Bitcoin, Ethereum, and Ripple surge higher after Fidelity launches crypto service

October 16 2018 - 6:05AM

ADVFN Crypto NewsWire

It has been a positive start to the week for the crypto market

with strong gains being seen across almost all major coins.

This has led to the crypto market adding 3.9% to its value over

the last 24 hours, giving it a market capitalisation of US$209.9

billion according to Coin Market Cap.

At one stage the market had climbed as much as 9.4% to US$221.4

billion on Monday before profit taking led to prices pulling back a

touch.

Why is the crypto market surging higher?

Traders have been fighting to get hold of coins after Fidelity

announced the launch of Fidelity Digital Asset Services. The new

business will handle cryptocurrency custody and trade execution for

institutional investors.

According to CNBC, its services will be available to

institutions such as hedge funds, endowments, and family offices

but not to retail investors.

Traders appear to believe this could be the start of

institutional money flooding into the market, supporting or even

driving prices higher in the medium term. Considering Fidelity

administers US$7.2 trillion in customer assets, has 27 million

customers, and 13,000 institutional clients, I can see why they may

be excited by this development.

However, only time will tell whether institutional money finds

its way into the crypto market in the near future.

In the meantime, here is the state of play on Tuesday morning

compared to 24 hours ago:

The Bitcoin (BTC) price has climbed 3.9% to

US$6,573.87, lifting its market capitalisation to US$113.9

billion.

The Ethereum (ETH) price has pushed 4.4% higher

to US$207.48. This gives ETH a market capitalisation of US$21.3

billion.

The Ripple (XRP) price has jumped 6.2% higher

to 44.36 U.S. cents. The XRP market capitalisation has now climbed

to US$17.75 billion.

The Bitcoin Cash (BCH) price

is up 2.8% to US$457.69. This gives the Bitcoin spin off a market

capitalisation of just under US$8 billion.

The EOS (EOS) price has risen 4.5% to US$5.45,

giving EOS an improved market capitalisation of US$4.9 billion.

Outside the top five things were equally positive.

Stellar (XLM) is up 3.5%,

Litecoin (LTC) has risen 3.6%,

Cardano (ADA) has climbed 2.1%, and

Monero (XMR) is 4.1% higher.

The only coin in the top ten that isn’t in positive territory is

Tether (USD). It is down 1% to 97.8 U.S. cents

after reports suggested that the U.S. dollar-backed coin didn’t

have the full backing it claims to have. Tether is supposed to be

backed 1:1 by USD held in a bank account and available on

demand.

Source:

The Motley Fool

By

James Mickleboro

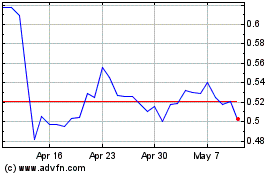

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

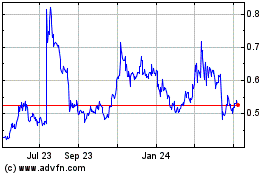

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024