Report of Foreign Issuer (6-k)

September 20 2018 - 5:11PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of September 2018

Commission File Number: 001-38097

ARGENX SE

(Translation of registrant’s name into English)

Willemstraat 5

4811 AH, Breda, the Netherlands

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

argenx SE

Underwriting Agreement

On September 18, 2018, argenx SE (the “

Company

”) entered into an Underwriting Agreement (the “

Underwriting Agreement

”) with Morgan Stanley & Co. LLC, Cowen and Company, LLC and Evercore Group L.L.C. as representatives of the several underwriters named therein (the “

Underwriters

”), relating to the U.S. public offering (the “

Offering

”) of 3,475,000 American Depositary Shares, each representing one ordinary share, nominal value of €0.10 per share, of the Company (the “

ADSs

”), at a price to the public of $86.50 per ADS (the “

Offering Price

”), before underwriting discounts and commissions. The net proceeds to the Company from the sale of the ADSs, after deducting the underwriting discounts and commissions and other estimated offering expenses payable by the Company, will be approximately $283.2 million. The Offering is expected to close on September 21, 2018, subject to the satisfaction of customary closing conditions. The Company has also granted the Underwriters a 30-day option to purchase up to an additional 521,250 ADSs at the Offering Price.

The Offering was made pursuant to the Company’s effective shelf registration statement on Form F-3ASR (File No. 333-225370) filed on June 1, 2018, as supplemented by a prospectus supplement dated September 17, 2018, filed on September 17, 2018.

In the Underwriting Agreement, the Company makes customary representations, warranties and covenants and also agrees to indemnify the Underwriters against certain liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to payments that the Underwriters may be required to make because of such liabilities. The foregoing is only a brief description of the terms of the Underwriting Agreement, does not purport to be a complete description of the rights and obligations of the parties thereunder, and is qualified in its entirety by reference to the Underwriting Agreement that is filed as Exhibit 1.1 to this Form 6-K and incorporated by reference herein. The legal opinion of Freshfields Bruckhaus Deringer LLP relating to the ordinary shares underlying the ADSs is filed as Exhibit 5.1 to this Form 6-K and incorporated by reference herein.

On September 17, 2018, the Company issued a press release announcing the Offering, and on September 18, 2018, the Company issued a press release announcing the pricing of the Offering. Copies of these press releases are filed as Exhibit 99.1 and Exhibit 99.2 to this Form 6-K and are incorporated by reference herein.

The information contained in this Current Report on Form 6-K, including the Exhibits, is incorporated by reference into the Company’s Registration Statements on Forms F-3 (File No. 333-225370) and S-8 (File No. 333-225375).

2

EXHIBITS

|

Exhibit

|

|

Description

|

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated as of September 18, 2018, among the Company and Morgan Stanley & Co. LLC, Cowen and Company, LLC and Evercore Group L.L.C. as representatives of the several Underwriters named therein

|

|

|

|

|

|

5.1

|

|

Opinion of Freshfields Bruckhaus Deringer LLP

|

|

|

|

|

|

23.1

|

|

Consent of Freshfields Bruckhaus Deringer LLP (included in Exhibit 5.1)

|

|

|

|

|

|

99.1

|

|

Press Release dated September 17, 2018

|

|

|

|

|

|

99.2

|

|

Press Release dated September 18, 2018

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

ARGENX SE

|

|

|

|

|

|

Date: September 20, 2018

|

By:

|

/s/ Dirk Beeusaert

|

|

|

|

Dirk Beeusaert

|

|

|

|

General Counsel

|

4

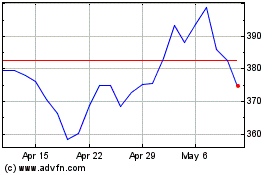

argenx (NASDAQ:ARGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

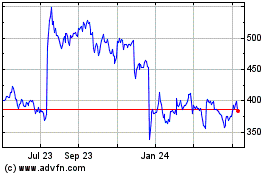

argenx (NASDAQ:ARGX)

Historical Stock Chart

From Apr 2023 to Apr 2024