve, defaults by

borrowers, availability of suitable reinvestment opportunities,

variability in investment portfolio cash flows, fluctuations in

interest rates, fluctuations in property capitalization rates and

values of commercial real estate, defaults by third-party

servicers, prepayments of investment portfolio assets, other

general competitive factors, uncertainty around the impact of

government regulatory changes, including ongoing financial

institution regulatory reform efforts, the full impacts of which

are unknown at this time, and another ownership change under

Section 382 that further impacts the use of our tax net operating

loss carryforward. For additional information on risk factors that

could affect the Company's forward-looking statements, see the

Company's Annual Report on Form 10-K for the year ended December

31, 2017, and other reports filed with and furnished to the

Securities and Exchange Commission.

All forward-looking statements are qualified in their entirety

by these and other cautionary statements that the Company makes

from time to time in its filings with the Securities and Exchange

Commission and other public communications. The Company cannot

assure the reader that it will realize the results or developments

the Company anticipates or, even if substantially realized, that

they will result in the consequences or affect the Company or its

operations in the way the Company expects. Forward-looking

statements speak only as of the date made. The Company undertakes

no obligation to update or revise any forward-looking statements to

reflect events or circumstances arising after the date on which

they were made, except as otherwise required by law. As a result of

these risks and uncertainties, readers are cautioned not to place

undue reliance on any forward-looking statements included herein or

that may be made elsewhere from time to time by, or on behalf of,

the Company.

DYNEX CAPITAL, INC.

CONSOLIDATED BALANCE SHEETS

($ in thousands except per share

data)

September 30, 2018 June 30, 2018

December 31, 2017 ASSETS (unaudited) (unaudited)

Available-for-sale investments, at fair value: Mortgage-backed

securities $ 3,294,510 $ 2,759,894 $ 3,026,989 U.S. Treasuries —

57,923 146,530 Mortgage loans held for investment, net 12,342

13,628 15,738 Cash and cash equivalents 55,251 165,126 40,867

Restricted cash 58,334 52,832 46,333 Derivative assets 2,612 7,642

2,940 Accrued interest receivable 19,575 19,326 19,819 Other

assets, net 5,555 6,406 6,562 Total assets $

3,448,179 $ 3,082,777 $ 3,305,778

LIABILITIES AND SHAREHOLDERS’ EQUITY Liabilities:

Repurchase agreements $ 2,690,858 $ 2,514,984 $ 2,565,902 Payable

for unsettled securities 182,922 529 156,899 Non-recourse

collateralized financing 3,709 4,393 5,520 Derivative liabilities

2,039 — 269 Accrued interest payable 5,676 5,469 3,734 Accrued

dividends payable 13,121 12,727 12,526 Other liabilities 3,101

2,441 3,870 Total liabilities 2,901,426

2,540,543 2,748,720

Shareholders’ equity: Preferred

stock - aggregate liquidation preference of $148,541; $147,725; and

$147,217, respectively $ 142,574 $ 141,788 $ 141,294 Common stock,

par value $.01 per share: 59,016,554; 56,906,200; and 55,831,549

shares issued and outstanding, respectively 590 569 558 Additional

paid-in capital 795,630 782,011 775,873 Accumulated other

comprehensive loss (85,833 ) (63,919 ) (8,697 ) Accumulated deficit

(306,208 ) (318,215 ) (351,970 ) Total shareholders' equity 546,753

542,234 557,058 Total liabilities and

shareholders’ equity $ 3,448,179 $ 3,082,777 $

3,305,778 Book value per common share $ 6.75 $ 6.93 $

7.34

DYNEX CAPITAL, INC.

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME

(UNAUDITED)

(amounts in thousands except per share

data)

Three Months Ended September 30, 2018 June

30, 2018 March 31, 2018 December 31,

2017 September 30, 2017 Interest income $ 26,925

$ 25,922 $ 25,190 $ 24,124 $ 23,103 Interest expense 14,751

14,175 11,595 10,056 9,889 Net interest

income 12,174 11,747 13,595 14,068 13,214 Gain on derivative

instruments, net 19,499 20,667 38,354 12,678 5,993 Loss on sale of

investments, net (1,726 ) (12,444 ) (3,775 ) (902 ) (5,211 ) Fair

value adjustments, net 12 27 29 12 23 Other operating expense, net

(409 ) (339 ) (253 ) (50 ) (109 ) General and administrative

expenses: Compensation and benefits (1,712 ) (1,751 ) (1,962 )

(2,153 ) (2,070 ) Other general and administrative (2,252 ) (2,255

) (1,681 ) (1,690 ) (1,529 )

Net income 25,586 15,652 44,307

21,963 10,311 Preferred stock dividends (2,956 ) (2,942 ) (2,940 )

(2,910 ) (2,808 )

Net income to common shareholders $ 22,630

$ 12,710 $ 41,367 $ 19,053 $ 7,503

Other comprehensive income: Unrealized (loss)

gain on available-for-sale investments, net $ (23,574 ) $ (22,156 )

$ (49,189 ) $ (15,438 ) $ 981 Reclassification adjustment for loss

on sale of investments, net 1,726 12,444 3,775 902 5,211

Reclassification adjustment for de-designated cash flow hedges (66

) (48 ) (48 ) (48 ) (48 )

Total other comprehensive (loss)

income (21,914 ) (9,760 ) (45,462 ) (14,584 ) 6,144

Comprehensive income (loss) to common shareholders $ 716

$ 2,950 $ (4,095 ) $ 4,469 $ 13,647

Net income per common share-basic and diluted $ 0.39

$ 0.23 $ 0.74 $ 0.36 $ 0.15

Weighted average common shares

57,727 56,295 55,871 53,399 49,832

DYNEX CAPITAL, INC.

KEY STATISTICS

(UNAUDITED)

($ in thousands except per share data)

As Of September 30, 2018 June 30, 2018

March 31, 2018 December 31, 2017

September 30, 2017 Portfolio and Other Balance Sheet

Statistics: Total MBS fair value $ 3,294,510 $ 2,759,894 $

2,864,822 $ 3,026,989 $ 2,921,444 Agency CMBS, amortized cost $

997,058 $ 1,008,887 $ 1,015,486 $ 1,134,409 $ 1,314,925 Agency

RMBS-fixed rate, amortized cost $ 1,780,027 $ 1,163,875 $ 965,173 $

903,269 $ 541,262 Agency RMBS-variable rate, amortized cost $

36,339 $ 38,966 $ 278,474 $ 289,305 $ 305,265 CMBS IO, amortized

cost(1) $ 562,327 $ 607,452 $ 652,563 $ 683,833 $ 717,115 Other

non-Agency MBS, amortized cost $ 4,833 $ 4,890 $ 5,092 $ 23,536 $

37,441 TBA dollar roll positions, fair value (if settled) $ 779,697

$ 784,442 $ 846,940 $ 830,908 $ 683,680 TBA dollar roll positions,

amortized cost (if settled) $ 780,865 $ 782,408 $ 844,941 $ 829,425

$ 683,813 TBA dollar roll positions, carrying value $ (1,168 ) $

2,034 $ 1,999 $ 1,483 $ (133 ) U.S. Treasuries, fair value $ — $

57,923 $ 204,535 $ 146,530 $ — Book value per common share $ 6.75 $

6.93 $ 7.07 $ 7.34 $ 7.46 Leverage including TBA dollar roll

positions at cost as if settled (2) 6.7 x 6.1 x 6.5 x 6.4 x 6.3 x

Three Months Ended September 30, 2018 June

30, 2018 March 31, 2018 December 31, 2017

September 30, 2017 Performance Statistics: Net income

per common share $ 0.39 $ 0.23 $ 0.74 $ 0.36 $ 0.15 Core net

operating income per common share (3) $ 0.19 $ 0.18 $ 0.18 $ 0.20 $

0.19 Comprehensive income (loss) per common share $ 0.01 $ 0.05 $

(0.07 ) $ 0.08 $ 0.27 Dividends per common share $ 0.18 $ 0.18 $

0.18 $ 0.18 $ 0.18 Average interest earning assets (4) $ 3,031,388

$ 3,210,554 $ 3,140,125 $ 2,939,786 $ 2,960,595 Average TBA dollar

roll position $ 1,037,347 $ 742,111 $ 866,821 $ 944,103 $ 797,484

Average interest bearing liabilities $ 2,569,123 $ 2,721,099 $

2,651,101 $ 2,563,206 $ 2,622,067 Effective yield on investments

3.33% 3.13% 3.09% 3.07% 2.95% Cost of funds (5) 2.25% 2.06% 1.75%

1.53% 1.48% Net interest spread 1.08% 1.07% 1.34% 1.54% 1.47%

Adjusted cost of funds (6) 1.98% 1.72% 1.59% 1.66% 1.46% Adjusted

net interest spread (7) 1.41% 1.51% 1.52% 1.44% 1.50% CPR for

adjustable-rate Agency RMBS (8) 18.1% 20.4% 16.0% 17.1% 16.8% CPR

for fixed-rate Agency RMBS (8) 4.8% 5.7% 4.3% 1.3% —%

(1) CMBS IO includes Agency and non-Agency

issued securities.

(2) Leverage equals the sum of (i) total

liabilities and (ii) amortized cost basis of TBA dollar roll

positions (if settled) divided by total shareholders' equity.

(3) Non-GAAP financial measures are

reconciled in the supplement to this release.

(4) Excludes TBA dollar roll

positions.

(5) Percentages shown are equal to

annualized interest expense divided by average interest bearing

liabilities.

(6) Adjusted cost of funds is equal to

annualized adjusted interest expense (a non-GAAP measure) divided

by average interest bearing liabilities.

(7) Adjusted net interest spread includes

the impact of drop income from TBA dollar roll positions after

deducting adjusted cost of funds from effective yield.

(8) Represents the average constant

prepayment rate ("CPR") experienced during the quarter.

DYNEX CAPITAL, INC.

SUPPLEMENTAL INFORMATION

(UNAUDITED)

($ in thousands)

Computations of Non-GAAP Measures: September 30, 2018

June 30, 2018 March 31, 2018

December 31, 2017 September 30, 2017 Net

interest income $ 12,174 $ 11,747 $ 13,595 $ 14,068 $ 13,214 Add:

TBA drop income (1) 4,262 3,619 3,733 3,925 3,902 Add: net periodic

interest benefit (cost) (2) 1,777 2,333 (220 ) (319 ) (1,131 )

Less: de-designated cash flow hedge accretion (3) (66 ) (48 ) (48 )

(48 ) (48 ) Adjusted net interest income 18,147 17,651 17,060

17,626 15,937 Other expense, net (409 ) (339 ) (253 ) (50 ) (109 )

General and administrative expenses (3,964 ) (4,006 ) (3,643 )

(3,843 ) (3,599 ) Preferred stock dividends (2,956 ) (2,942 )

(2,940 ) (2,910 ) (2,808 ) Core net operating income to common

shareholders $ 10,818 $ 10,364 $ 10,224 $

10,823 $ 9,421

(1) TBA drop income is calculated by

multiplying the notional amount of the TBA dollar roll positions by

the difference in price between two

TBA securities with the same terms but

different settlement dates.

(2) Amount represents net periodic

interest benefit (cost) of effective interest rate swaps

outstanding during the period and excludes

realized and unrealized gains and losses

from changes in fair value of derivatives.

(3) Amount recorded as a portion of

"interest expense" in accordance with GAAP related to the accretion

of the balance remaining in

accumulated other comprehensive loss as a

result of the Company's discontinuation of cash flow hedge

accounting effective June 30, 2013.

DYNEX CAPITAL, INC.

RECONCILIATIONS OF GAAP MEASURES TO

NON-GAAP MEASURES

(UNAUDITED)

($ in thousands)

Three Months Ended September 30, 2018 June

30, 2018 March 31, 2018 December 31,

2017 September 30, 2017 GAAP net income to common

shareholders $ 22,630 $ 12,710 $ 41,367 $ 19,053 $ 7,503 Less:

Change in fair value of derivative instruments, net (1) (13,460 )

(14,715 ) (34,841 ) (9,072 ) (3,222 ) Loss on sale of investments,

net 1,726 12,444 3,775 902 5,211 De-designated cash flow hedge

accretion (2) (66 ) (48 ) (48 ) (48 ) (48 ) Fair value adjustments,

net (12 ) (27 ) (29 ) (12 ) (23 ) Core net operating income to

common shareholders $ 10,818 $ 10,364 $ 10,224

$ 10,823 $ 9,421 Weighted average common

shares 57,727 56,295 55,871 53,399 49,832 Core net operating income

per common share $ 0.19 $ 0.18 $ 0.18 $ 0.20 $ 0.19

(1) Amount includes unrealized gains and

losses from changes in fair value of derivatives and realized gains

and losses

on terminated derivatives and excludes net

periodic interest benefits/costs incurred on effective interest

rate swaps outstanding during the period.

(2) Amount recorded as a portion of

"interest expense" in accordance with GAAP related to the accretion

of the balance remaining

in accumulated other comprehensive loss as

a result of the Company's discontinuation of cash flow hedge

accounting effective June 30, 2013.

Three Months Ended September 30, 2018 June

30, 2018 March 31, 2018 December 31,

2017 September 30, 2017 GAAP net interest income

$ 12,174 $ 11,747 $ 13,595 $ 14,068 $ 13,214 Add: TBA drop income

4,262 3,619 3,733 3,925 3,902 Add: net periodic interest benefit

(cost) (1) 1,777 2,333 (220 ) (319 ) (1,131 ) Less: de-designated

cash flow hedge accretion (2) (66 ) (48 ) (48 )

(48 ) (48 ) Non-GAAP adjusted net interest income $

18,147 $ 17,651 $ 17,060 $ 17,626 $

15,937

GAAP interest expense $ 14,751 $ 14,175

$ 11,595 $ 10,056 $ 9,889 Add: net periodic interest (benefit) cost

(1) (1,777 ) (2,333 ) 220 319 1,131 Less: de-designated cash flow

hedge accretion (2) 66 48 48 48 48

Non-GAAP adjusted interest expense $ 13,040 $ 11,890

$ 11,863 $ 10,423 $ 11,068

(1) Amount represents net periodic

interest benefit (cost) of effective interest rate swaps

outstanding during the period and

excludes realized and unrealized gains and

losses from changes in fair value of derivatives.

(2) Amount recorded as a portion of

"interest expense" in accordance with GAAP related to the accretion

of the balance remaining

in accumulated other comprehensive loss as

a result of the Company's discontinuation of cash flow hedge

accounting effective June 30, 2013.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181031005410/en/

For Dynex Capital, Inc.Alison Griffin(804)

217-5897

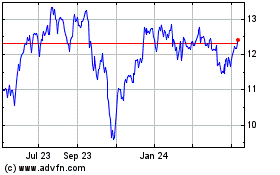

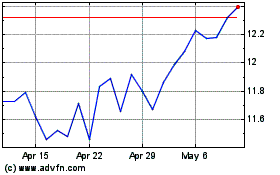

Dynex Capital (NYSE:DX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dynex Capital (NYSE:DX)

Historical Stock Chart

From Apr 2023 to Apr 2024