Orchid Island Capital Announces October 2018 Monthly Dividend and September 30, 2018 RMBS Portfolio Characteristics

October 17 2018 - 5:15PM

Orchid Island Capital, Inc. (the “Company”) (NYSE:ORC) announced

today that the Board of Directors (the “Board”) declared a monthly

cash dividend for the month of October 2018. The dividend of $0.08

per share will be paid November 9, 2018 to holders of record on

October 31, 2018, with an ex-dividend date of October 30, 2018.The

Company plans on announcing its next dividend after the Board’s

meeting on November 14, 2018.

The Company intends to make regular monthly cash

distributions to its stockholders. In order to qualify as a real

estate investment trust (“REIT”), the Company must distribute

annually to its stockholders an amount at least equal to 90% of its

REIT taxable income, determined without regard to the deduction for

dividends paid and excluding any net capital gain. The Company will

be subject to income tax on taxable income that is not distributed

and to an excise tax to the extent that a certain percentage of its

taxable income is not distributed by specified dates. The Company

has not established a minimum distribution payment level and is not

assured of its ability to make distributions to stockholders in the

future.

As of October 17, 2018, the Company had

52,039,168 shares outstanding. At June 30, 2018, the Company had

52,034,596 shares outstanding.

Estimated September 30, 2018 Book Value

Per Share

The Company’s estimated book value per share as

of September 30, 2018 was $7.56. The Company computes book

value per share by dividing total stockholders' equity by the total

number of outstanding shares of common stock. At September 30,

2018, the Company's preliminary estimated total stockholders'

equity was approximately $393.3 million with 52,039,168 shares of

common stock outstanding. These figures and the resulting estimated

book value per share are preliminary, subject to change, and

subject to review by the Company’s independent registered public

accounting firm.

Estimated Net Income Per Share and

Realized and Unrealized Gains and Losses on RMBS and Derivative

Instruments

The Company estimates it generated a net loss

per share of $0.06, which includes $0.39 per share of net

realized and unrealized gains and losses on RMBS and

derivative instruments for the quarter ended September 30,

2018. These amounts compare to total dividends declared

during the quarter of $0.25 per share. Net income per common

share calculated under generally accepted accounting principles

can, and does, differ from our REIT taxable income. The

Company views REIT taxable income as a better indication of income

to be paid in the form of a dividend rather than net income. Many

components of REIT taxable income can only be estimated at this

time and our monthly dividends declared are based on both estimates

of REIT taxable income to be earned over the course of the current

quarter and calendar year and a longer-term estimate of the REIT

taxable income of the Company. These figures are preliminary,

subject to change, and subject to review by the Company’s

independent registered public accounting firm.

Estimated Return on Equity

The Company’s estimated total return on equity

for the quarter ended September 30, 2018 was (0.6)%, or (2.5)% on

an annualized basis. The Company calculates total return on equity

as the sum of dividends declared and paid during the quarter plus

changes in book value during the quarter, divided by the Company’s

stockholders’ equity at the beginning of the quarter. The

total return was $(0.05) per share, comprised of dividends per

share of $0.25 and a decrease in book value per share of $0.30 from

June 30, 2018.

RMBS Portfolio

Characteristics

Details of the RMBS portfolio as of September

30, 2018 are presented below. These figures are preliminary and

subject to change and, with respect to figures that will appear in

the Company’s financial statements and associated footnotes as of

and for the quarter ended September 30, 2018, are subject to review

by the Company’s independent registered public accounting firm.

- RMBS Valuation Characteristics

- RMBS Assets by Agency

- Investment Company Act of 1940 Whole Pool Test Results

- Repurchase Agreement Exposure by Counterparty

- RMBS Risk Measures

About Orchid Island Capital,

Inc.

Orchid Island Capital, Inc. is a specialty

finance company that invests in Agency RMBS that are either

traditional pass-through Agency RMBS or structured Agency RMBS.

Orchid Island Capital, Inc. has elected to be taxed as a REIT for

federal income tax purposes.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and other federal securities laws. These

forward-looking statements include, but are not limited to,

statements about the Company’s distributions. These forward-looking

statements are based upon Orchid Island Capital, Inc.’s present

expectations, but these statements are not guaranteed to occur.

Investors should not place undue reliance upon forward-looking

statements. For further discussion of the factors that could affect

outcomes, please refer to the “Risk Factors” section of the

Company’s Form 10-K for the year ended December 31, 2017.

|

RMBS Valuation Characteristics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized |

Realized |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sep 2018 |

Jul - Sep |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net |

|

|

Weighted |

CPR |

2018 CPR |

|

Modeled |

|

Modeled |

|

|

|

|

|

|

% |

|

|

Weighted |

|

|

Average |

(1-Month) |

(3-Month) |

|

Rate |

|

Rate |

|

|

|

Current |

|

Fair |

of |

|

Current |

Average |

|

|

Maturity |

(Reported |

(Reported |

|

Sensitivity |

|

Sensitivity |

| Type |

|

Face |

|

Value |

Portfolio |

|

Price |

Coupon |

GWAC |

Age |

(Months) |

in Oct) |

in Oct) |

|

(-50

BPS)(1) |

|

(+50

BPS)(1) |

| ARM RMBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ARM RMBS |

$ |

1,361 |

$ |

1,437 |

0.04 |

% |

$ |

105.63 |

4.64 |

% |

5.08 |

% |

166 |

194 |

0.01 |

% |

43.58 |

% |

$ |

8 |

|

$ |

(7 |

) |

| Total ARM RMBS |

|

1,361 |

|

1,437 |

0.04 |

% |

|

105.63 |

4.64 |

% |

5.08 |

% |

166 |

194 |

0.01 |

% |

43.58 |

% |

|

8 |

|

|

(7 |

) |

| Fixed Rate RMBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fixed Rate CMO |

|

740,989 |

|

760,587 |

21.64 |

% |

|

102.64 |

4.27 |

% |

4.62 |

% |

7 |

351 |

7.36 |

% |

7.09 |

% |

|

6,662 |

|

|

(11,508 |

) |

| Fixed Rate CMO Total |

|

740,989 |

|

760,587 |

21.64 |

% |

|

102.64 |

4.27 |

% |

4.62 |

% |

7 |

351 |

7.36 |

% |

7.09 |

% |

|

6,662 |

|

|

(11,508 |

) |

|

15yr 3.5 |

|

2,860 |

|

2,884 |

0.08 |

% |

|

100.85 |

3.50 |

% |

3.83 |

% |

59 |

119 |

0.14 |

% |

22.75 |

% |

|

56 |

|

|

(55 |

) |

| 15yr 4.0 |

|

769,252 |

|

790,445 |

22.49 |

% |

|

102.76 |

4.00 |

% |

4.52 |

% |

4 |

174 |

4.97 |

% |

4.77 |

% |

|

14,827 |

|

|

(15,791 |

) |

| 15yr Total |

|

772,112 |

|

793,329 |

22.57 |

% |

|

102.75 |

4.00 |

% |

4.51 |

% |

4 |

174 |

4.96 |

% |

4.86 |

% |

|

14,883 |

|

|

(15,846 |

) |

|

20yr 4.0 |

|

205,140 |

|

209,485 |

5.97 |

% |

|

102.12 |

4.00 |

% |

4.47 |

% |

16 |

220 |

8.42 |

% |

9.27 |

% |

|

4,917 |

|

|

(5,057 |

) |

| 20yr 4.5 |

|

19,024 |

|

19,763 |

0.56 |

% |

|

103.89 |

4.50 |

% |

5.14 |

% |

5 |

234 |

14.88 |

% |

15.95 |

% |

|

299 |

|

|

(379 |

) |

| 20yr Total |

|

224,164 |

|

229,248 |

6.53 |

% |

|

101.44 |

4.04 |

% |

4.52 |

% |

15 |

221 |

8.97 |

% |

9.84 |

% |

|

5,216 |

|

|

(5,436 |

) |

|

30yr 4.0 |

|

325,251 |

|

329,921 |

9.39 |

% |

|

101.44 |

4.00 |

% |

4.48 |

% |

18 |

338 |

5.70 |

% |

6.45 |

% |

|

8,417 |

|

|

(9,764 |

) |

|

30yr 4.5 |

|

1,040,243 |

|

1,083,556 |

30.84 |

% |

|

104.16 |

4.50 |

% |

4.92 |

% |

12 |

346 |

7.84 |

% |

9.41 |

% |

|

20,511 |

|

|

(25,887 |

) |

| 30yr 5.0 |

|

169,898 |

|

180,862 |

5.15 |

% |

|

106.45 |

5.00 |

% |

5.50 |

% |

6 |

352 |

7.95 |

% |

6.78 |

% |

|

2,824 |

|

|

(3,672 |

) |

| 30yr Total |

|

1,535,392 |

|

1,594,339 |

45.38 |

% |

|

103.84 |

4.45 |

% |

4.89 |

% |

12 |

345 |

7.40 |

% |

8.35 |

% |

|

31,752 |

|

|

(39,323 |

) |

| Total Fixed Rate RMBS |

|

3,272,657 |

|

3,377,503 |

96.12 |

% |

|

103.20 |

4.27 |

% |

4.72 |

% |

9 |

297 |

6.92 |

% |

7.48 |

% |

|

58,513 |

|

|

(72,113 |

) |

| Total Pass Through

RMBS |

|

3,274,018 |

|

3,378,940 |

96.16 |

% |

|

103.20 |

4.27 |

% |

4.72 |

% |

9 |

297 |

6.92 |

% |

7.50 |

% |

|

58,521 |

|

|

(72,120 |

) |

| Structured RMBS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-Only Securities |

|

714,440 |

|

111,929 |

3.19 |

% |

|

15.67 |

3.70 |

% |

4.28 |

% |

61 |

246 |

10.11 |

% |

11.07 |

% |

|

(12,360 |

) |

|

8,349 |

|

| Inverse Interest-Only Securities |

|

234,523 |

|

23,087 |

0.66 |

% |

|

9.84 |

3.06 |

% |

4.86 |

% |

51 |

300 |

11.02 |

% |

12.93 |

% |

|

2,702 |

|

|

(3,196 |

) |

| Total Structured RMBS |

|

948,963 |

|

135,016 |

3.84 |

% |

|

14.23 |

3.54 |

% |

4.42 |

% |

58 |

259 |

10.33 |

% |

11.53 |

% |

|

(9,658 |

) |

|

5,153 |

|

| Total Mortgage Assets |

$ |

4,222,981 |

$ |

3,513,956 |

100.00 |

% |

|

|

4.11 |

% |

4.65 |

% |

20 |

289 |

7.69 |

% |

8.57 |

% |

$ |

48,863 |

|

$ |

(66,967 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Int |

|

Int |

|

|

|

Average |

|

Hedge |

|

|

|

|

|

|

|

|

|

|

Rate |

|

Rate |

|

|

|

Notional |

|

Period |

|

|

|

|

|

|

|

|

|

|

Sensitivity |

|

Sensitivity |

| Hedge |

|

Balance(2) |

|

End |

|

|

|

|

|

|

|

|

|

|

(-50

BPS)(1) |

|

(+50 BPS)(1) |

|

Eurodollar Futures |

|

(1,500,000 |

) |

|

Jan-2020 |

|

|

|

|

|

|

|

|

|

$ |

(15,000 |

) |

$ |

15,000 |

|

Swaps |

|

(1,260,000 |

) |

|

Oct-2020 |

|

|

|

|

|

|

|

|

|

|

(13,455 |

) |

|

13,455 |

|

5-Year Treasury Future |

|

(165,000 |

) |

|

Dec-2018 |

|

|

|

|

|

|

|

|

|

|

(4,142 |

) |

|

4,112 |

|

TBA |

|

(400,000 |

) |

|

Oct-2018 |

|

|

|

|

|

|

|

|

|

|

(11,284 |

) |

|

12,835 |

| Swaptions |

|

(850,000 |

) |

|

Mar-2028 |

|

|

|

|

|

|

|

|

|

|

(5,930 |

) |

|

22,887 |

| Hedge Total |

|

(4,175,000 |

) |

|

|

|

|

|

|

|

|

|

|

|

$ |

(49,811 |

) |

$ |

68,289 |

| Rate Shock Grand Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(948 |

) |

$ |

1,322 |

(1) Modeled results from Citigroup Global Markets Inc. Yield

Book. Interest rate shocks assume instantaneous parallel shifts and

horizon prices are calculated assuming constant LIBOR

option-adjusted spreads. These results are for illustrative

purposes only and actual results may differ materially.(2) Five

year treasury futures contracts were valued at prices of $112.48 at

September 30, 2018. The notional contract value of the short

position was $185.6 million.

|

RMBS Assets by Agency |

|

|

|

|

Investment Company Act of 1940 Whole Pool

Test |

| ($ in thousands) |

|

|

|

|

($ in thousands) |

|

|

|

|

|

|

|

Percentage |

|

|

|

|

Percentage |

|

|

|

Fair |

of |

|

|

|

Fair |

of |

| Asset Category |

|

Value |

Portfolio |

|

Asset Category |

|

Value |

Portfolio |

|

As of September 30, 2018 |

|

|

|

|

As of September 30, 2018 |

|

|

|

|

Fannie Mae |

$ |

2,196,959 |

62.5 |

% |

|

Non-Whole Pool Assets |

$ |

1,123,264 |

32.0 |

% |

|

Freddie Mac |

|

1,312,238 |

37.4 |

% |

|

Whole Pool Assets |

|

2,390,692 |

68.0 |

% |

| Ginnie Mae |

|

4,759 |

0.1 |

% |

|

Total Mortgage Assets |

$ |

3,513,956 |

100.0 |

% |

| Total Mortgage Assets |

$ |

3,513,956 |

100.0 |

% |

|

|

|

|

|

| Borrowings By Counterparty |

|

|

|

|

|

|

|

|

| ($ in thousands) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Weighted |

Weighted |

|

| |

|

|

|

% of |

|

Average |

Average |

|

| |

|

Total |

|

Total |

|

Repo |

Maturity |

Longest |

| As of September 30,

2018 |

|

Borrowings |

|

Debt |

|

Rate |

in Days |

Maturity |

| RBC Capital Markets, LLC |

$ |

451,522 |

|

13.4 |

% |

|

2.33 |

% |

44 |

11/28/2018 |

| Mirae Asset Securities (USA) Inc. |

|

365,454 |

|

11.0 |

% |

|

2.28 |

% |

38 |

11/13/2018 |

| J.P. Morgan Securities LLC |

|

279,921 |

|

8.4 |

% |

|

2.35 |

% |

66 |

12/7/2018 |

| Wells Fargo Bank, N.A. |

|

270,968 |

|

8.2 |

% |

|

2.25 |

% |

12 |

10/26/2018 |

| Citigroup Global Markets Inc |

|

242,867 |

|

7.3 |

% |

|

2.35 |

% |

21 |

11/5/2018 |

| Mitsubishi UFJ Securities (USA), Inc |

|

224,256 |

|

6.8 |

% |

|

2.27 |

% |

36 |

11/16/2018 |

| ICBC Financial Services LLC |

|

181,998 |

|

5.5 |

% |

|

2.30 |

% |

63 |

12/13/2018 |

| Cantor Fitzgerald & Co |

|

177,575 |

|

5.3 |

% |

|

2.24 |

% |

44 |

11/13/2018 |

| ING Financial Markets LLC |

|

157,743 |

|

4.7 |

% |

|

2.30 |

% |

28 |

11/29/2018 |

| ABN AMRO Bank N.V. |

|

154,901 |

|

4.7 |

% |

|

2.28 |

% |

67 |

12/13/2018 |

| ED&F Man Capital Markets Inc |

|

147,852 |

|

4.5 |

% |

|

2.26 |

% |

36 |

11/9/2018 |

| Natixis, New York Branch |

|

121,495 |

|

3.7 |

% |

|

2.41 |

% |

17 |

10/24/2018 |

| FHLB-Cincinnati |

|

99,336 |

|

3.0 |

% |

|

2.36 |

% |

1 |

10/1/2018 |

| South Street Securities, LLC |

|

80,063 |

|

2.4 |

% |

|

2.35 |

% |

59 |

11/29/2018 |

| Bank of Montreal |

|

75,774 |

|

2.3 |

% |

|

2.28 |

% |

15 |

10/15/2018 |

| ASL Capital Markets Inc. |

|

55,622 |

|

1.7 |

% |

|

2.29 |

% |

46 |

11/16/2018 |

| Lucid Cash Fund USG LLC |

|

54,122 |

|

1.6 |

% |

|

2.33 |

% |

18 |

10/18/2018 |

| Goldman, Sachs & Co |

|

46,174 |

|

1.4 |

% |

|

2.23 |

% |

5 |

10/5/2018 |

| Nomura Securities International, Inc. |

|

42,851 |

|

1.3 |

% |

|

2.29 |

% |

18 |

10/22/2018 |

| ASL Capital Markets Inc. |

|

40,866 |

|

1.2 |

% |

|

2.29 |

% |

46 |

11/16/2018 |

| J.V.B. Financial Group, LLC |

|

26,294 |

|

0.8 |

% |

|

2.19 |

% |

16 |

10/16/2018 |

| Mizuho Securities USA, Inc |

|

10,155 |

|

0.3 |

% |

|

2.32 |

% |

22 |

10/22/2018 |

| Merrill Lynch, Pierce, Fenner & Smith |

|

8,401 |

|

0.3 |

% |

|

2.62 |

% |

6 |

10/10/2018 |

| Lucid Prime Fund, LLC |

|

5,594 |

|

0.2 |

% |

|

2.72 |

% |

18 |

10/18/2018 |

| Total Borrowings |

$ |

3,321,803 |

|

100.0 |

% |

|

2.30 |

% |

37 |

12/13/2018 |

Contact:

Orchid Island Capital, Inc.Robert E. Cauley3305

Flamingo Drive, Vero Beach, Florida 32963Telephone: (772)

231-1400

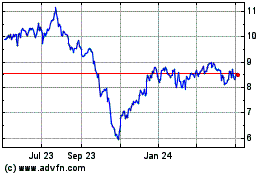

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

From Mar 2024 to Apr 2024

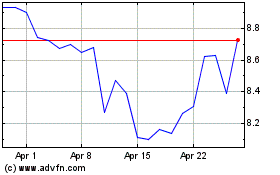

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

From Apr 2023 to Apr 2024