Seritage Growth Properties Provides Business Update with Respect to Recent Events Regarding Sears Holdings

October 15 2018 - 9:15AM

Business Wire

– Seritage is well-positioned with a

diversified tenant base and strong liquidity position –

– Non-Sears tenants represent approximately

70% of signed lease income, up from 20% at inception –

– Nearly $1.0 billion of cash on hand and

committed capital to fund development activity and operations

–

Seritage Growth Properties (NYSE: SRG) (the “Company”) today

provided a business update related to the recent announcement by

Sears Holdings Corporation (“Sears Holdings”) that Sears Holdings

has filed for Chapter 11 bankruptcy protection.

“All of our capital investment, leasing and development activity

over the last three years is unlocking substantial value, and has

significantly diversified our income stream with approximately 70%

of our signed leased income now coming from diversified, non-Sears

tenants,” said Benjamin Schall, President and Chief Executive

Officer. “We have $1 billion of cash and committed capital under

our Term Loan facility, which provides us the funds to complete all

of our on-going redevelopment projects and cover reductions in cash

flow that may result from the potential disruption in Sears income.

The completion of our redevelopment projects brings our signed

leased income on-line and will replace any potential lost income

from Sears Holdings.”

“Our go-forward strategy remains as it has been – to unlock

substantial value through investment of capital and the intensive

redevelopment of our well-located buildings and land,” continued

Mr. Schall. “All of our active projects will continue

uninterrupted, and we are excited to further build our pipeline of

redevelopment activity by partnering with growing retailers and

users, mixed-use developers and institutional capital

allocators.”

Additional comments from Mr. Schall can be found in our “Letter

from our Chief Executive Officer” dated October 15, 2018 and filed

on Form 8-K with the Securities and Exchange Commission.

Development Activities

- Announced Projects: as of

September 30, 2018, the Company had completed or commenced 94

redevelopment projects, representing over $1.4 billion of total

investment, and will proceed uninterrupted with all active and

underway projects. The Company’s share of remaining spending at

these projects is approximately $880 million which is expected to

be funded with cash on hand and committed borrowing facilities.

This capital is being invested at targeted incremental returns of

approximately 11% and is creating significant value for our

shareholders.

- Development Pipeline: the

Company will continue to build its pipeline of redevelopment

opportunities through the activation of the remainder of its

portfolio for higher and better uses much in the same way it has

since its inception in July 2015. The scale and quality of the

Company’s portfolio, combined with its unique redevelopment

platform and control over its real estate, provide Seritage with

competitive advantages that will allow it to continue as an

industry leader in transforming retail real estate around the

country.

Leasing Activities

- Signed Not Opened Leases: the

Company has sufficient liquidity to complete all underway projects

and, as such, the Company is positioned to fulfill all of its

commitments to tenants under signed but not opened (“SNO”) leases.

As of September 30, 2018, the Company had 156 SNO leases

representing $75.0 million of annual base rent, including the

Company’s proportional share of its unconsolidated joint ventures,

the majority of which is expected to steadily come on line

throughout the next 24 months.

- Lease Up at Underway Projects:

completing all underway projects includes the lease-up of remaining

unleased space at these projects. The Company projects an

additional $80 million of rental income, including the Company’s

proportional share of its unconsolidated joint ventures, can be

generated as these projects are stabilized without allocating

additional capital beyond the $880 million referenced above1.

Seritage Liquidity

- Cash on Hand: as of September

30, 2018, the Company had approximately $580 million of cash on

hand. This capital is available to fund on-going development

activities, as well as adverse impacts to operating cash flow that

may result from potential reductions of rental income under the

Master Lease with Sears Holdings.

- Incremental Funding Facility:

the Company’s $2.0 billion term loan facility (the “Term Loan

Facility”) includes a committed $400 million incremental funding

facility. This capital would also be available, subject to certain

conditions, to fund announced and future redevelopment

activities.

- Asset Monetization: the Company

will continue to opportunistically pursue select asset monetization

and new joint ventures that support the Company’s value creation

activities.

- Common Stock Dividends: the

Company expects to maintain its current common stock dividend

policy of making distributions that approximate taxable income so

as to retain as much free cash flow as possible for reinvestment

back into the portfolio. To the extent estimated taxable income

falls meaningfully below current distribution levels (approximately

$55 million annually), as a result of reduced income under the

Master Lease or reduced capital gains from asset monetization

activities, the Board of Trustees may consider adjustments to

common stock dividend amounts. Any reduction of the common dividend

would be made to allow the Company to reinvest the capital retained

into future redevelopment projects at accretive returns.

- Preferred Stock Dividends: the

Company expects to continue paying dividends ($4.9 million

annually) on its preferred shares.

Master Leases with Sears

Holdings

- Remaining Exposure: as of

September 30, 2018, including the effect of all previously

exercised recapture and termination activity, Sears Holdings was a

tenant in 82 properties under the Master Lease and 20 properties

under the JV Master Leases representing an aggregate of 12.4

million square feet and $61.2 million of annual base rent, or 31.4%

of all base rent under signed leases.

- Impact of Re-Leasing Spreads:

the 3.5x to 4.5x rental uplift that Company has historically

achieved upon re-leasing space formerly occupied by Sears Holdings

allows it to recover all the rental income generated from Sears

Holdings by re-leasing only 25-35% of the formerly occupied space

and deploying the capital required to bring the rental income

online.

Term Loan Facility with Berkshire

Hathaway

- Loan Status: there is no direct

impact of Sears Holdings’ bankruptcy filing, or a potential

rejection of the Master Lease, on the Company’s Term Loan Facility.

Specifically, such occurrences will not result in an event of

default, mandatory amortization, cash flow sweep or any similar

provision.

- Financial Metrics: the Term Loan

Facility includes certain financial metrics, including fixed charge

coverage ratios, leverage ratios and a minimum net worth, that

could be negatively impacted by a loss of revenue from Sears

Holdings. A failure to satisfy any of these financial metrics will

require the Company to seek lender approval to monetize assets via

sale or joint venture and also provide the lender the right to

request mortgages on its real estate collateral, but will not

result in an event of default, mandatory amortization, cash flow

sweep or any similar provision.

The Company is monitoring, and will continue to monitor, Sears

Holdings’ bankruptcy proceedings and the impact on its business. By

their nature, bankruptcy proceedings and their outcomes are subject

to uncertainty. For more information regarding the same, refer to

the risk factors relating to Sears Holdings in our periodic filings

with the Securities and Exchange Commission.

Forward-Looking

Statements

This document contains forward-looking statements within the

meaning of the federal securities laws. Forward-looking statements

relate to expectations, beliefs, projections, future plans and

strategies, anticipated events or trends and similar expressions

concerning matters that are not historical facts. In some cases,

you can identify forward-looking statements by the use of

forward-looking terminology such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “believes,”

“estimates,” “predicts,” or “potential” or the negative of these

words and phrases or similar words or phrases that are predictions

of or indicate future events or trends and that do not relate

solely to historical matters. Forward-looking statements involve

known and unknown risks, uncertainties, assumptions and

contingencies, many of which are beyond the company’s control,

which may cause actual results to differ significantly from those

expressed in any forward-looking statement. Factors that could

cause or contribute to such differences include, but are not

limited to: our significant exposure to Sears Holdings and the

effects of its recently announced bankruptcy filing; Sears

Holdings’ termination and other rights under its master lease with

us; competition in the real estate and retail industries; risks

relating to our recapture and redevelopment activities;

contingencies to the commencement of rent under leases; the terms

of our indebtedness; restrictions with which we are required to

comply in order to maintain REIT status and other legal

requirements to which we are subject; and our relatively limited

history as an operating company. For additional discussion of these

and other applicable risks, assumptions and uncertainties, see the

“Risk Factors” and forward-looking statement disclosure contained

in our filings with the Securities and Exchange Commission,

including the risk factors relating to Sears Holdings. While we

believe that our forecasts and assumptions are reasonable, we

caution that actual results may differ materially. We intend the

forward-looking statements to speak only as of the time made and do

not undertake to update or revise them as more information becomes

available, except as required by law.

About Seritage Growth

Properties

Seritage Growth Properties is a publicly‐traded,

self‐administered and self‐managed REIT with 211 wholly-owned

properties and 26 joint venture properties totaling approximately

37.5 million square feet of space across 48 states and Puerto Rico.

The Company was formed and listed on the New York Stock Exchange

(NYSE: SRG) in July 2015 in conjunction with the acquisition of a

portfolio of real estate from Sears Holdings. Our mission is to

create and own revitalized shopping, dining, entertainment and

mixed‐use destinations that provide enriched experiences for

consumers and local communities, and that generate long‐term value

for our shareholders. The Company is headquartered in New York,

NY.

1 Projected income includes assumptions for stabilized rents at

projects under redevelopment. There can be no assurance that

stabilized rent targets will be achieved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181015005546/en/

Seritage Growth Properties646-277-1268IR@Seritage.com

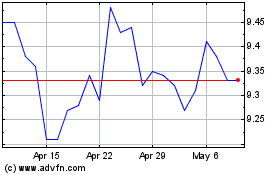

Seritage Growth Properties (NYSE:SRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

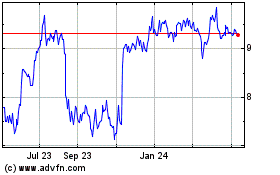

Seritage Growth Properties (NYSE:SRG)

Historical Stock Chart

From Apr 2023 to Apr 2024