Current Report Filing (8-k)

October 17 2018 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October

1

5

, 201

8

OPTICAL CABLE CORPORATION

(Exact name of registrant as specified in its charter)

|

Virginia

|

|

000-27022

|

|

54-1237042

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

|

|

|

|

5290 Concourse Drive

Roanoke, VA

|

|

24019

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(540) 265-0690

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Table of Contents

|

Item 1.01 Entry into a Material Definitive Agreement

|

|

|

|

Item 9.01 Financial Statements and Exhibits

|

|

|

|

Signatures

|

|

|

|

Exhibits

|

Item 1.01 Entry into a Definitive Agreement

F

ifth

Loan Modification Agreement.

On October 15, 2018, Optical Cable Corporation (the “Company”) and Pinnacle Bank, a Tennessee banking corporation, as successor in interest by name change and by merger with the Bank of North Carolina (the “Lender”) entered into a Fifth Loan Modification Agreement (the “Agreement”) to modify the Credit Agreement dated April 26, 2016 (as amended and modified by Loan Modification Agreement dated December 21, 2016, and by Second Loan Modification Agreement dated February 28, 2017, and by Third Loan Modification Agreement dated April 27, 2017, and by Fourth Loan Modification Agreement dated April 10, 2018 (collectively, the “Credit Agreement”) and the associated Term Loan A Note, Term Loan B Note, and Revolving Credit Note, all dated April 26, 2016 (collectively, the “Notes”). The Credit Agreement, the Notes, and the ancillary documents (as defined in the Credit Agreement), as amended by the Agreement are defined as the “Loan”.

The Company’s credit facilities from the Lender pursuant to the Loan consist of (i) the term loan evidenced by the Term Loan A Note, (ii) the term loan evidenced by the Term Loan B Note, and (iii) a $7,000,000 revolving line of credit (the “Revolving Loan”).

The primary purpose of the Agreement was to: (i) extend the expiration date of the Revolving Loan in one year increments by Lender giving written notice of extension to the Company no later than April 30 of the calendar year immediately prior to the calendar year of the then effective Revolving Loan expiration date, (ii) modify the fixed charge coverage ratio financial covenant for the Company to not less than 1.25 to 1.00 under the Loan, (iii) modify the debt to worth ratio of total liabilities to tangible net worth financial covenant for the Company to no greater than 0.95:1.00 under the Loan, (iv) modify the current ratio financial covenant for the Company to not less than 3.00 to 1.00 under the Loan, and (v) extend the Revolving Loan expiration date to April 30, 2020.

The Loan remains generally secured by the land and buildings at the Company’s headquarters and manufacturing facilities located in Roanoke, Virginia and its manufacturing and office facilities located near Asheville, North Carolina and the Company’s personal property and assets.

All other terms of the Loan remain unaltered and remain in full force and effect.

The Agreement with the Lender is attached hereto as Exhibit 4.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(c) Exhibits

The following is filed as an Exhibit to this Report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

OPTICAL CABLE CORPORATION

|

|

|

|

|

|

|

By:

|

/s/ TRACY G. SMITH

|

|

|

Name:

|

Tracy G. Smith

|

|

|

Title:

|

Senior Vice President and Chief Financial Officer

|

Dated: October 17, 2018

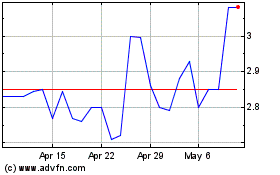

Optical Cable (NASDAQ:OCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

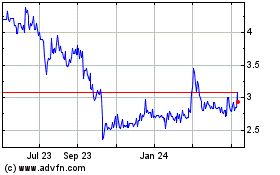

Optical Cable (NASDAQ:OCC)

Historical Stock Chart

From Apr 2023 to Apr 2024