As filed with the Securities and Exchange Commission on

October 2, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Biohaven Pharmaceutical Holding Company Ltd.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

British Virgin Islands

|

|

2834

|

|

Not applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

c/o Biohaven Pharmaceuticals, Inc.

215 Church Street

New Haven, Connecticut 06510

(203) 404-0410

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Vlad Coric, M.D.

Chief Executive Officer

Biohaven Pharmaceutical Holding Company Ltd.

215 Church Street

New Haven, Connecticut 06510

(203) 404-0410

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

|

|

|

|

Darren K. DeStefano

Brian F. Leaf

Katie Kazem

Cooley LLP

11951 Freedom Drive

Reston, VA 20190-5656

(703) 456-8000

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

Large accelerated filer

o

|

Accelerated filer

o

|

|

Non-accelerated filer

x

(Do not check if a smaller reporting company)

|

Smaller reporting company

o

|

|

|

Emerging growth company

x

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act.

x

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities to be Registered

|

Amount to be

Registered(1)

|

Proposed

Maximum

Aggregate

Offering Price

Per Share

|

Proposed

Maximum

Aggregate

Offering

Price(2)

|

Amount of

Registration

Fee(3)

|

|

Common Shares, no par value

|

109,523

|

$36.64

|

$4,012,922.72

|

$486

|

|

|

|

|

|

|

|

(1)

|

Represents shares offered by the Selling Shareholder. Includes an indeterminable number of additional common shares, pursuant to Rule 416 under the Securities Act of 1933, as amended, that may be issued to prevent dilution from stock splits, stock dividends or similar transactions that could affect the shares to be offered by Selling Shareholder.

|

|

|

|

|

(2)

|

Estimated solely for purposes of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act on the basis of the average of the high and low prices of the Registrant's common shares as reported on the New York Stock Exchange on September 25, 2018.

|

|

|

|

|

(3)

|

Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price.

|

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The Selling Shareholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS (Subject to Completion)

Dated

October 2, 2018

109,523

Shares

COMMON SHARES

This prospectus relates to the resale from time to time of up to

109,523

of our common shares in the aggregate that were issued to the Selling Shareholder named in this prospectus in connection with a licensing transaction completed on September 4, 2018. We are not selling any common shares and will not receive any proceeds from the sale of the shares by the Selling Shareholder.

We have agreed to bear all of the expenses incurred in connection with the registration of these shares. The Selling Shareholder will pay or assume brokerage commissions and similar charges, if any, incurred for the sale of our common shares.

The Selling Shareholder, or its pledgees, donees, transferees or other successors-in-interest, may offer the shares from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. For additional information on the methods of sale that may be used by the Selling Shareholder, see the section entitled “Plan of Distribution” beginning on page

7

.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

Our common shares are listed on the New York Stock Exchange under the symbol “BHVN.” The last reported sale price of our common shares on the New York Stock Exchange on

October 1, 2018

was

$37.23

per share.

We are an "emerging growth company" as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See "Prospectus Summary—Implications of Being an Emerging Growth Company."

Investing in our common shares involves risks. Please see "Risk Factors" beginning on page

4

as well as in the documents incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

, 2018

You should rely only on the information contained in this prospectus, any supplement to this prospectus or in any free writing prospectus filed with the Securities and Exchange Commission, or SEC. Neither we nor the Selling Shareholder has authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the SEC. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. The Selling Shareholder is offering to sell, and seeking offers to buy, our common shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common shares. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor the Selling Shareholder has done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common shares and the distribution of this prospectus outside the United States.

To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any document incorporated by reference filed with the SEC before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement in the document having the later date modifies or supersedes the earlier statement.

PROSPECTUS SUMMARY

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. Before investing in our common shares, you should carefully read this entire prospectus, including our financial statements and the related notes and other documents incorporated by reference in this prospectus, as well as the information under the caption “Risk Factors” herein and under similar headings in the other documents that are incorporated by reference into this prospectus. Unless the context otherwise requires, we use the terms "Biohaven," "company," "we," "us" and "our" in this prospectus to refer to Biohaven Pharmaceutical Holding Company Ltd. and, where appropriate, our subsidiaries.

Business Overview

We are a clinical-stage biopharmaceutical company with a portfolio of innovative, late-stage product candidates targeting neurological diseases, including rare disorders. Our product candidates are small molecules based on three distinct mechanistic platforms—calcitonin gene-related peptide, or CGRP, receptor antagonists, glutamate modulators and myeloperoxidase, or MPO, inhibitors—which we believe have the potential to significantly alter existing treatment approaches across a diverse set of neurologic indications with high unmet need in both large markets and orphan indications.

The most advanced product candidate from our CGRP receptor antagonist platform is rimegepant, an orally available, potent and selective small molecule human CGRP receptor antagonist that we are developing for both the acute treatment and prevention of migraine. We have completed two pivotal Phase 3 clinical trials of rimegepant, in the oral tablet formulation, which demonstrated comprehensive and durable efficacy across multiple outcome measures and which achieved the primary endpoint in both trials. In these two Phase 3 clinical trials, we observed a safety profile of rimegepant similar to placebo, including on liver function tests. We are currently conducting two additional Phase 3 clinical trials of rimegepant—one of which is an open label long-term safety study and the other is to evaluate our orally dissolving tablet, or ODT, formulation of rimegepant, which utilizes Zydis

®

fast dissolve technology, for the acute treatment of migraine. We anticipate receiving initial results from the long-term safety study and topline results from the ODT clinical trial in the fourth quarter of 2018. We are also evaluating rimegepant for the prevention of migraine and anticipate commencing a Phase 3 clinical trial in the fourth quarter of 2018. We plan to submit a new drug application, or NDA, to the U.S. Food and Drug Administration, or FDA, for rimegepant for the acute treatment of migraine in 2019. We are also developing BHV-3500, a third-generation CGRP receptor antagonist, for the acute treatment and prevention of migraine. We submitted an investigational new drug, or IND, application to the FDA in September 2018 and plan to initiate a Phase 1 clinical trial in the fourth quarter of 2018.

Our glutamate platform includes three clinical-stage product candidates being developed for the treatment of various neurological indications: troriluzole for the treatment of obsessive-compulsive disorder, or OCD, spinocerebellar ataxia, or SCA, Alzheimer’s disease and generalized anxiety disorder; nurtec (previously referred to as BHV-0223) for the treatment of amyotrophic lateral sclerosis, or ALS; and BHV-5000 for the treatment of neuropsychiatric indications. One of our advanced product candidates from our glutamate platform is nurtec, which we are developing for the treatment of ALS, a neurodegenerative disease that affects nerve cells in the brain and spinal cord. We have received orphan drug designation from the U.S. Food and Drug Administration, or FDA, for nurtec in ALS and we have observed results suggesting bioequivalence to Rilutek in a recently completed Phase 1 clinical trial. We plan to file a new drug application, or NDA, with the FDA for Nurtec in 2018. With respect to troriluzole, we anticipate commencing a second Phase 2/3 clinical trial in SCA and receiving the results from an open-label 48-week extension study in SCA in the fourth quarter of 2018. We are currently conducting enrollment in two Phase 2/3 clinical trials of troriluzole—one for the treatment of Alzheimer’s disease in collaboration with the Alzheimer’s Disease Cooperative Study and one for the treatment of OCD. With respect to BHV-5000, we initiated a Phase 1 study in December 2017 which we expect to be completed by the end of 2018.

Our MPO inhibitor platform consists of BHV-3241, formerly called AZ3241, which we in-licensed from AstraZeneca AB in September 2018. We plan to develop BHV-3241 for the treatment of multiple system atrophy, a rare, rapidly progressive and fatal neurodegenerative disease that has no effective treatments and is currently only being managed symptomatically.

Corporate Information

We were incorporated as a business company limited by shares organized under the laws of the British Virgin Islands in September 2013. Our registered office is located at P.O. Box 173, Road Town, Tortola, British Virgin Islands and our telephone number is +1 (284) 852-3000. Our U.S. office and the office of our U.S. subsidiary is located at 215 Church Street, New Haven, Connecticut 06510 and our telephone number is (203) 404-0410. Our website address is

www.biohavenpharma.com

. The

information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common shares.

We have four wholly owned subsidiaries, including Biohaven Pharmaceuticals, Inc., a Delaware corporation.

We have proprietary rights to a number of trademarks used in this prospectus which are important to our business, including the Biohaven logo. Solely for convenience, the trademarks and trade names in this prospectus are referred to without the ® and

TM

symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. All other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

Implications of Being an Emerging Growth Company

As a company with less than $1.07 billion in revenues during our last fiscal year, we qualify as an emerging growth company as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in 2012. As an emerging growth company, we expect to take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

|

|

|

|

•

|

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended;

|

|

|

|

|

•

|

reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and

|

|

|

|

|

•

|

exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

|

We may use these provisions until December 31, 2022. However, we expect to become a "large accelerated filer" starting January 1, 2019 and we will then cease to be an emerging growth company.

We have elected to take advantage of certain of the reduced disclosure obligations in the registration statement of which this prospectus is a part and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our shareholders may be different than you might receive from other public reporting companies in which you hold equity interests.

The JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

THE OFFERING

|

|

|

|

|

|

Selling Shareholder

|

AstraZeneca AB

|

|

Common shares offered by the Selling Shareholder

|

109,523 shares

|

|

Common shares outstanding

|

40,145,227 shares

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of shares in this offering. See “Use of Proceeds.”

|

|

Risk Factors

|

See "Risk Factors" on page

4

of this prospectus and the “Risk Factors” sections in the documents incorporated by reference herein for a discussion of factors to consider carefully before deciding to invest in our common shares.

|

|

NYSE symbol

|

BHVN

|

The number of common shares outstanding is based on

40,145,227

common shares outstanding as of

September 15, 2018

and excludes:

|

|

|

|

•

|

6,794,568

common shares issuable upon the exercise of stock options outstanding as of

September 15, 2018

, at a weighted average exercise price of

$10.57

per share;

|

|

|

|

|

•

|

221,751

common shares issuable upon the exercise of warrants outstanding as of

September 15, 2018

, at a weighted average exercise price of

$9.68

per share; and

|

|

|

|

|

•

|

2,254,631

common shares reserved for future issuance under our 2017 Equity Incentive Plan, or the 2017 Plan, and

699,716

common shares reserved for future issuance under our 2017 Employee Share Purchase Plan, or ESPP, as of

September 15, 2018

, as well as any automatic increases in the number of common shares reserved for issuance under the 2017 Plan and the ESPP after the date of this prospectus.

|

Except as otherwise indicated herein, all information in this prospectus assumes no exercise of the outstanding options and warrants described above.

RISK FACTORS

Investing in our common shares involves a high degree of risk. Before you invest in our common shares, you should carefully consider the following risks, as well as general economic and business risks, including those set forth under the heading "Risk Factors" in our Quarterly Report on Form 10-Q for the quarter ended

June 30, 2018

incorporated by reference herein, and all of the other information contained in this prospectus and in the documents incorporated by reference herein. Any of the following risks, including those discussed in the documents incorporated by reference herein, could have a material adverse effect on our business, operating results and financial condition and cause the trading price of our common shares to decline, which would cause you to lose all or part of your investment. When determining whether to invest, you should also refer to the other information contained or incorporated by reference in this prospectus, including our financial statements and the related notes thereto. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us may also adversely affect our business.

Risks related to this offering and ownership of our common shares

Sales of shares issued in this offering may cause the market price of our shares to decline.

On

September 19, 2018

, we issued

109,523

of our common shares to AstraZeneca AB, the selling shareholder, in connection with a license agreement. We have agreed to register for resale with the SEC such common shares. The registration statement of which this prospectus forms a part has been filed to satisfy this obligation. Upon the effectiveness of the registration statement, the

109,523

common shares we issued pursuant to the license agreement may be freely sold in the open market. The sale of a significant amount of these shares in the open market, or the perception that these sales may occur, could cause the market price of our common shares to decline or become highly volatile.

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future results of operations and financial position, strategy and plans, and our expectations for future operations, are forward-looking statements. The words "believe," "may," "will," "estimate," "continue," "anticipate," "design," "intend," "expect," "could," "plan," "potential," "predict," "seek," "should," "would" or the negative version of these words and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, strategy, short- and long-term business operations and objectives, and financial needs. These forward-looking statements include, but are not limited to, statements concerning the following:

|

|

|

|

•

|

our plans to develop and commercialize our product candidates;

|

|

|

|

|

•

|

our ongoing and planned clinical trials for our rimegepant, troriluzole, nurtec, BHV-5000 and BHV-3241 development programs;

|

|

|

|

|

•

|

the timing of the availability of data from our clinical trials;

|

|

|

|

|

•

|

the timing of our planned regulatory filings;

|

|

|

|

|

•

|

the timing of and our ability to obtain and maintain regulatory approvals for our product candidates;

|

|

|

|

|

•

|

the clinical utility of our product candidates;

|

|

|

|

|

•

|

our commercialization, marketing and manufacturing capabilities and strategy;

|

|

|

|

|

•

|

our intellectual property position; and

|

|

|

|

|

•

|

our estimates regarding future revenues, expenses and needs for additional financing.

|

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in "Risk Factors" in this prospectus and in our Quarterly Report on Form 10-Q for the quarter ended

June 30, 2018

incorporated by reference herein. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual results or to changes in our expectations.

You should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

USE OF PROCEEDS

We are registering

109,523

common shares for resale by the Selling Shareholder. We are not selling any securities under this prospectus and will not receive any proceeds from sales of the common shares sold from time to time under this prospectus by the Selling Shareholder.

We have agreed to pay all costs, expenses and fees relating to registering the common shares referenced in this prospectus. The Selling Shareholder will pay any brokerage commissions and/or similar charges incurred for the sale of such common shares.

MARKET PRICE OF COMMON SHARES

Our common shares commenced trading on the New York Stock Exchange under the symbol “BHVN” on May 4, 2017. The following table sets forth, for the periods indicated, the high and low reported sales prices of our common shares as reported on the New York Stock Exchange:

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

Low

|

|

2017

|

|

|

|

|

Second quarter (from May 4, 2017)

|

$

|

28.34

|

|

|

$

|

17.00

|

|

|

Third quarter

|

$

|

39.51

|

|

|

$

|

22.95

|

|

|

Fourth quarter

|

$

|

36.15

|

|

|

$

|

18.95

|

|

|

2018

|

|

|

|

|

First quarter

|

$

|

34.68

|

|

|

$

|

16.50

|

|

|

Second quarter

|

$

|

44.28

|

|

|

$

|

23.21

|

|

|

Third quarter (through October 1, 2018)

|

$

|

43.75

|

|

|

$

|

31.36

|

|

As of

October 1, 2018

, there were

65

holders of record of our common shares. The actual number of shareholders is greater than this number of record holders and includes shareholders who are beneficial owners but whose shares are held in street name by brokers and other nominees. This number of holders of record also does not include shareholders whose shares may be held in trust by other entities. The last reported sale price of our common shares on the New York Stock Exchange on

October 1, 2018

was

$37.23

per share.

DIVIDEND POLICY

We have never declared or paid any dividends on our common shares. We anticipate that we will retain all of our future earnings, if any, for use in the operation and expansion of our business and do not anticipate paying cash dividends in the foreseeable future.

SELLING SHAREHOLDER

The following table sets forth:

|

|

|

|

•

|

the name of the Selling Shareholder and any position, office or other material relationship with us within the past three years;

|

|

|

|

|

•

|

the number of common shares beneficially owned by the Selling Shareholder prior to this offering;

|

|

|

|

|

•

|

the percentage of common shares beneficially owned by the Selling Shareholder prior to this offering;

|

|

|

|

|

•

|

the number of common shares being offered pursuant to this prospectus;

|

|

|

|

|

•

|

the number of common shares beneficially owned by the Selling Shareholder upon completion of this offering; and

|

|

|

|

|

•

|

the percentage of common shares beneficially owned by the Selling Shareholder upon completion of this offering.

|

This table is prepared based on information supplied to us by the Selling Shareholder, and reflects holdings as of

October 1, 2018

. As used in this prospectus, the term “Selling Shareholder” includes the Selling Shareholder listed below, and any donees, pledges, transferees or other successors in interest selling shares received after the date of this prospectus from the Selling Shareholder as a gift, pledge, or other non-sale related transfer. The number of shares in the column “Number of Shares Being Offered” represents all of the shares that the Selling Shareholder may offer under this prospectus. The Selling Shareholder may sell some, all or none of its shares. The number of shares in the column “Common Shares Beneficially Owned After Offering” assumes that the Selling Shareholder sells all of the shares covered by this prospectus. We do not know how long the Selling Shareholder will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the Selling Shareholder regarding the sale of any of the shares.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to our common shares. The percentage of shares beneficially owned prior to the offering is based on

40,261,750

of our common shares outstanding as of

October 1, 2018

.

The Selling Shareholder may have sold or transferred, in transactions exempt from the registration requirements of the Securities Act, some or all of its common shares since the date on which the information in the table below is presented. Information about the Selling Shareholder may change over time.

Except as noted in the footnotes to the table below, the Selling Shareholder has not had, within the past three years, any position, office, or material relationship with us or any of our predecessors or affiliates.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares Beneficially Owned Prior to Offering

|

|

Number of Shares Being Offered

|

|

Common Shares Beneficially Owned After Offering

|

|

Selling Shareholder Name and Address

|

|

Number

|

|

Percentage

|

|

|

Number

|

|

Percentage

|

|

AstraZeneca AB

(1)

SE-431 83 Molndal, Sweden

|

|

109,523

|

|

0.27%

|

|

109,523

|

|

—

|

|

—%

|

|

|

|

|

|

|

(1)

|

We entered into an exclusive license agreement with AstraZeneca in October 2016 (the “

First License Agreement

”). As part of the consideration under the First License Agreement and in connection with the completion of the first closing of our Series A financing in October 2016 and the completion of our initial public offering in May 2017, we issued common shares to AstraZeneca. We entered into an exclusive license agreement with AstraZeneca in September 2018 (the “

Second License Agreement

”). As part of the consideration under the Second License Agreement, we issued 109,523 common shares to AstraZeneca in September 2018. The shares issued pursuant to the Second License Agreement are being offered hereby.

|

PLAN OF DISTRIBUTION

We are registering the common shares previously issued to permit the resale of these common shares by the holders of the common shares from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the Selling Shareholder of the common shares. We will bear all fees and expenses incident to our obligation to register the common shares, except that, if the common shares are sold through underwriters or broker-dealers, the Selling Shareholder will be responsible for underwriting discounts or commissions or agent’s commissions.

The Selling Shareholder may sell all or a portion of the common shares beneficially owned by it and offered hereby from time to time directly or through one or more underwriters, broker dealers or agents. The common shares may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of sale, or at negotiated prices. These sales may be effected in transactions, which may involve crosses or block transactions,

|

|

|

|

•

|

on any national securities exchange or quotation service on which the securities may be listed or quoted at the time of sale;

|

|

|

|

|

•

|

in the over-the-counter market;

|

|

|

|

|

•

|

in transactions otherwise than on these exchanges or systems or in the over-the-counter market;

|

|

|

|

|

•

|

through the writing of options, whether such options are listed on an options exchange or otherwise;

|

|

|

|

|

•

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

|

|

•

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

|

|

•

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

|

|

•

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

•

|

privately negotiated transactions;

|

|

|

|

|

•

|

sales pursuant to Rule 144 of the Securities Act;

|

|

|

|

|

•

|

broker-dealers may agree with the Selling Shareholder to sell a specified number of such shares at a stipulated price per share;

|

|

|

|

|

•

|

a combination of any such methods of sale; and

|

|

|

|

|

•

|

any other method permitted pursuant to applicable law.

|

If the Selling Shareholder effects such transactions by selling our common shares to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the Selling Shareholder or commissions from purchasers of our common shares for whom they may act as agent or to whom they may sell as principal (which discounts, concessions or commissions as to particular underwriters, broker-dealers or agents may be in excess of those customary in the types of transactions involved). In connection with sales of our common shares or otherwise, the Selling Shareholder may enter into hedging transactions with broker-dealers, which may in turn engage in short sales of our common shares in the course of hedging in positions they assume. The Selling Shareholder may also sell our common shares short and deliver our common shares covered by this prospectus to close out short positions and to return borrowed shares in connection with such short sales. The Selling Shareholder may also loan or pledge our common shares to broker-dealers that in turn may sell such shares.

The Selling Shareholder may pledge or grant a security interest in some or all of our common shares owned by it and, if it defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the common shares from time to time pursuant to this prospectus or other applicable provisions of the Securities Act, amending, if necessary, the list of selling shareholders to include the pledgee, transferee or other successors in interest as selling shareholders under this prospectus. The Selling Shareholder also may transfer and donate our common shares in other circumstances in which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The Selling Shareholder and any broker-dealer participating in the distribution of our common shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any commission paid, or any discounts or concessions allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act. At the time a particular offering of our common shares is made, a prospectus supplement, if required, will be distributed which will set forth the aggregate amount of our common shares being offered and the terms of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting compensation from the Selling Shareholder and any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers.

Under the securities laws of some states, our common shares may be sold in such states only through registered or licensed brokers or dealers. In addition, in some states our common shares may not be sold unless such shares have been registered or qualified for sale in such state or an exemption from registration or qualification is available and is complied with.

There can be no assurance that the Selling Shareholder will sell any or all of our common shares registered pursuant to the registration statement of which this prospectus forms a part. The Selling Shareholder and any other person participating in such distribution will be subject to applicable provisions of the Exchange Act, and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of any of the our common shares by the Selling Shareholder and any other participating person. Regulation M may also restrict the ability of any person engaged in the distribution of our common shares to engage in market-making activities with respect to our common shares. All of the foregoing may affect the marketability of our common shares and the ability of any person or entity to engage in market-making activities with respect to our common shares.

We will pay all expenses of the registration of our common shares pursuant to the registration statement of which this prospectus forms a part, including, without limitation, SEC filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that the Selling Shareholder will pay all underwriting discounts and selling commissions, if any. We will indemnify the Selling Shareholder against liabilities, including some liabilities under the Securities Act, or the Selling Shareholder will be entitled to contribution. We may be indemnified by the Selling Shareholder against civil liabilities, including liabilities under the Securities Act, that may arise from any written information furnished to us by the Selling Shareholder specifically for use in this prospectus or we may be entitled to contribution. Once sold under the registration statement of which this prospectus forms a part, our common shares will be freely tradable in the hands of persons other than our affiliates.

LEGAL MATTERS

The validity of the common shares being offered by this prospectus will be passed upon for us by Maples and Calder, our special British Virgin Islands counsel.

EXPERTS

The financial statements incorporated in this prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2017 have been so incorporated in reliance on the report (which contains an explanatory paragraph relating to the Company's ability to continue as a going concern as described in Note 1 to the financial statements) of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act, with respect to the common shares being offered by this prospectus. This prospectus, which constitutes part of the registration statement, does not contain all of the information in the registration statement and its exhibits. For further information with respect to our company and the common shares offered by this prospectus, we refer you to the registration statement and its exhibits. Statements contained in this prospectus as to the contents of any contract or any other document referred to are not necessarily complete, and in each instance, we refer you to the copy of the contract or other document filed as an exhibit to the registration statement. Each of these statements is qualified in all respects by this reference.

You can read our SEC filings, including the registration statement, over the internet at the SEC's website at

www.sec.gov

. You may also read and copy any document we file with the SEC at its public reference room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may also obtain copies of these documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facilities.

We are subject to the information reporting requirements of the Exchange Act, and we have filed and will file reports, proxy statements and other information with the SEC. These reports, proxy statements and other information will be available for inspection and copying at the public reference room and website of the SEC referred to above. We also maintain a website at

www.biohavenpharma.com

, at which you may access these materials free of charge as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to "incorporate by reference" information from other documents that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC (File No. 001-38080):

|

|

|

|

•

|

our Annual Report on Form 10-K for the year ended December 31, 2017, filed with the SEC on March 6, 2018;

|

|

|

|

|

•

|

our Definitive Proxy Statement on Schedule 14A filed with the SEC on March 29, 2018;

|

|

|

|

|

•

|

our Quarterly Report on Form 10-Q for the Quarter ended March 31, 2018, filed with the SEC on May 15, 2018;

|

|

|

|

|

•

|

our Quarterly Report on Form 10-Q for the Quarter ended June 30, 2018, filed with the SEC on August 14, 2018;

|

|

|

|

|

•

|

our Current Reports on Form 8-K filed with the SEC on January 11, 2018, March 12, 2018, March 26, 2018, May 18, 2018, June 19, 2018, June 25, 2018, August 31, 2018, September 10, 2018 and September 12, 2018; and

|

|

|

|

|

•

|

the description of our common shares contained in our registration statement on Form 8-A registering our common shares under Section 12 of the Exchange Act, filed with the SEC on May 1, 2017, including any amendments or reports filed for the purpose of updating that description.

|

Notwithstanding the statements in the preceding paragraphs, no document, report or exhibit (or portion of any of the foregoing) or any other information that we have "furnished" to the SEC pursuant to the Exchange Act shall be incorporated by reference into this prospectus.

We will furnish without charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference in this prospectus, including exhibits to these documents. You should direct any requests for documents to Biohaven Pharmaceutical Holding Company Ltd., Attn: Corporate Secretary, 215 Church Street, New Haven, Connecticut 06510.

You also may access these filings on our website at www.biohavenpharma.com. We do not incorporate the information on our website into this prospectus or any supplement to this prospectus and you should not consider any information on, or that can be accessed through, our website as part of this prospectus or any supplement to this prospectus (other than those filings with the SEC that we specifically incorporate by reference into this prospectus or any supplement to this prospectus).

Any statement contained in a document incorporated or deemed to be incorporated by reference in this prospectus will be deemed modified, superseded or replaced for purposes of this prospectus to the extent that a statement contained in this prospectus modifies, supersedes or replaces such statement.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13.

Other Expenses of Issuance and Distribution.

The following table sets forth the costs and expenses, other than underwriting discounts and commissions, payable by the registrant in connection with the sale and distribution of the common shares being registered. All amounts are estimates except for the SEC registration fee.

|

|

|

|

|

|

|

|

|

SEC registration fee

|

|

$

|

486

|

|

|

Legal fees and expenses

|

|

25,000

|

|

|

Accounting fees and expenses

|

|

15,000

|

|

|

Printing and miscellaneous fees and expenses

|

|

10,250

|

|

|

Total

|

|

$

|

50,736

|

|

Item 14.

Indemnification of Directors and Officers.

British Virgin Islands law does not limit the extent to which a company's articles of association may provide for indemnification of officers and directors, except to the extent any such provision may be held by the British Virgin Islands courts to be contrary to public policy, such as to provide indemnification against civil fraud or the consequences of committing a crime. Our Amended Memorandum and Articles of Association provide for the indemnification of our directors against all losses or liabilities incurred or sustained by him or her as a director of our company in defending any proceedings, whether civil, criminal, administrative or investigative in which the director acted honestly and in good faith with a view to the best interest of the company and had no reasonable cause to believe that their conduct was unlawful.

Further, we have entered into indemnification agreements with each of our directors and executive officers that may be broader than the specific indemnification provisions contained under British Virgin Islands law. These indemnification agreements require us, among other things, to indemnify our directors and executive officers against liabilities that may arise by reason of their status or service. These indemnification agreements also require us to advance all expenses incurred by the directors and executive officers in investigating or defending any such action, suit, or proceeding. We believe that these agreements are necessary to attract and retain qualified individuals to serve as directors and executive officers.

The limitation of liability and indemnification provisions in our memorandum and articles of association and in indemnification agreements that we enter into with our directors and executive officers may discourage shareholders from bringing a lawsuit against our directors and executive officers for breach of their fiduciary duties. They may also reduce the likelihood of derivative litigation against our directors and executive officers, even though an action, if successful, might benefit us and other shareholders. Further, a shareholder's investment may be harmed to the extent that we pay the costs of settlement and damage awards against directors and executive officers as required by these indemnification provisions. At present, we are not aware of any pending litigation or proceeding involving any person who is or was one of our directors, officers, employees or other agents or is or was serving at our request as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, for which indemnification is sought, and we are not aware of any threatened litigation that may result in claims for indemnification.

We have obtained insurance policies under which, subject to the limitations of the policies, coverage is provided to our directors and executive officers against loss arising from claims made by reason of breach of fiduciary duty or other wrongful acts as a director or executive officer, including claims relating to public securities matters, and to us with respect to payments that may be made by us to these directors and executive officers pursuant to our indemnification obligations or otherwise as a matter of law.

Item 15.

Recent Sales of Unregistered Securities.

Issuances of Share Capital

The following list sets forth information regarding all unregistered securities sold by us since January 1, 2015 through the date of the prospectus that forms a part of this registration statement.

|

|

|

|

1.

|

In July 2015, we issued an aggregate of 867,000 common shares to three investors at a purchase price of $5.60 per share, for aggregate consideration of $4.9 million.

|

|

|

|

|

2.

|

In August 2015, we issued 50,000 common shares with a value of $0.3 million to a third party in partial settlement of amounts due under a license agreement.

|

|

|

|

|

3.

|

In August 2015, as part of our license agreement, we issued ALS Biopharma, LLC warrants to purchase an aggregate of 600,000 of our common shares with an exercise price of $5.60 per share.

|

|

|

|

|

4.

|

In February 2016, we issued an aggregate of 429,000 common shares to two investors at a purchase price of $7.00 per share, for aggregate consideration of $3.0 million.

|

|

|

|

|

5.

|

In May 2016 and June 2016, we issued an aggregate of 1,090,500 common shares to 10 investors at a purchase price of $7.70 per share, for aggregate consideration of $8.4 million.

|

|

|

|

|

6.

|

In October 2016, we issued an aggregate of 4,305,209 Series A preferred shares to 45 investors at a purchase price of $9.2911 per share, for aggregate consideration of $40.0 million, 538,150 Series A preferred shares with a value of $5.0 million to a third party in satisfaction of our obligations under a license agreement and 105,010 Series A preferred shares with a value of $1.0 million to two third parties in connection with their placement services with respect to the Series A preferred financing.

|

|

|

|

|

7.

|

In December 2016, we issued promissory notes in the aggregate principal amount of $0.6 million to the stockholders of Biohaven Pharmaceuticals, Inc. in connection with our purchase of all of the outstanding capital stock of BPI.

|

|

|

|

|

8.

|

In January 2017, we issued warrants to two of our directors, each to purchase 107,500 of our common shares with an exercise price of $9.2911 per share, in connection with the directors' guaranties related to our credit agreement with Wells Fargo.

|

|

|

|

|

9.

|

In February 2017, we issued an aggregate of 4,305,182 Series A preferred shares to 45 investors at a purchase price of $9.2911 per share, for aggregate consideration of $40.0 million and 105,009 Series A preferred shares with a value of $1.2 million to two third parties in connection with their placement services with respect to the Series A preferred financing.

|

|

|

|

|

10.

|

In March 2017, we issued 32,500 common shares plus $249,750 in cash to one shareholder in exchange for 500,000 shares of common stock of Kleo Pharmaceuticals, Inc.

|

|

|

|

|

11.

|

In May 2017, in connection with the closing of our IPO, we issued 538,149 and 1,345,374 common shares to AstraZeneca AB and Bristol-Myers Squibb Company, respectively, pursuant to the terms of our license agreement with the respective party, for no additional consideration.

|

|

|

|

|

12.

|

In June 2017, as partial consideration issued in connection with an agreement to perform investor relations services with The Trout Group LLC, or Trout, we issued to Trout a warrant to purchase 6,751 common shares at an exercise price of $22.22 per share.

|

|

|

|

|

13.

|

In March 2018, we issued and sold an aggregate of 2,000,000 common shares in a private placement to 10 investors at a purchase price of $27.50 per share, for aggregate consideration of $55.0 million.

|

|

|

|

|

14.

|

In June 2018, we issued and sold 1,111,111 common shares to RPI Finance Trust in a private placement at a purchase price of $45.00 per share, for aggregate consideration of $50.0 million.

|

|

|

|

|

15.

|

In

September 2018

, we issued and sold

109,523

common shares to AstraZeneca AB as partial consideration pursuant to a license agreement, for no additional consideration.

|

The offers, sales and issuances of the securities described in the paragraphs above were exempt from registration under Section 4(a)(2) of the Securities Act or Regulation D promulgated under the Securities Act. Each of the purchasers represented

to us that they acquired the securities for investment only and not with a view to or for sale in connection with any distribution thereof and appropriate legends were affixed to the securities issued in these transactions. The purchasers also represented to us that they were accredited investors as defined in Rule 501 promulgated under the Securities Act.

In addition, upon the completion of our initial public offering in May 2017, all of our Series A preferred shares, including the shares described in paragraphs 6 and 9 above, automatically converted into an aggregate of 9,358,560 common shares. The issuance of such common shares was exempt from registration under Section 3(a)(9) of the Securities Act.

Stock Option Grants

From January 1, 2015 through May 23, 2017, the date on which our registration statement on Form S-8 was filed and became effective, we granted options under our 2014 Equity Incentive Plan to purchase an aggregate of 2,898,858 common shares to employees, consultants and directors, having exercise prices ranging from $5.60 to $10.82 per share. Of these,

329,591

common shares were issued upon the exercise of stock options, at a weighted average exercise price of

$8.28

per share, for aggregate proceeds of

$2,517,856

.

The offers, sales and issuances of the securities described in the foregoing paragraph were exempt from registration under Rule 701 promulgated under the Securities Act in that the transactions were under compensatory benefit plans and contracts relating to compensation as provided under Rule 701. The recipients of such securities were our employees, directors or consultants and received the securities under our 2014 Equity Incentive Plan. Appropriate legends were affixed to the securities issued in these transactions.

Item 16.

Exhibits and Financial Statement Schedules.

(a) Exhibits.

|

|

|

|

|

|

|

Exhibit Number

|

|

Description of Document

|

|

2.1

|

|

|

|

2.2

|

|

|

|

2.3

|

|

|

|

3.1

|

|

|

|

4.1

|

|

|

|

4.2

|

|

|

|

4.3

|

|

|

|

4.4

|

|

|

|

4.5

|

|

|

|

5.1

|

|

|

|

10.1

|

#

|

|

|

10.2

|

#

|

|

|

10.3

|

#

|

|

|

10.4

|

#

|

|

|

10.5

|

#

|

|

|

|

|

|

|

|

|

10.6

|

#

|

|

|

10.7

|

#

|

|

|

10.8

|

|

|

|

10.9

|

+

|

|

|

10.10

|

+

|

|

|

10.11

|

+

|

|

|

10.12

|

+

|

|

|

10.13

|

+

|

|

|

10.14

|

+

|

|

|

10.15

|

+

|

|

|

10.16

|

+

|

|

|

10.17

|

|

|

|

10.18

|

+

|

|

|

21.1

|

|

|

|

23.1

|

|

|

|

24.1

|

|

|

____________

|

|

|

|

#

|

Confidential treatment has been granted with respect to portions of this exhibit (indicated by asterisks) and have been separately filed with the Securities and Exchange Commission.

|

+ Indicates management contract or compensatory plan.

(b) Financial Statement Schedules.

No financial statement schedules have been submitted because they are not required or are not applicable or because the information required is included in the consolidated financial statements or the notes thereto incorporated by reference into the prospectus forming part of this registration statement.

Item 17.

Undertakings.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

The undersigned Registrant hereby undertakes that:

(1) For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of this Registration Statement in reliance upon Rule 430A and contained in a form of prospectus filed by the Registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this Registration Statement as of the time it was declared effective.

(2) For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of New Haven, State of Connecticut, on the

2

nd day of

October, 2018

.

BIOHAVEN PHARMACEUTICAL HOLDING COMPANY LTD.

By:

/s/ VLAD CORIC, M.D.

Vlad Coric, M.D.

Chief Executive Officer

KNOW ALL BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Vlad Coric his or her true and lawful agent, proxy and attorney-in-fact, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to (i) act on, sign and file with the Securities and Exchange Commission any and all amendments (including post-effective amendments) to this registration statement together with all schedules and exhibits thereto and any subsequent registration statement filed pursuant to Rule 462(b) under the Securities Act of 1933, as amended, together with all schedules and exhibits thereto, (ii) act on, sign and file such certificates, instruments, agreements and other documents as may be necessary or appropriate in connection therewith, (iii) act on and file any supplement to any prospectus included in this registration statement or any such amendment or any subsequent registration statement filed pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and (iv) take any and all actions which may be necessary or appropriate to be done, as fully for all intents and purposes as he or she might or could do in person, hereby approving, ratifying and confirming all that such agent, proxy and attorney-in-fact or any of his substitutes may lawfully do or cause to be done by virtue thereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

Signature

|

|

|

Title

|

|

Date

|

|

|

/s/ VLAD CORIC, M.D.

|

|

|

Chief Executive Officer and Director (Principal Executive Officer)

|

|

October 2, 2018

|

|

|

Vlad Coric, M.D.

|

|

|

|

|

|

/s/ JAMES ENGELHART

|

|

|

Chief Financial Officer (Principal Financial Officer and Principal Accounting Officer)

|

|

October 2, 2018

|

|

|

James Engelhart

|

|

|

|

|

|

/s/ DECLAN DOOGAN, M.D.

|

|

|

Chairman of the Board of Directors

|

|

October 2, 2018

|

|

|

Declan Doogan, M.D.

|

|

|

|

|

|

/s/ GREGORY H. BAILEY, M.D.

|

|

|

Director

|

|

October 2, 2018

|

|

|

Gregory H. Bailey, M.D.

|

|

|

|

|

|

/s/ JOHN W. CHILDS

|

|

|

Director

|

|

October 2, 2018

|

|

|

John W. Childs

|

|

|

|

|

|

/s/ ROBERT REPELLA

|

|

|

Director

|

|

October 2, 2018

|

|

|

Robert Repella

|

|

|

|

|

|

/s/ ERIC AGUIAR, M.D.

|

|

|

Director

|

|

October 2, 2018

|

|

|

Eric Aguiar, M.D.

|

|

|

|

|

|

/s/ JULIA GREGORY

|

|

|

Director

|

|

October 2, 2018

|

|

|

Julia Gregory

|

|

|

|

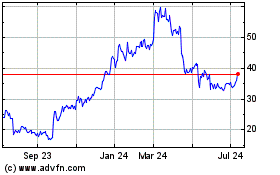

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

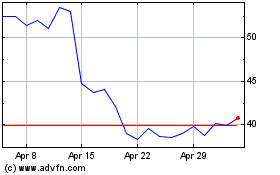

Biohaven (NYSE:BHVN)

Historical Stock Chart

From Apr 2023 to Apr 2024