Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

October 17 2018 - 5:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check

the appropriate box:

☐ Preliminary Proxy Statement

☐

Confidential, for Use of the

Commission Onl

y (as permitted by Rule

14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material Pursuant to

§240.14a-12

CAMPBELL SOUP COMPANY

(Name of the Registrant as Specified In Its Charter)

THIRD POINT LLC

DANIEL

S. LOEB

THIRD POINT PARTNERS QUALIFIED L.P.

THIRD POINT PARTNERS L.P.

THIRD POINT OFFSHORE MASTER FUND L.P.

THIRD POINT ULTRA MASTER FUND L.P.

THIRD POINT ENHANCED LP

THIRD POINT ADVISORS LLC

THIRD POINT ADVISORS II LLC

FRANCI BLASSBERG

MATTHEW

COHEN

SARAH HOFSTETTER

MUNIB ISLAM

LAWRENCE

KARLSON

BOZOMA SAINT JOHN

KURT SCHMIDT

RAYMOND

SILCOCK

DAVID SILVERMAN

MICHAEL SILVERSTEIN

GEORGE STRAWBRIDGE, JR.

WILLIAM TOLER

(Name of

Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

This filing contains (1) a press release issued by Third Point LLC, (2) a Tweet issued by

@ThirdPointLLC and (3) a communication from Third Point LLC, each issued on October 17, 2018.

***

Third Point Comments on Unsurprising Announcement that Dorrance Family Members Intend to Vote for

Themselves and Their Own Interests at Campbell’s Annual Meeting

Calls on Entrenched Family Board Members to Listen to the Voices of Shareholders Rather Than Trying to

Intimidate Them with Inherited Voting Bloc

Notes Stock is Down ~4% in Hours Following the Announcement, Suggesting Shareholders’

Dissatisfaction with the Family’s Stunt

Reminds the Board That Shareholders Will Finally Have the Opportunity to Render a Verdict on The Insiders’ Multi-Decade “Reign of

Error” at this Year’s Annual Meeting and Their Voices Deserve to be Heard

Urges CPB Shareholders to VOTE the WHITE Proxy

Card to Elect the Independent Slate, Which Brings True Shareholder Alignment to the Board and Cares About Shareholder Interests Over Those of Insiders and Heirs

NEW YORK—(BUSINESS WIRE)—Third Point LLC (NYSE: TPRE; LSE: TPOU) (“Third Point”), a New York-based investment firm managing

approximately $18 billion in assets and a holder of approximately 7% of the outstanding common shares of Campbell Soup Company (NYSE: CPB) (“Campbell” or the “Company”), today responded to the Company’s announcement

that the entrenched family Board members intend to vote for themselves at this year’s Annual Meeting, saying:

“It is hardly news that the

entrenched family owners, who have long enriched themselves at the expense of shareholders and the Company, seek to preserve their Board seats and reign of error. Instead of patiently listening to shareholder views, waiting for votes to come in, and

respectfully awaiting the verdict of shareholder advisory firms, this group of billionaire heirs and heiresses are attempting to intimidate smaller shareholders by flaunting their inherited voting bloc as an impenetrable moat. This stunt shows that

Campbell’s is in for more of the same unless the Independent Slate is elected in November. The Independent Slate is not intimidated – indeed, we are running precisely so that shareholders finally have an opportunity to render a

verdict on the entrenched insiders’ dreadful tenure at this year’s Annual Meeting. This is a long overdue reckoning that they have no interest in hearing, as their actions today show.

We encourage shareholders to VOTE THE WHITE CARD to #RefreshTheRecipe and end the rule of unqualified heirs and heiresses who do not believe in accountability

– but rather in the divine right of inherited power.”

We also encourage all shareholders to review

The Independents

and

our

detailed presentation

to understand why the Independent Slate will respect Shareholder voices, end the Insiders’ Reign of Error, and set Campbell’s on a new and profitable path. We urge shareholders to VOTE the WHITE Proxy Card to

elect the Independent Slate and #RefreshTheRecipe.

***

Your Vote Is Important, No Matter How Many or How Few Shares You Own!

PLEASE REMEMBER TO CAN THE COMPANY’S CARD! If you return a Campbell’s proxy card –

even by simply indicating “withhold” on the Company’s slate – you will revoke any vote you had previously submitted for Third Point on the WHITE proxy card.

IMPORTANT INFORMATION

On

September 28, 2018, Third Point LLC filed a definitive proxy statement and on October 1, 2018 filed Supplement No. 1 thereto and on October 9, 2018 filed Supplement No. 2 thereto (collectively, the “Definitive Proxy

Statement”) with the U.S. Securities and Exchange Commission (“SEC”) to solicit proxies from stockholders of Campbell Soup Company (the “Company”) for use at the Company’s 2018 annual meeting of stockholders. THIRD

POINT STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ THE DEFINITIVE PROXY STATEMENT BECAUSE IT CONTAINS IMPORTANT INFORMATION.

THE DEFINITIVE PROXY STATEMENT ALSO INCLUDES INFORMATION ABOUT THE IDENTITY OF THE PARTICIPANTS IN THE THIRD

POINT SOLICITATION AND A DESCRIPTION OF THEIR DIRECT OR INDIRECT INTERESTS THEREIN.

The Definitive Proxy Statement is available at no charge on the SEC’s website at

http://www.sec.gov

and is also available, without

charge, on request from Third Point LLC’s proxy solicitor, Okapi Partners LLC, at (855)

208-8902

or via email at

CPBinfo@okapipartners.com.

CONTACTS

For Media:

Third Point LLC

Elissa Doyle,

917-748-8533

Chief Marketing Officer

edoyle@thirdpoint.com

###

Nothing like stale #corpgov & voter intimidation to get us tweeting! Now that

@CampbellSoupCo is set on maintaining its reign of error, we want to ensure ALL shareholders are empowered. Get today’s response to $CPB: http://bit.ly/RefreshCPB (SEC Legend: http://bit.ly/SEC_Legend)

* * *

|

|

|

View this email in your browser

|

|

|

|

Vote the WHITE Card

this Proxy Season

Read

Third Point’s

response

to today’s unsurprising announcement that

Dorrance family members intend to vote FOR themselves

and

their own interests at Campbell’s Annual Meeting

We encourage you to

vote the WHITE

proxy

card to end this reign of

error and elect

the Independent Slate

.

#RefreshTheRecipe

|

|

|

|

Copyright

©

2018 Third Point LLC, All rights

reserved.

www.RefreshCampbells.com

Want

to change how you receive these emails?

You can

update your preferences

or

unsubscribe from this list

.

|

****

IMPORTANT INFORMATION

On September 28, 2018, Third

Point LLC filed a definitive proxy statement and on October 1, 2018 filed Supplement No. 1 thereto and on October 9, 2018 filed Supplement No. 2 thereto (collectively, the “Definitive Proxy Statement”) with the U.S.

Securities and Exchange Commission (“SEC”) to solicit proxies from stockholders of Campbell Soup Company (the “Company”) for use at the Company’s 2018 annual meeting of stockholders. THIRD POINT STRONGLY ADVISES ALL

STOCKHOLDERS OF THE COMPANY TO READ THE DEFINITIVE PROXY STATEMENT BECAUSE IT CONTAINS IMPORTANT INFORMATION.

THE DEFINITIVE PROXY STATEMENT ALSO INCLUDES INFORMATION ABOUT THE IDENTITY OF THE PARTICIPANTS IN THE THIRD POINT SOLICITATION AND A

DESCRIPTION OF THEIR DIRECT OR INDIRECT INTERESTS THEREIN.

The Definitive Proxy Statement is available at no charge on the SEC’s website at http://www.sec.gov and is also available, without charge, on request from Third Point LLC’s

proxy solicitor, Okapi Partners LLC, at (855)

208-8902

or via email at

CPBinfo@okapipartners.com

.

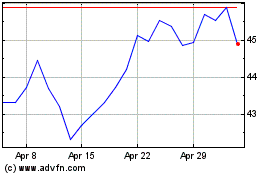

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Mar 2024 to Apr 2024

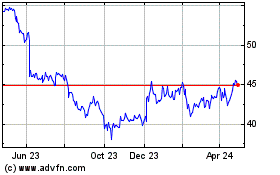

Campbell Soup (NYSE:CPB)

Historical Stock Chart

From Apr 2023 to Apr 2024