Seoul crypto exchange Bithumb gets mainstream backing

October 15 2018 - 9:35AM

ADVFN Crypto NewsWire

l South Korea's major exchanges are now

operated by conglomerates

Late last week it was announced that a majority stake in South

Korea’s largest crypto exchange has been sold to a consortium led

by a plastic surgeon.

According to a Reuters report, 50 percent plus

one share of Bithumb has been sold to Singapore-based BK Global

Consortium for approximately $354 million. The exchange is one of

Korea’s largest with a daily trade volume of over a billion dollars

according to analytics website coinmarketcap.com. However, due to

discrepancies in reporting it has been difficult to gauge true

trade volume figures from crypto exchanges.

The consortium is led by Kim Byung-gun, plastic surgeon and

blockchain platform investor. It has now become the largest

stakeholder in the Korean crypto exchange. A consortium

representative told media: “Kim Byung-gun demonstrated his

multinational management ability in the field of medical care,

fintech, and blockchain in Singapore. He is the right person to

pursue the systemization and globalization of the virtual currency

exchange.” Additionally, Kim has already announced plans to open

‘Bithumb Dex’, a decentralized exchange, through his Hong Kong

subsidiary this month.

Bithumb, despite a number of security breaches and high profile hacks, has secured

its position as one of South Korea’s leading crypto-currency

exchanges, along with Upbit. Local crypto media have said South

Korean investors are upbeat about the acquisition of Bithumb

because it means that all of South Korea’s major exchanges are now

operated by large-scale conglomerates.

This provides an extra layer of liquidity and security in what

currently are very shaky market conditions. Upbit is run by Kakao,

Korea’s largest internet conglomerate; the country’s largest

commercial bank, Shinhan, runs Gopax; and Korbit is operated by

Nexon, an international South Korean video game company.

One advantage that Korbit, Upbit, and Gopax exchanges hold over

Bithumb is that they have never been hacked due to a focus on

security and investor protection. South Korean conglomerates must

strive to protect their brand and name to maintain consumer and

investor loyalty. With BK getting into Bithumb the focus can now

turn to security, legitimization, and internal system management,

which is good news for investors.

Due to its ties with Singapore, BK is likely to be

eyeing that market on the heels of Binance and Upbit which have

already announced plans for expansion to the island nation. Stable

banking services and a blockchain- and crypto-friendly environment

makes Singapore a likely venue for Bithumb’s international

expansion.

By Luke Thompson

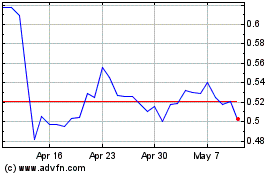

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

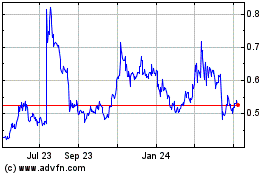

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024