Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

October 04 2018 - 7:13AM

Edgar (US Regulatory)

Free Writing Prospectus

Filed Pursuant to Rule 433

Registration No. 333-217356

Supplementing the Preliminary Prospectus Supplement dated October 3, 2018 (to Prospectus dated

November 17, 2017)

WILLDAN GROUP, INC.

1,750,000 SHARES OF COMMON STOCK

FINAL TERM SHEET

DATE: OCTOBER 4, 2018

|

Issuer:

|

|

Willdan Group, Inc.

|

|

|

|

|

|

Security:

|

|

Common stock, par value $0.01

|

|

|

|

|

|

Offering Size:

|

|

1,750,000 shares of common stock

|

|

|

|

|

|

Over-allotment Option:

|

|

262,500 shares of common stock

|

|

|

|

|

|

Trade Date:

|

|

October 4, 2018

|

|

|

|

|

|

Settlement Date:

|

|

October 9, 2018

|

|

|

|

|

|

Public Offering Price:

|

|

$30.00 per share

|

|

|

|

|

|

Underwriting Discounts and Commissions:

|

|

$1.95 per share

|

|

|

|

|

|

Net Proceeds to the Issuer:

|

|

$48,087,500 (after deducting the underwriters’ discounts and commissions and estimated offering expenses)

|

|

|

|

|

|

Joint Book-Running Managers:

|

|

Wedbush Securities Inc.

Roth Capital Partners, LLC

|

The issuer has filed a registration statement including a prospectus and a prospectus supplement with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may obtain these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus and the prospectus supplement if you request them by contacting: (i) Wedbush Securities Inc., Attention: Equity Syndicate Prospectus Department, 2 Embarcadero Center, Suite 600, San Francisco, CA 94111, by email at ecm@wedbush.com or by telephone at 800.422.4309 or (ii) Roth Capital Partners, LLC, 888 San Clemente Drive, Suite 400, Newport Beach, CA 92660 or by telephone at 800.678.9147.

Willdan Group, Inc., together with its direct and indirect subsidiaries, is referred to herein collectively as “we,” “our,” “Willdan,” or the “Company.” Other capitalized terms used, but not defined, in this Free Writing Prospectus have the meanings given to them in the Preliminary Prospectus Supplement, filed with the SEC on October 3, 2018 (“Preliminary Prospectus Supplement”).

Any disclaimer or other notice that may appear below is not applicable to this communication and should be disregarded. Such disclaimer or notice was automatically generated as a result of this communication being sent by Bloomberg or another email system.

CAPITALIZATION

The table below sets forth our capitalization as of June 29, 2018:

·

on an actual basis;

·

on an as adjusted basis, assuming that the acquisition of Lime Energy is not completed and the conditions precedent to borrowing under the Delayed Draw Term Loan Facility are not satisfied, and giving effect to this offering, as if this offering had occurred on June 29, 2018; and

·

on an as adjusted pro forma basis, assuming the acquisition of Lime Energy is completed, the conditions precedent to borrowing under the Delayed Draw Term Loan Facility are satisfied, and giving effect to this offering, as if each had occurred on June 29, 2018.

You should read this table together with “

Use of Proceeds

” appearing in the Preliminary Prospectus Supplement, the “

Management’s Discussion and Analysis of Financial Condition and Results of Operations

” section and our consolidated financial statements and related notes included in our Annual Report on Form 10-K for the fiscal year ended December 29, 2017, in our Quarterly Report on Form 10-Q for the quarterly periods ended March 30, 2018 and June 29, 2018, and our Current Report on Form 8-K filed with the SEC on October 3, 2018, which are incorporated by reference into the Preliminary Prospectus Supplement and related prospectus.

|

|

|

As of June 29, 2018

(Unaudited)

|

|

|

|

|

Actual

|

|

As Adjusted for

No Acquisition

|

|

As Adjusted

Pro Forma

for Acquisition

|

|

|

|

|

(Dollars in thousands, except per share

data)

|

|

|

Cash and cash equivalents

|

|

$

|

11,225

|

|

$

|

59,313

|

|

$

|

9,313

|

|

|

Total debt:

|

|

|

|

|

|

|

|

|

Existing revolving credit facility (1)

|

|

2,000

|

|

—

|

|

—

|

|

|

New revolving credit facility (2)

|

|

—

|

|

—

|

|

—

|

|

|

Delayed Draw Term Loan Facility (3)

|

|

—

|

|

—

|

|

70,000

|

|

|

Total debt

|

|

2,000

|

|

—

|

|

70,000

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, 10,000,000 shares authorized, no shares issued and outstanding

|

|

—

|

|

—

|

|

—

|

|

|

Common stock, $0.01 par value, 40,000,000 shares authorized; 8,857,000 shares issued and outstanding at June 29, 2018

|

|

89

|

|

107

|

|

107

|

|

|

Additional paid-in capital

|

|

54,216

|

|

102,286

|

|

102,286

|

|

|

Retained earnings

|

|

25,659

|

|

25,659

|

|

25,659

|

|

|

Total stockholders’ equity

|

|

79,964

|

|

128,052

|

|

128,052

|

|

|

Total capitalization

|

|

$

|

81,964

|

|

$

|

128,052

|

|

$

|

198,052

|

|

(1)

All amounts previously outstanding under the existing revolving credit facility were repaid subsequent to June 29, 2018.

(2)

Assumes no amounts will be outstanding under the new revolving credit facility after giving effect to the acquisition of Lime Energy. We may borrow up to an aggregate of $30.0 million under our new revolving credit facilities.

(3)

The amount available for borrowing under the Delayed Draw Term Loan Facility will be reduced by the net proceeds from any equity offering completed by us prior to any borrowings under such facility but, in no event, will the amount available for borrowing be less than $70.0 million. For purposes of the above table, we have assumed we will borrow $70.0 million under the Delayed Draw Term Loan Facility after giving effect to the acquisition of Lime Energy.

2

SUMMARY UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

The following tables present our summary unaudited pro forma condensed combined financial information as of and for the six months ended June 29, 2018 and for the fiscal year ended December 29, 2017. The unaudited pro forma condensed combined financial information for the six months ended June 29, 2018 gives effect to the acquisition of Lime Energy, this offering of our common stock and the use of proceeds therefrom and borrowings under the New Credit Facilities, assuming each had occurred on December 30, 2017. The unaudited pro forma condensed combined financial information for the fiscal year ended December 29, 2017 gives effect to the acquisition of Lime Energy, this offering of our common stock and the use of proceeds therefrom and borrowings under the New Credit Facilities, assuming each had occurred on December 31, 2016. The unaudited pro forma condensed combined balance sheet data as of June 29, 2018 gives effect to the acquisition of Lime Energy, this offering of our common stock and the use of proceeds therefrom and borrowings under the New Credit Facilities, assuming each had occurred on June 29, 2018.

The summary unaudited pro forma condensed combined financial information does not purport to be indicative of the financial position or results of operations that would have been reported had the acquisition of Lime Energy, this offering of our common stock and the use of proceeds therefrom and borrowings under the Credit Agreement actually been effected on the dates indicated, or at all, or which may be reported in the future. The summary unaudited pro forma condensed combined financial information does not reflect any revenue enhancements or cost savings from synergies that may be achieved with respect to the acquisition of Lime Energy, or the impact of non-recurring items directly related to the acquisition and the related debt financing. Although our management believes the assumptions used in preparing the summary unaudited pro forma condensed combined financial information were reasonable as of the date of this prospectus supplement, these assumptions may not prove to be correct. As a result, actual results could differ materially. The summary unaudited pro forma condensed combined financial information should be read together with our consolidated financial statements and the consolidated financial statements of Lime Energy and their respective accompanying notes included in our Current Report on Form 8-K filed with the SEC on October 3, 2018 along with our other documents incorporated by reference in the Preliminary Prospectus Supplement.

3

WILLDAN GROUP, INC. AND SUBSIDIARIES

Pro Forma Condensed Combined Statements of Operations

(Unaudited)

|

|

|

Willdan

Group, Inc.

Historical

|

|

Lime

Energy Co.

Historical

|

|

|

|

|

|

|

|

|

Six Months

Ended

June 29,

2018

|

|

Six Months

Ended

June 30,

2018

|

|

Pro Forma

Adjustments

|

|

Willdan

Group, Inc.

Pro Forma

Combined

|

|

|

|

|

(Dollars in thousands, except per share amounts)

|

|

|

Contract revenue

|

|

$

|

114,428

|

|

$

|

73,303

|

|

$

|

—

|

|

$

|

187,731

|

|

|

Direct costs of contract revenue (exclusive of depreciation and amortization shown separately below):

|

|

|

|

|

|

|

|

|

|

|

Salaries and wages

|

|

22,125

|

|

—

|

|

6,385

|

(a)

|

28,510

|

|

|

Subconsultant services and other direct costs

|

|

49,613

|

|

49,711

|

|

(250

|

)(b)

|

99,074

|

|

|

Total direct costs of contract revenue

|

|

71,738

|

|

49,711

|

|

6,135

|

|

127,584

|

|

|

General and administrative expenses:

|

|

|

|

|

|

|

|

|

|

|

Salaries and wages, payroll taxes and employee benefits

|

|

20,750

|

|

—

|

|

7,689

|

(c)

|

28,439

|

|

|

Facilities and facilities related

|

|

2,595

|

|

—

|

|

756

|

(c)

|

3,351

|

|

|

Stock-based compensation

|

|

2,726

|

|

—

|

|

285

|

(c)

|

3,011

|

|

|

Depreciation and amortization

|

|

2,175

|

|

167

|

|

3,805

|

(d)

|

6,147

|

|

|

Other

|

|

8,265

|

|

20,386

|

|

(15,670

|

)(e)

|

12,981

|

|

|

Total general and administrative expenses (income)

|

|

36,511

|

|

20,553

|

|

(3,135

|

)

|

53,929

|

|

|

Income (loss) from operations

|

|

6,179

|

|

3,039

|

|

(3,000

|

)

|

6,218

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

—

|

|

213

|

|

—

|

|

213

|

|

|

Interest (expense)

|

|

(53

|

)

|

(1,363

|

)

|

(632

|

)(f)

|

(2,048

|

)

|

|

Other, net

|

|

19

|

|

(794

|

)

|

794

|

(g)

|

19

|

|

|

Total other (expense)

|

|

(34

|

)

|

(1,944

|

)

|

162

|

|

(1,816

|

)

|

|

Income (loss) before income taxes

|

|

6,145

|

|

1,095

|

|

(2,838

|

)

|

4,402

|

|

|

Income tax expense (benefit)

|

|

627

|

|

3

|

|

(795

|

)(h)

|

(165

|

)

|

|

Net income (loss)

|

|

$

|

5,518

|

|

$

|

1,092

|

|

$

|

(2,043

|

)

|

$

|

4,567

|

|

|

Earnings per share:

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.63

|

|

|

|

|

|

$

|

0.43

|

|

|

Diluted

|

|

$

|

0.60

|

|

|

|

|

|

$

|

0.42

|

|

|

Weighted-average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

8,775,000

|

|

|

|

1,750,000

|

|

10,525,000

|

|

|

Diluted

|

|

9,247,000

|

|

|

|

1,750,000

|

|

10,997,000

|

|

(a)

Reflects reclassification from Subconsultant services and other direct costs and Other in General and administrative expenses to conform the presentation of Lime Energy’s financial information to Willdan’s presentation.

(b)

Reflects reclassification to Salaries and wages under Direct costs of contract revenue to conform the presentation of Lime Energy’s financial information to Willdan’s presentation.

(c)

Reflects reclassification from Other in General and administrative expenses to conform the presentation of Lime Energy’s financial information to Willdan’s presentation.

(d)

Reflects $3.0 million of amortization expenses attributable to intangible assets assumed to be acquired as part of the acquisition and reclassification of $0.8 million from Other in General and administrative expenses to conform the presentation of Lime Energy’s financial information to Willdan’s presentation.

(e)

Reflects reclassification to Salaries and wages under Direct costs of contract revenue, Salaries and wages under General and administrative expenses, Facilities and facilities related expenses, Stock-based compensation and Depreciation and amortization to conform the presentation of Lime Energy’s financial information to Willdan’s presentation.

4

(f)

Reflects expected interest expense after repayment of the outstanding debt of Lime Energy in connection with the acquisition of Lime Energy and anticipated borrowings under the New Credit Facilities to finance the acquisition. Assumes Willdan will not borrow under the new revolving credit facility and will borrow $70.0 million under the Delayed Draw Term Loan Facility. The interest expense for borrowings under the New Credit Facilities is based on an expected interest rate of 5.39%, which assumes LIBOR as of October 1, 2018, plus an applicable margin of 3.00% based on Willdan’s expected consolidated leverage ratio after the acquisition of Lime Energy. Borrowings under the New Credit Facilities will bear interest at a rate equal to either, at Willdan’s option, (i) the highest of the prime rate, the Federal Funds Rate plus 0.50% or one-month LIBOR plus 1.00% (“Base Rate”) or (ii) LIBOR, in each case plus an applicable margin ranging from 0.25% to 3.00% with respect to Base Rate borrowings or 1.25% to 4.00% with respect to LIBOR borrowings. The applicable margin will be based upon Willdan’s consolidated total leverage ratio. A change of 12.5 basis points in the interest rate would change interest expense for the period shown by $43,500.

(g)

Represents elimination of gain from change in derivative liability from related party due to extinguishment of convertible debt held by a substantial stockholder of Lime Energy in connection with the acquisition.

(h)

Represents the income tax impact of the pro forma adjustments based on the federal statutory rate of 28.0%.

5

WILLDAN GROUP, INC. AND SUBSIDIARIES

Pro Forma Condensed Combined Statements of Operations

(Unaudited)

|

|

|

Willdan

Group, Inc.

Historical

|

|

Lime

Energy Co.

Historical

|

|

|

|

|

|

|

|

|

Fiscal Year

Ended

December 29,

2017

|

|

Fiscal Year

Ended

December 31,

2017

|

|

Pro Forma

Adjustments

|

|

Willdan

Group, Inc.

Pro Forma

Combined

|

|

|

|

|

(Dollars in thousands, except per share amounts)

|

|

|

Contract revenue

|

|

$

|

273,352

|

|

$

|

124,595

|

|

$

|

—

|

|

$

|

397,947

|

|

|

Direct costs of contract revenue (exclusive of depreciation and amortization shown separately below):

|

|

|

|

|

|

|

|

|

|

|

Salaries and wages

|

|

44,743

|

|

—

|

|

10,736

|

(a)

|

55,479

|

|

|

Subconsultant services and other direct costs

|

|

151,919

|

|

81,732

|

|

(278

|

)(b)

|

233,373

|

|

|

Total direct costs of contract revenue

|

|

196,662

|

|

81,732

|

|

10,458

|

|

288,852

|

|

|

General and administrative expenses:

|

|

|

|

|

|

|

|

|

|

|

Salaries and wages, payroll taxes and employee benefits

|

|

36,534

|

|

—

|

|

14,123

|

(c)

|

50,657

|

|

|

Facilities and facilities related

|

|

4,624

|

|

—

|

|

1,626

|

(c)

|

6,250

|

|

|

Stock-based compensation

|

|

2,774

|

|

—

|

|

332

|

(c)

|

3,106

|

|

|

Depreciation and amortization

|

|

3,949

|

|

1,693

|

|

7,410

|

(d)

|

13,052

|

|

|

Other

|

|

15,105

|

|

36,536

|

|

(27,949

|

)(e)

|

23,692

|

|

|

Total general and administrative expenses (income)

|

|

62,986

|

|

38,229

|

|

(4,458

|

)

|

96,757

|

|

|

Income (loss) from operations

|

|

13,704

|

|

4,634

|

|

(6,000

|

)

|

12,338

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

—

|

|

429

|

|

—

|

|

429

|

|

|

Interest (expense)

|

|

(111

|

)

|

(2,568

|

)

|

(1,419

|

)(f)

|

(4,098

|

)

|

|

Other, net

|

|

98

|

|

2,294

|

|

(2,294

|

)(g)

|

98

|

|

|

Total other (expense)

|

|

(13

|

)

|

155

|

|

(3,713

|

)

|

(3,571

|

)

|

|

Income (loss) before income taxes

|

|

13,691

|

|

4,789

|

|

(9,713

|

)

|

8,767

|

|

|

Income tax expense (benefit)

|

|

1,562

|

|

127

|

|

(2,720

|

)(h)

|

(1,031

|

)

|

|

Net income (loss)

|

|

$

|

12,129

|

|

$

|

4,662

|

|

$

|

(6,993

|

)

|

$

|

9,798

|

|

|

Earnings per share:

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

1.42

|

|

|

|

|

|

$

|

0.95

|

|

|

Diluted

|

|

$

|

1.32

|

|

|

|

|

|

$

|

0.90

|

|

|

Weighted-average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

8,541,000

|

|

|

|

1,750,000

|

|

10,291,000

|

|

|

Diluted

|

|

9,155,000

|

|

|

|

1,750,000

|

|

10,905,000

|

|

(a)

Reflects reclassification from Subconsultant services and other direct costs and Other in General and administrative expenses to conform the presentation of Lime Energy’s financial information to Willdan’s presentation.

(b)

Reflects reclassification to Salaries and wages under Direct costs of contract revenue to conform the presentation of Lime Energy’s financial information to Willdan’s presentation.

(c)

Reflects reclassification from Other in General and administrative expenses to conform the presentation of Lime Energy’s financial information to Willdan’s presentation.

(d)

Reflects $6.0 million of amortization expenses attributable to intangible assets assumed to be acquired as part of the acquisition and reclassification of $1.4 million from Other in General and administrative expenses to conform the presentation of Lime Energy’s financial information to Willdan’s presentation.

(e)

Reflects reclassification to Salaries and wages under Direct costs of contract revenue, Salaries and wages under General and administrative expenses, Facilities and facilities related expenses, Stock-based compensation and

6

Depreciation and amortization to conform the presentation of Lime Energy’s financial information to Willdan’s presentation.

(f)

Reflects expected interest expense after repayment of the outstanding debt of Lime Energy in connection with the acquisition of Lime Energy and anticipated borrowings under the New Credit Facilities to finance the acquisition. Assumes Willdan will not borrow under the new revolving credit facility and will borrow $70.0 million under the Delayed Draw Term Loan Facility. The interest expense for borrowings under the New Credit Facilities is based on an expected interest rate of 5.39%, which assumes LIBOR as of October 1, 2018, plus an applicable margin of 3.00% based on Willdan’s expected consolidated leverage ratio after the acquisition of Lime Energy. Borrowings under the New Credit Facilities will bear interest at a rate equal to either, at Willdan’s option, (i) the highest of the prime rate, the Federal Funds Rate plus 0.50% or one-month LIBOR plus 1.00% (“Base Rate”) or (ii) LIBOR, in each case plus an applicable margin ranging from 0.25% to 3.00% with respect to Base Rate borrowings or 1.25% to 4.00% with respect to LIBOR borrowings. The applicable margin will be based upon Willdan’s consolidated total leverage ratio. A change of 12.5 basis points in the interest rate would change interest expense for the period shown by $87,500.

(g)

Represents elimination of gain from change in derivative liability from related party due to extinguishment of convertible debt held by a substantial stockholder of Lime Energy in connection with the acquisition.

(h)

Represents the income tax impact of the pro forma adjustments based on the federal statutory rate of 28.0%.

7

WILLDAN GROUP, INC. AND SUBSIDIARIES

Pro Forma Condensed Combined Balance Sheet

(Unaudited)

|

|

|

Willdan

Group, Inc.

Historical

|

|

Lime

Energy Co.

Historical

|

|

|

|

Willdan

|

|

|

|

|

As of

June 29,

2018

|

|

As of

June 30,

2018

|

|

Pro Forma

Adjustments

|

|

Group, Inc.

Pro Forma

Combined

|

|

|

|

|

(Dollars in thousands, except per share amounts)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

11,225

|

|

$

|

2,055

|

|

$

|

(3,967

|

)(a)

|

$

|

9,313

|

|

|

Accounts receivable, net of allowance for doubtful accounts of $714,000 at June 29, 2018

|

|

22,896

|

|

26,130

|

|

—

|

|

49,026

|

|

|

Contract assets

|

|

42,410

|

|

10,320

|

|

—

|

|

52,730

|

|

|

Other receivables

|

|

777

|

|

—

|

|

—

|

|

777

|

|

|

Prepaid expenses and other current assets

|

|

3,242

|

|

5,452

|

|

—

|

|

8,694

|

|

|

Total current assets

|

|

80,550

|

|

43,957

|

|

(3,967

|

)

|

120,540

|

|

|

Equipment and leasehold improvements, net

|

|

5,142

|

|

3,520

|

|

—

|

|

8,662

|

|

|

Goodwill

|

|

40,342

|

|

8,173

|

|

51,025

|

(b)

|

99,540

|

|

|

Other intangible assets, net

|

|

11,201

|

|

729

|

|

42,000

|

(c)

|

53,930

|

|

|

Other assets

|

|

920

|

|

1,100

|

|

—

|

|

2,020

|

|

|

Total assets

|

|

$

|

138,155

|

|

$

|

57,479

|

|

$

|

89,058

|

|

$

|

284,692

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

14,024

|

|

$

|

12,253

|

|

—

|

|

$

|

26,277

|

|

|

Accrued liabilities

|

|

24,198

|

|

15,535

|

|

—

|

|

39,733

|

|

|

Contingent consideration payable

|

|

4,224

|

|

—

|

|

—

|

|

4,224

|

|

|

Contract liabilities

|

|

6,163

|

|

661

|

|

—

|

|

6,824

|

|

|

Notes payable

|

|

—

|

|

595

|

|

(595

|

)(d)

|

—

|

|

|

Capital lease obligations

|

|

237

|

|

—

|

|

—

|

|

237

|

|

|

Total current liabilities

|

|

48,846

|

|

29,044

|

|

(595

|

)

|

77,295

|

|

|

Contingent consideration payable

|

|

3,650

|

|

—

|

|

—

|

|

3,650

|

|

|

Notes payable

|

|

2,000

|

|

357

|

|

69,643

|

(e)

|

72,000

|

|

|

Capital lease obligations, less current portion

|

|

192

|

|

—

|

|

—

|

|

192

|

|

|

Deferred lease obligations

|

|

631

|

|

—

|

|

—

|

|

631

|

|

|

Deferred income taxes, net

|

|

2,404

|

|

—

|

|

—

|

|

2,404

|

|

|

Other noncurrent liabilities

|

|

468

|

|

14,029

|

|

(14,029

|

)(d)

|

468

|

|

|

Total liabilities

|

|

58,191

|

|

43,430

|

|

55,019

|

|

156,640

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

14,708

|

|

(14,708

|

)

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value, 10,000,000 shares authorized, no shares issued and outstanding

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|

Common stock, $0.01 par value, 40,000,000 shares authorized; 8,857,000 shares issued and outstanding at June 29, 2018

|

|

89

|

|

—

|

|

18

|

(f)

|

107

|

|

|

Stockholders’ Equity

|

|

—

|

|

1

|

|

(1

|

)

|

—

|

|

|

Additional paid-in capital

|

|

54,216

|

|

206,002

|

|

(157,932

|

)(g)

|

102,286

|

|

|

Accumulated earnings (deficit)

|

|

25,659

|

|

(206,662

|

)

|

206,662

|

(h)

|

25,659

|

|

|

Total stockholders’ equity

|

|

79,964

|

|

(659

|

)

|

48,747

|

|

128,052

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

138,155

|

|

$

|

57,479

|

|

$

|

89,058

|

|

$

|

284,692

|

|

(a)

Reflects expected use of cash-on-hand, net of any cash proceeds received from expected borrowings under the New Credit Facilities, to fund the purchase price and transaction expenses related to the acquisition of Lime Energy and elimination of cash-on-hand from Lime Energy’s balance sheet.

(b)

Reflects the estimated amount of goodwill to be acquired at the date of the acquisition of Lime Energy. Goodwill represents the total excess of the total purchase price over the fair value of the net assets acquired. This allocation is

8

based on preliminary estimates; the final acquisition cost allocation may differ materially from the preliminary assessment outlined above. Any changes to the initial estimates of the fair value of the assets and liabilities will be allocated to goodwill. Residual goodwill at the date of the acquisition of Lime Energy will vary from goodwill presented in the unaudited pro forma condensed combined balance sheet due to changes in the net book value of intangible assets during the period from June 30, 2018 through the date of the acquisition of Lime Energy as well as results of an independent valuation, which has not been completed as of the date of this prospectus supplement.

(c)

Reflects the preliminary estimate of the fair value of the acquired intangible assets. The purchase price allocated to these intangible assets is based on management’s estimate of the fair value of assets purchased, and has not been subject to an independent valuation as of the date of this prospectus supplement.

(d)

Reflects elimination of outstanding debt of Lime Energy prior to closing of the acquisition of Lime Energy.

(e)

Reflects expected borrowings under the New Credit Facilities in connection with the acquisition of Lime Energy and elimination of outstanding debt of Lime Energy prior to closing of the acquisition of Lime Energy. Assumes Willdan will not borrow under the new revolving credit facility and will borrow $70.0 million under the Delayed Draw Term Loan Facility.

(f)

Represents the elimination of the historical owners’ equity interest in Lime Energy.

(g)

Represents the elimination of the historical owners’ equity interest in Lime Energy.

(h)

Represents the elimination of the retained earnings of Lime Energy.

9

Reconciliation of Net Income to Adjusted Net Income and Adjusted Diluted EPS

The following is an updated reconciliation of net income to Adjusted Net Income and Adjusted Diluted EPS:

|

|

|

Six Months Ended

|

|

Fiscal Year

|

|

|

|

|

June 29, 2018

|

|

June 30, 2017

|

|

2017

|

|

2016

|

|

2015

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands, except per share amounts)

|

|

|

Net income

|

|

$

|

5,518

|

|

$

|

5,953

|

|

$

|

12,129

|

|

$

|

8,299

|

|

$

|

4,259

|

|

|

Stock-based compensation

|

|

2,726

|

|

1,096

|

|

2,774

|

|

1,239

|

|

777

|

|

|

Intangible amortization

|

|

1,400

|

|

1,096

|

|

2,426

|

|

1,924

|

|

1,171

|

|

|

Tax effect of stock-based compensation and intangible amortization

|

|

(421

|

)

|

(184

|

)

|

(593

|

)

|

(854

|

)

|

(818

|

)

|

|

Adjusted net income

|

|

$

|

9,223

|

|

$

|

7,961

|

|

$

|

16,736

|

|

$

|

10,608

|

|

$

|

5,389

|

|

|

Diluted weighted-average shares outstanding

|

|

9,247,000

|

|

9,078,000

|

|

9,155,000

|

|

8,565,000

|

|

8,113,000

|

|

|

Diluted earnings per share

|

|

$

|

0.60

|

|

$

|

0.66

|

|

$

|

1.32

|

|

$

|

0.97

|

|

$

|

0.52

|

|

|

Stock-based compensation per share

|

|

0.29

|

|

0.12

|

|

0.30

|

|

0.14

|

|

0.10

|

|

|

Intangible amortization per share

|

|

0.15

|

|

0.12

|

|

0.26

|

|

0.22

|

|

0.14

|

|

|

Tax effect on stock-based compensation and intangible amortization per share

|

|

(0.04

|

)

|

(0.02

|

)

|

(0.06

|

)

|

(0.09

|

)

|

(0.10

|

)

|

|

Adjusted Diluted EPS

|

|

$

|

1.00

|

|

$

|

0.88

|

|

$

|

1.82

|

|

$

|

1.24

|

|

$

|

0.66

|

|

10

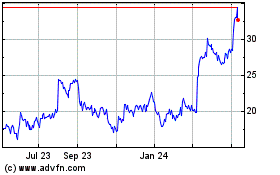

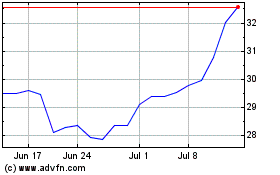

Willdan (NASDAQ:WLDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Willdan (NASDAQ:WLDN)

Historical Stock Chart

From Apr 2023 to Apr 2024