Fiscal 2018 Operating Income Increased 47% on a

10% Gain in Revenue

Trio-Tech International (NYSE MKT: TRT) today announced

financial results for the fourth quarter and fiscal year ended June

30, 2018:

● Fourth quarter net income increased 91% to $0.17 per diluted

share vs $0.09 for the same quarter last year.

● Fiscal 2018 operating income increased 47% vs fiscal 2017.

● Fiscal 2018 net income after one-time $900,000 tax expense was

$0.31 per diluted share vs $0.36 for fiscal 2017.

CEO Comments

"The fourth quarter of fiscal 2018 was another good quarter for

Trio-Tech. Improved gross margin and slightly higher revenue helped

us deliver solid earnings growth for the quarter, capping an

impressive year for our company.

"Fiscal 2018 revenue increased at each of Trio-Tech’s core

business segments, compared to fiscal 2017, and was led by a 17%

gain in our revenue at our testing services operations. However,

our bottom-line performance for fiscal 2018 was affected by a

one-time, income tax expense of $900,000, related to the Tax Cuts

and Jobs Act of 2017, which requires a mandatory one-time

repatriation of certain earnings and profits of the Company’s

foreign subsidiaries previously deferred from U.S. taxation. This

estimated tax is payable over a period of eight years at no

interest and is not expected to have a material effect on the

Company’s working capital position. Without this one-time tax

expense, net earnings for fiscal 2018 would have exceeded our

fiscal 2017 result.

"Trio-Tech's financial condition grew even stronger in fiscal

2018. Higher cash flow from operations versus prior year

contributed to an increase in cash and equivalents to $1.84 per

outstanding share at June 30, 2018, compared to $1.35 per

outstanding share at June 30, 2017. Shareholders' equity also

increased, to $6.61 per outstanding share at the close of fiscal

2018 compared to $6.11 per outstanding share at June 30, 2017.

"Our backlog at the end of fiscal 2018 remained strong at

$8,699,000 compared to $7,546,000 at the end of fiscal 2017," said

S.W. Yong, Trio-Tech's CEO.

Fiscal 2018 Fourth Quarter Results

For the fiscal fourth quarter ended June 30, 2018, revenue

increased 1% to $10,760,000 compared to revenue of $10,638,000 for

the fourth quarter of fiscal 2017. Testing services revenue

increased 13% to $4,937,000 compared to $4,382,000 for the same

quarter last year reflecting higher volume at the company's

Singapore, Malaysia and Tianjin, China facilities. Manufacturing

revenue increased 1% to $4,116,000 from $4,068,000 due to firmer

demand at Trio-Tech's Suzhou, China and U.S. operations.

Distribution revenue declined 22% to $1,678,000 from $2,151,000,

primarily because of lower customer demand in Asia.

Gross margin for the fiscal fourth quarter improved to 27% of

revenue, compared to 22% of revenue for the same quarter of the

prior fiscal year, driven primarily by a favorable product mix in

Trio-Tech's manufacturing segment.

Operating expenses for the fourth quarter were $2,142,000, or

20% of revenue, compared to $2,014,000, or 19% of revenue, for the

fourth quarter of fiscal 2017.

Income from operations for the fourth quarter more than doubled

to $709,000 from $349,000 for the fourth quarter of fiscal

2017.

Net income attributable to Trio-Tech International common

shareholders for the fourth quarter of fiscal 2018 increased 91% to

$675,000, or $0.17 per diluted share, from $353,000, or $0.09 per

diluted share, for the fourth quarter of the prior fiscal year.

Fiscal 2018 Results

For the twelve months ended June 30, 2018, revenue increased 10%

to $42,361,000 compared to revenue of $38,538,000 for fiscal 2017.

Testing services revenue increased 17% to $19,391,000, compared to

$16,586,000 for fiscal 2017. Manufacturing revenue increased 5% to

$15,978,000 compared to $15,289,000 in fiscal 2017. Distribution

revenue increased 5% to $6,853,000 compared to $6,511,000 in fiscal

2017.

Gross profit for fiscal 2018 increased 12% to $10,638,000

compared to $9,462,000 for fiscal 2017. Gross margin was

approximately 25% of revenue in both periods, as higher gross

margin for the manufacturing segment was offset by lower gross

margin in testing services.

Operating expenses for fiscal 2018 increased 6% to $8,450,000

compared to $7,973,000 for fiscal 2017, but declined, as percent of

revenue, to 20% from 21% for fiscal 2017.

Income from operations increased 47% to $2,188,000 compared to

$1,489,000 in fiscal 2017.

Net income attributable to Trio-Tech International common

shareholders for fiscal 2018 declined 10% to $1,184,000, or $0.31

per diluted share, compared to $1,316,000, or $0.36 per diluted

share in fiscal 2017. Fiscal 2018 net income was affected by a

one-time, income tax expense of $900,000, related to the Tax Cuts

and Jobs Act of 2017.

About Trio-Tech

Established in 1958 and headquartered in Van Nuys, California,

Trio-Tech International is a diversified business group with

interests in semiconductor testing services, manufacturing and

distribution of semiconductor testing equipment, and real estate.

Further information about Trio-Tech's semiconductor products and

services can be obtained from the Company's Web site at

www.triotech.com, www.universalfareast.com, and

www.ttsolar.com.

Forward-Looking Statements

This press release contains statements that are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995 and may contain forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and assumptions regarding future activities and results of

operations of the Company. In light of the "safe harbor" provisions

of the Private Securities Litigation Reform Act of 1995, the

following factors, among others, could cause actual results to

differ materially from those reflected in any forward-looking

statements made by or on behalf of the Company: market acceptance

of Company products and services; changing business conditions or

technologies and volatility in the semiconductor industry, which

could affect demand for the Company’s products and services; the

impact of competition; problems with technology; product

development schedules; delivery schedules; changes in military or

commercial testing specifications which could affect the market for

the Company’s products and services; difficulties in profitably

integrating acquired businesses, if any, into the Company; risks

associated with conducting business internationally and especially

in Asia, including currency fluctuations and devaluation, currency

restrictions, local laws and restrictions and possible social,

political and economic instability; changes to government policies,

potential legislative changes in U.S. and global financial and

equity markets, including market disruptions and significant

interest rate fluctuations; and other economic, financial and

regulatory factors beyond the Company’s control. Other than

statements of historical fact, all statements made in this press

release are forward-looking, including, but not limited to,

statements regarding industry prospects, future results of

operations or financial position, and statements of our intent,

belief and current expectations about our strategic direction,

prospective and future financial results and condition. In some

cases, you can identify forward-looking statements by the use of

terminology such as “may,” “will,” “expects,” “plans,”

“anticipates,” “estimates,” “potential,” “believes,” “can impact,”

“continue,” or the negative thereof or other comparable

terminology. Forward-looking statements involve risks and

uncertainties that are inherently difficult to predict, which could

cause actual outcomes and results to differ materially from our

expectations, forecasts and assumptions.

TRIO-TECH INTERNATIONAL AND SUBSIDIARIES CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME AUDITED (IN

THOUSANDS, EXCEPT EARNINGS PER SHARE)

Three Months Ended Twelve Months Ended June 30, June 30,

Revenue 2018 2017 2018 2017

Manufacturing $ 4,116 $ 4,068 $ 15,978 $ 15,289 Testing services

4,937 4,382 19,391 16,586 Distribution 1,678 2,151 6,853 6,511

Others 29 37 139

152 10,760 10,638 42,361

38,538 Cost of Sales Cost of manufactured

products sold 2,967 3,329 12,213 12,091 Cost of testing services

rendered 3,442 2,988 13,323 11,057 Cost of distribution 1,470 1,929

6,068 5,828 Others 30 29 119

100 7,909 8,275

31,723 29,076 Gross Margin 2,851 2,363

10,638 9,462 Operating Expenses: General and administrative 1,911

1,733 7,250 6,911 Selling 214 220 826 807 Research and development

74 52 451 208 (Loss) Gain on disposal of property, plant and

equipment (57 ) 9 (77 ) 47

Total operating expenses 2,142 2,014

8,450 7,973 Income from

Operations 709 349 2,188 1,489 Other (Expenses) Income Interest

expense (59 ) (53 ) (233 ) (202 ) Other income, net 24

156 335 514 Total

other (Expenses) Income (35 ) 103 102

312 Income from Continuing Operations before

Income Taxes 674 452 2,290 1,801 Income Tax Benefit Expense

48 (85 ) (987 ) (341 )

Income from Continuing Operations before

Non-controlling Interest, net of tax

722 367 1,303 1,460 Loss from discontinued operations, net of tax

(2 ) (1 ) (13 ) (5 ) NET INCOME 720 366

1,290 1,455 Less: Net income attributable to the non-controlling

interest 45 13 106

139 Net Income attributable to Trio-Tech International 675

353 1,184 1,316 Net Income Attributable to Trio-Tech International:

Income from continuing operations, net of tax 677 355 1,197 1,325

Loss from discontinued operations, net of tax (2 ) (2

) (13 ) (9 ) Net Income Attributable to Trio-Tech

International $ 675 $ 353 $ 1,184 $ 1,316

Basic Earnings per Share - Continuing Operations $ 0.19 $

0.10 $ 0.34 $ 0.38 Basic Loss per Share - Discontinued Operations

(0.01 ) -- (0.01 ) --

Basic Earnings per Share $ 0.18 $ 0.10 $ 0.33

$ 0.38 Diluted Earnings per Share – Continuing Operations $

0.18 $ 0.09 $ 0.32 $ 0.36 Diluted Loss per Share – Discontinued

Operations (0.01 ) -- (0.01 ) --

Diluted Earnings per Share $ 0.17 $ 0.09 $

0.31 $ 0.36 Weighted Average Shares Outstanding -

Basic 3,553 3,523 3,553 3,523 Weighted Average Shares Outstanding -

Diluted 3,714 3,737 3,771 3,644

TRIO-TECH

INTERNATIONAL AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME AUDITED (IN THOUSANDS, EXCEPT

EARNINGS PER SHARE) Three Months

Ended Twelve Months Ended June 30, June 30, 2018 2017

2018 2017

Comprehensive Income Attributable to

Trio-Tech International:

Net income $ 720 $ 366 $ 1,290 $ 1,455 Foreign currency

translation, net of tax (1,081 ) 408 728

(679 ) Comprehensive (Loss) Income (361 ) 774 2,018 776

Less: Comprehensive Income (Loss)

attributable to non-controlling interests

30 64 285 (11 )

Comprehensive (Loss) Income Attributable

to Trio-Tech International

$ (391 ) $ 710 $ 1,733 $ 787

TRIO-TECH

INTERNATIONAL AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE

SHEETS (IN THOUSANDS, EXCEPT NUMBER OF SHARES) June

30, June 30, 2018 2017

ASSETS

(audited) CURRENT ASSETS: Cash and cash equivalents $ 6,539

$ 4,772 Short-term deposits 653 787 Trade accounts receivable, net

8,007 9,009 Other receivables 621 401 Inventories, net 2,930 1,756

Prepaid expenses and other current assets 208 226 Assets held for

sale 91 86 Total current assets 19,049 17,037

Deferred tax assets 400 375 Investment properties, net 1,146 1,216

Property, plant and equipment, net 11,935 11,291 Other assets 2,249

1,922 Restricted term deposits 1,695 1,657 Total

non-current assets 17,425 16,461 TOTAL ASSETS $

36,474 $ 33,498

LIABILITIES AND SHAREHOLDERS’ EQUITY

CURRENT LIABILITIES: Lines of credit $ 2,043 $ 2,556

Accounts payable 3,704 3,229 Accrued expenses 3,172 3,043 Income

taxes payable 285 233 Current portion of bank loans payable 367 260

Current portion of capital leases 250 228 Total

current liabilities 9,821 9,549 Bank loans payable, net of current

portion 1,437 1,552 Capital leases, net of current portion 524 531

Deferred tax liabilities 327 295 Income taxes payable 828 -- Other

non-current liabilities 36 44 Total non-current

liabilities 3,152 2,422 TOTAL LIABILITIES

12,973 11,971 COMMITMENTS AND CONTINGENCIES -- -- EQUITY

TRIO-TECH INTERNATIONAL'S SHAREHOLDERS' EQUITY:

Common stock, no par value, 15,000,000

shares authorized; 3,553,055 and 3,523,055 issued and outstanding

at June 30, 2018 and June 30, 2017, respectively

11,023 10,921 Paid-in capital 3,249 3,206 Accumulated retained

earnings 5,525 4,341 Accumulated other comprehensive

gain-translation adjustments 2,182 1,633 Total

Trio-Tech International shareholders' equity 21,979 20,101

Non-controlling interest 1,522 1,426 TOTAL EQUITY

23,501 21,527 TOTAL LIABILITIES AND EQUITY $ 36,474 $

33,498

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180925005435/en/

Company Contact:Trio-Tech InternationalA. Charles

WilsonChairman(818) 787-7000orInvestor Contact:Berkman

Associates(310) 477-3118info@BerkmanAssociates.com

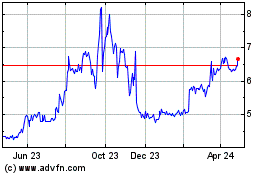

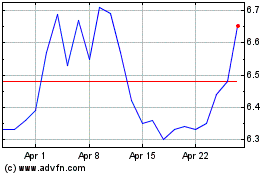

Trio Tech (AMEX:TRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trio Tech (AMEX:TRT)

Historical Stock Chart

From Apr 2023 to Apr 2024