J&J Raises Forecast as Sales Rise -- WSJ

October 17 2018 - 3:02AM

Dow Jones News

By Peter Loftus and Kimberly Chin

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 17, 2018).

Johnson & Johnson reported higher revenue and profit for the

third quarter, as improved pharmaceutical sales helped offset

weakness in its medical-device business.

Global sales of J&J's cancer drugs, which include Zytiga for

prostate cancer and blood-cancer treatments Darzalex and Imbruvica,

jumped 36% for the quarter. Overall, sales at the company's

pharmaceutical unit -- its biggest business -- rose 6.7%.

But sales were less impressive in the New Jersey-based

health-care conglomerate's other two units, with consumer-product

sales up 1.8% and medical-device sales down 0.2% for the

quarter.

"Our positive view on pharma is offset by ongoing challenges to

the company's medical device and consumer franchises," JPMorgan

analyst Chris Schott wrote in a research note. "While today's

consumer results were encouraging, we believe it remains too early

to call for a broad recovery in these businesses."

J&J's results are considered a bellwether for many

health-care sectors because of the company's range of products.

J&J Chief Executive Alex Gorsky said the company was

accelerating sales momentum in its consumer business and making

"consistent progress" in the device unit.

Declines in sales of diabetes-care and orthopedics products

weighed on the medical-device division.

J&J executives said they weren't satisfied with the

performance of the medical-device unit, and are pursuing ways to

jump-start growth. The company has shed some underperforming device

units, and it's developing new products in-house and pursuing

external acquisitions to boost the unit, Ashley McEvoy, executive

vice president and world-wide chairman of medical devices, said on

a conference call with analysts.

In the consumer-product division, J&J posted improved sales

of over-the-counter drugs including the Tylenol pain reliever and

Zyrtec allergy medicine.

Global sales of baby-care products, such as Johnson's Baby

Shampoo, dropped 1%, but in the U.S. they jumped 20% after the

company introduced new versions of the products.

Overall, J&J's third-quarter sales rose 3.6% from a year ago

to $20.35 billion. Analysts polled by Refinitiv had expected $20.05

billion.

J&J's profit was $3.93 billion, or $1.44 a share, compared

with $3.76 billion, or $1.37 a share, in the same period last year.

The quarter included a noncash, after-tax impairment charge of

about $630 million, to reflect the diminished value of an

experimental infectious-disease drug after a clinical trial of the

drug was halted.

On an adjusted basis, excluding various costs and gains, J&J

made $2.05 a share, slightly above analysts' estimates of

$2.03.

J&J raised its forecast for full-year 2018 results. It now

expects earnings of $8.13 to $8.18 a share compared with previous

guidance of $8.07 to $8.17, excluding certain items.

J&J now expects sales for the year to be between $81 billion

and $81.4 billion, above its previous guidance of $80.5 billion to

$81.3 billion.

Shares of J&J rose 2.6% to $137.63 in morning trading.

Write to Peter Loftus at peter.loftus@wsj.com and Kimberly Chin

at kimberly.chin@wsj.com

(END) Dow Jones Newswires

October 17, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

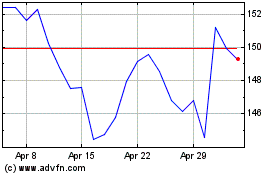

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

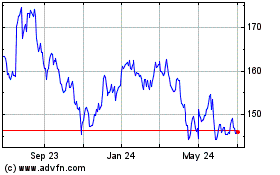

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024