Liberty All-Star® Growth Fund, Inc.

October 15 2018 - 12:08PM

Business Wire

Temporarily Suspends and Recommences Rights

Offering

Liberty All-Star® Growth Fund, Inc. (NYSE: ASG) (the “Fund”) has

announced that, as of the close of the market on October 11, 2018,

it had temporarily suspended its previously announced offering to

shareholders of record as of September 17, 2018 of non-transferable

rights entitling them to subscribe for one additional shares for

every three shares held (the “Primary Subscription”), with the

right to subscribe for additional shares not subscribed for by

others in the Primary Subscription. The Fund expects to file a

supplement to its prospectus with the U.S. Securities and Exchange

Commission (“SEC”) no later than October 15, 2018 reflecting the

event described below and will reinstate the rights offering

immediately upon filing of the prospectus supplement. In addition,

the Fund will extend the rights offering until October 31,

2018.

The Fund had, as required by the SEC’s registration form,

undertaken to suspend the offering until it amended its prospectus

relating to the offering if, subsequent to September 17, 2018, the

effective date of the Fund’s registration statement relating to the

offering, the Fund’s net asset value (“NAV”) declined more than ten

percent from its NAV as of September 17, 2018. The NAV of the Fund

as of October 11, 2018 was $5.65, representing a decline of 10.2%

from its net asset value of $6.29 as of September 17, 2018.

As indicated above, the Fund expects to file a supplement

updating information in the prospectus with the SEC no later than

October 15, 2018 and will recommence the rights offering

immediately upon filing the prospectus supplement. The Fund will

notify shareholders of this decline by means of the prospectus

supplement and thereby permit them to cancel any exercise of

subscription rights they made prior to suspension of the offering

on October 11, 2018.

Cancellation must be made by written communication to the

subscription agent for the rights offering at the address listed in

the prospectus referencing the prior subscription request.

Cancellation requests by shareholders who exercised their

subscription rights through securities brokers must be made to

those brokers. All cancellation requests must be received by the

Fund prior to the close of business on the revised Expiration Date

of the offering, which is October 31, 2018. If a shareholder does

not cancel a prior subscription request, the subscription will

remain valid and be processed as submitted.

As a result of the extension of the rights offering, the

following terms and conditions of the offering also are being

revised: the Subscription Period (September 21, 2018 to October 31,

2018), the Expiration Date (October 31, 2018), and the Pricing Date

(November 1, 2018), subject to the ability of the Fund to further

extend the Subscription Period and the related dates as disclosed

in the prospectus. All other terms and conditions are not being

changed, including the Record Date (September 17, 2018), the

aggregate number of shares offered (9,205,421) and the rate (one

additional share for each three rights held).

This press release shall not constitute an offer to sell or

constitute a solicitation of an offer to buy. Investors should read

the prospectus, and consider the investment objective, risks,

charges and expenses of the Fund carefully before investing.

The Fund does not continuously issue shares and trades in the

secondary market. Investors wishing to buy or sell shares need to

place orders through an intermediary or broker. The share price of

a closed-end fund is based on the market’s value. The Fund’s shares

are listed on the New York Stock Exchange under the ticker symbol

ASG. ALPS Advisors, Inc. is the investment advisor of the Fund, a

multi-managed, closed-end investment company with more than

$158 million in net assets as of October 12, 2018.

Past performance cannot predict future results.An investment in

the Fund involves risk, including loss of principal.Secondary

market support provided to the Fund by ALPS Fund Services, Inc.’s

affiliate ALPS Portfolio Solutions Distributor, Inc., a FINRA

Member. ALPS Fund Services, Inc., ALPS Advisors, Inc. and ALPS

Portfolio Solutions Distributor, Inc. are affiliated entities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181015005726/en/

Liberty All-Star® Growth Fund, Inc.Bill

Parmentier, 1-800-241-1850www.all-starfunds.com

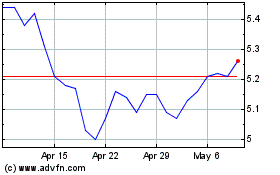

Liberty All Star Growth (NYSE:ASG)

Historical Stock Chart

From Mar 2024 to Apr 2024

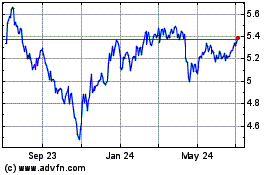

Liberty All Star Growth (NYSE:ASG)

Historical Stock Chart

From Apr 2023 to Apr 2024