KKR Announces Intra-Quarter Monetization Activity for the Third Quarter

September 24 2018 - 6:18PM

Business Wire

KKR today announced monetization activities for the period from

July 1, 2018 through September 24, 2018. Driven by secondary and

strategic sale activity, the Firm estimates having earned gross

realized carried interest of approximately $450 million and total

realized investment income of approximately $225 million, both on a

segment basis.

As disclosed earlier this year, as part of the Firm’s effort to

increase transparency of monetization activities and quarterly

financial progress, KKR intends to periodically disclose the

expected impact of material monetization activities during a given

fiscal quarter.

The estimates disclosed above are not intended to predict or

represent the realized carried interest, total realized investment

income or total segment revenues for the full quarter ending

September 30, 2018, because they do not include the results or

impact of any other sources of income, including fee income, losses

or expenses, and we may realize further gains or losses relating to

carried interest and total realized investment income after the

date of this press release. These estimates are also not

necessarily indicative of the results that may be expected for any

other period, including the entire year ending December 31,

2018.

About KKR

KKR is a leading global investment firm that manages multiple

alternative asset classes, including private equity, energy,

infrastructure, real estate and credit, with strategic manager

partnerships that manage hedge funds. KKR aims to generate

attractive investment returns for its fund investors by following a

patient and disciplined investment approach, employing world-class

people, and driving growth and value creation with KKR portfolio

companies. KKR invests its own capital alongside the capital it

manages for fund investors and provides financing solutions and

investment opportunities through its capital markets business.

References to KKR's investments may include the activities of its

sponsored funds. For additional information about KKR & Co.

Inc. (NYSE: KKR), please visit KKR's website at www.kkr.com and on

Twitter @KKR_Co.

Forward-Looking Statements

This press release may contain forward-looking statements,

including estimated operating results from certain monetization

activities. Words such as “expect,” estimate,” “will,” “may” and

“believe” or similar expressions may identify forward-looking

statements. These forward-looking statements are subject to the

inherent uncertainties in predicting future results and conditions.

Certain factors could cause actual results to differ materially

from those included in these forward-looking statements, and

investors should not place undue reliance on such statements. These

forward-looking statements speak only as of the date of this press

release, and we do not undertake any obligation to update or revise

any of the forward-looking statements to reflect future events or

circumstances, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180924006047/en/

KKRInvestor Relations:Craig Larson, 1-877-610-4910 (U.S.)

/ 212-230-9410investor-relations@kkr.comorMedia:Kristi

Huller, 212-750-8300media@kkr.com

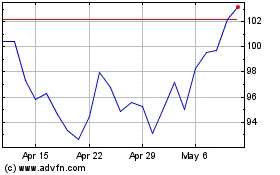

KKR (NYSE:KKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

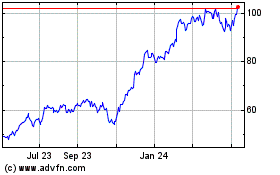

KKR (NYSE:KKR)

Historical Stock Chart

From Apr 2023 to Apr 2024