UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

October

2018

Commission File Number

1-12260

COCA-COLA FEMSA, S.A.B. de C.V.

(Translation of registrant’s name into English)

(Jurisdiction of incorporation or organization)

Calle Mario Pani No. 100,

Santa Fe Cuajimalpa,

Cuajimalpa de Morelos,

05348, Ciudad de México,

México

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

X

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes

No

X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes

No

X

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

No

X

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with

Rule 12g3-2(b): 82-__.

2018 THIRD QUARTER AND FIRST NINE MONTHS RESULTS

Mexico City, October 25, 2018, Coca-Cola FEMSA, S.A.B. de C.V. (BMV: KOFL, NYSE: KOF) (“Coca-Cola FEMSA,” “KOF” or the “Company”), the largest Coca-Cola franchise bottler in the world by sales volume, announces results for the third quarter of 2018.

|

Relevant Reporting Information

|

·

Volumes and financial results of the recently acquired territories in Guatemala and Uruguay were consolidated as of May 1, 2018 and as of July 1, 2018, respectively. Coca-Cola FEMSA de Venezuela was deconsolidated as of December 31, 2017.

·

On August 16, 2018, KOF announced the exercise of the put option to sell its 51% stake in Coca-Cola FEMSA Philippines, Inc. Therefore, the Philippines is now presented as a discontinued operation as of January 1, 2018, and the consolidated income statements presented herein are re-presented as if the Philippines had been discontinued from February 2017, date of the consolidation of said operation. As a result, the Asia Division is no longer reported.

·

As of July 1, 2018, Argentina is reported as a hyperinflationary subsidiary.

|

Operational and Financial Highlights

|

·

Volumes increased in Brazil, Central America, Colombia, and Mexico; transactions outperformed volumes in Argentina and Brazil.

·

Revenues decreased 0.7%, as pricing aligned with or ahead of inflation in the Mexico & Central America division and in Argentina, combined with the consolidation of recent acquisitions were offset by unfavorable currency translation effects from the Brazilian Real, hyperinflationary accounting in Argentina and the deconsolidation of Venezuela.

·

Comparable revenues grew 6.5% for the quarter driven by growth in Brazil, Central America, Colombia, and Mexico.

·

Operating income grew 8.2%, while comparable operating income increased 5.5% for the quarter, driven mainly by lower sweetener costs, a favorable currency hedging position in South America, and operating expense efficiencies, partially offset by higher PET prices.

·

Operating cash flow declined 1.2%, while comparable operating cash flow grew 6.2%.

|

|

Third Quarter

|

|

Year to Date

|

|

|

As Reported

(1)

|

|

Comparable

(2)

|

|

As Reported

(1)

|

|

Comparable

(2)

|

|

Expressed in millions of Mexican pesos.

|

2018

|

D%

|

|

D%

|

|

2018

|

D%

|

|

D%

|

|

Total revenues

|

44,148

|

(0.7%)

|

|

6.5%

|

|

130,577

|

(4.7%)

|

|

5.2%

|

|

Gross profit

|

20,237

|

0.6%

|

|

5.8%

|

|

60,150

|

(2.1%)

|

|

5.4%

|

|

Operating income

|

5,777

|

8.2%

|

|

5.5%

|

|

17,103

|

1.6%

|

|

(0.4%)

|

|

Operating cash flow

(3)

|

8,492

|

(1.2%)

|

|

6.2%

|

|

24,909

|

(5.2%)

|

|

3.8%

|

|

Net income attributable to equity holders of the company

|

3,266

|

3.6%

|

|

|

|

8,201

|

(19.9%)

|

|

|

|

Earnings per share - Continued operations

|

1.36

|

|

|

|

|

3.75

|

|

|

|

|

Earnings per share

(4)

|

1.55

|

|

|

|

|

3.90

|

|

|

|

(1)

2017 financial information is re-presented as if the Philippines had been discontinued from February 2017, date of the consolidation of said operation.

(2)

Please refer to page 9 for our definition of “comparable” and a description of the factors affecting the comparability of our financial and operating performance.

(3)

Operating cash flow = operating income + depreciation + amortization & other operating non-cash charges.

(4)

Quarterly earnings / outstanding shares as of the end of the period. Outstanding shares were 2,100.8 million

|

Message from the Chief Executive Officer

|

“Our third-quarter results reflect very encouraging positive trends in many of our markets. In Mexico, our revenue management platform’s analytics are enabling us to deliver solid top-line growth, backed by positive volume performance. In Central America, organic volumes are showing encouraging trends, coupled with the ongoing integration of very promising territories in Guatemala. Importantly, in South America, we continue to gain share in gradually recovering consumer environments as we offer affordability and focus relentlessly on point-of-sale execution: Colombia is gaining traction; Brazil continues to deliver top-and-bottom-line growth, while Argentina is better than ever prepared to face the challenging macro environment. Finally, this quarter, we welcome Uruguay as the newest territory to our diversified footprint. As we approach the end of the year, we look forward to continue capitalizing on our capabilities to capture the marketplace’s many opportunities, while obsessively focusing on serving our customers and consumers.” said John Santa Maria Otazua, Chief Executive Officer of the Company.

|

Press Release 3Q 2018

October 25, 2018

|

Page 1

|

|

Consolidated results for the third quarter

|

Comparable

(1)

figures:

Revenues:

Comparable total revenues grew 6.5% in the third quarter of 2018 as compared to the same period of 2017, driven by average price per unit case growth aligned with or ahead of inflation in Mexico and Central America, coupled with volume growth in Brazil, Colombia, Central America, and Mexico.

Transactions:

Comparable number of transactions increased 2.0%. Our sparkling beverage category grew 1.2%, driven by 3.1% growth in our colas portfolio, partially offset by a decline in flavors. Our positive performance in colas was driven by growth across all of our operations. Our still beverage category increased 3.6%, driven mainly by the positive performance of Brazil and Mexico, partially offset by declines in Central America and Colombia. Finally, our water category’s transactions increased by 7.4%, driven by growth in Brazil, Colombia, and Mexico, partially offset by a decline in Central America.

Volume:

Comparable sales volume increased 2.5% in the third quarter of 2018 as compared to the same period in 2017. Additionally, excluding jug water, comparable sales volume increased 3.2%. Our sparkling beverage portfolio’s volume increased 2.5%, driven by growth in our colas portfolio, partially offset by a decline in our flavors portfolio. Our growth in colas was driven by the positive performance of all of our operations. Our still beverage category’s volume grew 3.6%, driven by Central America and Mexico. Our personal water portfolio’s volume grew 12.0% due to positive performance across most of our operations. Finally, our bulk water portfolio’s volume declined 3.1%, driven mainly by declines in Central America, Colombia, and Mexico, partially offset by growth in the rest of our operations.

Gross profit:

Comparable gross profit grew 5.8%. Our volume growth, lower sweetener prices in most of our operations, and favorable currency hedging positions in South America were offset by higher PET prices across most of our operations, higher concentrate prices in Mexico, and the depreciation in the average exchange rate of the Brazilian Real as applied to our U.S. dollar-denominated raw material costs.

Operating Income:

Comparable operating income increased 5.5% for the third quarter of 2018 as compared to the same period of 2017.

Operating cash flow:

Comparable operating cash flow increased 6.2% in the third quarter of 2018.

As reported figures:

According to IFRS 5, the Philippines is presented as a discontinued operation as of January 1, 2018 and the consolidated income

statements presented herein are re-presented as if the Philippines had been discontinued from February 2017.

Revenues:

Total revenues decreased 0.7% to Ps. 44,148 million in the third quarter of 2018, driven mainly by the negative translation effect resulting from the depreciation of the Argentine Peso and the Brazilian Real as compared to the Mexican Peso, combined with a volume decline and hyperinflationary accounting in Argentina and the deconsolidation of Coca-Cola FEMSA de Venezuela as of December 31, 2017. These factors were partially offset by volume growth in Brazil, Central America, Colombia, and Mexico, price increases aligned with or above inflation in Mexico and Argentina, and the consolidation of recently acquired territories in Guatemala and Uruguay.

Transactions:

Reported total number of transactions increased 2.2% to 4,973.1 million in the third quarter of 2018 as compared to the same period in 2017.

Volume:

Reported total sales volume increased 2.2% to 839.2 million unit cases in the third quarter of 2018 as compared to the same period in 2017.

Gross profit:

Gross profit increased 0.6% to Ps. 20,236.7 million, and gross margin expanded 60 basis points to 45.8%.

(Continued on next page)

(1)

Please refer to page 9 for our definition of “comparable” and a description of the factors affecting the comparability of our financial and operating performance.

|

Press Release 3Q 2018

October 25, 2018

|

Page 2

|

Equity method:

T

he reported share of the profits of associates and joint ventures recorded a loss of Ps. 85 million in the third quarter of 2018, compared to a loss of Ps. 6 million recorded in the third quarter of 2017. This is mainly due to a loss in our dairy joint venture in Panama, partially offset by gains in our joint ventures in Brazil.

Operating Income:

Operating income increased 8.2% to Ps. 5,777.5 million, and operating margin expanded 110 basis points to 13.1% during the third quarter of 2018 as compared with the same period of 2017, which included Venezuela.

Other non-operative expenses, net:

Other non-operative expenses, net, recorded an expense of Ps. 95 million, compared to an expense of Ps. 597 million during the third quarter of 2017, which mainly resulted from the effects of negative currency fluctuations in Coca-Cola FEMSA de Venezuela.

Comprehensive financing result:

Comprehensive financing result in the third quarter of 2018 recorded an expense of Ps. 1,322 million, compared to an expense of Ps. 341 million in the same period of 2017.

During the third quarter of 2018, we recorded an interest expense, net, of Ps. 1,558 million, compared to Ps. 1,929 million in the third quarter of 2017. This decrease was driven by the decline of short-term interest rates in Brazil; the average exchange rate depreciation of the Brazilian Real compared to the Mexican Peso as applied to existing Brazilian Real-denominated interest expense; and the reduction of debt in Colombia. However, these effects were partially offset by financing during the previous quarter of Ps. 10,100 million for the acquisition of our new territories in Guatemala and Uruguay.

In addition, for the third quarter, we recorded a foreign exchange gain of Ps. 60 million as compared to a gain of Ps. 84 million in the same period of 2017.

Moreover, due to the reporting of our Argentina operation as a hyperinflationary subsidiary as of the third quarter of 2018, monetary position in inflationary subsidiaries recorded a gain of Ps. 117 million as compared to a gain of Ps. 1,301 million during the same period of 2017, which was generated by Venezuela.

Market value on financial instruments recorded a gain of Ps. 59 million as compared to a gain of Ps. 203 million in the third quarter of 2017.

Income tax:

During the third quarter of 2018, reported income tax as a percentage of income before taxes was 31.4%, compared to 25.2% in the same period of 2017. The higher tax rate was driven mainly by the increase in the relative weight of Brazil’s profits in our consolidated results, coupled with the deconsolidation of Venezuela, which had deferred taxes in the third quarter of 2017.

Net income:

Consolidated net controlling interest income increased 3.6% to Ps. 3,266.1 million in the third quarter 2018, as compared to the same period of the previous year, which included Venezuela; resulting in earnings per share (EPS) of Ps. 1.55 (Ps. 15.54 per ADS).

Earnings per share from continuing operations was Ps. 1.36 (Ps. 13.56 per ADS).

Operating cash flow:

Operating cash flow decreased 1.2% to Ps. 8,491.6 million, and operating cash flow margin contracted 10 basis points to 19.2%.

|

Press Release 3Q 2018

October 25, 2018

|

Page 3

|

|

Consolidated Balance Sheet

(1)

|

As of September 30, 2018, we had a cash balance of Ps. 18,475 million of which US$180 million is denominated in U.S. dollars. This amount excludes the Philippine’s cash position of Ps. 5,918 million now that the Philippines operation is classified as assets available for sale. Excluding the Philippine’s cash position in 2017, our cash balance increased Ps. 6,007 million compared to year-end 2017, mainly driven by cash flow generation. As of September 30, 2018, total short-term debt was Ps. 10,121 million and long-term debt was Ps. 79,840 million. Total debt increased by Ps. 6,601 million and net debt, excluding the Philippine’s cash position, increased by Ps. 594 million compared year-end 2017, due mainly to financing for the acquisition of our new territories in Guatemala and Uruguay.

The weighted average cost of debt for the quarter, including the effect of debt swapped to Brazilian Reals and Mexican Pesos, was

7.71

%, a

reduction as compared to the fourth quarter of 2017, due mainly to the reduction of interest rates in Brazil. The following charts set forth the Company’s debt profile by currency and interest rate type and by maturity date as of September 30, 2018.

|

Currency

|

% Total Debt

(2)

|

% Interest Rate Floating

(2)(3)

|

|

Mexican Pesos

|

55.5%

|

15.0%

|

|

U.S. Dollars

|

1.3%

|

0.0%

|

|

Colombian Pesos

|

1.6%

|

100.0%

|

|

Brazilian Reals

|

40.1%

|

11.6%

|

|

Uruguayan Pesos

|

1.4%

|

0.0%

|

|

Argentine Pesos

|

0.2%

|

0.0%

|

Debt Maturity Profile

|

Maturity Date

|

2018

|

2019

|

2020

|

2021

|

2022

|

2023+

|

|

% of Total Debt

|

9.4%

|

14.7%

|

11.9%

|

13.2%

|

1.7%

|

49.1%

|

(1)

See page 15 for detailed information.

(2)

After giving effect to cross-currency swaps.

(3)

Calculated by weighting each year’s outstanding debt balance mix.

|

Selected Financial Ratios

|

|

|

|

LTM 2018

|

|

FY 2017

|

D

%

|

|

Net debt including effect of hedges

(1)(3)

|

|

69,223

|

|

68,973

|

0.4%

|

|

Net debt including effect of hedges / Operating cash flow

(1)(3)

|

1.96

|

|

1.74

|

|

|

Operating cash flow/ Interest expense, net

(1)

|

|

5.72

|

|

4.99

|

|

|

Capitalization

(2)

|

|

42.6%

|

|

39.3%

|

|

|

|

|

|

|

|

|

|

(1)

Net debt = total debt - cash

|

|

|

|

|

|

|

(2)

Total debt / (long-term debt + shareholders' equity)

|

|

|

|

|

|

|

(3)

After giving effect to cross-currency swaps.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Press Release 3Q 2018

October 25, 2018

|

Page 4

|

|

Mexico & Central America Division

|

(Costa Rica, Guatemala, Mexico, Nicaragua, and Panama)

Comparable

(1)

figures:

Revenues:

Comparable total revenues from our Mexico and Central America division increased 7.3% in the third quarter of 2018 as compared to the same period in 2017, driven by volume growth, coupled with pricing aligned with inflation, partially offset by a mix effect in Mexico and Central America.

Transactions:

Comparable transactions in our Mexico and Central America division increased 1.7% in the

third quarter of 2018

. Our sparkling beverage portfolio’s transactions grew 0.6%, driven by a 1.2% increase in our colas portfolio. Our still beverage category’s transactions increased 5.6% in the division, driven by 8.4% growth in Mexico, partially offset by a decline in Central America. Our water transactions, including bulk water, increased 8.1%, driven by 9.5% growth in Mexico.

Volume:

Total sales volume for the division increased 2.8% in the third quarter of 2018, compared to the same period of 2017. Additionally, excluding jug water, total sales volume increased 3.6%. Our sparkling beverage category’s volume increased 2.7%, driven by a 3.3% increase in our colas portfolio. Performance in

colas for the division

was driven by growth in both Mexico and Central America. Our still beverage category’s volume increased 10.6%, driven by 11.9% growth in Mexico and 3.6% growth in Central America. Our personal water portfolio’s volume increased 8.2%, driven by 9.5% growth in Mexico, partially offset by a 4.1% decline in Central America. Our bulk water portfolio’s volume declined 1.8% in the division due to a contraction in Mexico and Central America.

Gross profit:

Comparable gross profit grew 6.6% in the third quarter of 2018 as compared to the same period in 2017. Our pricing initiatives and declining sweetener costs were offset by higher PET prices, higher concentrate costs in Mexico, and the depreciation of the average exchange rates of the Mexican Peso, the Guatemalan Quetzal, and the Nicaraguan Cordoba as applied to U.S. dollar-denominated raw material costs.

Operating income:

Comparable operating income in the division increased 3.9% in the third quarter of 2018 as compared to the same period in 2017, despite higher freight, marketing and maintenance expenses in Mexico; these factors were partially offset by a non-cash operating foreign exchange gain in Mexico.

Operating cash flow:

Comparable operating cash flow increased 4.6% in the third quarter of 2018 as compared to the same period in 2017.

As reported figures:

Revenues:

Reported total revenues increased 12.2% to Ps. 26,069 million in the third quarter of 2018 as compared to the same period of 2017, driven by the consolidation of recently acquired territories in Guatemala as of May 1, 2018, volume growth in Central America and Mexico, and pricing aligned with inflation in Mexico, partially offset by a mix effect in Mexico and Central America.

Transactions:

Reported total number of transactions increased 5.9% to 2,953.8 in the third quarter of 2018 as compared to the same period of 2017.

Volume:

Reported total sales volume increased 5.5% to 534.1 million unit cases in the third quarter of 2018 as compared to the same period in 2017.

Gross profit:

Reported gross profit increased 11.2% to Ps. 12,566 million in the third quarter of 2018, and gross profit margin contracted 40 basis points to 48.2% during the period.

Operating income:

Reported operating income increased 5.9% to Ps. 3,750 million in the third quarter of 2018, and operating income margin contracted 80 basis points to 14.4% during the period.

Operating cash flow:

Reported operating cash flow increased 7.7% to Ps. 5,402 million in the third quarter of 2018, resulting in a margin contraction of 90 basis points to 20.7%.

(1)

Please refer to page 9 for our definition of “comparable” and a description of the factors affecting the comparability of our financial and operating performance.

|

Press Release 3Q 2018

October 25, 2018

|

Page 5

|

(Argentina, Brazil, Colombia and Uruguay)

Comparable

(1)

figures:

Revenues:

Comparable total revenues increased 5.1%, driven by volume growth in Brazil and Colombia, partially offset by unfavorable price mix effects.

Transactions:

Comparable transactions in the division increased 2.5% during the third quarter of 2018. Our sparkling beverage portfolio’s transactions increased 2.3%, driven by 6.5% growth in colas, partially offset by a decline in our flavors portfolio. Our positive performance in colas was driven by growth in both Brazil and Colombia. Our still beverage category’s transactions remained flat. Our water transactions, including bulk water, increased 6.7%.

Volume:

Comparable total sales volume in South America increased 1.8% during the third quarter of 2018 as compared to the same period of 2017. Excluding the bulk water category, total sales volume increased 2.3%. Our sparkling beverage category’s volume increased 2.5%, driven by 6.8% growth in colas, partially offset by a decline in flavors.

Colas’

positive performance was driven by growth in Brazil and Colombia. Our still beverage category’s volume decreased 11.5%, driven by declines in Brazil and Colombia. Our personal water category’s volume increased 18.5%, driven by growth in Brazil and Colombia. Our bulk water business’s volume decreased 18.5%, driven by Colombia.

Gross profit:

Comparable gross profit increased 4.4% as a result of lower sweetener prices, a favorable currency hedging position in the division, and the appreciation of the Colombian Peso as applied to U.S. dollar-denominated raw material costs. These factors were partially offset by higher PET prices in the division, an unfavorable raw material hedging position in Brazil, and the depreciation of the average exchange rate of the Brazilian Real as applied to our U.S. dollar-denominated raw material costs.

Operating income:

Comparable operating income in the division increased 8.7% as compared to the same period in 2017, driven by operating expense efficiencies in Brazil and Colombia.

Operating cash flow:

Comparable operating cash flow increased 9.6% as compared to the same period of 2017.

As reported figures:

Revenues:

Reported total revenues declined 14.8% to Ps. 18,079.2 million in the third quarter of 2018, driven mainly by an unfavorable currency translation effect resulting from the depreciation of the Brazilian Real as compared to the Mexican Peso, the reporting of Argentina as a hyperinflationary subsidiary, and the deconsolidation of Coca-Cola FEMSA de Venezuela as of December 31, 2017. These factors were partially offset by volume growth in Brazil and Colombia, coupled with the consolidation of the recently acquired territory in Uruguay as of July 1, 2018.

Transactions:

Reported total number of transactions decreased 2.7% to 2,019.3 million in the third quarter of 2018 as compared to the same period in 2017.

Volume:

Reported total sales volume decreased 3.2% to 305.1 million unit cases in the third quarter of 2018 as compared to the same period in 2017.

Gross profit:

Reported gross profit decreased 12.9% to Ps. 7,671.2 million in the third quarter of 2018, and gross profit margin expanded 90 basis points to 42.4%.

Operating income:

Reported operating income grew 12.6% to Ps. 2,028.0 million in the third quarter of 2018, resulting in a margin expansion of 270 basis points to 11.2%.

Operating cash flow:

Reported operating cash flow decreased 13.7% to Ps. 3,089.5 million in the third quarter of 2018, resulting in a margin expansion of 20 basis points to 17.1%.

(1)

Please refer to page 9 for our definition of “comparable” and a description of the factors affecting the comparability of our financial and operating performance.

|

Press Release 3Q 2018

October 25, 2018

|

Page 6

|

Comparable

(1)

figures:

Revenues:

Comparable total revenues grew 5.2% in the first nine months of 2018 as compared to the same period of 2017, driven by average price per unit case growth aligned with inflation in Mexico, coupled with volume growth in Brazil, Colombia, Central America, and Mexico.

Transactions:

Comparable number of transactions increased 1.4%. Our sparkling beverage category remained flat, driven by 1.9% growth in our colas portfolio offset by a decline in flavors. Our positive performance in colas was driven by growth in Brazil, Central America, and Colombia. Our still beverage category increased 1.6%, driven mainly by the positive performance of Brazil and Mexico. Finally, our water category’s transactions increased by 4.2%, driven by growth across most of our operations, partially offset by a decline in Central America.

Volume:

Comparable sales volume increased 1.4% in the first nine months of 2018 as compared to the same period in 2017. Additionally, excluding jug water volume, comparable sales volume increased 2.2%. Our sparkling beverage portfolio’s volume increased 1.3%, driven mainly by 3.4% growth in our colas portfolio across all of our operations, partially offset by a decline in our flavors portfolio. Our still beverage category’s volume increased 3.9%, driven by volume growth in Brazil, Central America, and Mexico, which offset negative performance in Colombia. Our personal water portfolio’s volume grew 12.8% due to the positive performance of most of our operations. Finally, our bulk water portfolio’s volume decreased 5.3%, driven by declines in Colombia and Mexico.

Gross profit:

Comparable gross profit grew 5.4%. Our pricing initiatives, coupled with lower sweetener prices in most of our operations, were partially offset by higher PET costs across most of our operations, higher concentrate costs in Mexico, and the depreciation in the average exchange rate of the Argentine Peso and the Brazilian Real as applied to our U.S. dollar-denominated raw material costs.

Operating Income:

Comparable operating income remained flat for the first nine months of 2018 as compared to the same period of 2017.

Operating cash flow:

Comparable operating cash flow increased 3.8% in the first nine months of 2018.

As reported figures:

Revenues:

Reported total revenues decreased 4.7% to Ps. 130,577 million in the first nine months of 2018, driven by the consolidation of recently acquired territories in Guatemala and Uruguay, volume growth in Brazil, Central America, Colombia, and Mexico, and price increases aligned with or above inflation in Argentina and Mexico. These factors were partially offset by the negative translation effect resulting from the depreciation of the Argentine Peso and the Brazilian Real as compared to the Mexican Peso, the deconsolidation of Coca-Cola FEMSA de Venezuela as of December 31, 2017, and the reporting of Argentina as a hyperinflationary subsidiary as of July 1, 2018.

Transactions:

Reported total number of transactions increased 0.5% to 14,539.0 million in the first nine months of 2018 as compared to the same period in 2017.

Volume:

Reported total sales volume remained flat at 2,450.1 million unit cases for the first nine months of 2018 as compared to the same period in 2017.

Gross profit:

Reported gross profit decreased 2.1% to Ps. 60,150 million, and gross margin expanded 130 basis points to 46.1%.

Equity method:

T

he reported share of the profits of associates and joint ventures recorded a loss of Ps. 201 million in the first nine months of 2018, compared to a gain of Ps. 5 million recorded in the first nine months of 2017. This is due mainly to a loss in our dairy joint venture in Panama, partially offset by gains in our joint ventures in Brazil and in our

Jugos del Valle

joint venture in Mexico

(Continued on next page)

(1)

Please refer to page 9 for our definition of “comparable” and a description of the factors affecting the comparability of our financial and operating performance.

|

Press Release 3Q 2018

October 25, 2018

|

Page 7

|

Operating Income:

Operating income increased 1.6% to Ps. 17,103.5 million, and operating margin expanded 80 basis points to 13.1% during the first nine months of 2018 as compared with the same period of 2017, which included Venezuela.

Other non-operative expenses, net:

Other non-operative expenses, net, recorded an expense of Ps. 216 million, compared to an expense of Ps. 707 million during the first nine months of 2017, due mainly to the effect of negative currency fluctuations in Venezuela during the first nine months of 2017.

Comprehensive financing result:

Comprehensive financing result in the first nine months of 2018 recorded an expense of Ps. 4,837 million, compared to an expense of Ps. 3,271 million in the same period of 2017.

During the first nine months of 2018, we recorded an interest expense, net, of Ps. 5,461 million, compared to Ps. 6,840 million in the same period of 2017. This decrease was driven by the decline of short-term interest rates in Brazil; the average exchange rate depreciation of the Brazilian Real compared to the Mexican Peso as applied to existing Brazilian Real-denominated interest expense; and the reduction of debt in Argentina, Brazil, and Colombia. However, these factors were partially offset by: (i) an interest rate increase in Mexico; (ii) financing of Ps. 10,100 million for the acquisition of our new territories in Guatemala and Uruguay; and (iii) an interest rate increase resulting from swapping U.S. dollar-denominated debt to Brazilian Real and Mexican Peso-denominated debt as part of our strategy to eliminate our U.S. dollar net debt exposure.

In addition, for the first nine months of 2018, we recorded a foreign exchange gain of Ps. 51 million as compared to a gain of Ps. 268 million in 2017, which resulted from the depreciation of the Mexican Peso as applied to our U.S. dollar-denominated cash position.

Due to the deconsolidation of Coca-Cola FEMSA de Venezuela, no monetary position in hyperinflationary subsidiaries was recorded in the first six months of 2018. Nevertheless, with the reporting of Argentina as of July 1, 2018, a gain of Ps. 117 million was recorded in monetary position in hyperinflationary subsidiaries, compared to a gain of Ps. 2,163 million related to Venezuela for the first nine months of 2017.

Market value on financial instruments recorded a loss of Ps. 246 million, compared to a gain of Ps. 556 million in the first nine months of 2017, due to the decrease in long-term interest rates in Brazil as applied to our fixed rate cross-currency swaps, during the period.

Income tax:

During the first nine months of 2018, reported income tax as a percentage of income before taxes was 31.2%, compared to 20.7% in the same period of 2017. The lower tax rate in the first nine months of 2017 was driven mainly by deferred taxes in Venezuela.

Net income:

Consolidated net controlling interest income decreased 19.9% to Ps. 8,201.0 million in the first nine months of 2018, resulting in earnings per share (EPS) of Ps. 3.90 (Ps. 39.04 per ADS), driven mainly by a non-cash gain on monetary position in inflationary subsidiaries generated by Venezuela during the comparable period of 2017.

Operating cash flow:

Operating cash flow decreased 5.2% to Ps. 24,909.3 million, and operating cash flow margin contracted 10 basis points to 19.1%.

|

Result from discontinued operations

|

On August 16, 2018, KOF announced the exercise of the put option to sell its 51% stake in Coca-Cola FEMSA Philippines, Inc. Therefore, the Philippines is presented as a discontinued operation as of January 1, 2018, and the consolidated income statements presented herein are re-presented as if the Philippines had been discontinued from February 2017, date of the consolidation of said operation.

During the first nine months of 2018, the result of discontinued operations reached Ps. 576 million as compared to Ps. 700 million in the same period of the previous year. This decrease was driven mainly by an increase in the cost of goods related to (i) the implementation of the excise tax, (ii) sugar scarcity, and (iii) higher PET prices; partially offset by operational efficiencies.

|

Press Release 3Q 2018

October 25, 2018

|

Page 8

|

·

On August 16, 2018, Coca-Cola FEMSA announced that it has notified The Coca-Cola Company, the exercise of KOF’s put option to sell its 51% stake in Coca-Cola FEMSA Philippines, Inc.

·

On October 1, 2018, Coca-Cola FEMSA remained the only Latin American beverage company included in the Dow Jones Sustainability Emerging Markets Index for the sixth consecutive year. It was also included in the Dow Jones Sustainability MILA Pacific Alliance Index for the second consecutive year.

·

On November 1, 2018, Coca-Cola FEMSA will pay the second installment of the 2017 dividend in the amount of Ps. 1.67 per share.

In an effort to provide our readers with a more useful representation of our company's underlying financial and operating performance, we are including the term “Comparable.” This means, with respect to a year-over-year comparison, the change of a given measure excluding the effects of: (i) mergers, acquisitions, and divestitures: acquisitions made in Guatemala and Uruguay as of May and July 2018, respectively; (ii) translation effects resulting from exchange rate movements; and (iii) the results of hyperinflationary subsidiaries in both periods: Venezuela’s results from 2017 and Argentina’s results from 2018 and 2017. In preparing this measure, management has used its best judgment, estimates, and assumptions in order to maintain comparability.

|

Conference Call Information

|

Our third quarter 2018 conference call will be held on October 25, 2018, at 12:00 P.M. Eastern Time (11:00 A.M. Mexico City Time). To participate in the conference call, please dial: Domestic U.S.: 800-289-0438 or International: +1 323-794-2423. Participant code: 7189300. We invite investors to listen to the live audio cast of the conference call on the Company’s website, www.coca-colafemsa.com. If you are unable to participate live, the conference call audio will be available at www.coca-colafemsa.com

|

Mexican Stock Exchange Quarterly Filing

|

Coca-Cola FEMSA encourages the reader to refer to our quarterly filing to the Mexican Stock Exchange (

Bolsa Mexicana de Valores

or BMV) for more detailed information. This filing contains a detailed cash flow statement and selected notes to the financial statements, including segment information. This filing is available at www.bmv.com.mx in the

Información Financiera

section for Coca-Cola FEMSA (KOF) and on our corporate website at www.coca-colafemsa.com/inversionistas/registros-bmv.

|

Press Release 3Q 2018

October 25, 2018

|

Page 9

|

This news release may contain forward-looking statements concerning Coca-Cola FEMSA’s future performance, which should be considered as good faith estimates by Coca-Cola FEMSA. These forward-looking statements reflect management’s expectations and are based upon currently available data. Actual results are subject to future events and uncertainties, many of which are outside Coca-Cola FEMSA’s control, which could materially impact the Company’s actual performance. References herein to “US$” are to United States dollars. This news release contains translations of certain Mexican peso amounts into U.S. dollars for the convenience of the reader. These translations should not be construed as representations that Mexican peso amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated.

All of the financial information presented in this report was prepared under International Financial Reporting Standards (IFRS).

Earnings per share were computed based on 2,100.8 million shares (each ADS represents 10 local shares).

For reporting purposes, all corporate expenses, including the equity method recorded from our stake of the results of Coca-Cola FEMSA Philippines, Inc., were included in the results of the Mexico and Central America division. Starting on February 2013 and ending on January 2017, we incorporated our stake of the results of Coca-Cola FEMSA Philippines, Inc. through the equity method.

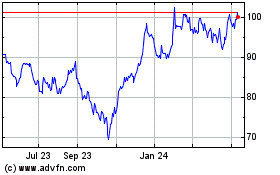

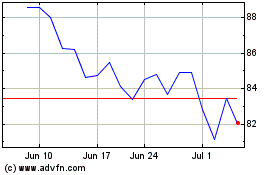

Stock listing information: Mexican Stock Exchange, Ticker: KOFL | NYSE (ADR), Ticker: KOF | Ratio of KOF L to KOF = 10:1

Coca-Cola FEMSA, S.A.B. de C.V. is the largest franchise bottler in the world by sales volume. The Company produces and distributes trademark beverages of The Coca-Cola Company, offering a wide portfolio of 169 brands to more than 396 million consumers daily. With over 100 thousand employees, the Company markets and sells approximately 4 billion unit cases through 2.8 million points of sale a year. Operating 67 manufacturing plants and 344 distribution centers, Coca-Cola FEMSA is committed to generating economic, social, and environmental value for all of its stakeholders across the value chain. The Company is a member of the Dow Jones Sustainability Emerging Markets Index, Dow Jones Sustainability MILA Pacific Alliance Index, FTSE4Good Emerging Index, and the Mexican Stock Exchange’s IPC and Social Responsibility and Sustainability Indices, among others. Its operations encompass franchise territories in Mexico, Guatemala, Colombia, Brazil, and Argentina, and, nationwide, in Nicaragua, Costa Rica, Panama, Uruguay, Venezuela and the Philippines. For further information, please visit www.coca-colafemsa.com

For additional information or inquiries, contact the Investor Relations team:

·

Maria Dyla Castro | mariadyla.castro@kof.com.mx

·

Jorge Collazo |

jorge.collazo@kof.com.mx

·

Maria Fernanda Garcia | maria.garciacr@kof.com.mx

(8 pages of tables to follow)

|

Press Release 3Q 2018

October 25, 2018

|

Page 10

|

|

Quarter - Consolidated Income Statement

|

|

|

|

|

|

|

|

|

|

|

Expressed in millions of Mexican pesos

(1)

|

|

|

|

|

|

|

|

|

|

|

|

3Q 18

|

% Rev

|

|

3Q 17 Re-presented

(2)

|

% Rev

|

|

D %

Reported

|

|

D %

Comparable

(9)

|

|

Transactions (million transactions)

|

4,973.1

|

|

|

4,866.0

|

|

|

2.2%

|

|

2.0%

|

|

Volume (million unit cases)

(3)

|

839.2

|

|

|

821.4

|

|

|

2.2%

|

|

2.5%

|

|

Average price per unit case

(3)

|

48.95

|

|

|

50.63

|

|

|

-3.3%

|

|

|

|

Net revenues

|

44,012

|

|

|

44,353

|

|

|

-0.8%

|

|

|

|

Other operating revenues

|

136

|

|

|

112

|

|

|

22.0%

|

|

|

|

Total revenues

(4)

|

44,148

|

100.0%

|

|

44,464

|

100.0%

|

|

-0.7%

|

|

6.5%

|

|

Cost of goods sold

|

23,911

|

54.2%

|

|

24,358

|

54.8%

|

|

-1.8%

|

|

|

|

Gross profit

|

20,237

|

45.8%

|

|

20,107

|

45.2%

|

|

0.6%

|

|

5.8%

|

|

Operating expenses

|

14,256

|

32.3%

|

|

14,535

|

32.7%

|

|

-1.9%

|

|

|

|

Other operating expenses, net

|

118

|

0.3%

|

|

224

|

0.5%

|

|

-47.1%

|

|

|

|

Operating equity method (gain) loss in associates

(5)

|

85

|

0.2%

|

|

6

|

0.0%

|

|

1332.9%

|

|

|

|

Operating income

(6)

|

5,777

|

13.1%

|

|

5,341

|

12.0%

|

|

8.2%

|

|

5.5%

|

|

Other non operating expenses, net

|

95

|

|

|

597

|

|

|

-84.0%

|

|

|

|

Non Operating equity method (gain) loss in associates

(7)

|

(34)

|

|

|

(40)

|

|

|

-14.6%

|

|

|

|

Interest expense

|

1,834

|

|

|

2,182

|

|

|

-16.0%

|

|

|

|

Interest income

|

276

|

|

|

253

|

|

|

9.2%

|

|

|

|

Interest expense, net

|

1,558

|

|

|

1,929

|

|

|

-19.3%

|

|

|

|

Foreign exchange loss (gain)

|

(60)

|

|

|

(84)

|

|

|

-28.2%

|

|

|

|

Loss (gain) on monetary position in inflationary subsidiaries

|

(117)

|

|

|

(1,301)

|

|

|

-91.0%

|

|

|

|

Market value (gain) loss on financial instruments

|

(59)

|

|

|

(203)

|

|

|

-71.0%

|

|

|

|

Comprehensive financing result

|

1,322

|

|

|

341

|

|

|

287.9%

|

|

|

|

Income before taxes

|

4,394

|

|

|

4,443

|

|

|

-1.1%

|

|

|

|

Income taxes

|

1,382

|

|

|

1,119

|

|

|

23.4%

|

|

|

|

Result from discontinued operations

|

410

|

|

|

15

|

|

|

2660.1%

|

|

|

|

Consolidated net income

|

3,422

|

|

|

3,339

|

|

|

2.5%

|

|

|

|

Net income attributable to equity holders of the company

|

3,266

|

7.4%

|

|

3,152

|

7.1%

|

|

3.6%

|

|

|

|

Non-controlling interest

|

156

|

0.4%

|

|

186

|

0.4%

|

|

-16.4%

|

|

|

|

Operating income

(6)

|

5,777

|

13.1%

|

|

5,341

|

12.0%

|

|

8.2%

|

|

|

|

Depreciation

|

2,190

|

|

|

2,322

|

|

|

-5.7%

|

|

|

|

Amortization and other operating non-cash charges

|

524

|

|

|

932

|

|

|

-43.8%

|

|

|

|

Operating cash flow

(6)(8)

|

8,492

|

19.2%

|

|

8,596

|

19.3%

|

|

-1.2%

|

|

6.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

CAPEX

|

3,103

|

|

|

2,923

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Except volume and average price per unit case figures.

(2) 2017 financial information is re-presented as if the Philippines had been discontinued from February 2017, date of the consolidation of said operation.

(3) Sales volume and average price per unit case exclude beer results.

(4) Please refer to page 16 for revenue breakdown.

(5) Includes equity method in Jugos del Valle, Leao Alimentos, Estrella Azul, among others.

(6) The operating income and operating cash flow lines are presented as non-gaap measures for the convenience of the reader.

(7) Includes equity method in PIASA, IEQSA, Beta San Miguel, IMER and KSP Participacoes among others.

(8) Operating cash flow = operating income + depreciation, amortization & other operating non-cash charges.

(9) Please refer to page 9 for our definition of “comparable” and a description of the factors affecting the comparability of our financial and operating performance.

|

|

|

|

Press Release 3Q 2018

October 25, 2018

|

Page 11

|

|

YTD - Consolidated Income Statement

|

|

|

|

|

|

|

|

|

|

|

Expressed in millions of Mexican pesos

(1)

|

|

|

|

|

|

|

|

|

|

|

|

YTD 2018

|

% Rev

|

|

YTD 2017

Re-presented

(2)

|

% Rev

|

|

D %

Reported

|

|

D %

Comparable

(9)

|

|

Transactions (million transactions)

|

14,539.0

|

|

|

14,472.8

|

|

|

0.5%

|

|

1.4%

|

|

Volume (million unit cases)

(3)

|

2,450.1

|

|

|

2,444.9

|

|

|

0.2%

|

|

1.4%

|

|

Average price per unit case

(3)

|

49.34

|

|

|

52.39

|

|

|

-5.8%

|

|

|

|

Net revenues

|

130,252

|

|

|

136,775

|

|

|

-4.8%

|

|

|

|

Other operating revenues

|

325

|

|

|

266

|

|

|

22.1%

|

|

|

|

Total revenues

(4)

|

130,577

|

100.0%

|

|

137,041

|

100.0%

|

|

-4.7%

|

|

5.2%

|

|

Cost of goods sold

|

70,427

|

53.9%

|

|

75,592

|

55.2%

|

|

-6.8%

|

|

|

|

Gross profit

|

60,150

|

46.1%

|

|

61,449

|

44.8%

|

|

-2.1%

|

|

5.4%

|

|

Operating expenses

|

42,225

|

32.3%

|

|

44,695

|

32.6%

|

|

-5.5%

|

|

|

|

Other operating expenses, net

|

621

|

0.5%

|

|

(71)

|

-0.1%

|

|

NA

|

|

|

|

Operating equity method (gain) loss in associates

(5)

|

201

|

0.2%

|

|

(5)

|

-0.0%

|

|

NA

|

|

|

|

Operating income

(6)

|

17,103

|

13.1%

|

|

16,830

|

12.3%

|

|

1.6%

|

|

-0.4%

|

|

Other non operating expenses, net

|

216

|

|

|

707

|

|

|

-69.5%

|

|

|

|

Non Operating equity method (gain) loss in associates

(7)

|

(40)

|

|

|

(66)

|

|

|

-38.9%

|

|

|

|

Interest expense

|

5,461

|

|

|

6,840

|

|

|

-20.2%

|

|

|

|

Interest income

|

702

|

|

|

583

|

|

|

20.4%

|

|

|

|

Interest expense, net

|

4,759

|

|

|

6,258

|

|

|

-24.0%

|

|

|

|

Foreign exchange loss (gain)

|

(51)

|

|

|

(268)

|

|

|

-80.8%

|

|

|

|

Loss (gain) on monetary position in inflationary subsidiaries

|

(117)

|

|

|

(2,163)

|

|

|

-94.6%

|

|

|

|

Market value (gain) loss on financial instruments

|

246

|

|

|

(556)

|

|

|

NA

|

|

|

|

Comprehensive financing result

|

4,837

|

|

|

3,271

|

|

|

47.9%

|

|

|

|

Income before taxes

|

12,091

|

|

|

12,918

|

|

|

-6.4%

|

|

|

|

Income taxes

|

3,773

|

|

|

2,671

|

|

|

41.2%

|

|

|

|

Result from discontinued operations

|

576

|

|

|

700

|

|

|

-17.7%

|

|

|

|

Consolidated net income

|

8,894

|

|

|

10,947

|

|

|

-18.8%

|

|

|

|

Net income attributable to equity holders of the company

|

8,201

|

6.3%

|

|

10,233

|

7.5%

|

|

-19.9%

|

|

|

|

Non-controlling interest

|

693

|

0.5%

|

|

714

|

0.5%

|

|

-3.0%

|

|

|

|

Operating income

(6)

|

17,103

|

13.1%

|

|

16,830

|

12.3%

|

|

1.6%

|

|

|

|

Depreciation

|

6,178

|

|

|

6,647

|

|

|

-7.0%

|

|

|

|

Amortization and other operating non-cash charges

|

1,627

|

|

|

2,795

|

|

|

-41.8%

|

|

|

|

Operating cash flow

(6)(8)

|

24,909

|

19.1%

|

|

26,272

|

19.2%

|

|

-5.2%

|

|

3.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

CAPEX

|

7,120

|

|

|

8,485

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Except volume and average price per unit case figures.

(2) 2017 financial information is re-presented as if the Philippines had been discontinued from February 2017, date of the consolidation of said operation.

(3) Sales volume and average price per unit case exclude beer results.

(4) Please refer to page 17 for revenue breakdown.

(5) Includes equity method in Jugos del Valle, Leao Alimentos, Estrella Azul, among others. For January '17 includes Coca-Cola FEMSA Philippines, Inc.

(6) The operating income and operating cash flow lines are presented as non-gaap measures for the convenience of the reader.

(7) Includes equity method in PIASA, IEQSA, Beta San Miguel, IMER and KSP Participacoes among others.

(8) Operating cash flow = operating income + depreciation, amortization & other operating non-cash charges.

(9) Please refer to page 9 for our definition of “comparable” and a description of the factors affecting the comparability of our financial and operating performance.

|

|

Press Release 3Q 2018

October 25, 2018

|

Page 12

|

|

Mexico & Central America Division

|

|

|

|

|

|

|

|

|

|

|

Expressed in millions of Mexican pesos

(1)

|

|

|

|

|

|

|

|

|

|

|

Quarterly information

|

|

|

|

|

|

|

|

|

|

|

|

3Q 18

|

% Rev

|

|

3Q 17

|

% Rev

|

|

D %

Reported

|

|

D %

Comparable

(6)

|

|

Transactions (million transactions)

|

2,953.8

|

|

|

2,789.9

|

|

|

5.9%

|

|

1.7%

|

|

Volume (million unit cases)

|

534.1

|

|

|

506.1

|

|

|

5.5%

|

|

2.8%

|

|

Average price per unit case

|

48.78

|

|

|

45.89

|

|

|

6.3%

|

|

|

|

Net revenues

|

26,056

|

|

|

23,223

|

|

|

|

|

|

|

Other operating revenues

|

13

|

|

|

15

|

|

|

|

|

|

|

Total revenues

(2)

|

26,069

|

100.0%

|

|

23,239

|

100.0%

|

|

12.2%

|

|

7.3%

|

|

Cost of goods sold

|

13,503

|

51.8%

|

|

11,942

|

51.4%

|

|

|

|

|

|

Gross profit

|

12,566

|

48.2%

|

|

11,297

|

48.6%

|

|

11.2%

|

|

6.6%

|

|

Operating expenses

|

8,748

|

33.6%

|

|

7,652

|

32.9%

|

|

|

|

|

|

Other operating expenses, net

|

(31)

|

-0.1%

|

|

57

|

0.2%

|

|

|

|

|

|

Operating equity method (gain) loss in associates

(3)

|

99

|

0.4%

|

|

48

|

0.2%

|

|

|

|

|

|

Operating income

(4)

|

3,750

|

14.4%

|

|

3,540

|

15.2%

|

|

5.9%

|

|

3.9%

|

|

Depreciation, amortization & other operating non-cash charges

|

1,653

|

6.3%

|

|

1,475

|

6.3%

|

|

|

|

|

|

Operating cash flow

(4)(5)

|

5,402

|

20.7%

|

|

5,015

|

21.6%

|

|

7.7%

|

|

4.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated information

|

|

|

|

|

|

|

|

|

|

|

|

YTD 2018

|

% Rev

|

|

YTD 2017

|

% Rev

|

|

D

%

Reported

|

|

D

%

Comparable

(6)

|

|

Transactions (million transactions)

|

8,700.0

|

|

|

8,467.8

|

|

|

2.7%

|

|

0.4%

|

|

Volume (million unit cases)

|

1,561.2

|

|

|

1,522.8

|

|

|

2.5%

|

|

1.0%

|

|

Average price per unit case

|

47.85

|

|

|

45.45

|

|

|

5.3%

|

|

|

|

Net revenues

|

74,708

|

|

|

69,218

|

|

|

|

|

|

|

Other operating revenues

|

30

|

|

|

41

|

|

|

|

|

|

|

Total revenues

(2)

|

74,738

|

100.0%

|

|

69,259

|

100.0%

|

|

7.9%

|

|

5.6%

|

|

Cost of goods sold

|

38,808

|

51.9%

|

|

35,375

|

51.1%

|

|

|

|

|

|

Gross profit

|

35,930

|

48.1%

|

|

33,883

|

48.9%

|

|

6.0%

|

|

3.8%

|

|

Operating expenses

|

25,334

|

33.9%

|

|

23,051

|

33.3%

|

|

|

|

|

|

Other operating expenses, net

|

141

|

0.2%

|

|

(36)

|

-0.1%

|

|

|

|

|

|

Operating equity method (gain) loss in associates

(3)

|

243

|

0.3%

|

|

94

|

0.1%

|

|

|

|

|

|

Operating income

(4)

|

10,212

|

13.7%

|

|

10,774

|

15.6%

|

|

-5.2%

|

|

-6.5%

|

|

Depreciation, amortization & other operating non-cash charges

|

4,900

|

6.6%

|

|

4,117

|

5.9%

|

|

|

|

|

|

Operating cash flow

(4)(5)

|

15,112

|

20.2%

|

|

14,890

|

21.5%

|

|

1.5%

|

|

-0.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Except volume and average price per unit case figures.

(2) Please refer to pages 16 and 17 for revenue breakdown.

(3) Includes equity method in Jugos del Valle, Estrella Azul, among others. For January '17 includes Coca-Cola FEMSA Philippines, Inc.

(4) The operating income and operating cash flow lines are presented as non-gaap measures for the convenience of the reader.

(5) Operating cash flow = operating income + depreciation, amortization & other operating non-cash charges.

(6) Please refer to page 9 for our definition of “comparable” and a description of the factors affecting the comparability of our financial and operating performance.

|

|

Press Release 3Q 2018

October 25, 2018

|

Page 13

|

|

South America Division

|

|

|

|

|

|

|

|

|

|

|

Expressed in millions of Mexican pesos

(1)

|

|

|

|

|

|

|

|

|

|

|

Quarterly information

|

|

|

|

|

|

|

|

|

|

|

|

3Q 18

|

% Rev

|

|

3Q 17

|

% Rev

|

|

D %

Reported

|

|

D %

Comparable

(7)

|

|

Transactions (million transactions)

|

2,019.3

|

|

|

2,016.7

|

|

|

-2.7%

|

|

2.5%

|

|

Volume (million unit cases)

(2)

|

305.1

|

|

|

316.1

|

|

|

-3.2%

|

|

1.8%

|

|

Average price per unit case

(2)

|

49.25

|

|

|

58.24

|

|

|

-15.4%

|

|

|

|

Net revenues

|

17,955

|

|

|

21,129

|

|

|

|

|

|

|

Other operating revenues

|

124

|

|

|

96

|

|

|

|

|

|

|

Total revenues

(3)

|

18,079

|

100.0%

|

|

21,226

|

100.0%

|

|

-14.8%

|

|

5.1%

|

|

Cost of goods sold

|

10,408

|

57.6%

|

|

12,416

|

58.5%

|

|

|

|

|

|

Gross profit

|

7,671

|

42.4%

|

|

8,810

|

41.5%

|

|

-12.9%

|

|

4.4%

|

|

Operating expenses

|

5,507

|

30.5%

|

|

6,883

|

32.4%

|

|

|

|

|

|

Other operating expenses, net

|

150

|

0.8%

|

|

167

|

0.8%

|

|

|

|

|

|

Operating equity method (gain) loss in associates

(4)

|

(14)

|

-0.1%

|

|

(42)

|

-0.2%

|

|

|

|

|

|

Operating income

(5)

|

2,028

|

11.2%

|

|

1,801

|

8.5%

|

|

12.6%

|

|

8.7%

|

|

Depreciation, amortization & other operating non-cash charges

|

1,062

|

5.9%

|

|

1,779

|

8.4%

|

|

|

|

|

|

Operating cash flow

(5)(6)

|

3,090

|

17.1%

|

|

3,580

|

16.9%

|

|

-13.7%

|

|

9.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated information

|

|

|

|

|

|

|

|

|

|

|

|

YTD 2018

|

% Rev

|

|

YTD 2017

|

% Rev

|

|

D

%

Reported

|

|

D

%

Comparable

(7)

|

|

Transactions (million transactions)

|

5,838.9

|

|

|

6,005.0

|

|

|

-2.8%

|

|

2.9%

|

|

Volume (million unit cases)

(2)

|

888.9

|

|

|

922.1

|

|

|

-3.6%

|

|

2.2%

|

|

Average price per unit case

(2)

|

51.96

|

|

|

63.84

|

|

|

-18.6%

|

|

|

|

Net revenues

|

55,544

|

|

|

67,557

|

|

|

|

|

|

|

Other operating revenues

|

295

|

|

|

226

|

|

|

|

|

|

|

Total revenues

(3)

|

55,839

|

100.0%

|

|

67,783

|

100.0%

|

|

-17.6%

|

|

4.7%

|

|

Cost of goods sold

|

31,619

|

56.6%

|

|

40,217

|

59.3%

|

|

|

|

|

|

Gross profit

|

24,220

|

43.4%

|

|

27,566

|

40.7%

|

|

-12.1%

|

|

8.3%

|

|

Operating expenses

|

16,891

|

30.3%

|

|

21,644

|

31.9%

|

|

|

|

|

|

Other operating expenses, net

|

480

|

0.9%

|

|

(35)

|

-0.1%

|

|

|

|

|

|

Operating equity method (gain) loss in associates

(4)

|

(42)

|

-0.1%

|

|

(99)

|

-0.1%

|

|

|

|

|

|

Operating income

(5)

|

6,891

|

12.3%

|

|

6,057

|

8.9%

|

|

13.8%

|

|

11.7%

|

|

Depreciation, amortization & other operating non-cash charges

|

2,906

|

5.2%

|

|

5,325

|

7.9%

|

|

|

|

|

|

Operating cash flow

(5)(6)

|

9,797

|

17.5%

|

|

11,382

|

16.8%

|

|

-13.9%

|

|

11.4%

|

|

|

|

(1) Except volume and average price per unit case figures.

(2) Sales volume and average price per unit case exclude beer results.

(3) Please refer to pages 16 and 17 for revenue breakdown.

(4) Includes equity method in Leao Alimentos, Verde Campo, among others.

(5) The operating income and operating cash flow lines are presented as non-gaap measures for the convenience of the reader.

(6) Operating cash flow = operating income + depreciation, amortization & other operating non-cash charges.

(7) Please refer to page 9 for our definition of “comparable” and a description of the factors affecting the comparability of our financial and operating performance.

|

|

Press Release 3Q 2018

October 25, 2018

|

Page 14

|

|

Consolidated Balance Sheet

|

|

|

|

|

|

Expressed in millions of Mexican pesos.

|

|

|

|

|

|

|

|

Sep-18

(1)

|

|

Dec-17

(2)

|

|

Assets

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

Cash, cash equivalents and marketable securities

|

Ps.

|

18,475

|

Ps.

|

18,767

|

|

Total accounts receivable

|

|

12,605

|

|

17,576

|

|

Inventories

|

|

10,299

|

|

11,364

|

|

Assets available for sale

|

|

28,571

|

|

-

|

|

Other current assets

|

|

8,936

|

|

7,950

|

|

Total current assets

|

|

78,886

|

|

55,657

|

|

Property, plant and equipment

|

|

|

|

|

|

Property, plant and equipment

|

|

100,436

|

|

121,968

|

|

Accumulated depreciation

|

|

(42,106)

|

|

(46,141)

|

|

Total property, plant and equipment, net

|

|

58,330

|

|

75,827

|

|

Investment in shares

|

|

10,841

|

|

12,540

|

|

Intangibles assets and other assets

|

|

113,513

|

|

124,243

|

|

Other non-current assets

|

|

17,234

|

|

17,410

|

|

Total Assets

|

Ps.

|

278,804

|

Ps.

|

285,677

|

|

|

|

|

|

|

|

Liabilities and Equity

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

Short-term bank loans and notes payable

|

Ps.

|

10,121

|

Ps.

|

12,171

|

|

Liabilities available for sale

|

|

8,515

|

|

-

|

|

Suppliers

|

|

15,609

|

|

19,956

|

|

Other current liabilities

|

|

17,764

|

|

23,467

|

|

Total current liabilities

|

|

52,009

|

|

55,595

|

|

Long-term bank loans and notes payable

|

|

79,840

|

|

71,189

|

|

Other long-term liabilities

|

|

15,835

|

|

18,184

|

|

Total liabilities

|

|

147,685

|

|

144,968

|

|

Equity

|

|

|

|

|

|

Non-controlling interest

|

|

15,929

|

|

18,141

|

|

Total controlling interest

|

|

115,190

|

|

122,568

|

|

Total equity

|

|

131,119

|

|

140,709

|

|

Total Liabilities and Equity

|

Ps.

|

278,804

|

Ps.

|

285,677

|

(1)

The Philippines is classified as available-for-sale.

(2)

Information for 2017 is presented as reported.

|

Press Release 3Q 2018

October 25, 2018

|

Page 15

|

|

Quarter - Volume, Transactions & Revenues

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended on September 30, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

Volume

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expressed in million unit cases

|

3Q 2018

|

|

3Q 2017

(3)

|

|

YoY

|

|

Sparkling

|

Water

(1)

|

Bulk

(2)

|

Stills

|

Total

|

|

Sparkling

|

Water

(1)

|

Bulk

(2)

|

Stills

|

Total

|

|

D%

|

|

Mexico

|

349.1

|

25.9

|

72.0

|

30.6

|

477.6

|

|

340.0

|

23.6

|

73.3

|

27.4

|

464.3

|

|

2.9%

|

|

Central America

|

48.5

|

2.7

|

0.1

|

5.2

|

56.6

|

|

34.4

|

2.5

|

0.1

|

4.9

|

41.9

|

|

35.2%

|

|

Mexico and Central America

|

397.6

|

28.6

|

72.1

|

35.8

|

534.1

|

|

374.4

|

26.1

|

73.4

|

32.2

|

506.1

|

|

5.5%

|

|

Colombia

|

53.3

|

8.0

|

3.7

|

4.4

|

69.5

|

|

51.2

|

6.0

|

5.0

|

5.7

|

67.9

|

|

2.3%

|

|

Venezuela

|

-

|

-

|

-

|

-

|

-

|

|

16.2

|

1.8

|

0.2

|

0.6

|

18.8

|

|

-

|

|

Brazil

|

164.3

|

10.2

|

1.6

|

8.8

|

184.9

|

|

161.8

|

9.4

|

1.5

|

9.2

|

181.9

|

|

1.6%

|

|

Argentina

|

34.1

|

3.9

|

0.9

|

2.5

|

41.4

|

|

37.6

|

4.6

|

0.9

|

3.5

|

46.6

|

|

-11.3%

|

|

Uruguay

|

8.7

|

0.6

|

0.0

|

0.0

|

9.4

|

|

-

|

-

|

-

|

-

|

-

|

|

-

|

|

South America

|

260.4

|

22.7

|

6.2

|

15.8

|

305.1

|

|

266.8

|

21.8

|

7.6

|

19.1

|

315.3

|

|

-3.2%

|

|

Total

|

658.0

|

51.3

|

78.3

|

51.6

|

839.2

|

|

641.2

|

47.9

|

81.0

|

51.3

|

821.4

|

|

2.2%

|

|

(1)

Excludes water presentations larger than 5.0 Lt ; includes flavored water

|

|

|

|

|

|

|

|

|

|

|

|

(2)

Bulk Water = Still bottled water in 5.0, 19.0 and 20.0 - liter packaging presentations; includes flavored water

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expressed in million of transactions

|

3Q 2018

|

|

3Q 2017

(3)

|

|