Amended Tender Offer Statement by Issuer (sc To-i/a)

September 25 2018 - 10:23AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1) OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 1)

BLUE BIRD CORPORATION

(Name Of Subject Company (Issuer) And Filing Person (Offeror))

Common Stock, par value $0.0001 per share

Series A Convertible Preferred Stock, par value $0.0001 per share

(Title of Class of Securities)

095306106

095306205

(CUSIP Number of Common Stock)

Paul Yousif

General Counsel and Corporate Treasurer

Blue Bird Corporation

3920 Arkwright Road, Suite 200

Macon, Georgia 31210

(478) 822-2801

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing persons)

With copies to:

Michael E. Lubowitz, Esq.

Eoghan P. Keenan, Esq.

Weil, Gotshal & Manges LLP

767 Fifth Avenue

New York, New York 10153

(212) 310-8000

CALCULATION OF FILING FEE

|

Transaction Valuation*

|

|

Amount Of Filing Fee**

|

|

$50,000,000

|

|

$6,225

|

*

The transaction value is estimated only for purposes of calculating the filing fee. This calculation assumes the purchase of (i) 1,782,568 shares of Common Stock, par value $0.0001 per share, at a price of $28.00 per share and (ii) 364 shares of Series A Convertible Preferred Stock, par value $0.0001 per share, at a price of $241.69 per share.

**

The amount of the filing fee, calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, equals $124.50 per million dollars of the value of the transaction.

x

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

Amount Previously Paid:

|

$6,225

|

Filing Party:

|

Blue Bird Corporation

|

|

Form or Registration No.:

|

Schedule TO

|

Date Filed:

|

September 14, 2018

|

o

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

o

third-party tender offer subject to Rule 14d-1.

x

issuer tender offer subject to Rule 13e-4.

o

going-private transaction subject to Rule 13e-3.

o

amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer:

o

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

o

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

o

Rule 14d-1(d) (Cross-Border Third Party Tender Offer)

SCHEDULE TO

This Amendment No. 1 amends and supplements the Tender Offer Statement on Schedule TO (“Schedule TO”) filed with the Securities and Exchange Commission on September 14, 2018, relating to the offer by Blue Bird Corporation, a Delaware corporation (“Blue Bird” or the “Company”), to purchase up to $50 million in aggregate value of its shares of Common Stock and Preferred Stock (each as defined below). The offer is made with respect to (i) 1,782,568 shares of our common stock, $0.0001 par value per share (the “Common Stock”), for purchase by us at a price of $28.00 per Share (the “Common Stock Offer Price”), and (ii) 364 shares of our 7.625% Series A Convertible Cumulative Preferred Stock, par value $0.0001 per share (the “Preferred Stock” and together with the Common Stock, the “Shares”), for purchase by us at a price of $241.69 per Share, which is equal to the Common Stock Offer Price multiplied by 8.6318, which is the conversion rate to acquire shares of Common Stock set forth in the Company’s Certificate of Designations, Preferences, Rights and Limitations of the Preferred Stock, rounded to the nearest one-ten-thousandth (such price, the “Preferred Stock Offer Price”), to the seller in cash, less any applicable withholding taxes and without interest. The Company’s offer is being made upon the terms and subject to the conditions set forth in the Offer to Purchase dated September 14, 2018 (the “Original Offer to Purchase” as supplemented on September 25, 2018, the “Supplemental Offer to Purchase”) and in the related Letter of Transmittal, which as amended or further supplemented from time to time together constitute the “Offer.” This Tender Offer Statement on Schedule TO is intended to satisfy the reporting requirements of Rule 13e-4(c)(2) under the Securities Exchange Act of 1934, as amended.

Blue Bird is supplementing the Offer to clarify that it is offering to purchase up to 1,782,568 shares of its Common Stock and up to 364 shares of its Preferred Stock.

ITEMS 1 THROUGH 11.

Items 1 through 11 of the Schedule TO, which incorporate by reference the information contained in the Offer to Purchase, are hereby amended and supplemented in the manner set forth in the Supplement to Offer to Purchase, attached hereto as Exhibit (a)(1)(vi).

ITEM 12. EXHIBITS

Item 12 of the Schedule TO is hereby amended and supplemented as follows:

(a)(1)(vi) Supplement to Offer to Purchase, dated September 25, 2018.

2

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Schedule TO is true, complete and correct.

|

|

BLUE BIRD CORPORATION

|

|

|

|

|

Dated: September 25, 2018

|

By:

|

/s/

Paul Yousif

|

|

|

Name:

|

Paul Yousif

|

|

|

Title:

|

General Counsel and Corporate Treasurer

|

3

EXHIBIT INDEX

|

(a)(1)(i)*

|

|

Offer to Purchase, dated September 14, 2018.

|

|

(a)(1)(ii)*

|

|

Letter of Transmittal (including IRS Form W-9).

|

|

(a)(1)(iii)*

|

|

Notice of Guaranteed Delivery.

|

|

(a)(1)(iv)*

|

|

Letter to Brokers, Dealers, Banks, Trust Companies and Other Nominees.

|

|

(a)(1)(v)*

|

|

Letter to Clients for Use by Brokers, Dealers, Banks, Trust Companies and Other Nominees.

|

|

(a)(1)(vi)

|

|

Supplement to Offer to Purchase, dated September 25, 2018.

|

|

(a)(2)

|

|

Not applicable.

|

|

(a)(3)

|

|

Not applicable.

|

|

(a)(4)

|

|

Not applicable.

|

|

(a)(5)(i)*

|

|

Press Release, dated September 14, 2018.

|

|

(a)(5)(ii)*

|

|

Summary Advertisement, dated September 14, 2018.

|

|

(b)(i)

|

|

Credit Agreement dated as of December 12, 2016 by and among the Company, School Bus Holdings, Inc. and certain of its subsidiaries and affiliates and Bank of Montreal, as Administrative Agent and an Issuing Bank, Fifth Third Bank, as Co-Syndication Agent and an Issuing Bank and Regions Bank, as Co-Syndication Agent, and the other lenders party thereto, together with certain exhibits (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed by the registrant on December 15, 2016).

|

|

(b)(2)

|

|

First Amendment, dated as of September 13, 2018, by and among the Company, School Bus Holdings, Inc. and certain of its subsidiaries, including Blue Bird Body Company as the borrower, Bank of Montreal, as Administrative Agent and an Issuing Bank, Fifth Third Bank, as Co-Syndication Agent and an Issuing Bank and Regions Bank, as Co-Syndication Agent, and certain other financial institutions from time to time party thereto (incorporated by reference to Exhibit 10.1 of the Company’s Current Report on Form 8-K filed by the Company on September 13, 2018).

|

|

(d)(1)

|

|

Registration Rights Agreement between the Company and certain security holders entered into in connection with the Company’s initial public offering (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed by the Company on January 23, 2014).

|

|

(d)(2)

|

|

Blue Bird Corporation 2015 Omnibus Equity Incentive Plan (the “Incentive Plan”) (incorporated by reference to Annex D to the Company’s definitive Proxy Statement, as filed on January 20, 2015).

|

|

(d)(3)

|

|

Registration Rights Agreement, dated as of February 24, 2015, by and among the Company, The Traxis Group B.V. and the investors named therein (incorporated by reference to Exhibit 10.11 of the Company’s Current Report on Form 8-K filed by the Company on March 2, 2015).

|

|

(d)(4)

|

|

Phantom Equity Plan (incorporated by reference to Exhibit 10.14 to the Company’s Current Report on Form 8-K filed by the Company on March 2, 2015).

|

|

(d)(5)

|

|

Amendment No. 1 to Phantom Equity Plan (incorporated by reference to Exhibit 10.15 to the Company’s Current Report on Form 8-K filed by the Company on March 2, 2015).

|

|

(d)(6)

|

|

Amendment No. 1 to Phantom Equity Plan (incorporated by reference to Exhibit 10.15 to the Company’s Current Report on Form 8-K filed by the Company on March 2, 2015).

|

|

(d)(7)

|

|

Form of grant agreement for non-qualified stock options granted under the Company’s Incentive Plan (incorporated by reference to Exhibit 10.17 to the Company’s Current Report on Form 8-K filed by the Company on March 2, 2015).

|

|

(d)(8)

|

|

Form of grant agreement for restricted stock granted under the Company’s Incentive Plan (incorporated by reference to Exhibit 10.18 to the Company’s Current Report on Form 8-K filed by the Company on March 2, 2015).

|

|

(d)(9)

|

|

Form of grant agreement for restricted stock units granted under the Company’s Incentive Plan (incorporated by reference to Exhibit 10.19 to the Company’s Current Report on Form 8-K filed by the Company on March 2, 2015).

|

|

(d)(10)

|

|

Form of indemnity agreement between the Company and each of its directors and executive officers (incorporated by reference to Exhibit 10.23 to the Company’s Current Report on Form 8-K filed by the Company on March 2, 2015).

|

|

(d)(11)

|

|

Employment Agreement, dated as of April 1, 2011, between School Bus Holdings Inc. and Philip Horlock (incorporated by reference to Exhibit 10.24 to the Company’s Current Report on Form 8-K/A filed by the Company on April 23, 2015).

|

|

(d)(12)

|

|

First Amendment to Employment Agreement dated as of April 1, 2011 between School Bus Holdings Inc. and Philip Horlock made as of June 1, 2012 (incorporated by reference to Exhibit 10.25 to the Company’s Current Report on Form 8-K/A filed by the Company on April 23, 2015).

|

|

(d)(13)

|

|

Severance Agreement, dated as of May 10, 2012, between Blue Bird Corporation and Phillip Tighe (incorporated by reference to Exhibit 10.29 to the Company’s Current Report on Form 8-K/A filed by the Company on April 23, 2015).

|

|

(d)(14)

|

|

Severance Agreement, dated as of July 1, 2008, between School Bus Holdings Inc. and Paul Yousif (incorporated by reference to Exhibit 10.31 to the Company’s Current Report on Form 8-K/A filed by the Company on April 23, 2015).

|

|

(d)(15)

|

|

Form of Restricted Stock Unit Grant Agreement for directors under the Company’s Incentive Plan (incorporated by reference to Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q/A filed by the Company on August 18, 2015).

|

|

(d)(16)

|

|

Purchase and Sale Agreement dated May 26, 2016 by and among The Traxis Group G.V., Blue Bird Corporation, and ASP BB Holdings LLC (incorporated by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K filed by the Company on May 27, 2016).

|

|

(d)(17)

|

|

Letter Agreement dated May 26, 2016 among American Securities LLC, ASP BB Holdings LLC and Blue Bird Corporation (incorporated by reference to Exhibit 10.2 to the Company’s Current Report on Form 8-K filed by the Company on May 27, 2016).

|

|

(d)(18)

|

|

Offer Letter dated March 29, 2016 and Severance Agreement dated April 18, 2016 between Blue Bird Corporation and Mark Terry (incorporated by reference to Exhibit 10.19 to the Company’s Annual Report on Form 10-K filed by the Company on December 8, 2017).

|

|

(d)(19)

|

|

Offer Letter dated October 19, 2015 between Blue Bird Corporation and Tom Roberts (incorporated by reference to Exhibit 10.20 to the Company’s Annual Report on Form 10-K filed by the Company on December 8, 2017).

|

|

(d)(20)

|

|

Securities Purchase Agreement dated September 23, 2017 by and among Blue Bird Corporation and Coliseum Capital Partners, L.P., Coliseum Capital Partners II, L.P., Blackwell Partners, LLC - Series A, and Coliseum School Bus Holdings,

|

4

|

|

|

LLC (incorporated by reference to Exhibit 10.21 to the Company’s Annual Report on Form 10-K filed by the Company on December 8, 2017).

|

|

(d)(21)

|

|

Credit Agreement dated as of December 12, 2016 by and among the Company, School Bus Holdings, Inc. and certain of its subsidiaries and affiliates and Bank of Montreal, as Administrative Agent and an Issuing Bank, Fifth Third Bank, as Co-Syndication Agent and an Issuing Bank and Regions Bank, as Co-Syndication Agent, and the other lenders party thereto, together with certain exhibits (incorporated by reference to Exhibit 10.1 to the registrant’s Current Report on Form 8-K filed by the registrant on December 15, 2016).

|

|

(d)(22)

|

|

First Amendment, dated as of September 13, 2018, by and among the Company, School Bus Holdings, Inc. and certain of its subsidiaries, including Blue Bird Body Company as the borrower, Bank of Montreal, as Administrative Agent and an Issuing Bank, Fifth Third Bank, as Co-Syndication Agent and an Issuing Bank and Regions Bank, as Co-Syndication Agent, and certain other financial institutions from time to time party thereto (incorporated by reference to Exhibit 10.1 of the Company’s Current Report on Form 8-K filed by the Company on September 13, 2018).

|

*

Previously filed with the Schedule TO on September 14, 2018

5

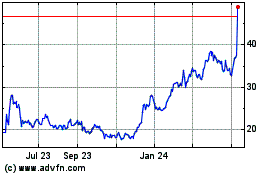

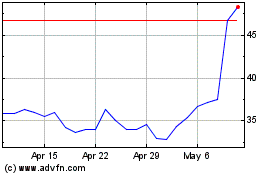

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blue Bird (NASDAQ:BLBD)

Historical Stock Chart

From Apr 2023 to Apr 2024