Current Report Filing (8-k)

October 12 2018 - 4:49PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report

(Date of earliest event reported):

October 12,

2018

OXFORD

SQUARE CAPITAL CORP.

(Exact name

of registrant as specified in its charter)

|

Maryland

|

000-50398

|

20-0188736

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

of incorporation)

|

|

|

8 Sound Shore Drive, Suite 255

Greenwich, CT 06830

(Address of principal executive offices

and zip code)

Registrant’s

telephone number, including area code:

(203) 983-5275

Check the appropriate box below if the Form 8-K is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

On October 12, 2018, Oxford Square Funding

2018, LLC (“OXSQ Funding”), a special purpose vehicle that is a wholly-owned subsidiary of Oxford Square Capital Corp.

(the “Company,” “we,” “us,” or “our”), entered into a First Amendment (the “Amendment”)

to its credit facility (the “Facility”) with Citibank, N.A., dated as of June 21, 2018.

The Amendment amends the Facility by providing

for an additional borrowing by OXSQ Funding under the Facility of approximately $37.3 million, for a total outstanding principal

amount of $125.0 million. No further borrowings under the Facility are permitted. The Company will continue to act as the

collateral manager of the loans owned by OXSQ Funding and will continue to retain a residual interest through its ownership of

OXSQ Funding. OXSQ Funding used the proceeds of the Facility to pay the purchase price for the loans purchased by it from the Company.

Subject to certain continuing exceptions,

pricing under the Facility continues to be based on the London interbank offered rate for an interest period equal to three months

plus a spread of 2.25% per annum. Interest on the outstanding principal amount owing under the Facility continues to be payable

quarterly in arrears.

The Facility will mature, and all outstanding

principal and accrued and unpaid interest thereunder continues to be due and payable, on June 21, 2020, and is subject to periodic

repayment prior to such date from collections on OXSQ Funding’s loan assets and certain other mandatory payment requirements.

OXSQ Funding may elect to reduce the amount of the Facility, in whole or in part, at any time subject to payment of a prepayment

fee and certain funding breakage fees if prepayments occur prior to expiration of the relevant interest period.

In connection with the Facility, the Company

entered into a sale, contribution and master participation agreement with OXSQ Funding under which the Company sold and contributed

an additional portfolio of loans to OXSQ Funding.

The Bank of New York Mellon Trust Company,

National Association serves as collateral administrator to OXSQ Funding under a collateral administration agreement entered into

in connection with the Facility. The collateral administration agreement was not amended in connection with the Amendment.

The descriptions of the documentation relating

to this transaction contained in this Current Report on Form 8-K do not purport to be complete and are qualified in their entirety

by reference to the forms of underlying agreements, attached hereto as Exhibits 10.1 and 10.2 and incorporated into this Current

Report on Form 8-K by reference.

Item 2.03. Creation of a Direct Financial Obligation or an

Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01

is incorporated by reference into this Item 2.03.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

|

|

10.1

|

First Amendment to the Credit and Security Agreement among Oxford Square Funding 2018, LLC, as borrower, Oxford Square Capital Corp., as equityholder and collateral manager, and Citibank, N.A., as lender and administrative agent, dated October 12, 2018.

|

|

|

10.2

|

Sale, Contribution and Master Participation Agreement by and between Oxford Square Funding 2018, LLC, as the buyer and Oxford Square Capital Corp., as the seller, dated October 12, 2018.

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: October 12, 2018

|

OXFORD SQUARE CAPITAL CORP.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Saul B. Rosenthal

|

|

|

|

|

Saul B. Rosenthal

|

|

|

|

|

President

|

|

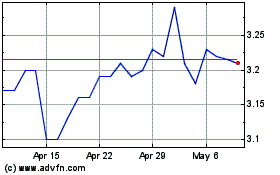

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

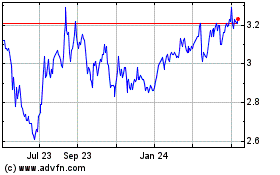

Oxford Square Capital (NASDAQ:OXSQ)

Historical Stock Chart

From Apr 2023 to Apr 2024