Securities Registration Statement (s-1/a)

October 19 2018 - 12:48PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on October 19,

2018

Registration No. 333-227778

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

(Amendment No.

1)

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IMAGEWARE SYSTEMS,

INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

7372

|

33-0224167

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Primary

standard industrial

classification code number)

|

(I.R.S. Employer

Identification Number)

|

10815 Rancho Bernardo Road, Suite 310

San Diego, California 92127

(858) 673-8600

(Address, Including Zip Code, and Telephone Number, Including Area

Code, of Registrant’s Principal Executive

Offices)

S. James Miller, Jr.

President and Chief Executive Officer

ImageWare Systems, Inc.

10815 Rancho Bernardo Road, Suite 310

San Diego, California 92127

(858) 673-8600

(Name, Address, Including Zip Code, and Telephone Number, Including

Area Code, of Agent for Service)

Copies to

Daniel W. Rumsey, Esq.

Jessica R. Sudweeks, Esq.

Disclosure Law Group, a Professional Corporation

600 West Broadway, Suite 700

San Diego, CA 92101

(619) 272-7050

Approximate date of

commencement of proposed sale to the public

: From time to time after this registration

statement becomes effective, as determined by market conditions and

other factors.

If

any of the securities being registered on this form are to be

offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in

connection with dividend or interest reinvestment plans, check the

following box. [X]

If

this form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration

statement number of the earlier effective registration statement

for the same offering. [ ]

If

this form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier

effective registration statement for the same

offering. [ ]

If

this form is a post-effective amendment filed pursuant to Rule

462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier

effective registration statement for the same

offering. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer,” “smaller reporting company,” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act. (Check one):

|

Large accelerated filer

|

|

[ ]

|

|

Accelerated

filer

|

|

[X]

|

|

|

|

|

|

|

|

|

Non-accelerated

filer

|

|

[ ]

|

|

Smaller reporting company

|

|

[X]

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging

growth company

|

|

[ ]

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of the Securities Act. [

]

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to

be registered

|

Amount to be Registered

(1)

|

Proposed Maximum Aggregate

Offering Price

(2)

|

Amount of Registration

Fee

|

|

Common

Stock, par value $0.01 per share

|

11,031,000

(3)

|

$

10,920,690

|

$

1,323.59

(4)

|

|

(1)

|

In

accordance with Rule 416 under the Securities Act of 1933, as

amended (the “

Securities

Act

”), the shares being registered hereunder include

such indeterminate number of shares of common stock as may be

issuable with respect to the shares being registered hereunder as a

result of stock splits, stock dividends or similar

transactions.

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee for the

offering pursuant to Rule 457(c) under the Securities Act, based on

the average of the high and low prices of the Registrant’s

common stock on the OTCQB Marketplace on October 4,

2018.

|

|

(3)

|

Includes

(i) 10,000,000 shares of common stock issuable upon the conversion

of shares of the Company’s Series C Convertible Preferred

Stock, par value $0.01 per share (“

Series C Preferred

”) held by the

selling stockholders (“

Conversion Shares

”), and (ii) an

estimated 1,031,000 shares of common stock issuable as payment of

accrued dividends on shares of Series C Preferred held by selling

stockholders within 12 months from the date of this Registration

Statement (any shares of common stock issuable as dividends on

shares of Series C Preferred, the “

Dividend Shares

”). The number of

Dividend Shares issuable over the next 12 months are estimated

based on the closing price of the Registrant’s common stock

on October 4, 2018, as reported on the OTCQB

Marketplace.

|

The Registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of

1933 or until the registration statement shall become effective on

such date as the Commission, acting pursuant to said section 8(a),

may determine.

EXPLANATORY NOTE

ImageWare

Systems, Inc. (the “

Company

”) is filing this

Amendment No. 1 to our Registration Statement on Form S-1

(File No. 333-227778) for the sole purpose of filing Exhibits 5.1

and 23.1 with the Securities and Exchange Commission. This

Amendment No. 1 does not modify any provision of the Prospectus

that forms a part of the Registration Statement and accordingly

such Prospectus has not been included herein.

PART II

ITEM 16. EXHIBITS

|

|

|

Agreement and Plan of Merger, dated October 27, 2005 (incorporated

by reference to Annex A to the Company’s Definitive Proxy

Statement on Schedule 14A, filed November 15, 2005).

|

|

|

|

Certificate of Incorporation (incorporated by reference to Annex B

to the Company’s Definitive Proxy Statement on Schedule 14A,

filed November 15, 2005).

|

|

|

|

Certificate of Amendment to Certificate of Incorporation

(incorporated by reference to Exhibit 3.1 to the Company's Current

Report on Form 8-K, filed October 14, 2011).

|

|

|

|

Amended

and Restated Bylaws (incorporated by reference to Exhibit 3.2 to

the Company’s Current Report on Form 8-K, filed February 16,

2017).

|

|

|

|

Certificate of Designations, Preferences and Rights of the Series E

Convertible Preferred Stock (incorporated by reference to Exhibit

3.1 to the Company’s Current Report on Form 8-K, filed

February 2, 2015).

|

|

|

|

Certificate of Designations, Preferences and Rights of the Series F

Convertible Preferred Stock (incorporated by reference to Exhibit

3.1 to the Company’s Current Report on Form 8-K, filed

September 9, 2016).

|

|

|

|

Certificate of Designations, Preferences and Rights of the Series G

Convertible Preferred Stock (incorporated by reference to Exhibit

3.1 to the Company’s Current Report on Form 8-K, filed

December 30, 2016).

|

|

|

|

Amendment No. 1 to the Certificate of Designations, Preferences and

Rights of the Series E Convertible Preferred Stock (incorporated by

reference to Exhibit 3.2 to the Company’s Current Report on

Form 8-K, filed December 30, 2016).

|

|

|

|

Certificate of Designations, Preferences and Rights of the Series A

Convertible Preferred Stock (incorporated by reference to Exhibit

3.1 to the Company’s Current Report on Form 8-K, filed

September 19, 2017).

|

|

|

|

Certificate of Elimination of the Series E Convertible Preferred

Stock, Series F Convertible Preferred Stock and Series G

Convertible Preferred Stock (incorporated by reference to Exhibit

3.1 to the Company’s Current Report on Form 8-K, filed

October 19, 2017).

|

|

|

|

Certificate of Amendment to Certificate of Incorporation

(incorporated by reference to Exhibit 3.1 to the Company’s

Current Report on Form 8-K, filed February 13, 2018).

|

|

|

|

Certificate of Designations, Preferences, and Rights of Series C

Convertible Preferred Stock (incorporated by reference to Exhibit

3.1 to the Company’s Current Report on Form 8-K, filed

September 13, 2018)

|

|

|

|

Amendment No. 1 to the Certificate of Designations, Preferences,

and Rights of Series A Convertible Preferred Stock (incorporated by

reference to Exhibit 3.2 to the Company’s Current Report on

Form 8-K, filed September 13, 2018)

|

|

|

|

Form of Amendment to Warrant, dated March 21, 2012, (incorporated

by reference to Exhibit 4.16 to the Company's Annual Report on Form

10-K, filed April 4, 2012).

|

|

|

|

Form of Warrant, dated September 10, 2018 (incorporated by

reference to Exhibit 3.3 to the Company’s Current Report on

Form 8-K, filed September 13, 2018)

|

|

|

|

Opinion of Disclosure Law Group, a Professional

Corporation

|

|

|

|

Employment Agreement, dated September 27, 2005, between the Company

and S. James Miller (incorporated by reference to Exhibit 10.1 to

the Company’s Current Report on Form 8-K, filed September 30,

2005).

|

|

|

|

Form of Indemnification Agreement entered into by the Company with

its directors and executive officers (incorporated by reference to

Exhibit 10.4 to the Company’s Registration Statement on Form

SB-2 (No. 333-93131), filed December 20, 1999, as

amended).

|

|

|

|

Amended and Restated 1999 Stock Plan Award (incorporated by

reference to Appendix B of the Company’s Definitive Proxy

Statement on Schedule 14A, filed November 21, 2007).

|

|

|

|

Form of Stock Option Agreement (incorporated by reference to

Exhibit 10.2 to the Company’s Current Report on Form 8-K,

filed July 14, 2005).

|

|

|

|

2001 Equity Incentive Plan (incorporated by reference to Exhibit

10.2 to the Company’s Quarterly Report on Form 10-QSB, filed

November 14, 2001).

|

|

|

|

Securities Purchase Agreement, dated September 25, 2007, by and

between the Company and certain accredited investors (incorporated

by reference to Exhibit 10.1 to the Company’s Current Report

on Form 8-K, filed September 26, 2007).

|

|

|

|

Office Space Lease between I.W. Systems Canada Company and GE

Canada Real Estate Equity, dated July 25, 2008 (incorporated by

reference to Exhibit 10.39 to the Company’s Annual Report on

Form 10-K, filed February 24, 2010).

|

|

|

|

Form of Securities Purchase Agreement, dated August 29, 2008 by and

between the Company and certain accredited investors (incorporated

by reference to Exhibit 10.40 to the Company’s Annual Report

on Form 10-K, filed February 24, 2010).

|

|

|

|

Change of Control and Severance Benefits Agreement, dated September

27, 2008, between Company and Charles Aubuchon (incorporated by

reference to Exhibit 10.41 to the Company’s Annual Report on

Form 10-K, filed February 24, 2010).

|

|

|

|

Change of Control and Severance Benefits Agreement, dated September

27, 2008, between Company and David Harding (incorporated by

reference to Exhibit 10.42 to the Company’s Annual Report on

Form 10-K, filed February 24, 2010).

|

|

|

|

First Amendment to Employment Agreement, dated September 27, 2008,

between the Company and S. James Miller (incorporated by reference

to Exhibit 10.43 to the Company’s Annual Report on Form 10-K,

filed February 24, 2010).

|

|

|

|

Form of Convertible Note dated November 14, 2008 (incorporated by

reference to Exhibit 10.45 to the Company’s Annual Report on

Form 10-K, filed February 24, 2010).

|

|

|

|

Second Amendment to Employment Agreement, dated April 6, 2009,

between the Company and S. James Miller (incorporated by reference

to Exhibit 10.50 to the Company’s Annual Report on Form 10-K,

filed February 24, 2010).

|

|

|

|

Office Space Lease between the Company and Allen W. Wooddell, dated

July 25, 2008 (incorporated by reference to Exhibit 10.54 to the

Company’s Annual Report on Form 10-K, filed February 24,

2010).

|

|

|

|

Third Amendment to Employment Agreement, dated December 10, 2009,

between the Company and S. James Miller (incorporated by reference

to Exhibit 10.60 to the Company’s Annual Report on Form 10-K,

filed February 24, 2010).

|

|

|

|

Securities Purchase Agreement, dated December 12, 2011, by and

between the Company and certain accredited investors (incorporated

by reference to Exhibit 10.1 to the Company’s Current Report

on Form 8-K, filed December 21, 2011).

|

|

|

|

Note Exchange Agreement, dated December 12, 2011, by and between

the Company and certain accredited investors (incorporated by

reference to Exhibit 10.2 to the Company’s Current Report on

Form 8-K, filed December 21, 2011).

|

|

|

|

Fourth Amendment to Employment Agreement, dated March 10, 2011,

between the Company and S. James Miller, (incorporated by reference

to Exhibit 10.40 to the Company’s Annual Report on Form 10-K,

filed January 17, 2012).

|

|

|

|

Fifth Amendment to Employment Agreement, dated January 31, 2012,

between the Company and S. James Miller, Jr., (incorporated by

reference to Exhibit 10.44 to the Company’s Annual Report on

Form 10-K, filed April 4, 2012.

|

|

|

|

Employment Agreement, dated January 1, 2013, between the Company

and Wayne Wetherell (incorporated by reference to Exhibit 10.1 to

the Company's Current Report on Form 8-K, filed March 7,

2013).

|

|

|

|

Employment Agreement, dated January 1, 2013, between the Company

and David Harding (incorporated by reference to Exhibit 10.1 to the

Company's Current Report on Form 8-K, filed March 7,

2013).

|

|

|

|

Convertible Promissory Note dated March 27, 2013 issued by the

Company to Neal Goldman (incorporated by reference to Exhibit 10.41

to the Company's Annual Report on Form 10-K, filed April 1,

2013).

|

|

|

|

Amendment to Convertible Promissory Note, dated March 12, 2014

(incorporated by reference to Exhibit 10.1 to the Company's Current

Report on Form 8-K, filed March 13, 2014).

|

|

|

|

Note Exchange Agreement, dated January 29, 2015 (incorporated by

reference to the Company’s Current Report on Form 8-K, filed

February 2, 2015).

|

|

|

|

Sixth

Amendment to Employment Agreement, by and between S. James Miller

and the Company, dated November 1, 2013 (incorporated by reference

to Exhibit 10.1 to the Company's Current Report on Form 8-K, filed

November 7, 2013).

|

|

|

|

Seventh Amendment to Employment Agreement, by and between S. James

Miller, Jr. and the Company, dated January 9, 2015 (incorporated by

reference to the Company’s Current Report on Form 8-K, filed

January 15, 2015).

|

|

|

|

Second Amendment to Employment Agreement, by and between Wayne

Wetherell and the Company, dated January 9, 2015 (incorporated by

reference to the Company’s Current Report on Form 8-K, filed

January 15, 2015).

|

|

|

|

Second

Amendment to Employment Agreement, by and between David E. Harding

and the Company, dated January 9, 2015 (incorporated by reference

to the Company’s Current Report on Form 8-K, filed January

15, 2015).

|

|

|

|

Amendment

No. 3 to Convertible Promissory Note, dated December 8, 2014

(incorporated by reference to the Company’s Current Report on

Form 8-K, filed December 10, 2014).

|

|

|

|

Third

Amendment to Employment Agreement, by and between Wayne Wetherell

and the Company, dated December 14, 2015 (incorporated by reference

to Exhibit 10.2 to the Company's Current Report on Form 8-K, filed

December 21, 2015).

|

|

|

|

Third

Amendment to Employment Agreement, by and between David E. Harding

and the Company, dated December 14, 2015 (incorporated by reference

to Exhibit 10.3 to the Company's Current Report on Form 8-K, filed

December 21, 2015).

|

|

|

|

Eighth

Amendment to Employment Agreement, by and between S. James Miller

and the Company, dated December 14, 2015 (incorporated by reference

to Exhibit 10.1 to the Company's Current Report on Form 8-K, filed

December 21, 2015).

|

|

|

|

Amendment No. 4 to Convertible Promissory Note, dated March 8, 2016

(incorporated by reference to the Company's Current Report on Form

8-K, filed March 10, 2017).

|

|

|

|

Convertible Promissory Note, dated March 9, 2016 (incorporated by

reference to the Company's Current Report on Form 8-K, filed March

10, 2017).

|

|

|

|

Form of Securities Purchase Agreement, dated September 7, 2016

(incorporated by reference to Exhibit 10.1 to the Company’s

Current Report on Form 8-K, filed September 9, 2016).

|

|

|

|

Amendment No. 5 to Convertible Promissory Note, dated January 23,

2017 (incorporated by reference to Exhibit 10.1 to the

Company’s Current Report on Form 10-K, filed January 26,

2017).

|

|

|

|

Form of Subscription Agreement for Series G Convertible Preferred

Stock (incorporated by reference to Exhibit 10.1 to the

Company’s Current Report on Form 8-K, filed December 30,

2016).

|

|

|

|

Form of Exchange Agreement (incorporated by reference to Exhibit

10.2 to the Company’s Current Report on Form 8-K, filed

December 30, 2016).

|

|

|

|

Ninth Amendment to Employment Agreement, by and between James

Miller, Jr. and the Company, dated October 20, 2016 (incorporated

by reference to Exhibit 10.3 to the Company’s Current Report

on Form 8-K, filed December 30, 2016).

|

|

|

|

F

ourth

Amendment to Employment Agreement, by and between Wayne Wetherell

and the Company, dated October 20, 2016 (incorporated by reference

to Exhibit 10.4 to the Company’s Current Report on Form 8-K,

filed December 30, 2016).

|

|

|

|

Fourth Amendment to Employment Agreement, by and between David E.

Harding and the Company, dated October 20, 2016 (incorporated by

reference to Exhibit 10.5 to the Company’s Current Report on

Form 8-K, dated December 30, 2016).

|

|

|

|

Amendment No. 2 to Convertible Promissory Note, dated May 10, 2017

(incorporated by reference to Exhibit 10.1 to the Company’s

Quarterly Report on Form 10-Q, filed May 12, 2017).

|

|

|

|

Amendment No. 6 to Convertible Promissory Note, dated May 10, 2017

(incorporated by reference to Exhibit 10.2 to the Company’s

Quarterly Report on Form 10-Q, filed May 12, 2017).

|

|

|

|

Form of Subscription Agreement for Series A Convertible Preferred

Stock (incorporated by reference to Exhibit 10.1 to the

Company’s Current Report on Form 8-K, filed September 19,

2017).

|

|

|

|

Form of Exchange Agreement (incorporated by reference to Exhibit

10.2 to the Company’s Current Report on Form 8-K, filed

September 19, 2017).

|

|

|

|

Fifth Amendment to Employment Agreement, by and between David E.

Harding and the Company, dated February 7, 2018 (incorporated by

reference to Exhibit 10.1 to the Company’s Current Report on

Form 8-K, dated February 13, 2018).

|

|

|

|

Tenth Amendment to Employment Agreement, by and between James

Miller, Jr. and the Company, dated February 8, 2018 (incorporated

by reference to Exhibit 10.2 to the Company’s Current Report

on Form 8-K, dated February 13, 2018).

|

|

|

|

Form of Securities Purchase Agreement for Series C Convertible

Preferred Stock (incorporated by reference to Exhibit 10.1 to the

Company’s Current Report on Form 8-K, filed September 13,

2018)

|

|

|

|

Form of Registration Rights Agreement (incorporated by reference to

Exhibit 10.2 to the Company’s Current Report on Form 8-K,

filed September 13, 2018)

|

|

|

|

Placement Agency Agreement, by and between the Company and

Northland Capital Markets (incorporated by reference to Exhibit

10.3 to the Company’s Current Report on Form 8-K, filed

September 13, 2018)

|

|

|

|

Form of Exchange Agreement (incorporated by reference to Exhibit

10.4 to the Company’s Current Report on Form 8-K, filed

September 13, 2018)

|

|

|

|

List of Subsidiaries (incorporated by referenced to Exhibit 21.1 to

the Company’s Annual Report on Form 10-K filed February 24,

2010).

|

|

|

|

Consent of Disclosure Law Group, a Professional Corporation

(included in Exhibit 5.1)

|

|

|

|

Consent of Independent Registered Public Accounting Firm

–

Mayer Hoffman McCann P.C.

|

|

|

|

Power of Attorney (

included on the

signature page of the Registration Statement on Form S-1, filed on

October 11, 2018.)

|

|

**

|

Previously filed as

an exhibit to the Company's Registration Statement on Form S-1,

filed on October 11, 2018.

|

SIGNATURES

Pursuant to the requirements of the Securities Act

of l933, the registrant has duly caused this Registration Statement

to be signed on its behalf by the undersigned, thereunto duly

authorized, in the City of San Diego, California on

October

19, 2018

.

|

|

IMAGEWARE SYSTEMS, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ S. James

Miller, Jr.

|

|

|

|

|

S.

James Miller, Jr.

|

|

|

|

|

Chief

Executive Officer, President

|

|

Pursuant

to the requirements of the Securities Act of 1933, this

registration statement has been signed by the following persons in

the capacities and on the dates indicated.

|

Signature

|

|

Title(s)

|

|

Date

|

|

|

|

|

|

/s/

*

S.

James Miller, Jr.

|

|

President,

Chief Executive Officer and Chairman

(Principal

Executive Officer)

|

|

October

19, 2018

|

|

|

|

|

|

/s/

*

Wayne

Wetherell

|

|

Chief

Financial Officer

(Principal

Financial and Accounting Officer)

|

|

October

19, 2018

|

|

|

|

|

|

/s/

*

David

Loesch

|

|

Director

|

|

October

19, 2018

|

|

|

|

|

|

/s/

*

Steve

Hamm

|

|

Director

|

|

October

19, 2018

|

|

|

|

|

|

/s/

*

David

Carey

|

|

Director

|

|

October

19, 2018

|

|

|

|

|

|

|

|

/s/

*

John

Cronin

|

|

Director

|

|

October

19, 2018

|

|

/s/

*

Neal

Goldman

|

|

Director

|

|

October

19, 2018

|

|

|

|

|

|

/s/

*

Charles

Crocker

|

|

Director

|

|

October

19, 2018

|

|

|

|

|

|

/s/

*

Dana

Kammersgard

|

|

Director

|

|

October

19, 2018

|

|

|

|

|

|

/s/

*

Charles

Frischer

|

|

Director

|

|

October

19, 2018

|

|

|

|

|

|

/s/

*

Robert

Clutterbuck

|

|

Director

|

|

October

19, 2018

|

|

|

|

|

* By:

/s/ S. James Miller,

Jr.

Attorney-in-fact

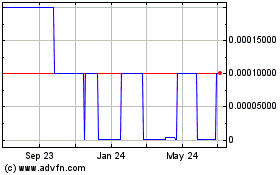

ImageWare Systems (CE) (USOTC:IWSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

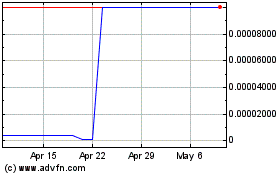

ImageWare Systems (CE) (USOTC:IWSY)

Historical Stock Chart

From Apr 2023 to Apr 2024