United Rentals, Inc. (NYSE: URI) today announced financial

results for the third quarter 20181. Total revenue was $2.116

billion and rental revenue was $1.861 billion for the third

quarter, compared with $1.766 billion and $1.536 billion,

respectively, for the same period last year. On a GAAP basis, the

company reported third quarter net income of $333 million, or $4.01

per diluted share, compared with $199 million, or $2.33 per diluted

share, for the same period last year. The third quarter 2018

includes a net income benefit associated with the Tax Cuts and Jobs

Act (the “Tax Act”) that was enacted in December 2017. The Tax Act

reduced the U.S. federal corporate statutory tax rate from 35% to

21%, which contributed an estimated $0.73 to earnings per diluted

share for the third quarter 20182.

Adjusted EPS3 for the quarter was $4.74 per diluted share,

compared with $3.25 per diluted share for the same period last

year. The reduction in the tax rate discussed above contributed an

estimated $0.87 to adjusted EPS for the third quarter 20182.

Adjusted EBITDA3 was $1.059 billion and adjusted EBITDA margin3 was

50.0%, reflecting increases of $180 million and 20 basis points,

respectively, from the same period last year. Excluding the impact

of the BakerCorp acquisition, adjusted EBITDA margin improved 80

basis points year-over-year to a record of 50.6%.

Third Quarter 2018 Highlights

- Rental revenue4 increased 21.2%

year-over-year. Owned equipment rental revenue increased 20.3%,

reflecting increases of 17.8% in the volume of equipment on rent

and 2.1% in rental rates.

- Pro forma1 rental revenue increased

10.9% year-over-year, reflecting growth of 7.4% in the volume of

equipment on rent and a 2.1% increase in rental rates.

- Time utilization decreased 100 basis

points year-over-year to 70.9%, primarily reflecting the impact of

the Neff and BakerCorp acquisitions. On a pro forma basis, time

utilization decreased 10 basis points year-over-year to 70.7%.

- For the company’s specialty segment,

Trench, Power and Fluid Solutions, rental revenue increased by

39.5% year-over-year, including a 12.7% increase on a same store

basis. Rental gross margin decreased by 250 basis points to 52.3%.

The decrease in rental gross margin was primarily due to the impact

of the BakerCorp acquisition and an increase in lower-margin fuel

revenues primarily within the Power and HVAC region1.

_______________ 1. The company completed the acquisitions of

NES Rentals Holdings II, Inc. (“NES”), Neff Corporation ("Neff")

and BakerCorp International Holdings, Inc. (“BakerCorp”) in April

2017, October 2017, and July 2018, respectively. The acquisitions

are included in the company's results subsequent to the acquisition

dates. Pro forma results reflect the combination of United Rentals,

NES, Neff and BakerCorp for all periods presented. The acquired

BakerCorp locations are reflected in the Trench, Power and Fluid

Solutions specialty segment. The name of the specialty segment was

changed (formerly "Trench, Power and Pump") to reflect the broader

product offering following the BakerCorp acquisition. 2. The

estimated contribution of the Tax Act was calculated by applying

the percentage point tax rate reduction to U.S. pretax income and

the pretax adjustments reflected in adjusted EPS. 3. Adjusted EPS

(earnings per share) and adjusted EBITDA (earnings before interest,

taxes, depreciation and amortization) are non-GAAP measures that

exclude the impact of the items noted in the tables below. See the

tables below for amounts and reconciliations to the most comparable

GAAP measures. Adjusted EBITDA margin represents adjusted EBITDA

divided by total revenue. 4. Rental revenue includes owned

equipment rental revenue, re-rent revenue and ancillary revenue.

- The company generated $140 million of

proceeds from used equipment sales at a GAAP gross margin of 40.7%

and an adjusted gross margin of 50.0%, compared with $139 million

at a GAAP gross margin of 39.6% and an adjusted gross margin of

56.8% for the same period last year. The year-over-year decrease in

adjusted gross margin was primarily due to the impact of selling

more fully depreciated fleet acquired in the NES acquisition in the

third quarter 20175.

BlueLine Acquisition

On September 10, 2018, the company announced that it has entered

into a definitive agreement to acquire Vander Holding Corporation

and its subsidiaries (“BlueLine”) for approximately $2.1 billion in

cash. The company expects to fund the acquisition using a new $1

billion term loan facility and other debt issuances. BlueLine is

one of the ten largest equipment rental companies in North America,

serves over 50,000 customers in the construction and industrial

sectors, and has 114 locations and over 1,700 employees based in 25

U.S. states, Canada and Puerto Rico. BlueLine has annual revenues

of approximately $786 million. The transaction is expected to close

in the fourth quarter, subject to Hart-Scott-Rodino clearance and

other customary conditions.

CEO Comments

Michael Kneeland, chief executive officer of United Rentals,

said, "We are pleased with the strength of our third quarter

results, including the acceleration in volume growth and improved

margins. Our rates were again positive for each month in a

competitive market, while time utilization remained robust. We

continue to make good progress integrating Baker into our specialty

operations, and look forward to beginning that process with

BlueLine this quarter."

Kneeland continued, "Our updated guidance reflects the

combination of strong market demand and the contributions from our

completed acquisitions, which, together with internal and external

indicators, point to a solid fourth quarter and healthy momentum

into 2019. Our strategy remains highly focused on driving

profitable growth across our core businesses, integrating our

recent acquisitions and leveraging our cash flows to maximize

shareholder value."

Nine Months 2018 Highlights

- Rental revenue increased 21.7%

year-over-year. Owned equipment rental revenue increased 21.4%,

reflecting increases of 19.6% in the volume of equipment on rent

and 2.3% in rental rates.

- Pro forma rental revenue increased

11.0% year-over-year, reflecting growth of 7.3% in the volume of

equipment on rent and a 2.4% increase in rental rates.

- Time utilization decreased 80 basis

points year-over-year to 68.5%, primarily reflecting the impact of

the NES, Neff and BakerCorp acquisitions. On a pro forma basis,

time utilization increased 20 basis points year-over-year to

68.2%.

- For the company’s specialty segment,

Trench, Power and Fluid Solutions, rental revenue increased by

36.8% year-over-year, including a 19.1% increase on a same store

basis. Rental gross margin decreased by 90 basis points to 49.5%.

The decrease in rental gross margin was primarily due to the impact

of the BakerCorp acquisition.

- The company generated $478 million of

proceeds from used equipment sales at a GAAP gross margin of 41.0%

and an adjusted gross margin of 52.1%, compared with $378 million

at a GAAP gross margin of 40.5% and an adjusted gross margin of

53.7% for the same period last year. The year-over-year increase in

used equipment sales primarily reflects increased volume, driven by

a significantly larger fleet size, in a strong used equipment

market.5

_______________ 5. Used equipment sales adjusted gross

margin excludes the impact of the fair value mark-up of acquired

RSC, NES and Neff fleet that was sold. In 2018, we adopted

Accounting Standards Codification (“ASC”) Topic 606, “Revenue from

Contracts with Customers”. Used equipment sales in the third

quarter of 2017 would have been reduced by $14 million under Topic

606 because such sales would have been recognized prior to the

third quarter. The amount of used equipment sales recognized for

the nine months ended September 30, 2017 does not differ materially

from the amount that would have been recognized under Topic 606.

While the adoption of Topic 606 impacted the timing of revenue

recognition, it has no impact on annual revenue.

2018 Outlook

The following revised full-year guidance does not include the impact of the pending

acquisition of BlueLine. For additional detail on BlueLine, please

see the section above, as well as the investor presentations that

are currently accessible on www.unitedrentals.com.

Prior Outlook

Current Outlook Total revenue $7.64 billion to $7.84 billion

$7.77 billion to $7.87 billion

Adjusted EBITDA6

$3.715 billion to $3.815 billion $3.765 billion to $3.815 billion

Net rental capital expenditures aftergross

purchases

$1.3 billion to $1.4 billion,after gross

purchases of$1.95 billion to $2.05 billion

$1.35 billion to $1.45 billion,after gross

purchases of $2.0billion to $2.1 billion

Net cash provided by operating activities $2.725 billion to $2.875

billion $2.725 billion to $2.875 billion

Free cash flow7 (excluding the impact

ofmerger and restructuring related payments)

$1.3 billion to $1.4 billion $1.25 billion to $1.35 billion

Free Cash Flow and Fleet Size

For the first nine months of 2018, net cash provided by

operating activities was $2.123 billion, and free cash flow was

$536 million after total rental and non-rental gross capital

expenditures of $2.096 billion. For the first nine months of 2017,

net cash provided by operating activities was $1.756 billion, and

free cash flow was $582 million after total rental and non-rental

gross capital expenditures of $1.572 billion. Free cash flow for

the first nine months of 2018 and 2017 included aggregate merger

and restructuring related payments of $32 million and $52 million,

respectively.

The size of the rental fleet was $12.90 billion of OEC at

September 30, 2018, compared with $11.51 billion at December

31, 2017. The age of the rental fleet was 46.6 months on an

OEC-weighted basis at September 30, 2018, compared with 47.0

months at December 31, 2017.

Return on Invested Capital (ROIC)

ROIC was 10.7% for the 12 months ended September 30, 2018,

compared with 8.6% for the 12 months ended September 30, 2017.

The company’s ROIC metric uses after-tax operating income for the

trailing 12 months divided by average stockholders’ equity, debt

and deferred taxes, net of average cash. To mitigate the volatility

related to fluctuations in the company’s tax rate from period to

period, the U.S. federal corporate statutory tax rates of 21% and

35% for 2018 and 2017, respectively, were used to calculate

after-tax operating income.

The company expects ROIC to materially increase due to the

reduced tax rates following the enactment of the Tax Act, but,

because the trailing 12 months are used for the ROIC calculation,

the full impact will not be reflected until one year after the

lower tax rate became effective. If the 21% U.S. federal corporate

statutory tax rate following the enactment of the Tax Act was

applied to ROIC for all historic periods, the company estimates

that ROIC would have been 11.0% and 10.3% for the 12 months ended

September 30, 2018 and 2017, respectively.

_______________ 6. Information reconciling forward-looking

adjusted EBITDA to the comparable GAAP financial measures is

unavailable to the company without unreasonable effort, as

discussed below. 7. Free cash flow is a non-GAAP measure. See the

table below for amounts and a reconciliation to the most comparable

GAAP measure.

Share Repurchase Program

In July 2018, the company commenced its previously announced

$1.25 billion share repurchase program. As of September 30,

2018, the company has repurchased $210 million of common stock

under the program. The company expects to pause repurchases under

the program following the completion of the pending BlueLine

acquisition discussed above. The company intends to complete the

share repurchase program; however, it will continue to evaluate its

decision to do so as it integrates BlueLine.

Conference Call

United Rentals will hold a conference call tomorrow, Thursday,

October 18, 2018, at 11:00 a.m. Eastern Time. The conference

call number is 855-458-4217 (international: 574-990-3618). The

conference call will also be available live by audio webcast at

unitedrentals.com, where it will be archived until the next

earnings call. The replay number for the call is 404-537-3406,

passcode is 3484139.

Non-GAAP Measures

Free cash flow, earnings before interest, taxes, depreciation

and amortization (EBITDA), adjusted EBITDA, and adjusted earnings

per share (adjusted EPS) are non-GAAP financial measures as defined

under the rules of the SEC. Free cash flow represents net cash

provided by operating activities less purchases of, and plus

proceeds from, equipment. The equipment purchases and proceeds

represent cash flows from investing activities. EBITDA represents

the sum of net income, provision for income taxes, interest

expense, net, depreciation of rental equipment and non-rental

depreciation and amortization. Adjusted EBITDA represents EBITDA

plus the sum of the merger related costs, restructuring charge,

stock compensation expense, net, and the impact of the fair value

mark-up of acquired fleet. Adjusted EPS represents EPS plus the sum

of the merger related costs, restructuring charge, the impact on

depreciation related to acquired fleet and property and equipment,

the impact of the fair value mark-up of acquired fleet, the loss on

repurchase/redemption of debt securities and amendment of ABL

facility, and merger related intangible asset amortization. The

company believes that: (i) free cash flow provides useful

additional information concerning cash flow available to meet

future debt service obligations and working capital requirements;

(ii) EBITDA and adjusted EBITDA provide useful information about

operating performance and period-over-period growth, and help

investors gain an understanding of the factors and trends affecting

our ongoing cash earnings, from which capital investments are made

and debt is serviced; and (iii) adjusted EPS provides useful

information concerning future profitability. However, none of these

measures should be considered as alternatives to net income, cash

flows from operating activities or earnings per share under GAAP as

indicators of operating performance or liquidity.

Information reconciling forward-looking adjusted EBITDA to GAAP

financial measures is unavailable to the company without

unreasonable effort. The company is not able to provide

reconciliations of adjusted EBITDA to GAAP financial measures

because certain items required for such reconciliations are outside

of the company’s control and/or cannot be reasonably predicted,

such as the provision for income taxes. Preparation of such

reconciliations would require a forward-looking balance sheet,

statement of income and statement of cash flow, prepared in

accordance with GAAP, and such forward-looking financial statements

are unavailable to the company without unreasonable effort. The

company provides a range for its adjusted EBITDA forecast that it

believes will be achieved, however it cannot accurately predict all

the components of the adjusted EBITDA calculation. The company

provides an adjusted EBITDA forecast because it believes that

adjusted EBITDA, when viewed with the company’s results under GAAP,

provides useful information for the reasons noted above. However,

adjusted EBITDA is not a measure of financial performance or

liquidity under GAAP and, accordingly, should not be considered as

an alternative to net income or cash flow from operating activities

as an indicator of operating performance or liquidity.

About United Rentals

United Rentals, Inc. is the largest equipment rental company in

the world. The company has an integrated network of 1,075 rental

locations in North America and 11 in Europe. In North America, the

company operates in 49 states and every Canadian province. The

company’s approximately 16,700 employees serve construction and

industrial customers, utilities, municipalities, homeowners and

others. The company offers approximately 3,800 classes of equipment

for rent with a total original cost of $12.90 billion. United

Rentals is a member of the Standard & Poor’s 500 Index, the

Barron’s 400 Index and the Russell 3000 Index® and is headquartered

in Stamford, Conn. Additional information about United Rentals is

available at unitedrentals.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of

1934, as amended, and the Private Securities Litigation Reform Act

of 1995, known as the PSLRA. These statements can generally be

identified by the use of forward-looking terminology such as

“believe,” “expect,” “may,” “will,” “should,” “seek,” “on-track,”

“plan,” “project,” “forecast,” “intend” or “anticipate,” or the

negative thereof or comparable terminology, or by discussions of

vision, strategy or outlook. These statements are based on current

plans, estimates and projections, and, therefore, you should not

place undue reliance on them. No forward-looking statement can be

guaranteed, and actual results may differ materially from those

projected. Factors that could cause actual results to differ

materially from those projected include, but are not limited to,

the following: (1) the challenges associated with past or future

acquisitions, including NES, Neff, BakerCorp and the proposed

BlueLine acquisition, such as undiscovered liabilities, costs,

integration issues and/or the inability to achieve the cost and

revenue synergies expected; (2) the risk that the proposed BlueLine

acquisition may not be completed; (3) a slowdown in North American

construction and industrial activities, which could reduce our

revenues and profitability; (4) our significant indebtedness, which

requires us to use a substantial portion of our cash flow for debt

service and can constrain our flexibility in responding to

unanticipated or adverse business conditions; (5) the inability to

refinance our indebtedness at terms that are favorable to us, or at

all; (6) the incurrence of additional debt, which could exacerbate

the risks associated with our current level of indebtedness; (7)

noncompliance with covenants in our debt agreements, which could

result in termination of our credit facilities and acceleration of

outstanding borrowings; (8) restrictive covenants and amount of

borrowings permitted under our debt agreements, which could limit

our financial and operational flexibility; (9) an overcapacity of

fleet in the equipment rental industry; (10) a decrease in levels

of infrastructure spending, including lower than expected

government funding for construction projects; (11) fluctuations in

the price of our common stock and inability to complete stock

repurchases in the time frame and/or on the terms anticipated; (12)

our rates and time utilization being less than anticipated; (13)

our inability to manage credit risk adequately or to collect on

contracts with customers; (14) our inability to access the capital

that our business or growth plans may require; (15) the incurrence

of impairment charges; (16) trends in oil and natural gas could

adversely affect demand for our services and products; (17) our

dependence on distributions from subsidiaries as a result of our

holding company structure and the fact that such distributions

could be limited by contractual or legal restrictions; (18) an

increase in our loss reserves to address business operations or

other claims and any claims that exceed our established levels of

reserves; (19) the incurrence of additional costs and expenses

(including indemnification obligations) in connection with

litigation, regulatory or investigatory matters; (20) the outcome

or other potential consequences of litigation and other claims and

regulatory matters relating to our business, including certain

claims that our insurance may not cover; (21) the effect that

certain provisions in our charter and certain debt agreements and

our significant indebtedness may have of making more difficult or

otherwise discouraging, delaying or deterring a takeover or other

change of control of us; (22) management turnover and inability to

attract and retain key personnel; (23) our costs being more than

anticipated and/or the inability to realize expected savings in the

amounts or time frames planned; (24) our dependence on key

suppliers to obtain equipment and other supplies for our business

on acceptable terms; (25) our inability to sell our new or used

fleet in the amounts, or at the prices, we expect; (26) competition

from existing and new competitors; (27) security breaches,

cybersecurity attacks and other significant disruptions in our

information technology systems; (28) the costs of complying with

environmental, safety and foreign laws and regulations, as well as

other risks associated with non-U.S. operations, including currency

exchange risk; (29) labor difficulties and labor-based legislation

affecting our labor relations and operations generally; (30)

increases in our maintenance and replacement costs and/or decreases

in the residual value of our equipment; and (31) the effect of

changes in tax law, such as the effect of the Tax Cuts and Jobs Act

that was enacted on December 22, 2017. For a more complete

description of these and other possible risks and uncertainties,

please refer to our Annual Report on Form 10-K for the year ended

December 31, 2017, as well as to our subsequent filings with the

SEC. The forward-looking statements contained herein speak only as

of the date hereof, and we make no commitment to update or publicly

release any revisions to forward-looking statements in order to

reflect new information or subsequent events, circumstances or

changes in expectations.

UNITED RENTALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME (UNAUDITED)

(In millions, except per share

amounts)

Three Months Ended Nine Months Ended

September 30, September 30, 2018

2017 2018 2017 Revenues:

Equipment rentals $ 1,861

$

1,536 $ 4,951 $ 4,069 Sales of rental equipment 140 139 478 378

Sales of new equipment 54 40 140 126 Contractor supplies sales 24

21 66 60 Service and other revenues 37 30 106

86

Total revenues 2,116 1,766

5,741 4,719 Cost of revenues:

Cost of equipment rentals, excluding depreciation 671 557 1,883

1,556 Depreciation of rental equipment 343 290 988 804 Cost of

rental equipment sales 83 84 282 225 Cost of new equipment sales 46

34 121 108 Cost of contractor supplies sales 15 14 43 42 Cost of

service and other revenues 20 14 58 42

Total cost of revenues 1,178 993

3,375 2,777 Gross profit

938 773 2,366 1,942 Selling, general

and administrative expenses 265 237 736 648 Merger related costs 11

16 14 32 Restructuring charge 9 9 15 28 Non-rental depreciation and

amortization 75 63 213 189 Operating

income 578 448 1,388 1,045 Interest expense, net 118 131 339 338

Other income, net — (5 ) (2 ) (5 ) Income before provision

for income taxes 460 322 1,051 712 Provision for income taxes (1)

127 123 265 263

Net income (1)

$ 333 $ 199 $

786 $ 449 Diluted earnings

per share (1) $ 4.01 $ 2.33

$ 9.34 $ 5.26

(1) The three and nine months ended September 30,

2018 reflect a reduction in the U.S. federal corporate statutory

tax rate from 35% to 21% following the enactment of the Tax Cuts

and Jobs Act in December 2017, which contributed an estimated $0.73

and $1.68 to diluted earnings per share for the three and nine

months ended September 30, 2018, respectively.

UNITED RENTALS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(In millions)

September 30, 2018 December 31, 2017

ASSETS Cash and cash equivalents $ 65 $ 352 Accounts

receivable, net 1,438 1,233 Inventory 104 75 Prepaid expenses and

other assets 85 112 Total current assets 1,692 1,772

Rental equipment, net 8,910 7,824 Property and equipment, net 529

467 Goodwill 4,313 4,082 Other intangible assets, net 895 875 Other

long-term assets 15 10

Total assets $

16,354 $ 15,030 LIABILITIES

AND STOCKHOLDERS’ EQUITY Short-term debt and current maturities

of long-term debt $ 896 $ 723 Accounts payable 688 409 Accrued

expenses and other liabilities 503 536 Total current

liabilities 2,087 1,668 Long-term debt 9,182 8,717 Deferred taxes

1,628 1,419 Other long-term liabilities 123 120

Total liabilities 13,020 11,924

Common stock 1 1 Additional paid-in capital 2,380 2,356 Retained

earnings 3,791 3,005 Treasury stock (2,660 ) (2,105 ) Accumulated

other comprehensive loss (178 ) (151 )

Total stockholders’

equity 3,334 3,106 Total

liabilities and stockholders’ equity $ 16,354

$ 15,030

UNITED RENTALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (UNAUDITED)

(In millions)

Three Months Ended Nine Months Ended

September 30, September 30, 2018

2017 2018 2017 Cash Flows

From Operating Activities: Net income $ 333 $ 199 $ 786 $ 449

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 418 353 1,201

993 Amortization of deferred financing costs and original issue

discounts 3 2 9 6 Gain on sales of rental equipment (57 ) (55 )

(196 ) (153 ) Gain on sales of non-rental equipment (1 ) (1 ) (4 )

(4 ) Gain on insurance proceeds from damaged equipment (4 ) (2 )

(18 ) (10 ) Stock compensation expense, net 30 24 73 64 Merger

related costs 11 16 14 32 Restructuring charge 9 9 15 28 Loss on

repurchase/redemption of debt securities and amendment of ABL

facility — 31 — 43 Increase in deferred taxes 97 57 190 97 Changes

in operating assets and liabilities: Increase in accounts

receivable (160 ) (156 ) (131 ) (172 ) Increase in inventory (4 )

(4 ) (23 ) (9 ) Decrease (increase) in prepaid expenses and other

assets 6 6 31 (1 ) (Decrease) increase in accounts payable (213 )

(79 ) 238 350 Increase (decrease) in accrued expenses and other

liabilities 6 27 (62 ) 43

Net cash provided

by operating activities 474 427 2,123

1,756 Cash Flows From Investing Activities: Purchases

of rental equipment (736 ) (572 ) (1,962 ) (1,485 ) Purchases of

non-rental equipment (54 ) (32 ) (134 ) (87 ) Proceeds from sales

of rental equipment 140 139 478 378 Proceeds from sales of

non-rental equipment 5 4 13 10 Insurance proceeds from damaged

equipment 4 2 18 10 Purchases of other companies, net of cash

acquired (747 ) (98 ) (805 ) (1,063 ) Purchases of investments —

(1 ) (1 ) (5 )

Net cash used in investing activities

(1,388 ) (558 ) (2,393 )

(2,242 ) Cash Flows From Financing Activities:

Proceeds from debt 2,732 4,759 7,062 8,702 Payments of debt (1,658

) (4,613 ) (6,464 ) (8,156 ) Payments of financing costs — (37 ) (1

) (44 ) Proceeds from the exercise of common stock options — — 2 1

Common stock repurchased (1) (211 ) (2 ) (606 ) (26 )

Net cash

provided by (used in) financing activities 863

107 (7 ) 477 Effect of foreign exchange

rates (1 ) 10 (10 ) 21

Net (decrease) increase in

cash and cash equivalents (52 ) (14

) (287 ) 12 Cash and cash equivalents

at beginning of period 117 338 352 312

Cash and cash equivalents at end of period $

65 $ 324 $ 65

$ 324 Supplemental disclosure of

cash flow information: Cash paid for income taxes, net $ 11 $

55 $ 50 $ 114 Cash paid for interest 166 128 379 305

UNITED RENTALS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (UNAUDITED) (continued)

(1) We have an open $1.25 billion share repurchase program

that commenced in July 2018. We expect to pause repurchases under

the program following the completion of the pending BlueLine

acquisition discussed above. We intend to complete the share

repurchase program; however, we will continue to evaluate the

decision to do so as we integrate BlueLine. The common stock

repurchases include i) shares repurchased pursuant to our share

repurchase programs and ii) shares withheld to satisfy tax

withholding obligations upon the vesting of restricted stock unit

awards.

UNITED RENTALS, INC.

SEGMENT PERFORMANCE

($ in millions)

Three Months Ended Nine Months Ended

September 30, September 30, 2018

2017 Change 2018

2017 Change General Rentals

Reportable segment equipment rentals revenue $1,444 $1,237 16.7%

$3,977 $3,357 18.5% Reportable segment equipment rentals gross

profit 629 525 19.8% 1,598 1,350 18.4% Reportable segment equipment

rentals gross margin 43.6% 42.4% 120 bps 40.2% 40.2% — bps

Trench, Power and Fluid Solutions Reportable segment

equipment rentals revenue $417 $299 39.5% $974 $712 36.8%

Reportable segment equipment rentals gross profit 218 164 32.9% 482

359 34.3% Reportable segment equipment rentals gross margin 52.3%

54.8% (250) bps 49.5% 50.4% (90) bps

Total United Rentals

Total equipment rentals revenue $1,861 $1,536 21.2% $4,951 $4,069

21.7% Total equipment rentals gross profit 847 689 22.9% 2,080

1,709 21.7% Total equipment rentals gross margin 45.5% 44.9% 60 bps

42.0% 42.0% — bps

UNITED RENTALS, INC.

DILUTED EARNINGS PER SHARE

CALCULATION

(In millions, except per share

data)

Three Months Ended Nine Months Ended

September 30, September 30, 2018

2017 2018 2017 Numerator: Net

income available to common stockholders (1) $ 333 $ 199 $ 786 $ 449

Denominator: Denominator for basic earnings per

share—weighted-average common shares 82.3 84.7 83.3 84.6 Effect of

dilutive securities: Employee stock options 0.4 0.4 0.4 0.4

Restricted stock units 0.5 0.5 0.5 0.5

Denominator for diluted earnings per

share—adjusted weighted-averagecommon shares

83.2 85.6 84.2 85.5 Diluted earnings

per share (1) $ 4.01 $ 2.33

$ 9.34 $ 5.26 (1) The

three and nine months ended September 30, 2018 reflect a reduction

in the U.S. federal corporate statutory tax rate from 35% to 21%

following the enactment of the Tax Cuts and Jobs Act in December

2017, which contributed an estimated $0.73 and $1.68 to diluted

earnings per share for the three and nine months ended September

30, 2018, respectively.

UNITED RENTALS, INC.ADJUSTED EARNINGS

PER SHARE GAAP RECONCILIATION

We define “earnings per share – adjusted” as the sum of earnings

per share – GAAP, as reported plus the impact of the following

special items: merger related costs, merger related intangible

asset amortization, impact on depreciation related to acquired

fleet and property and equipment, impact of the fair value mark-up

of acquired fleet, restructuring charge and loss on

repurchase/redemption of debt securities and amendment of ABL

facility. Management believes that earnings per share - adjusted

provides useful information concerning future profitability.

However, earnings per share - adjusted is not a measure of

financial performance under GAAP. Accordingly, earnings per share -

adjusted should not be considered an alternative to GAAP earnings

per share. The table below provides a reconciliation between

earnings per share – GAAP, as reported, and earnings per share –

adjusted.

Three Months Ended

Nine Months Ended September 30, September 30,

2018 2017 2018

2017 Earnings per share - GAAP, as reported (1)

$ 4.01 $ 2.33 $ 9.34

$ 5.26 After-tax impact of: Merger related costs (2)

0.09 0.12 0.12 0.23 Merger related intangible asset amortization

(3) 0.42 0.27 1.18 0.83 Impact on depreciation related to acquired

fleet and property and equipment (4) 0.02 0.07 0.19 0.05 Impact of

the fair value mark-up of acquired fleet (5) 0.11 0.17 0.47 0.36

Restructuring charge (6) 0.09 0.07 0.13 0.21 Loss on

repurchase/redemption of debt securities and amendment of ABL

facility — 0.22 — 0.31

Earnings per

share - adjusted (1) $ 4.74 $

3.25 $ 11.43 $

7.25 Tax rate applied to above adjustments (1) 25.4 %

38.5 % 25.3 % 38.5 % (1) The three and nine months

ended September 30, 2018 reflect a reduction in the U.S. federal

corporate statutory tax rate from 35% to 21% following the

enactment of the Tax Cuts and Jobs Act in December 2017, which

contributed an estimated $0.73 and $1.68, respectively, to earnings

per share-GAAP, and $0.87 and $2.07, respectively, to earnings per

share-adjusted, for the three and nine months ended September 30,

2018. The tax rates applied to the adjustments reflect the

statutory rates in the applicable entities. (2) Reflects

transaction costs associated with the NES, Neff, BakerCorp and

BlueLine acquisitions discussed above. As discussed above, the

BlueLine acquisition is expected to close in the fourth quarter of

2018, subject to Hart-Scott-Rodino clearance and customary

conditions. We have made a number of acquisitions in the past and

may continue to make acquisitions in the future. Merger related

costs only include costs associated with major acquisitions that

significantly impact our operations. The historic acquisitions that

have included merger related costs are RSC, which had annual

revenues of approximately $1.5 billion prior to the acquisition,

and National Pump, which had annual revenues of over $200 million

prior to the acquisition. NES had annual revenues of approximately

$369 million, Neff had annual revenues of approximately $413

million, BakerCorp had annual revenues of approximately $295

million and BlueLine has annual revenues of approximately $786

million. (3) Reflects the amortization of the intangible assets

acquired in the RSC, National Pump, NES, Neff and BakerCorp

acquisitions. (4) Reflects the impact of extending the useful lives

of equipment acquired in the RSC, NES, Neff and BakerCorp

acquisitions, net of the impact of additional depreciation

associated with the fair value mark-up of such equipment. (5)

Reflects additional costs recorded in cost of rental equipment

sales associated with the fair value mark-up of rental equipment

acquired in the RSC, NES and Neff acquisitions and subsequently

sold. (6) Primarily reflects severance and branch closure charges

associated with our closed restructuring programs and our current

restructuring programs. We only include such costs that are part of

a restructuring program as restructuring charges. Since the first

such restructuring program was initiated in 2008, we have completed

three restructuring programs. We have cumulatively incurred total

restructuring charges of $299 million under our restructuring

programs.

UNITED RENTALS, INC.EBITDA AND

ADJUSTED EBITDA GAAP RECONCILIATIONS(In millions)

EBITDA represents the sum of net income, provision for income

taxes, interest expense, net, depreciation of rental equipment, and

non-rental depreciation and amortization. Adjusted EBITDA

represents EBITDA plus the sum of the merger related costs,

restructuring charge, stock compensation expense, net, and the

impact of the fair value mark-up of acquired fleet. These items are

excluded from adjusted EBITDA internally when evaluating our

operating performance and for strategic planning and forecasting

purposes, and allow investors to make a more meaningful comparison

between our core business operating results over different periods

of time, as well as with those of other similar companies. The

EBITDA and adjusted EBITDA margins represent EBITDA or adjusted

EBITDA divided by total revenue. Management believes that EBITDA

and adjusted EBITDA, when viewed with the Company’s results under

GAAP and the accompanying reconciliation, provide useful

information about operating performance and period-over-period

growth, and provide additional information that is useful for

evaluating the operating performance of our core business without

regard to potential distortions. Additionally, management believes

that EBITDA and adjusted EBITDA help investors gain an

understanding of the factors and trends affecting our ongoing cash

earnings, from which capital investments are made and debt is

serviced.

The table below provides a reconciliation between net income and

EBITDA and adjusted EBITDA.

Three Months Ended

Nine Months Ended September 30, September 30,

2018 2017 2018

2017 Net income $ 333 $

199 $ 786 $ 449 Provision for

income taxes 127 123 265 263 Interest expense, net 118 131 339 338

Depreciation of rental equipment 343 290 988 804 Non-rental

depreciation and amortization 75 63 213 189

EBITDA (A) $ 996 $ 806 $

2,591 $ 2,043 Merger related costs (1) 11 16

14 32 Restructuring charge (2) 9 9 15 28 Stock compensation

expense, net (3) 30 24 73 64 Impact of the fair value mark-up of

acquired fleet (4) 13 24 53 50

Adjusted

EBITDA (B) $ 1,059 $ 879

$ 2,746 $ 2,217 A)

Our EBITDA margin was 47.1% and 45.6% for the three months

ended September 30, 2018 and 2017, respectively, and 45.1% and

43.3% for the nine months ended September 30, 2018 and 2017,

respectively. B) Our adjusted EBITDA margin was 50.0% and 49.8% for

the three months ended September 30, 2018 and 2017, respectively,

and 47.8% and 47.0% for the nine months ended September 30, 2018

and 2017, respectively. (1) Reflects transaction

costs associated with the NES, Neff, BakerCorp and BlueLine

acquisitions discussed above. As discussed above, the BlueLine

acquisition is expected to close in the fourth quarter of 2018,

subject to Hart-Scott-Rodino clearance and customary conditions. We

have made a number of acquisitions in the past and may continue to

make acquisitions in the future. Merger related costs only include

costs associated with major acquisitions that significantly impact

our operations. The historic acquisitions that have included merger

related costs are RSC, which had annual revenues of approximately

$1.5 billion prior to the acquisition, and National Pump, which had

annual revenues of over $200 million prior to the acquisition. NES

had annual revenues of approximately $369 million, Neff had annual

revenues of approximately $413 million, BakerCorp had annual

revenues of approximately $295 million and BlueLine has annual

revenues of approximately $786 million. (2) Primarily reflects

severance and branch closure charges associated with our closed

restructuring programs and our current restructuring program. We

only include such costs that are part of a restructuring program as

restructuring charges. Since the first such restructuring program

was initiated in 2008, we have completed three restructuring

programs. We have cumulatively incurred total restructuring charges

of $299 million under our restructuring programs. (3) Represents

non-cash, share-based payments associated with the granting of

equity instruments. (4) Reflects additional costs recorded in cost

of rental equipment sales associated with the fair value mark-up of

rental equipment acquired in the RSC, NES and Neff acquisitions and

subsequently sold.

UNITED RENTALS, INC.EBITDA AND

ADJUSTED EBITDA GAAP RECONCILIATIONS (continued)(In

millions)

The table below provides a reconciliation between net cash

provided by operating activities and EBITDA and adjusted

EBITDA.

Three Months Ended

Nine Months Ended September 30, September 30,

2018 2017 2018

2017 Net cash provided by operating activities

$ 474 $ 427 $ 2,123

$ 1,756

Adjustments for items included in net cash

provided by operating activities butexcluded from the calculation

of EBITDA:

Amortization of deferred financing costs and original issue

discounts (3 ) (2 ) (9 ) (6 ) Gain on sales of rental equipment 57

55 196 153 Gain on sales of non-rental equipment 1 1 4 4 Gain on

insurance proceeds from damaged equipment 4 2 18 10 Merger related

costs (1) (11 ) (16 ) (14 ) (32 ) Restructuring charge (2) (9 ) (9

) (15 ) (28 ) Stock compensation expense, net (3) (30 ) (24 ) (73 )

(64 ) Loss on repurchase/redemption of debt securities and

amendment of ABL facility — (31 ) — (43 ) Changes in assets and

liabilities 336 220 (68 ) (126 ) Cash paid for interest 166 128 379

305 Cash paid for income taxes, net 11 55 50

114

EBITDA $ 996 $ 806

$ 2,591 $ 2,043 Add back: Merger

related costs (1) 11 16 14 32 Restructuring charge (2) 9 9 15 28

Stock compensation expense, net (3) 30 24 73 64 Impact of the fair

value mark-up of acquired fleet (4) 13 24 53

50

Adjusted EBITDA $ 1,059

$ 879 $ 2,746 $

2,217 (1) Reflects transaction costs

associated with the NES, Neff, BakerCorp and BlueLine acquisitions

discussed above. As discussed above, the BlueLine acquisition is

expected to close in the fourth quarter of 2018, subject to

Hart-Scott-Rodino clearance and customary conditions. We have made

a number of acquisitions in the past and may continue to make

acquisitions in the future. Merger related costs only include costs

associated with major acquisitions that significantly impact our

operations. The historic acquisitions that have included merger

related costs are RSC, which had annual revenues of approximately

$1.5 billion prior to the acquisition, and National Pump, which had

annual revenues of over $200 million prior to the acquisition. NES

had annual revenues of approximately $369 million, Neff had annual

revenues of approximately $413 million, BakerCorp had annual

revenues of approximately $295 million and BlueLine has annual

revenues of approximately $786 million. (2) Primarily reflects

severance and branch closure charges associated with our closed

restructuring programs and our current restructuring program. We

only include such costs that are part of a restructuring program as

restructuring charges. Since the first such restructuring program

was initiated in 2008, we have completed three restructuring

programs. We have cumulatively incurred total restructuring charges

of $299 million under our restructuring programs. (3) Represents

non-cash, share-based payments associated with the granting of

equity instruments. (4) Reflects additional costs recorded in cost

of rental equipment sales associated with the fair value mark-up of

rental equipment acquired in the RSC, NES and Neff acquisitions and

subsequently sold.

UNITED RENTALS, INC.FREE CASH FLOW

GAAP RECONCILIATION(In millions)

We define “free cash flow” as net cash provided by operating

activities less purchases of, and plus proceeds from, equipment.

The equipment purchases and proceeds are included in cash flows

from investing activities. Management believes that free cash flow

provides useful additional information concerning cash flow

available to meet future debt service obligations and working

capital requirements. However, free cash flow is not a measure of

financial performance or liquidity under GAAP. Accordingly, free

cash flow should not be considered an alternative to net income or

cash flow from operating activities as an indicator of operating

performance or liquidity. The table below provides a reconciliation

between net cash provided by operating activities and free cash

flow.

Three Months Ended

Nine Months Ended September 30, September 30,

2018 2017 2018

2017 Net cash provided by operating activities

$ 474 $ 427 $ 2,123

$ 1,756 Purchases of rental equipment (736 ) (572 )

(1,962 ) (1,485 ) Purchases of non-rental equipment (54 ) (32 )

(134 ) (87 ) Proceeds from sales of rental equipment 140 139 478

378 Proceeds from sales of non-rental equipment 5 4 13 10 Insurance

proceeds from damaged equipment 4 2 18 10

Free cash flow (1) $ (167 )

$ (32 ) $ 536 $

582 (1) Free cash flow included

aggregate merger and restructuring related payments of $16 million

and $21 million for the three months ended September 30, 2018 and

2017, respectively, and $32 million and $52 million for the nine

months ended September 30, 2018 and 2017, respectively.

The table below provides a reconciliation between 2018

forecasted net cash provided by operating activities and free cash

flow.

Net cash provided by operating

activities $2,725- $2,875 Purchases of rental equipment

$(2,000)-$(2,100) Proceeds from sales of rental equipment $600-$700

Purchases of non-rental equipment, net of proceeds from sales and

insurance proceeds from damaged equipment $(75)-$(125)

Free cash

flow (excluding the impact of merger and restructuring related

payments) $1,250- $1,350

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181017005856/en/

Ted Grace(203) 618-7122Cell: (203) 399-8951tgrace@ur.com

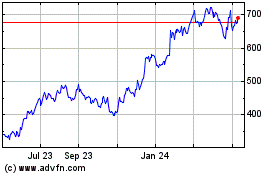

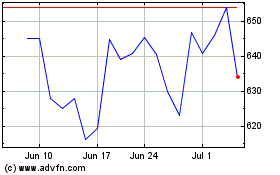

United Rentals (NYSE:URI)

Historical Stock Chart

From Mar 2024 to Apr 2024

United Rentals (NYSE:URI)

Historical Stock Chart

From Apr 2023 to Apr 2024