By Stu Woo and Shalini Ramachandran

LONDON -- Having secured control of European pay-TV giant Sky

PLC, Comcast Corp. now must persuade investors that it didn't

overpay and that the deal will accelerate its growth.

The U.S. cable giant topped 21st Century Fox Inc. with a $38.8

billion bid in a rare auction held by British regulators over the

weekend, ending a monthslong takeover battle that was part of a

larger chess match among some of media's most powerful players.

Comcast's offer of GBP17.28 a share, or about $22.60 a share,

easily surpassed Fox's highest bid of GBP15.67 after three rounds

of bidding Saturday. The final round was blind, so neither side

knew the other's offer until the results were announced.

Comcast executives say a combination with Sky -- which itself is

a giant in both content and distribution -- will boost its user

base to 53 million and add more heft to invest in technology,

programming and valuable sports-media rights. The merger will help

Comcast diversify its revenue base beyond the U.S., where cable

cord-cutting is taking a toll on the traditional TV business.

In a statement late Saturday, Comcast Chief Executive Brian

Roberts said the acquisition "will allow us to quickly, efficiently

and meaningfully increase our customer base and expand

internationally."

Still, Wall Street had shown some jitters about Comcast's

pursuit of Sky, even before the weekend auction. Veteran cable

analyst Craig Moffett of MoffettNathanson research said Sunday the

price the company is paying is a substantial premium over the

market's valuation of Sky before it went into play two years ago.

"They're going to have a very hard time convincing shareholders

that this is a good use of their capital," he said.

Comcast's winning bid was up sharply from its GBP12.50 bid in

February and Fox's initial GBP10.75 bid in December 2016.

Jonathan Chaplin, an analyst at New Street Research, said the

stock could face pressure from investors frustrated at the price,

but he will be recommending clients buy it on a dip, because he

believes Comcast's fundamentals, especially in its growing

broadband business, are strong. "I am not delighted by the price

but I am delighted that this is behind us. Now the market will

start refocusing on the business, and the business is doing really

well," he said in an email.

Comcast's Mr. Roberts tightly oversaw the bidding, alongside a

select group of executives, including his chief financial officer,

top deal executives and outside advisers in a London war room,

according to people familiar with the matter. Comcast felt it

needed to win by a substantial margin to avoid difficulty winning

over any significant shareholders and ensure it can close the deal

smoothly, one of the people said.

Comcast finance chief Michael Cavanagh, over a period of months,

strategized with his deal team about how best to beat the other

side.

The jostling over Sky was part of a broader scramble by media

companies to fortify themselves against a rising threat from

Silicon Valley giants such as Netflix Inc.

This summer, Comcast lost a bidding war to Walt Disney Co. for

Fox's entertainment assets. Disney agreed to pay $71 billion for

Fox's famed Hollywood studio and international assets, including a

39% stake in Sky that Fox had long held. That bigger deal is

expected to close in coming months.

If Fox had won the weekend's auction for Sky, Disney would

ultimately have taken 100% control of the pay-TV company. Instead,

attention will now turn to whether Disney will sell the 39% stake

in Sky -- its value has increased by the bidding competition -- or

remain a minority partner for Comcast.

Fox, in a statement, said it was considering its options

regarding its 39% stake in Sky.

Analysts have raised the idea that Comcast could trade its 30%

stake in Hulu to Disney -- giving Disney overwhelming control of

the streaming-video service -- in return for the rest of Sky.

Comcast has said it values its position in Hulu and just named some

NBCUniversal executives to Hulu's board.

Mr. Roberts of Comcast has said he would be prepared to jointly

own Sky with a rival. Rupert Murdoch and his family are major

shareholders in Fox and Wall Street Journal parent News Corp.

To seal control of Sky, Comcast needs more than 50% of Sky's

shareholders to support the offer. That seems likely given the wide

gap between the bids. But it could still prove challenging if

Disney and Fox decide against tendering to the offer.

Sky sells phone, TV and internet services to 23 million European

customers and produces its own news, entertainment and sports

programming.

Comcast executives have said acquiring the company will further

its ability to counter Netflix, potentially with an international

streaming service. Sky already operates a streaming service called

NOW TV in several European countries and has been investing in

premium original shows in response to Netflix's spending.

The merger could also yield benefits in news and entertainment

programming. Sky News and NBC News could share resources, and

larger scale could help the company bargain for the best content

deals.

That is especially true in sports, where deep-pocketed tech

companies such as Amazon.com Inc. and Alphabet Inc.'s Google are

throwing their hats in the ring. NBC has rights to the Olympics,

NFL games, Nascar and the Premier League, while Sky carries matches

from marquee European soccer leagues.

Comcast investors worry that the company is buying a satellite

broadcaster at a time when U.S. satellite companies such as DirecTV

and Dish Network Corp. have hemorrhaged customers under competitive

pressure. Investors have also worried that Comcast's pursuit of Sky

and its failed bid for the Fox entertainment assets showed that

management wasn't confident in Comcast's core business.

Comcast shares slid considerably after it announced its initial

Sky bid in February, but rallied more recently and are 4.5% below

their February price. The company is using debt to finance its

all-cash offer.

Mr. Roberts has sought to allay Wall Street's concerns, noting

that Sky isn't simply a satellite-TV business -- it also has a

broadband offering, a content studio and has invested significantly

in video technology. In June, Sky posted strong results, including

customer additions up 39% in the quarter. He has also said Comcast

is confident in the strength of its core U.S. cable business.

"Right now, I feel we're in a strategically great place, and any

deals we're doing we're trying to play offense in a belief that we

over the long term can create exceptional shareholder value," Mr.

Roberts said at a recent Goldman Sachs investor conference.

Write to Stu Woo at Stu.Woo@wsj.com and Shalini Ramachandran at

shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

September 23, 2018 19:42 ET (23:42 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

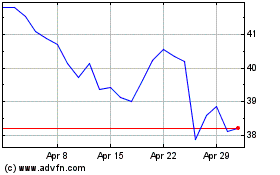

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comcast (NASDAQ:CMCSA)

Historical Stock Chart

From Apr 2023 to Apr 2024