Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on October 22, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ANGI Homeservices Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

82-1204801

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

14023 Denver West Parkway

Building 64

Golden, CO 80401

(303) 963-7200

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

ANGI Homeservices Inc.

General Counsel

c/o IAC/InterActiveCorp

555 West 18th Street

New York, NY 10011

Telephone: (212) 314-7300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Brandon Van Dyke

Dwight S. Yoo

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New York, NY 10036

Telephone: (212) 735-3000

Facsimile: (212) 735-2000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box.

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

ý

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an

emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

(Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

o

|

|

Accelerated filer

o

|

|

Non-accelerated filer

ý

|

|

Smaller reporting company

o

Emerging growth company

ý

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

ý

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed Maximum

Offering Price Per

Share(2)

|

|

Proposed Maximum

Aggregate Offering

Price(2)

|

|

Amount of

Registration Fee

|

|

|

|

Class A Common Stock, par value $0.001 per share

|

|

7,482,167

|

|

$19.12

|

|

$143,059,033.04

|

|

$17,338.76

|

|

|

-

(1)

-

The

shares of Class A Common Stock, par value $0.001 per share ("Class A Common Stock"), will be offered for resale by the selling stockholders

pursuant to the prospectus contained herein. Pursuant to Rule 416 under the Securities Act of 1933, as amended (the "Securities Act"), this registration statement also covers any additional

securities that may be offered or issued in connection with any stock split, stock dividend or similar transaction.

-

(2)

-

Calculated

pursuant to Rule 457(c) under the Securities Act based on the average of the high and low prices of the Class A Common Stock as reported on

the Nasdaq Global Select Market on October 15, 2018.

Table of Contents

Prospectus

ANGI Homeservices Inc.

7,482,167 Shares of Class A Common Stock

This prospectus relates to the offer and sale from time to time by the selling stockholders named in this prospectus of up to

7,482,167 shares of our Class A Common Stock, par value $0.001 per share. We are registering the offer and sale of these shares of Class A Common Stock to satisfy our obligations

pursuant to a registration rights agreement, dated October 19, 2018, among us and the selling stockholders. See "Selling Stockholders." The registration of these shares of Class A Common

Stock does not necessarily mean that any of the shares of Class A Common Stock will be offered or sold by the selling stockholders. We will not receive any proceeds from the sale of the shares

of Class A Common Stock by the selling stockholders.

The

selling stockholders may sell the shares of Class A Common Stock described in this prospectus through public or private transactions at fixed prices, at prevailing market

prices at the time of the sale, at prices related to such prevailing market prices, at varying prices determined at the time of sale or at negotiated prices. See "Plan of Distribution."

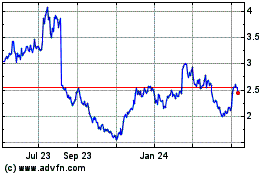

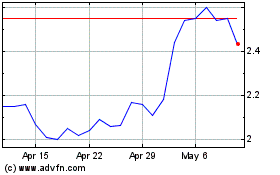

Our

Class A Common Stock is listed on The Nasdaq Global Select Market ("Nasdaq") under the trading symbol "ANGI." On October 19, 2018, the last reported sales price of our

Class A Common Stock was $19.31 per share.

Investing in our Class A Common Stock involves a number of risks. You should read the section entitled "Risk Factors" beginning on

page 4 of this prospectus before buying our Class A Common Stock. Information regarding risks involved when investing in our Class A Common Stock are also included in documents

incorporated by reference into this prospectus and may also be included in any prospectus supplement(s) and/or documents incorporated by reference therein.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

shares of Class A Common Stock or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is October 22, 2018

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the "SEC") as a "well-known

seasoned issuer" (as defined in Rule 405 under the Securities Act). Under the shelf registration rules, using this prospectus and, if required, one or more prospectus supplements, the selling

stockholders identified in this prospectus may sell, from time to time, the shares of Class A Common Stock covered by this prospectus in one or more offerings. See "Plan of Distribution."

We

may provide a prospectus supplement containing specific information about the terms of a particular offering by any of the selling stockholders. The prospectus supplement may also

add, update or change information contained in this prospectus. If the information in this prospectus is inconsistent with a prospectus supplement, you should rely on the information in that

prospectus supplement. You should also carefully read the additional information and documents described under "Where You Can Find More Information."

You

should rely only on the information contained or incorporated by reference in this prospectus or any prospectus supplement prepared by us or on our behalf. Neither we nor the selling

stockholders have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the selling

stockholders are making an offer to sell these shares of Class A Common Stock in any jurisdiction where the offer or sale is not permitted.

You

should not assume that the information in the registration statement, this prospectus, any prospectus supplement or any other offering materials is accurate as of any date other than

the date on the front of each document or that information incorporated by reference into this prospectus or any prospectus supplement is accurate as of any date other than the date of the document

incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since such date.

The

information in this prospectus is accurate as of the date on the front cover. You should not assume that the information contained in this prospectus is accurate as of any other

date.

In

this prospectus, unless otherwise specified or the context requires otherwise, the terms "ANGI Homeservices," the "Company," "we," "us" and "our" refer to ANGI

Homeservices Inc. and its subsidiaries.

Trademarks, Service Marks and Trade Names

This prospectus contains references to our: (i) trademarks, service marks or trade names or (ii) trademarks or service marks for

which we have pending applications or common law rights. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™

symbols, but such references are not intended to indicate, in any way, that we will not assert to the fullest extent under applicable law, our rights to these trademarks, service marks and trade

names.

1

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement(s) and the documents incorporated by reference herein or therein may contain certain

"forward-looking statements" as that term is defined in the Private Securities Litigation Reform Act of 1995. The use of words such as "anticipates," "estimates," "expects," "plans" and "believes,"

among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to our future financial performance, business prospects and

strategy, anticipated trends and prospects in home services industry, expected synergies and other benefits to be realized following the combination of the HomeAdvisor Business (as defined below) and

Angie's List, Inc. on September 29, 2017 (the "Combination") and other similar matters. "HomeAdvisor Business" means the businesses and operations of the HomeAdvisor segment of

IAC/InterActiveCorp ("IAC"), our controlling stockholder, as reported in IAC's filings with the SEC.

These

forward-looking statements are based on our management's current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes

in circumstances that are difficult to predict. Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons, including, among others:

(i) our ability to compete effectively against current and future competitors, (ii) the failure or delay of the home services market to migrate online, (iii) adverse economic

events or trends, particularly those that adversely impact consumer confidence and spending behavior, (iv) our ability to establish and maintain relationships with quality service

professionals, (v) our ability to build, maintain and/or enhance our various brands, (vi) our ability to market our various products and services in a successful and cost-effective

manner, (vii) our continued ability to communicate with consumers and service professionals via e-mail or an effective alternative means of communication, (viii) our ability to introduce

new and enhanced products and services that resonate with consumers and service professionals and that we are able to effectively monetize, (ix) our ability to realize the expected benefits of

the Combination within the anticipated time frames or at all, (x) the integrity, efficiency and scalability of our technology systems and infrastructures (and those of third parties) and our

ability to enhance, expand and adapt our technology systems and infrastructures in a timely and cost-effective manner, (xi) our ability to protect our systems from cyberattacks and to protect

personal and confidential user information, (xii) the occurrence of data security breaches, fraud and/or additional regulation involving or impacting credit card payments, (xiii) our

ability to adequately protect our intellectual property rights and not infringe the intellectual property rights of third parties, (xiv) our ability to operate (and expand into) international

markets successfully, (xv) operational and financial risks relating to acquisitions, (xvi) changes in key personnel, (xvii) increased costs and strain on our management as a

result of operating as a new public company, (xviii) adverse litigation outcomes and (xix) various risks related to our relationship with IAC and our outstanding indebtedness. Certain of

these and other risks and uncertainties are discussed on page 4 of this prospectus and in our filings with the SEC, including in Part I-Item 1A-Risk Factors of our Annual Report

on Form 10-K for the fiscal year ended December 31, 2017 (our "2017 Form 10-K").

Other

unknown or unpredictable factors that could also adversely affect our business, financial condition and operating results may arise from time to time. In light of these risks and

uncertainties, the forward-looking statements discussed in this prospectus may not prove to be accurate. Accordingly,

you should not place undue reliance on these forward-looking statements, which only reflect the views of our management as of the date of this prospectus. We do not undertake to update these

forward-looking statements.

2

Table of Contents

ANGI HOMESERVICES INC.

We connect millions of homeowners to home service professionals through our portfolio of digital home service brands, including

HomeAdvisor® and Angie's List®. Combined, these leading marketplaces allow homeowners to match, research and connect on-demand to the largest network of service professionals

either online, through our mobile apps or by voice assistants. The network of service professionals across our platforms is supported by approximately 15 million consumer reviews submitted on

hundreds of thousands of service professionals, collected over the course of over 20 years. We own and operate brands in eight countries.

We

have two operating segments: (i) North America, which primarily includes the HomeAdvisor digital marketplace, Angie's List, mHelpDesk and HomeStars, and (ii) Europe,

which includes Travaux.com, MyHammer, MyBuilder, Werkspot and Instapro.

We

own and operate the HomeAdvisor digital marketplace service in the United States (the "Marketplace"), which connects consumers with service professionals nationwide for home repair,

maintenance and improvement projects. The Marketplace provides consumers with tools and resources to help them find local, pre-screened and customer-rated service professionals, as well as instantly

book appointments with those professionals online. The Marketplace also connects consumers with service professionals instantly by telephone, as well as offers several home services-related resources,

such as cost guides for different types of home services projects.

We

also own and operate Angie's List, which connects consumers with service professionals for local services through a nationwide online directory of service professionals. Angie's List

also provides consumers with valuable tools, services and content, including more than ten million verified reviews of local service professionals, to help them research, shop and hire for local

services. We provide consumers with access to the Angie's List nationwide online directory and related basic tools and services free of charge.

We

also operate several international businesses that connect consumers with home service professionals. These international businesses include: (i) MyHammer, Travaux and

Werkspot, the leading home services marketplaces in Germany, France and the Netherlands, respectively, (ii) MyBuilder, HomeStars and Instapro, leading home services marketplaces in the United

Kingdom, Canada and Italy, respectively, and (iii) the Austrian operations of MyHammer. We own controlling interests in MyHammer, MyBuilder and HomeStars and wholly-own Travaux, Werkspot and

Instapro. The business models of our international businesses vary by jurisdiction and differ in certain respects from the Marketplace business model.

Our

principal executive offices are located at 14023 Denver West Parkway, Building 64, Golden, CO 80401 and our telephone number is (303) 963-7200. We maintain a website at

www.angihomeservices.com

.

The information on, or accessible through, our website or the websites of any of our brands and businesses is not part of this

prospectus and should not be relied upon in connection with making any investment decision with respect to the shares of Class A Common Stock offered pursuant to this prospectus.

3

Table of Contents

RISK FACTORS

Investing in our Class A Common Stock involves risks. See the risk factors described in Part I-Item 1A-Risk Factors of our

2017 Form 10-K and those contained in our other filings with the SEC that are incorporated by reference into this prospectus. Before making an investment decision, you should carefully consider

these risks, as well as other information included or incorporated by reference into this prospectus. These risks could materially affect our business, financial condition or results of operations and

cause the value of our Class A Common Stock to decline. You could lose all or part of your investment.

4

Table of Contents

USE OF PROCEEDS

The selling stockholders will receive all of the net proceeds from the sale of any shares of Class A Common Stock under this prospectus.

The Company is not selling any shares of Class A Common Stock under this prospectus and it will not receive any proceeds from the sale of any shares of Class A Common Stock by the

selling stockholders.

5

Table of Contents

SELLING STOCKHOLDERS

In connection with the consummation of our acquisition of Handy Technologies, Inc. ("Handy") on October 19, 2018 (the

"Acquisition") pursuant to the terms of an acquisition agreement dated September 29, 2018, we issued an aggregate of 7,482,167 shares of our Class A Common Stock to the selling

stockholders. The selling stockholders were equity holders in Handy and received shares of Class A Common Stock as consideration in the Acquisition in reliance on the private offering exemption

of Section 4(a)(2) of the Securities Act. Concurrently with the closing of the Acquisition, we also entered into the registration rights agreement with the selling stockholders (the

"Registration Rights Agreement"), whereby we agreed to file with the SEC a registration statement on Form S-3 in accordance with Rule 415 under the Securities Act to register the shares

of our Class A Common Stock that we issued to the selling stockholders pursuant to the Acquisition.

The

registration statement of which this prospectus forms a part covers the public resale of the shares of Class A Common Stock beneficially owned by the selling

stockholders listed in the table below. The

selling stockholders may from time to time offer and sell, pursuant to this prospectus and in accordance with the Registration Rights Agreement, any or all of the shares of Class A Common Stock

beneficially owned by them and covered by this prospectus. The selling stockholders may sell some, all or none of the shares of Class A Common Stock covered by this prospectus and make no

representations that such shares will be offered for sale.

As

used in this prospectus, the term "selling stockholders" includes only the selling stockholders listed below, and the pledgees, donees, transferees, assignees, successors and others

who later come to hold any of the selling stockholders' interest in our Class A Common Stock other than through a public sale. Information about the selling stockholders and certain transferees

may change over time. Any changed information will be set forth in prospectus supplements, if required. The selling stockholders may sell all, some or none of their shares in this offering. See "Plan

of Distribution."

The

table below presents information regarding the selling stockholders and the shares of Class A Common Stock that they may offer and sell pursuant to this prospectus. Beneficial

ownership is determined in accordance with applicable SEC rules, which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power

with respect to such securities. Except as otherwise indicated, we believe that the selling stockholders have sole voting and investment power with respect to all shares of Class A Common Stock

shown as beneficially owned by

6

Table of Contents

them.

All selling stockholder information has been furnished by or on behalf of the selling stockholders.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Class A

Common Stock

Beneficially

Owned Prior to

Offering(1)(2)

|

|

|

|

Shares of Class A

Common Stock

Beneficially

Owned After

Offering(1)(2)

|

|

|

|

Maximum Number

of Shares of Class A

Common Stock

to be Offered

Pursuant to this

Prospectus

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

Percent

|

|

Number

|

|

Percent

|

|

|

Entities affiliated with General Catalyst(3)

|

|

|

1,504,082

|

|

|

2.04

|

%

|

|

1,504,082

|

|

|

—

|

|

|

—

|

|

|

Entities affiliated with Highland Capital Partners(4)

|

|

|

1,326,725

|

|

|

1.80

|

%

|

|

1,326,725

|

|

|

—

|

|

|

—

|

|

|

Revolution Growth II, LP(5)

|

|

|

1,355,416

|

|

|

1.84

|

%

|

|

1,355,416

|

|

|

—

|

|

|

—

|

|

|

Affiliates of FMR LLC(6)

|

|

|

2,043,525

|

|

|

3.27

|

%

|

|

1,275,280

|

|

|

1,128,245

|

|

|

1.53

|

%

|

|

Addventure V Limited(7)

|

|

|

510,112

|

|

|

|

*

|

|

510,112

|

|

|

—

|

|

|

—

|

|

|

Oisin Hanrahan(8)

|

|

|

216,971

|

|

|

|

*

|

|

216,971

|

|

|

—

|

|

|

—

|

|

|

Umang Dua(9)

|

|

|

215,157

|

|

|

|

*

|

|

215,157

|

|

|

—

|

|

|

—

|

|

|

TPG Handy Holdings, LP(10)

|

|

|

331,573

|

|

|

|

*

|

|

331,573

|

|

|

—

|

|

|

—

|

|

|

Hydrazine Capital, LLC(11)

|

|

|

86,720

|

|

|

|

*

|

|

86,720

|

|

|

—

|

|

|

—

|

|

|

Mostafa Group, LLC(12)

|

|

|

102,022

|

|

|

|

*

|

|

102,022

|

|

|

—

|

|

|

—

|

|

|

Tusk Ventures LLC(13)

|

|

|

103,649

|

|

|

|

*

|

|

103,649

|

|

|

—

|

|

|

—

|

|

|

Sound Ventures, LLC(14)

|

|

|

51,011

|

|

|

|

*

|

|

51,011

|

|

|

—

|

|

|

—

|

|

|

All other selling stockholders who beneficially own, in the aggregate, less than 1% of our Class A Common Stock

|

|

|

403,449

|

|

|

|

*

|

|

403,449

|

|

|

—

|

|

|

—

|

|

-

*

-

Represents

beneficial ownership of less than 1%.

-

(1)

-

The

percentage of beneficial ownership prior to this offering is based on 66,073,192 shares of Class A Common Stock outstanding as of September 30,

2018 plus 7,482,167 shares of Class A Common Stock covered by this prospectus.

-

(2)

-

Assumes

that all the shares of the selling stockholders covered by this prospectus are sold, and that the selling stockholders do not acquire any additional shares

of Class A Common Stock before the completion of this offering. However, because the selling stockholders can offer all, some, or none of their shares of Class A Common Stock, no

definitive estimate can be given as to the number of shares that the selling stockholder will ultimately offer or sell under this prospectus.

-

(3)

-

Consists

of 1,473,332 shares held by General Catalyst Group V, LP ("GC Group V") and 30,750 shares held by GC Entrepreneurs Fund V, LP

("GC Entrepreneurs"). General Catalyst GP V, LLC ("GP V LLC") is the general partner of General Catalyst Partners V, L.P. ("GP V LP"), which is the general partner

of GC Group V and GC Entrepreneurs. Each of David Fialkow, Joel Cutler and Hemant Taneja is a managing director of GP V LLC and may be deemed to share voting and investment power over

the shares held of record and by GC Group V and GC Entrepreneurs. Each of GP V LLC, GP V LP, David Fialkow, Joel Cutler and Hemant Taneja disclaims beneficial ownership of

all shares held by the foregoing entities. The business address of these accounts is 20 University Road, Suite 450, Cambridge, MA 02138.

-

(4)

-

Consists

of (i) 275,610 shares held by Highland Capital Partners VII Limited Partnership, (ii) 66,784 shares held by Highland Capital

Partners VII-B Limited Partnership, (iii) 97,258 shares held by Highland Capital Partners VII-C Limited Partnership, (iv) 8,634 shares held by Highland Entrepreneurs' Fund

VII Limited Partnership, (v) 637,422 shares held by Highland Capital Partners VIII Limited Partnership, (vi) 9,879 shares held by Highland Capital Partners VIII-B Limited

Partnership and (vii) 231,138 shares held by Highland Capital Partners VIII-C Limited

7

Table of Contents

Partnership.

Highland Management Partners VII Limited Partnership, a Delaware limited partnership ("HMP VII LP"), is the general partner of the Highland Capital Partners VII Limited Partnership, Highland

Capital Partners VII-B Limited Partnership, Highland Capital Partners VII-C Limited Partnership and Highland Entrepreneurs' Fund VII Limited Partnership (collectively, the "Highland VII Investing

Entities"). Highland Management Partners VII, LLC, a Delaware limited liability company ("HMP VII LLC"), is the general partner of HMP VII LP. Paul A. Maeder, Sean M. Dalton,

Robert J. Davis, Daniel J. Nova and Corey M. Mulloy are the managing members of HMP VII LLC (the "Highland Managing Members"). HMP VII LLC, as the general partner of the general partner

of the Highland VII Investing Entities may be deemed to have beneficial ownership of the shares held by the Highland VII Investing Entities. The Highland Managing Members have shared power over all

investment decisions of HMP VII LLC and therefore may be deemed to share beneficial ownership of the shares held by the Highland VII Investing Entities. Each Highland Managing Member disclaims

beneficial ownership of the shares held by the Highland VII Investing Entities. Each of HMP VII LLC and HMP VII LP disclaims beneficial ownership of the shares held by the Highland VII

Investing Entities.

Highland Management Partners VIII Limited Partnership, a Cayman exempted limited partnership ("HMP VIII LP"), is the general partner of Highland Capital Partners VIII Limited Partnership,

Highland Capital Partners VIII-B Limited Partnership and Highland Capital Partners VIII-C Limited Partnership (together, the "Highland VIII Investing Entities"). Highland Management Partners VIII

Limited, a company incorporated under the laws of the Cayman Islands ("HMP VIII Ltd."), is the general partner of HMP VIII LP. Paul A. Maeder, Sean M. Dalton, Robert J. Davis, Daniel J.

Nova and Corey M. Mulloy are the directors of HMP VIII Ltd. (the "Highland Directors"). HMP VIII Ltd., as the general partner of the general partner of the Highland VIII Investing

Entities may be deemed to have beneficial ownership of the shares held by the Highland VIII Investing Entities. The Highland Directors have shared power over all investment decisions of HMP

VIII Ltd. and therefore may be deemed to share beneficial ownership of the shares held by the Highland VIII Investing Entities. Each Highland Director disclaims beneficial ownership of the

shares held by the Highland VIII Investing Entities. Each of HMP VIII Ltd. and HMP VIII LP disclaims beneficial ownership of the shares held by the Highland VIII Investing Entities.

The principal business address of these accounts is One Broadway, 16th Floor, Cambridge, MA 02142.

-

(5)

-

Steven

J. Murray is the operating manager of Revolution Growth UGP II, LLC, the general partner of Revolution Growth GP II, LP, which is the

general partner of Revolution Growth II, LP. Revolution Growth UGP II, LLC, Revolution Growth GP II, LP and Mr. Murray may be deemed to have voting and dispositive

power with respect to these shares. The business address of these accounts is 1717 Rhode Island Avenue, NW, 10th Floor, Washington, DC 20036.

-

(6)

-

Consists

of 1,057,296 shares held by Fidelity Contrafund: Fidelity Contrafund, 91,774 shares held by Fidelity Contrafund Commingled Pool,

1,966 shares held by Fidelity OTC Commingled Pool and 1,252,489 shares held by Fidelity Securities Fund: Fidelity OTC Portfolio.

These

accounts are managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Vice Chairman, the Chief Executive Officer and the President of FMR LLC.

Members

of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the

voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders' voting agreement under which all Series B voting common

shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders'

voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to

8

Table of Contents

form a

controlling group with respect to FMR LLC.

Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company

Act (the "Fidelity Funds") advised by Fidelity Management & Research Company ("FMR Co."), a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds' boards

of trustees. FMR Co. carries out the voting of the shares under written guidelines established by the Fidelity Funds' boards of trustees. The business address of these accounts is

245 Summer Street, Boston, MA 02210. The Fidelity Funds are affiliates of registered broker-dealers.

-

(7)

-

Pavel

Terentev and Maxim Medvedev are the controlling persons of AddVenture V Limited and may be deemed to have voting and dispositive power with respect to these

shares. The business address of these accounts is 5, Temislocles Dervis Str., Elenion Building, 1066, Nicosia, Cyprus.

-

(8)

-

Mr. Hanrahan's

principal business address is 53 West 23rd Street, 3rd Floor, New York, NY 10011.

-

(9)

-

Mr. Dua's

principal business address 53 West 23rd Street, 3rd Floor, New York, NY 10011.

-

(10)

-

The

general partner of TPG Handy Holdings, LP is TPG Growth II Advisors, Inc. David Bonderman and James G. Coulter are the shareholders of TPG Growth

II Advisors, Inc. Each of TPG Growth II Advisors, Inc., Mr. Bonderman and Mr. Coulter may be deemed to have voting and dispositive power with respect to these shares. TPG

Handy Holdings, LP has represented to us that it is an affiliate of a registered broker-dealer and that it acquired the shares to be resold in the ordinary course of business and, at the time

of the acquisition of such shares, it had no agreements or understandings, directly or indirectly, with any person to distribute such securities. The business address of these accounts is 301 Commerce

Street, Suite 3300, Fort Worth, TX 76102.

-

(11)

-

Sam

Altman is the controlling person of Hydrazine Capital, LLC and may be deemed to have voting and dispositive power with respect to these shares. The

business address of these accounts is 29 Dorland Street, San Francisco, CA 94110.

-

(12)

-

The

business address of these accounts is 956 Bellview Road, McLean, VA 22102.

-

(13)

-

Bradley

Tusk is the CEO of Tusk Ventures LLC and may be deemed to have voting and dispositive power with respect to these shares. The business address of

these accounts is 251 Park Avenue South, 8th Floor, New York, NY 10010.

-

(14)

-

Live

Nation Entertainment, Inc. is the parent entity of Sound Ventures, LLC and may be deemed to have voting and dispositive power with respect to

these shares. The business address of these accounts is 9348 Civic Center Drive, Beverly Hills, CA 90210.

9

Table of Contents

DESCRIPTION OF CAPITAL STOCK

This prospectus contains a summary description of our capital stock and certain provisions of our amended and restated certificate of

incorporation and amended and restated bylaws. This summary description is not complete and is qualified in its entirety by: (i) the full text of our amended and restated certificate of

incorporation and amended and restated bylaws, which are incorporated by reference herein as exhibits to our registration statement of which this prospectus forms a part, and (ii) the

applicable provisions of Delaware law.

Our

authorized capital stock consists of 5,500,000,000 shares of stock, comprised of 2,000,000,000 shares of Class A Common Stock, par value $0.001 per share, 1,500,000,000 shares

of Class B Common Stock, par value $0.001 per share ("Class B Common Stock"), 1,500,000,000 shares of Class C Common Stock, par value $0.001 per share ("Class C Common

Stock"), and 500,000,000 shares of preferred stock, par value $0.001 per share. As of September 30, 2018, there were 66,073,192 shares of Class A Common Stock outstanding, 415,904,443

shares of Class B Common Stock outstanding and no shares of Class C

Common Stock or preferred stock outstanding. The number of authorized shares of any class of stock may be increased or decreased (but not below the number of shares thereof then outstanding) by the

vote of the holders of a majority of the voting power of all then-outstanding shares of Class A Common Stock, Class B Common Stock and any outstanding series of preferred stock entitled

to vote thereon, voting together as one class.

Common Stock

The rights of holders of Class A Common Stock, Class B Common Stock and Class C Common Stock are identical, except for the

differences described below under "—Voting Rights," "—Dividend Rights" and "—Conversion Rights." Any authorized but unissued shares of Class A Common Stock,

Class B Common Stock and Class C Common Stock are available for issuance by our board of directors without any further stockholder action, subject to any limitations imposed by the

Marketplace Rules of The Nasdaq Stock Market, LLC (the "Nasdaq Rules").

Voting Rights

Holders of Class A Common Stock are entitled to one vote per share on all matters to be voted upon by stockholders. Holders of

Class B Common Stock are entitled to ten votes per share on all matters to be voted upon by stockholders. Holders of Class C Common Stock are not entitled to any votes per share (except

as, and then only to the extent, otherwise required by the laws of Delaware, in which case holders of Class C Common Stock are entitled to one one-hundredth of a vote per share). None of the

holders of Class A Common Stock, Class B Common Stock or Class C Common Stock have cumulative voting rights in the election of directors.

Dividend Rights

Holders of Class A Common Stock, Class B Common Stock and Class C Common Stock are entitled to ratably receive dividends

(other than in the event of a share distribution or an asset distribution, as further described below) if, as and when declared from time to time by our board of directors in its discretion out of

funds legally available for that purpose, after payment of any dividends required to be paid on any outstanding preferred stock. Under Delaware law, we can only pay dividends either out of "surplus"

or out of the current or the immediately preceding year's net

profits. Surplus is defined as the excess, if any, at any given time, of the total assets of a corporation over its total liabilities and statutory capital. The value of a corporation's assets can be

measured in a number of ways and may not necessarily equal their book value.

In

a distribution of shares of our common stock, we may distribute: (i) shares of Class C Common Stock (or securities convertible into or exercisable or exchangeable for

shares of Class C Common

10

Table of Contents

Stock),

on an equal per share basis, to holders of Class A Common Stock, Class B Common Stock and Class C Common Stock or (ii) (x) shares of Class A Common

Stock (or securities convertible into or exercisable or exchangeable for shares of Class A Common Stock), on an equal per share basis, to holders of Class A Common Stock,

(y) shares of Class B Common Stock (or securities convertible into or exercisable or exchangeable for shares of Class B Common Stock), on an equal per share basis, to holders of

Class B Common Stock and (z) shares of Class C Common Stock (or securities convertible into or exercisable or exchangeable for shares of Class C Common Stock), on an equal

per share basis, to holders of Class C Common Stock.

In

a distribution of any other of our securities or the capital stock or other securities of another person or entity, we may choose to distribute: (i) identical securities, on an

equal per share basis, to holders of Class A Common Stock, Class B Common Stock and Class C Common Stock, (ii) a separate class or series of securities to holders of shares

of Class A Common Stock, a separate class of securities to holders of shares of Class B Common Stock and a separate class or series of securities to holders of shares of Class C

Common Stock, on an equal per share basis, (iii) a separate class or series of securities to holders of shares of Class B Common Stock and a different class or series of securities to

holders of shares of Class A Common Stock and Class C Common Stock, on an equal per share basis or (iv) a separate class or series of securities to holders of shares of

Class C Common Stock and a different class or series of securities to holders of shares of Class A Common Stock and Class B Common Stock, on an equal per share basis, provided

that, in the case of clause (ii), (iii) or (iv), the different classes or series of securities to be distributed are not different in any respect other than their relative voting rights

(and any related differences in designation, conversion, redemption and share distribution provisions, as applicable), with either (x) holders of shares of Class B Common Stock receiving

the class or series of securities having the highest relative voting rights or (y) holders of shares of Class B Common Stock and Class A Common Stock receiving a class or series

of securities having the highest relative voting rights. A dividend involving a class or series of securities of another person or entity may be treated as a share distribution or as an asset

distribution as determined by our board of directors.

In

a distribution of our assets (including shares of any class or series of capital stock of another person or entity owned by us) to holders of any class or classes of common stock, a

dividend in cash and/or other property will be paid to holders of each other class of common stock then outstanding on an equal per share basis in an amount, in the case of a dividend consisting

solely of cash, equal to the fair market value of such holders' ownership interest in the assets paid as a dividend pursuant to the asset

distribution, or having a fair market value, in the case of any other dividend, equal to the fair market value of such holders' ownership interest in assets paid as a dividend pursuant to the asset

distribution.

Our

board of directors has the power and authority to, in good faith, make all determinations regarding, among other things: (i) whether or not a dividend is an equal dividend per

share or is declared and paid on an equal per share basis, (ii) whether one or more classes or series of securities differ in any respect other than their relative voting rights and

(iii) any other interpretations that may be required under the dividend rights provisions of the amended and restated certificate of incorporation described above.

Conversion Rights

Shares of Class B Common Stock are convertible into shares of Class A Common Stock at the option of the holder at any time on a

share for share basis. The conversion ratio will in all events be equitably preserved in the event of any recapitalization of the Company by means of a stock dividend on, or a stock split or

combination of, the outstanding shares of Class A Common Stock or of Class B Common Stock, or in the event of any merger, consolidation or other reorganization of the Company with

another corporation. Upon the conversion of a share of Class B Common Stock into a share of

11

Table of Contents

Class A

Common Stock, the applicable share of Class B Common Stock will be retired and will not be subject to reissue. Shares of Class A Common Stock and shares of Class C

Common Stock have no conversion rights.

Liquidation Rights

Upon the liquidation, dissolution or winding up of the Company, holders of Class A Common Stock, Class B Common Stock and

Class C Common Stock are entitled to receive ratably the assets available for distribution to the stockholders after the rights of holders of shares of preferred stock have been satisfied.

Other Matters

Shares of Class A Common Stock, Class B Common Stock and Class C Common Stock have no preemptive rights pursuant to the

terms of our amended and restated certificate of incorporation and amended and restated bylaws. There are no redemption or sinking fund provisions applicable to shares of Class A Common Stock,

Class B Common Stock or Class C Common Stock. All outstanding shares of Class A Common Stock and of Class B Common Stock are fully paid and non-assessable.

Listing

Our Class A Common Stock is listed on The Nasdaq Global Select Market under the symbol "ANGI."

Transfer Agent and Registrar

The transfer agent and registrar for our Class A Common Stock is Computershare Trust Company, N.A.

Preferred Stock

Pursuant to our amended and restated certificate of incorporation, shares of preferred stock are issuable from time to time, in one or more

series, with the designations of the series, the voting rights of the shares of the series (if any), the powers, preferences and relative, participation, optional or other special rights (if any), and

any qualifications, limitations or restrictions thereof as our board of directors from time to time may adopt by resolution (and without further stockholder approval, subject to any limitation imposed

by Nasdaq Rules). The rights, preferences and privileges of such preferred stock may be greater than, and may adversely affect, the rights of our

common stock. Each series will consist of that number of shares as will be stated and expressed in the certificate of designations providing for the issuance of the preferred stock of the series.

Anti-Takeover Effects of Provisions of our Amended and Restated Certificate of Incorporation, Amended and Restated Bylaws and Other Agreements

Certain provisions of the Delaware General Corporation Law (the "DGCL") and certain provisions of our amended and restated

certificate of incorporation and amended and restated bylaws summarized below may be deemed to have an anti-takeover effect and may delay, deter or prevent a tender offer or takeover attempt that a

stockholder might consider to be in such stockholder's best interests, including attempts that might result in a premium being paid over the market price for the shares held by our stockholders.

12

Table of Contents

Multi-Class Structure

As discussed above, each share of Class B Common Stock has ten votes per share, while each share of Class A Common Stock (the only

class of our stock that is publicly traded) has one vote per share. Except as provided in our amended and restated certificate of incorporation or by the DGCL, the holders of Class A Common

Stock and the holders of Class B Common Stock vote on all matters (including the election of directors) together as one class. Our Class C Common Stock, of which no shares are

outstanding, do not have any voting rights. IAC owns and controls all of the outstanding shares of Class B Common Stock, which at this time constitutes a substantial majority of both the total

voting power and the total number of shares of our total outstanding capital stock. Even if IAC in the future owns significantly less than 50% of our total outstanding capital stock, because of the

multi-class structure of our common stock and the higher relative voting rights of Class B Common Stock compared to Class A Common Stock, IAC will be able to control all matters in which

the Class A Common Stock and the Class B Common Stock vote together as one class that are submitted to our stockholders for approval. This concentrated control could discourage others

from initiating any potential merger, takeover or other change of control transaction that other stockholders may view as beneficial.

Director Vacancies

The DGCL provides that board vacancies and newly created directorships may be filled by a majority of the directors then in office (even though

less than a quorum) or by a sole remaining director unless (i) otherwise provided in the certificate of incorporation or bylaws of the corporation or (ii) the certificate of

incorporation directs that a particular class of stock is to elect such director, in which case a majority of the other directors elected by such class, or a sole remaining director elected by such

class, will fill such vacancy.

Our

amended and restated bylaws provide that vacancies and newly created directorships may be filled by the vote of a majority of the remaining directors elected by the stockholders who

vote on such directorship (even if less than a quorum) or the vote or written consent of a majority of the voting power of the shares of our stock issued and outstanding and entitled to vote on such

directorship (subject to the provisions of the Investor Rights Agreement, dated September 29, 2017 (the "Investor Rights Agreement"), by and between us and IAC, concerning two ANGI-Designated

Directors (as such term is defined in the Investor Rights Agreement)).

No Cumulative Voting

Under the DGCL, cumulative voting for elections of directors is not permitted unless the corporation's certificate of incorporation specifically

provides for it. Our amended and restated certificate of incorporation does not provide for cumulative voting.

Special Meetings of Stockholders

Under the DGCL, a special meeting of stockholders may be called by the board of directors or by such other persons as may be authorized in the

certificate of incorporation or the bylaws of the corporation.

Our

amended and restated bylaws provide that special meetings of the stockholders may be called by the chairman of our board of directors or by a majority of our directors. Our

stockholders, however, may not call for a special meeting of the stockholders.

13

Table of Contents

Amending Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws

Under the DGCL, a certificate of incorporation may be amended if: (i) the board of directors adopts a resolution setting forth the

proposed amendment, declares the advisability of the amendment and directs that it be submitted to a vote at a meeting of stockholders (except that, unless required by the certificate of

incorporation, no meeting or vote of stockholders is required to adopt an amendment for certain specified changes) and (ii) the holders of a majority of shares of stock entitled to vote on the

matter approve the amendment, unless the certificate of incorporation requires the vote of a greater number of shares. If a class vote on the amendment is required by the DGCL, or by the certificate

of incorporation, approval by a majority of the outstanding shares of stock of the class is required, unless a greater proportion is specified in the certificate of incorporation or by other

provisions of the DGCL. Our amended and restated certificate of incorporation provides that we reserve the right to amend, alter, change or repeal any provision contained in the certificate of

incorporation, as prescribed by the DGCL.

Under

the DGCL, the board of directors may adopt, amend or repeal a corporation's bylaws if so authorized in the certificate of incorporation. The stockholders of a Delaware corporation

also have the power to adopt, amend or repeal bylaws.

Our

amended and restated certificate of incorporation and amended and restated bylaws allow the board of directors to adopt, amend or repeal the bylaws by the vote of a majority of all

directors. Under the Investor Rights Agreement, however, up until the date on which the 2020 annual meeting of our stockholders is held, IAC has agreed not to vote in favor of any amendments to our

certificate of incorporation or bylaws that would be inconsistent with certain provisions of the Investor Rights Agreement and would adversely affect the rights of holders of Class A Common

Stock, other than as may be approved by the audit committee of our board of directors and a majority of the holders of Class A Common Stock.

Authorized but Unissued Shares

Delaware companies are permitted to authorize shares that may be issued in the future. A substantial number of unissued shares of our

Class A Common Stock, Class B Common Stock, Class C Common Stock and preferred stock are available for future issuances by our board of directors without stockholder approval,

subject to any limitations imposed by Nasdaq Rules. Issuances of these shares could be utilized for a variety of corporate purposes, including future offerings to raise additional capital,

acquisitions and employee benefit plans. The existence of any authorized but unissued and unreserved Class A Common Stock, Class B Common Stock, Class C Common Stock and preferred

stock could render more difficult or discourage an attempt to obtain control of the Company by means of a proxy contest, tender offer, merger or otherwise.

Exclusive Jurisdiction

Our amended and restated bylaws provide that a state court located within Delaware, or if no state court located within Delaware has

jurisdiction, the federal district court for the District of Delaware, shall be the exclusive forum for all of the following: (i) any derivative action or proceeding brought on our behalf,

(ii) any action asserting a claim for or based on breach of fiduciary duty owed by any current or former director or officer or other employee of the Company to us or to our stockholders,

(iii) any action asserting a claim against us or any of our current or former directors, officers or other employees pursuant to the DGCL, our certificate of incorporation, or our bylaws,

(iv) any action asserting a claim relating to or involving us that is governed by the internal affairs doctrine or (v) any action asserting an "internal corporate claim," as defined

under the DGCL.

14

Table of Contents

Limitation on Liability and Indemnification of Directors and Officers

Under the DGCL, subject to specified limitations in the case of derivative suits brought by a corporation's stockholders in its name, a

corporation may indemnify any person who is

made or is threatened to be made a party to any action, suit or proceeding on account of being a director, officer, employee or agent of the corporation (or was serving at the request of the

corporation in such capacity for another corporation, partnership, joint venture, trust or other enterprise) against expenses (including attorneys' fees), judgments, fines and amounts paid in

settlement actually and reasonably incurred by him or her in connection with the action, suit or proceeding, provided that there is a determination that: (i) the individual acted in good faith

and in a manner the individual reasonably believed to be in or not opposed to the best interest of the corporation and (ii) in a criminal action or proceeding, the individual had no reasonable

cause to believe his or her conduct was unlawful. Without court approval, however, no indemnification may be made in respect of any derivative action in which an individual is adjudged liable to the

corporation, except to the extent the Delaware Court of Chancery or the court in which such action or suit was brought determines upon application that, despite the adjudication but in view of all the

circumstances of the case, such person is fairly and reasonably entitled to be indemnified.

The

DGCL requires indemnification of directors and officers for expenses (including attorneys' fees) actually and reasonably relating to a successful defense on the merits or otherwise

of a derivative or third party action.

Under

DGCL, a corporation may advance expenses relating to the defense of any proceeding to directors and officers upon the receipt of an undertaking by or on behalf of the individual to

repay such amount if it is ultimately determined that such person is not entitled to be indemnified.

The

DGCL permits the adoption of a provision in a corporation's certificate of incorporation limiting or eliminating the monetary liability of a director to a corporation or its

stockholders by reason of a director's breach of the fiduciary duty of care. The DGCL does not permit any limitation of the liability of a director for: (i) breaching the duty of loyalty to the

corporation or its stockholders, (ii) acts or omissions not in good faith, (iii) engaging in intentional misconduct or a known violation of law, (iv) obtaining an improper

personal benefit from a transaction or (v) paying a dividend or approving a stock repurchase or redemption that was illegal under applicable law.

In

addition, our amended and restated certificate of incorporation provides that we must indemnify our directors and officers to the fullest extent authorized by law. Under our amended

and restated bylaws, we are also expressly required to advance certain expenses to our directors and officers and are permitted to carry directors' and officers' insurance providing indemnification

for our directors and officers for some liabilities.

Waiver of Corporate Opportunity of IAC and Officers and Directors of IAC

The DGCL permits the adoption of a provision in a corporation's certificate of incorporation renouncing any interests or expectancy of a

corporation in, or in being offered an opportunity to participate in, specified business opportunities or specified classes or categories of business opportunities that are presented to the

corporation or one or more of its officers, director or stockholders.

Our

amended and restated certificate of incorporation includes a "corporate opportunity" provision that renounces any of our interests or expectancy: (i) to participate in any

business of IAC or (ii) in any potential transaction or matter that may constitute a corporate opportunity for both (a) IAC and (b) us. Under this provision, we further recognize

that (1) any of our directors or officers who are also officers, directors, employees or other affiliates of IAC or its affiliates (except that we will not be deemed affiliates of IAC or its

affiliates for the purposes of this provision) and (2) IAC itself has no

15

Table of Contents

duty

to offer or communicate information regarding such a corporate opportunity. The provision generally provides that neither IAC nor our officers or directors who are also officers or directors of

IAC or its affiliates will be liable to us or our stockholders for breach of any fiduciary duty by reason of (i) such person's participation in any business on behalf of IAC or (ii) the

fact that any such person pursues or acquires any corporate opportunity for the account of IAC or its affiliates, directs or transfers such corporate opportunity to IAC or its affiliates, or does not

communicate information regarding such corporate opportunity to us. This renunciation does not extend to corporate opportunities expressly offered to one of our officers or directors solely in his or

her capacity as an officer or director of us.

16

Table of Contents

PLAN OF DISTRIBUTION

The selling stockholders, and the pledgees, donees, transferees, assignees, successors and others who later come to hold any of the selling

stockholders' interests in our Class A Common Stock other than through a public sale, may, in accordance with the Registration Rights Agreement, sell all or a portion of the shares of

Class A Common Stock offered hereby from time to time in the future. If the shares of Class A Common Stock are sold through underwriters or broker-dealers, the selling stockholders will

be responsible for underwriting discounts or commissions or agent's commissions. The shares of Class A Common Stock may be sold in one or more transactions at fixed prices, at prevailing market

prices at the time of the sale, at prices related to such prevailing market prices, at varying prices determined at the time of sale or at negotiated prices. These sales may be effected in

transactions, which may involve crosses or block transactions, pursuant to one or more of the following methods:

-

•

-

purchases by underwriters, dealers and agents who may receive compensation in the form of underwriting discounts or commissions or agent

commissions from the selling stockholders and/or the purchasers of the shares for whom they may act as agent;

-

•

-

any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

-

•

-

the over-the-counter market;

-

•

-

transactions otherwise than on these exchanges or systems or in the over-the-counter market;

-

•

-

the writing of options, whether such options are listed on an options exchange or otherwise;

-

•

-

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

-

•

-

block trades, including transactions in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion

of the block as principal to facilitate the transaction, or in crosses, in which the same broker acts as an agent on both sides of the trade;

-

•

-

purchases by a broker-dealer or market maker, as principal, and resale by the broker-dealer for its account;

-

•

-

an exchange distribution in accordance with the rules of the applicable exchange;

-

•

-

public or privately negotiated transactions;

-

•

-

the pledge of shares for any loan or obligation, including pledges to brokers or dealers who may from time to time effect distributions of such

shares;

-

•

-

short sales or transactions to cover short sales;

-

•

-

broker-dealers may agree with the selling stockholder to sell a specified number of such shares at a stipulated price per share;

-

•

-

sales pursuant to Rule 144 under the Securities Act;

-

•

-

transactions in which broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price

per share;

-

•

-

a combination of any such methods of sale; and

-

•

-

any other method permitted pursuant to applicable law.

A

selling stockholder that is an entity may elect to make an in-kind distribution of shares of Class A Common Stock, on a pro rata basis or otherwise, to its members, general or

limited partners or shareholders pursuant to the registration statement of which this prospectus is a part by delivering a

17

Table of Contents

prospectus.

To the extent that such members, general or limited partners or shareholders are not affiliates of ours, such members, partners or shareholders would thereby receive freely tradable shares

of Class A Common Stock pursuant to the distribution through a registration statement. Additionally, to the extent that entities, members, partners or shareholders who are affiliates of ours

received shares in any such distribution, such affiliates will also be selling stockholders and will be entitled to sell shares of Class A Common Stock pursuant to this prospectus.

The

selling stockholders may enter into sale, forward-sale and derivative transactions with third parties, or may sell securities not covered by this prospectus to third parties in

privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with those sale, forward-sale or derivative transactions, the third parties may sell securities

covered by this prospectus or the applicable prospectus supplement, including in short sale transactions and by issuing securities that are not covered by this prospectus but are exchangeable for or

represent beneficial interests in the Class A Common Stock. The third parties may also use shares received under those sale, forward-sale or derivative arrangements or shares pledged by the

selling stockholder or borrowed from the selling stockholders or others to settle such third-party sales or to close out any related open borrowings of common stock. The third parties may deliver this

prospectus in connection with any such transactions. Any third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement (or a

post-effective amendment to the registration statement of which this prospectus is a part).

In

connection with sales of shares of Class A Common Stock or otherwise, the selling stockholders may enter into hedging transactions with broker-dealers, which may in turn engage

in short sales of the shares in the course of hedging in positions they assume. The selling stockholders may also sell shares of Class A Common Stock short and deliver shares covered by this

prospectus to close out short positions and to return borrowed shares in connection with such short sales. The selling stockholders

may also enter into option or other transactions with broker-dealers which require the delivery of securities to the broker-dealer. The broker-dealer may then resell or otherwise transfer such

securities pursuant to this prospectus. The selling stockholders may also loan or pledge shares of Class A Common Stock to broker-dealers that in turn may sell or effect distributions of such

shares. Such borrower or pledgee may also transfer those shares of Class A Common Stock to investors in our securities or the selling stockholders' securities or in connection with the offering

of other securities not covered by this prospectus.

The

selling stockholders may also transfer, donate or gift shares of Class A Common Stock in other circumstances, in which case the pledgees, donees, transferees, assignees and

successors-in-interest will be selling stockholders under this prospectus.

If

the selling stockholders sell shares of Class A Common Stock to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive

commissions in the form of discounts, concessions or commissions from the selling stockholders or commissions from purchasers of the shares for whom they may act as agent or to whom they may sell as

principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). The selling

stockholders and any broker-dealer participating in the distribution of the shares of Class A Common Stock may be deemed to be "underwriters" within the meaning of the Securities Act, and any

commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular

offering of the shares of Class A Common Stock is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of shares of Class A Common

Stock being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the selling

stockholders and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers.

18

Table of Contents

Under

the securities laws of some states, shares of Class A Common Stock may be sold in such states only through registered or licensed brokers or dealers. In addition, in some

states shares of Class A Common Stock may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available

and is complied with.

There

can be no assurance that any selling stockholders will sell any or all of its shares of Class A Common Stock registered pursuant to the registration statement of which this

prospectus forms a part.

The

selling stockholders and any other person participating in such distribution will be subject to applicable provisions of the Securities Exchange Act of 1934 (the "Exchange Act") and

the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any shares of Class A Common

Stock by the selling stockholders and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of shares of Class A Common

Stock to engage in market-making activities with respect to shares of Class A Common Stock. All of the foregoing may affect the marketability of shares of Class A Common Stock and the

ability of any person or entity to engage in market-making activities with respect to shares of Class A Common Stock.

The

selling stockholders will receive all of the net proceeds from the sale of any shares of Class A Common Stock under this prospectus. We are not selling any shares of

Class A Common Stock under this prospectus and we will not receive any proceeds from the sale of shares of our Class A Common Stock by the selling stockholders. Pursuant to the

Registration Rights Agreement, we are obligated to pay the cost of registering any offer and sale of the shares of Class A Common Stock covered by this prospectus, as well as certain related

expenses; however, the selling stockholders are responsible for all discounts, selling commissions and other costs related to the offer and sale of their shares of Class A Common Stock pursuant

to this prospectus. We have agreed to indemnify the selling stockholders against liabilities, including some liabilities under the Securities Act, relating to the registration of the shares offered by

this prospectus.

In

addition, we or the selling stockholders may agree to indemnify any underwriters, broker-dealers and agents against or contribute to any payments the underwriters, broker-dealers or

agents may be required to make with respect to civil liabilities, including liabilities under the Securities Act. Underwriters, broker-dealers and agents and their affiliates are permitted to be

customers of, engage in transactions with, or perform services for us and our affiliates or the selling stockholders or their affiliates in the ordinary course of business.

19

Table of Contents

LEGAL MATTERS

Unless otherwise specified in any accompanying prospectus supplement(s), Skadden, Arps, Slate, Meagher & Flom LLP, New York, New

York, will provide opinions regarding the authorization and validity of the shares of Class A Common Stock covered by this prospectus. Skadden, Arps, Slate, Meagher & Flom LLP may

also provide opinions regarding certain other matters. Any

underwriters will be advised about legal matters by their own counsel, which will be named in an accompanying prospectus supplement.

EXPERTS

The consolidated and combined financial statements and the related notes and the financial statement schedule of ANGI Homeservices appearing in

its Annual Report on Form 10-K for the year ended December 31, 2017 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in

their report thereon, included therein, and incorporated herein by reference. Such consolidated and combined financial statements and the related notes and the financial statement schedule are

incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and

other required information with the SEC. The public may read and copy any materials on file with the SEC at

www.sec.gov

.

The

SEC allows us to "incorporate by reference" the information we file with them, which means that we can disclose important information to you by referring you to those documents. The

information incorporated by reference herein is considered to be a part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We

incorporate by reference the documents listed below (excluding any portions of such documents that have been "furnished" but not "filed" for purposes of the Exchange

Act):

-

•

-

our Annual Report on Form 10-K for the fiscal year ended December 31, 2017, filed with the SEC on March 14, 2018;

-

•

-

those portions of our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 30, 2018 and revised on

May 1, 2018, that are incorporated by reference into Part III of our Annual Report on Form 10-K for the year ended December 31, 2017;

-

•

-

our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2018 and June 30, 2018, filed with the SEC on

May 10, 2018 and August 9, 2018, respectively;

-

•

-

our Current Reports on Form 8-K, filed with the SEC on June 29, 2018, October 12, 2018 and October 22, 2018; and

-

•

-

the description of our Class A Common Stock contained in our Registration Statement on Form 8-A, filed with the SEC on

September 28, 2017, and any amendment or report filed for the purpose of updating such description.

All

documents we file pursuant to Section 13(a), 13(c), 14 or 15(d) under the Exchange Act after the date of this prospectus and prior to the termination of the offering of

Class A Common Stock pursuant to this prospectus shall also be deemed to be incorporated by reference in this prospectus from the date of filing of the documents, except for information

furnished under Item 2.02 and Item 7.01 of Form 8-K, which is not deemed filed and not incorporated by reference herein. Information that we file with the SEC will automatically

update and may replace information in this prospectus and information previously filed with the SEC.

20

Table of Contents

We

will provide without charge upon written or oral request to each person to whom this prospectus is delivered, a copy of any or all of the documents which are incorporated by reference

into this prospectus, excluding any exhibits to those documents unless the exhibit is specifically incorporated by reference as an exhibit to the registration statement of which this prospectus

forms a part. Requests should be directed to:

We

maintain a website at

www.angihomeservices.com

. The information on, or accessible through, our website or the websites of any of our

brands and businesses is not part of this prospectus and should not be relied upon in connection with making any investment decision with respect to the shares of Class A Common Stock offered

pursuant to this prospectus.

21

Table of Contents

PART II INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The expenses relating to the registration of the securities will be borne by the registrant.

|

|

|

|

|

|

|

|

Amount

to be paid*

|

|

|

Securities and Exchange Commission Registration Fee

|

|

$

|

17,338.76

|

|

|

Accounting Fees and Expenses*

|

|

$

|

|

*

|

|

Legal Fees and Expenses*

|

|

$

|

|

*

|

|

Printing Fees and Expenses*

|

|

$

|

|

*

|

|

Transfer Agent Fees and Expenses*