Amended Statement of Beneficial Ownership (sc 13d/a)

October 26 2018 - 4:55PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 2)*

PEDEVCO CORP.

(Name

of Issuer)

COMMON STOCK, PAR VALUE $0.001 PER SHARE

(Title

of Class of Securities)

70532Y303

(CUSIP

Number)

Dr. Simon G. Kukes

5100 Westheimer Suite 200

Houston, Texas 77056

Telephone: (713) 969-5027

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

October 25, 2018

(Date

of Event which Requires Filing of this Statement)

If the

filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following

box.

☐

Note

: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits.

See §240.13d-7 for other parties to whom copies are to be

sent.

* The

remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a

prior cover page.

The

information required on the remainder of this cover page shall not

be deemed to be “

filed

” for the purpose of

Section 18 of the Securities Exchange Act of 1934

(“

Act

”)

or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however,

see the Notes).

|

| 1

|

|

Names

of Reporting Persons.

|

|

|

|

I.R.S.

Identification Nos. of above persons (entities only).

|

|

|

|

|

|

|

|

SK

Energy LLC

|

|

|

|

|

|

|

| 2

|

|

Check

the Appropriate Box if a Member of a Group

|

(a)[X]

|

|

|

|

(b)[]

|

|

|

|

|

|

|

|

|

|

| 3

|

|

SEC Use

Only

|

|

|

|

|

|

|

|

|

|

|

| 4

|

|

Source

of Funds

|

|

|

|

WC

|

|

|

|

|

|

|

| 5

|

|

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

|

[

]

|

|

|

|

|

|

| 6

|

|

Citizenship

or Place of Organization

|

|

|

|

Delaware

|

|

|

|

|

|

|

| 7 |

Sole Voting Power

|

|

|

-0-

|

|

|

|

|

Number

of Shares

|

| 8 |

Shared Voting Power

|

|

Beneficially

|

7,577,038

shares of Common Stock*

|

|

Owned

by Each

|

|

|

Reporting

|

| 9 |

Sole Dispositive Power

|

|

Person

With

|

-0-

|

|

|

|

|

|

| 10 |

Shared Dispositive Power

|

|

|

7,577,038

shares of Common Stock*

|

|

| 11

|

|

Aggregate

Amount Beneficially Owned by Each Reporting Person

|

|

|

7,577,038

shares of Common Stock*

|

|

|

|

|

| 12

|

|

Check

if the Aggregate Amount in Row (11) Excludes Certain

Shares

|

|

|

Not

applicable.

|

|

|

|

|

| 13

|

|

Percent

of Class Represented by Amount in Row (11)

|

|

|

49.9%

of the Issuer’s outstanding Common Stock

|

|

|

|

|

| 14

|

|

Type of

Reporting Person

|

|

|

OO

|

*

Represents 49.9% of the Issuer’s outstanding Common Stock.

The ownership of the Reporting Persons is limited by the Beneficial

Ownership Limitation described below.

|

| 1

|

|

Names

of Reporting Persons.

|

|

|

|

I.R.S.

Identification Nos. of above persons (entities only).

|

|

|

|

|

|

|

|

Dr.

Simon G. Kukes

|

|

|

|

|

|

|

| 2

|

|

Check

the Appropriate Box if a Member of a Group

|

(a)[X]

|

|

|

|

(b)[]

|

|

|

|

|

|

|

|

|

|

| 3

|

|

SEC Use

Only

|

|

|

|

|

|

|

|

|

|

|

| 4

|

|

Source

of Funds

|

|

|

|

PF

|

|

|

|

|

|

|

| 5

|

|

Check

if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

|

[

]

|

|

|

|

|

|

| 6

|

|

Citizenship

or Place of Organization

|

|

|

|

United

States Citizen

|

|

|

|

|

|

|

| 7 |

Sole Voting Power

|

|

|

-0-

|

|

|

|

|

Number

of Shares

|

| 8 |

Shared Voting Power

|

|

Beneficially

|

7,577,038

shares of Common Stock*

|

|

Owned

by Each

|

|

|

Reporting

|

| 9 |

Sole Dispositive Power

|

|

Person

With

|

-0-

|

|

|

|

|

|

| 10 |

Shared Dispositive Power

|

|

|

7,577,038

shares of Common Stock*

|

|

| 11

|

|

Aggregate

Amount Beneficially Owned by Each Reporting Person

|

|

|

7,577,038

shares of Common Stock*

|

|

|

|

|

| 12

|

|

Check

if the Aggregate Amount in Row (11) Excludes Certain

Shares

|

|

|

Not

applicable.

|

|

|

|

|

| 13

|

|

Percent

of Class Represented by Amount in Row (11)

|

|

|

49.9%

of the Issuer’s outstanding Common Stock

|

|

|

|

|

| 14

|

|

Type of

Reporting Person

|

|

|

IN

|

*

Represents 49.9% of the Issuer’s outstanding Common Stock.

The ownership of the Reporting Persons is limited by the Beneficial

Ownership Limitation described below.

This

Amendment No. 2 (the “

Amendment

”) amends and

supplements the Schedule 13D filed with the Securities and Exchange

Commission (the “

Commission

”) on July 10,

2018, as amended by the Amendment No. 1 thereto, filed with the

Commission on September 11, 2018 (such Schedule 13D as amended to

date, the “

Schedule

13D

”), by SK Energy LLC, a Delaware limited liability

company (“

SK

Energy

”), and Dr. Simon G. Kukes (“

Kukes

”), each a

“

Reporting

Person

” and collectively, the “

Reporting Persons.

”

Capitalized terms used but not otherwise defined in this Amendment

have the meanings ascribed to such terms in the Schedule 13D.

Except as expressly amended and supplemented by this Amendment, the

Schedule 13D is not amended or supplemented in any respect, and the

disclosures set forth in the Schedule 13D, other than as amended

herein are incorporated by reference herein.

Item 3. Source of Amount of Funds or Other

Compensation

Item 3 is hereby amended and modified to include the following

(which shall be in addition to the information previously included

in the Schedule 13D):

On

October 25, 2018, SK Energy purchased a $7,000,000 Convertible

Promissory Note (the “

October 2018

Convertible Note

”) from

the Company. The October 2018 Convertible Note accrues interest

monthly at 8.5% per annum, which interest is payable on the

maturity date unless otherwise converted into shares of the

Company’s common stock as described below. The October 2018

Convertible Note and all accrued interest thereon are convertible

into shares of the Company’s common stock, from time to time,

at the option of the holder thereof, at a conversion price equal to

$1.79 per share (the “

Conversion Price

”), which

was $0.01 above the closing sales price of the Company’s

common stock on the date the October 2018 Convertible Note was

entered into.

The

conversion of the October 2018 Convertible Note is subject to a

49.9% conversion limitation for so long as SK Energy or any of its

affiliates holds such note, which prevents the conversion of any

portion thereof into common stock of the Company if such conversion

would result in SK Energy beneficially owning (as such term is

defined in the Securities Exchange Act of 1934, as

amended)(“

Beneficially Owning

”)

more than 49.9% of the Company’s outstanding shares of common

stock.

The

October 2018 Convertible Note is due and payable on October 25,

2021, but may be prepaid at any time without penalty. The October

2018 Convertible Note contains standard and customary events of

default and, upon the occurrence of an event of default, the amount

owed under the October 2018 Convertible Note accrues interest at

10% per annum.

On October 25, 2018, the Company and SK Energy agreed to convert an

aggregate of $163,756.76 of interest accrued under the June 2018

Convertible Note from its effective date through September 30,

2018, into shares of common stock of the Company, and the Company

issued an aggregate of 75,083 shares of common stock to SK Energy

on that date, based on an a conversion price equal to the average

of the closing sales prices of the Company’s common stock for

the ten trading days immediately preceding the last day of the

calendar quarter prior to the applicable payment date (i.e.,

September 30, 2018), rounded up to the nearest whole share of

common stock, which conversion price was equal to $2.18 per

share.

Item 5. Interest in Securities of the Issuer

|

|

(a)

|

As of

the close of business on October 26, 2018, the Reporting Persons

beneficially own in aggregate 7,577,038 shares of Common Stock

representing 49.9% of the 15,184,445 shares of the Company’s

issued and outstanding Common Stock on such date as confirmed by

the Company’s Transfer Agent on such date.

As of

the close of business on October 26, 2018, SK Energy beneficially

owns an aggregate 7,577,038 shares of Common Stock representing

49.9% of the 15,184,445 shares of the Company’s issued and

outstanding Common Stock on such date as confirmed by the

Company’s Transfer Agent on such date. By virtue of his

relationship with SK Energy discussed in further detail in Item 2,

Kukes is deemed to beneficially own the shares of Common Stock

beneficially owned by SK Energy.

|

|

|

(b)

|

Kukes

may be deemed to have shared power with SK Energy, to vote and

dispose of the securities reported in this Schedule 13D

beneficially owned by SK Energy.

|

|

|

|

|

|

|

(c)

|

See

Item 3, above.

|

|

|

(d)

|

No

other person has the right to receive or the power to direct the

receipt of dividends from or the proceeds from the sale of the

securities beneficially owned by the Reporting

Persons.

|

Item

6 is hereby amended and modified to include the following (which

shall be in addition to the information previously included in the

Schedule 13D):

Item 6. Contracts, Arrangements, Understanding or Relationships

with Respect to Securities of the Issuer

On September 20, 2018, SK Energy entered into an agreement with

American Resources Inc. (“

American

”),

whose principals are Ivar Siem, a member of the Board of Directors

of the Company, and J. Douglas Schick, the President of the

Company. Pursuant to the agreement, American agreed to assist Dr.

Kukes with his investments in the Company and SK Energy agreed to

pay American 25% of the profit realized by SK Energy, if any,

following the sale or disposal of the securities of the Company

which SK Energy holds and may acquire in the future (prior to such

sale/disposition). The profit is to be calculated based on (x) the

amount of consideration received by SK Energy in connection with

the sale of such securities, minus (y) the consideration paid by SK

Energy for the securities, increased by 10% each year that such

securities are held. The agreement has a term of four years, but

can be terminated at any time by SK Energy with written notice to

American.

Signatures

After

reasonable inquiry and to the best of my knowledge and belief, each

of the undersigned certifies that the information set forth in this

statement is true, complete and correct.

Dated: October

26, 2018

|

SK Energy LLC

|

|

|

|

|

|

|

|

|

|

|

/s/ Dr. Simon G. Kukes

|

|

|

|

Dr.

Simon G. Kukes

|

|

|

|

Chief

Executive Officer

|

|

|

|

|

|

|

|

/s/ Dr. Simon G. Kukes

|

|

|

|

Dr. Simon G. Kukes

|

|

|

The original statement shall be signed

by each person on whose behalf the statement is filed or his

authorized representative. If the statement is signed on behalf of

a person by his authorized representative (other than an executive

officer or general partner of the filing person), evidence of the

representative’s authority to sign on behalf of such person

shall be filed with the statement: provided, however, that a power

of attorney for this purpose which is already on file with the

Commission may be incorporated by reference. The name and any title

of each person who signs the statement shall be typed or printed

beneath his signature.

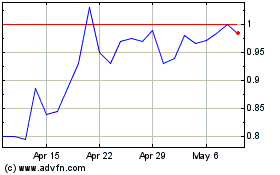

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Mar 2024 to Apr 2024

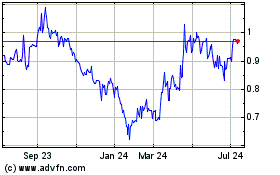

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Apr 2023 to Apr 2024