U.S. Stocks Dive on Earnings Outlooks, Worries About Global Growth

October 23 2018 - 11:19AM

Dow Jones News

By David Hodari and Akane Otani

Stocks sold off sharply Tuesday as worries about global economic

growth and downbeat earnings outlooks from bellwether U.S. firms

rippled across markets from New York to China.

The Dow Jones Industrial Average slid 497 points, or 2%, to

25820, moving closer to erasing all of its gains for the year. The

S&P 500 fell 2.2%, while the Nasdaq Composite shed 2.6% and was

on track to close in correction territory--or more than 10% off its

August record.

Investors began the day grappling with a fresh set of worries

about the global economy. Major indexes in Shanghai, Japan and Hong

Kong tumbled after Chinese officials moved to ramp up financing for

private firms, the latest step they have taken to try to stabilize

the country's financial markets and reverse a slowdown of

growth.

Tepid outlooks from industrial giants 3M and Caterpillar added

to the dark mood Tuesday. 3M lowered its earnings forecast for the

year, while Caterpillar said it would have to raise prices for most

of its machines and engines next year to offset rising materials

costs, as well as tariffs.

Altogether, investors were left with an increasingly muted

outlook for the global economy, which has shown signs of sputtering

this year after a synchronized expansion last year drove stocks

around the world higher. The International Monetary Fund, citing

headwinds from protectionist trade policies and instability in

emerging markets, earlier in October cut its forecasts for global

economic growth for 2018 and 2019.

Even the U.S., which many investors have regarded with more

optimism, has shown signs of faltering. Data have shown some

weakness in the housing and auto markets, and a report Friday is

expected to show economic growth moderating in the third

quarter.

Investors have a "glass half-empty" approach to the current

earnings seasons, according to Ronan Carr, equities strategist at

Bank of America Merrill Lynch. "Globally, results haven't been bad,

but the companies that miss are getting hammered and even the ones

that beat expectations have been underperforming in the 24 hours

after publishing."

As stocks around the world reared back, investors poured money

into government bonds and other assets that tend to perform well

during volatile stretches.

The yield on the benchmark 10-year U.S. Treasury note was at

3.120%, down from 3.196% Monday. Yields fall as bond prices rise.

Gold jumped 0.9% to $1,235.60 a troy ounce, while the Japanese yen

rose 0.6% against the U.S. dollar.

Technology shares resumed a recent slide. Shares of fast-growing

companies disrupting industries ranging from communications to

entertainment had powered much of the stock market's gains in the

first half of the year. Yet in recent months, investors have

increasingly questioned whether the rally had left shares

overextended.

That has sent shares of a range of technology-driven firms

tumbling, with Apple down 2.2%, Netflix down 3.3%, Alphabet off

2.5% and Amazon.com losing 3.5% on Tuesday.

The tech rout also hit Europe, where Austrian semiconductor

manufacturer AMS's earnings disappointed investors. The Stoxx

Europe 600 fell 1.7%, with its tech sector off 3.9%.

Downbeat European trading followed heavy selling in

Asia-Pacific, where investors reversed the broader market rally

that came on Friday and Monday amid anxieties about Chinese

economic growth.

The Shanghai Composite Index and the Shenzhen A Share closed

down 2.3% and 1.9% respectively. Sinking financial stocks dragged

Hong Kong's Hang Seng down 3.1%. Indexes across the rest of the

region suffered heavy losses, with the main benchmarks in Japan,

South Korea and Taiwan slumping 2% or more.

The steep fall in Chinese stocks marked a U-turn from the

Shanghai index's sharpest two-day rise since 2015, which came as

investors parsed reassuring comments by key government and central

bank officials about the health of Chinese economic growth.

Coming after government proposals to cut income tax, analysts

are uncertain whether such moves will prevent Chinese growth from

decelerating further.

"We're asking whether China is doing stimulus by a thousand

cuts, but I'm still very skeptical," said Ian Samson, markets

research analyst at Fidelity International. "The ongoing slowdown

is quite natural, but it will continue to weigh on global

growth."

Write to David Hodari at David.Hodari@dowjones.com and Akane

Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

October 23, 2018 11:04 ET (15:04 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

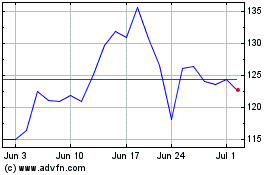

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024