Securities Registration: Employee Benefit Plan (s-8)

September 20 2018 - 4:06PM

Edgar (US Regulatory)

Registration No. 333-

As filed with the Securities and Exchange

Commission on September 20, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

GALMED PHARMACEUTICALS LTD.

(Exact name of registrant as specified in

its charter)

|

Israel

|

Not Applicable

|

|

(State or other jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

Galmed Pharmaceuticals Ltd.

16 Tiomkin Street,

Tel Aviv, Israel 6578317

Tel: (+972) (3)

693-8448

(Address

of Principal Executive Offices)(Zip Code)

2013 Incentive Share Option Plan

(Full title of the plan)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19715

(302) 738-6680

(Name and address of agent for service)

(Telephone number, including area code,

of agent for service)

With a copy to:

|

Shachar Hadar

Meitar Liquornik Geva

Leshem Tal

16 Abba Hillel Silver Rd.

Ramat Gan 52506, Israel

Tel: +972-3-610-3100

|

Gary Emmanuel, Esq.

McDermott Will & Emery LLP

340 Madison Avenue

New York, NY 10173

Tel: (212) 547-5400

|

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer, “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

o

|

|

Accelerated filer

x

|

Non-accelerated filer

¨

|

|

Smaller reporting company

o

Emerging growth company

x

|

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

o

CALCULATION OF REGISTRATION FEE

|

Title

of securities to be registered

|

|

Amount

to be registered

(1)

|

|

|

Proposed

maximum offering price per share

|

|

|

Proposed

maximum aggregate offering price

|

|

|

Amount

of registration fee

|

|

|

Ordinary shares, par value NIS 0.01 per share

|

|

|

1,250,000

(3)

|

|

|

$

|

12.885

(2)

|

|

|

$

|

16,106,250

(2)

|

|

|

$

|

2,006

|

|

|

|

(1)

|

This Registration Statement shall also cover any additional ordinary shares which become issuable

under the 2013 Incentive Share Option Plan (the “2013 Plan”) of Galmed Pharmaceuticals Ltd. (the “Registrant”

or the “Company”) by reason of any share dividend, share split, recapitalization or other similar transaction effected

without the Registrant’s receipt of consideration which results in an increase in the number of the Registrant’s outstanding

ordinary shares.

|

|

|

(2)

|

The proposed maximum offering price per share is calculated in accordance with Rules 457(c) and

457(h) under the Securities Act of 1933, as amended (the “Securities Act”), solely for purposes of calculating the

registration fee on the basis of $12.885 per share, the average of the high and low price of the Registrant’s ordinary shares

as reported on the Nasdaq Capital Market on September 17, 2018.

|

|

|

(3)

|

Consists of 1,250,000 ordinary shares available for future issuance under options that have not

been issued under the 2013 Plan.

|

EXPLANATORY NOTE

The purpose of this

Registration Statement on Form S-8 (this “Registration Statement”) is for Galmed Pharmaceuticals Ltd. (the “Registrant”)

to register an additional 1,250,000 ordinary shares, par value NIS 0.01, for issuance under the Registrant’s 2013 Incentive

Share Option Plan (the “2013 Plan”).

In accordance with

General Instruction E of Form S-8, the contents of the Registrant’s Registration Statements on Form S-8 (File No. 333-206292),

filed with the Securities and Exchange Commission (the “Commission”) on August 11, 2015, are incorporated herein by

reference and the information required by Part II is omitted, except as supplemented by the information set forth below.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a)

PROSPECTUS

|

Item 1.

|

|

Plan Information.*

|

|

Item 2.

|

|

Registrant Information and Employee Plan Annual Information. *

|

* The documents containing the information

specified in this Part I of Form S-8 (plan information and Registrant information and employee plan annual information) will be

sent or given to employees as specified by the Commission pursuant to Rule 428(b)(1) of the Securities Act. Such documents are

not required to be and are not filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus

supplements pursuant to Rule 424. These documents and the documents incorporated by reference in this Registration Statement pursuant

to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements of Section 10(a) of

the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

|

Item 3.

|

|

Incorporation of Documents by Reference

|

The Registrant hereby

incorporates by reference into this Registration Statement the following documents previously filed with the Commission:

(1) the

Registrant’s Annual Report on Form 20-F for the year ended December 31, 2017, filed with the Commission on March 13, 2018;

(2) the

description of the Registrant’s ordinary shares contained in the Registrant’s Registration Statement on Form 8-A12B

(File No. 001-336345) filed with the Commission on March 11, 2014, pursuant to Section 12(b) of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), including any amendment or report filed for the purpose of updating such

description; and

(3) the

Registrant’s Reports on Form 6-K furnished to the Commission on January 2 ,2018, February 7, 2018, February 14, 2018, March

13, 2018, April 3, 2018, April 4, 2018, May 9, 2018, June 12, 2018, June 18, 2018, June 21, 2018, July 19, 2018, August 2, 2018

and August 30, 2018 (in each case to the extent expressly incorporated by reference into the Registrant’s effective registration

statements filed by it under the Securities Act).

In addition to the

foregoing, all documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange

Act, and, to the extent specifically designated therein, Reports of Foreign Private Issuer on Form 6-K furnished by the Registrant to

the Commission, in each case prior to the filing of a post-effective amendment indicating that all securities offered hereby

have been sold or deregistering all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration

Statement and to be a part hereof from the date of filing of such documents, except as to specific sections of such statements

as set forth therein. Any statement contained herein or in a document all or a portion of which is incorporated or deemed to be

incorporated by reference herein or in any subsequently filed document which also is or is deemed to be incorporated by reference

herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this Registration Statement.

|

Item 6.

|

|

Indemnification

of Directors and Officers.

|

Under the Israeli

Companies Law 5759-1999, (the “Companies Law”), a company may not exculpate an office holder from liability for a breach

of the duty of loyalty. An Israeli company may exculpate an office holder in advance from liability to the company, in whole or

in part, for damages caused to the company as a result of a breach of the duty of care but only if a provision authorizing such

exculpation is included in its articles of association. The Company’s Articles of Association include such a provision. The

Company may not exculpate in advance a director from liability arising out of a prohibited dividend or distribution to shareholders.

Under the Companies

Law the Israeli Securities Law, 5728-1968 (the “Securities Law”), a company may indemnify, or undertake in advance

to indemnify, an office holder for the following liabilities and expenses, imposed on an office holder or incurred by an office

holder due to acts performed by him or her as an office holder, provided its articles of association include a provision authorizing

such indemnification:

|

|

·

|

a monetary liability incurred by or imposed

on him or her in favor of another person pursuant to a judgment, including a settlement or arbitrator’s award approved by

a court. However, if an undertaking to indemnify an office holder with respect to such liability is provided in advance, then such

an undertaking must be limited to events which, in the opinion of the board of directors, can be foreseen based on the company’s

activities when the undertaking to indemnify is given, and to an amount or according to criteria determined by the board of directors

as reasonable under the circumstances, and such undertaking shall detail the abovementioned foreseen events and amount or criteria;

|

|

|

·

|

reasonable litigation expenses, including

attorneys’ fees, incurred by the office holder as a result of an investigation or proceeding instituted against him or her

by an authority authorized to conduct such investigation or proceeding, provided that (i) no indictment was filed against such

office holder as a result of such investigation or proceeding; and (ii) no financial liability was imposed upon him or her as a

substitute for the criminal proceeding as a result of such investigation or proceeding or, if such financial liability was imposed,

it was imposed with respect to an offense that does not require proof of criminal intent or as a monetary sanction;

|

|

|

·

|

a monetary liability imposed on him or

her in favor of an injured party at an Administrative Procedure (as defined below) pursuant to Section 52(54)(a)(1)(a) of the Securities

Law;

|

|

|

·

|

expenses incurred by an office holder

in connection with an Administrative Procedure under the Securities Law, including reasonable litigation expenses and reasonable

attorneys’ fees; and

|

|

|

·

|

reasonable litigation expenses, including

attorneys’ fees, incurred by the office holder or imposed by a court in proceedings instituted against him or her by the

company, on its behalf, or by a third-party, or in connection with criminal proceedings in which the office holder was acquitted,

or as a result of a conviction for an offense that does not require proof of criminal intent.

|

|

|

·

|

An “Administrative Procedure”

is defined as a procedure pursuant to chapters H3 (Monetary Sanction by the Israeli Securities Authority), H4 (Administrative Enforcement

Procedures of the Administrative Enforcement Committee) or I1 (Arrangement to prevent Procedures or Interruption of procedures

subject to conditions) to the Securities Law.

|

Under the Companies

Law, a company may insure an office holder against the following liabilities incurred for acts performed by him or her as an office

holder if and to the extent provided in the company’s articles of association:

|

|

·

|

a breach of the duty of loyalty to the

company, provided that the office holder acted in good faith and had a reasonable basis to believe that such act would not prejudice

the company;

|

|

|

·

|

a breach of the duty of care to the company

or to a third-party;

|

|

|

·

|

a monetary liability imposed on the office

holder in favor of a third-party;

|

|

|

·

|

a monetary liability imposed on the office

holder in favor of an injured party at an Administrative Procedure pursuant to Section 52(54)(a)(1)(a) of the Securities Law; and

|

|

|

·

|

expenses incurred by an office holder

in connection with an Administrative Procedure, including reasonable litigation expenses and reasonable attorneys’ fees.

|

Nevertheless, under

the Companies Law, a company may not indemnify, exculpate or insure an office holder against any of the following:

|

|

·

|

a breach of the duty of loyalty, except

for indemnification and insurance for a breach of the duty of loyalty to the company in the event office holder acted in good faith

and had a reasonable basis to believe that the act would not prejudice the company;

|

|

|

·

|

a breach of the duty of care committed

intentionally or recklessly, excluding a breach arising out of the negligent conduct of the office holder;

|

|

|

·

|

an act or omission committed with intent

to derive unlawful personal benefit; or

|

|

|

·

|

a fine, monetary sanction, penalty or

forfeit levied against the office holder.

|

Under the Companies

Law, exculpation, indemnification and insurance of office holders require the approval of the remuneration committee, board of

directors and, in certain circumstances, the shareholders, as described above under “Item 6—Directors, Senior Management

and Employees—B. Compensation” in the Company’s Annual Report for the year ended December 31, 2017, on Form 20-F

incorporated by reference herein.

Our Articles of Association

permit us to exculpate, indemnify and insure our office holders to the fullest extent permitted by the Companies Law. Each of our

office holders have entered into an indemnification agreement with us, exculpating them, to the fullest extent permitted by Israeli

law, from liability to us for damages caused to us as a result of a breach of the duty of care and undertaking to indemnify them

to the fullest extent permitted by Israeli law, including with respect to liabilities resulting from certain acts performed by

such office holders in their capacity as an office holder of the Company, our subsidiaries or our affiliates.

In the opinion of

the SEC, indemnification of directors and office holders for liabilities arising under the Securities Act, however, is against

public policy and therefore unenforceable.

The Exhibits to this

Registration Statement on Form S-8 are listed in the Exhibit Index attached hereto and incorporated herein by reference.

SIGNATURES

Pursuant to the

requirements of the Securities Act, the Registrant certifies that it has reasonable grounds to believe that it meets all of the

requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in Tel Aviv, Israel on this 20

th

day of September, 2018.

|

|

GALMED PHARMACEUTICALS LTD.

|

|

|

|

|

|

|

By:

|

/s/

Allen

Baharaff

|

|

|

|

Name: Allen Baharaff

|

|

|

|

Title: President and Chief Executive Officer

|

POWER OF ATTORNEY

KNOWN ALL MEN BY THESE

PRESENTS, that each person whose signature appears below constitutes and appoints each of Allan Baharaff and Yohai Stenzler, and

each of them severally, his true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for

him and in his name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments)

to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with

the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority

to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents

and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or any

of them, or their or his substitute or substitutes, may lawfully do or cause to be done virtue hereof.

Pursuant to the requirements

of the Securities Act of 1933, as amended this registration statement has been signed by the following persons in the capacities

and on the dates indicated:

|

Signatures

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/

s/ Allen Baharaff

|

|

President and Chief Executive Officer

|

|

September 20, 2018

|

|

Allen Baharaff

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

/

s/ Yohai Stenzler

|

|

Chief Financial Officer

|

|

September 20, 2018

|

|

Yohai Stenzler

|

|

(Principal Financial and Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/

s/ Chaim Hurvitz

|

|

Chairman of the Board

|

|

September 20, 2018

|

|

Chaim Hurvitz

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Shmuel Nir

|

|

Director

|

|

September 20, 2018

|

|

Shmuel Nir

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Tali Yaron-Eldar

|

|

Director

|

|

September 20, 2018

|

|

Tali Yaron-Eldar

|

|

|

|

|

|

|

|

|

|

|

|

/

s/ David Sidransky, M.D.

|

|

Director

|

|

September 20, 2018

|

|

David Sidransky, M.D.

|

|

|

|

|

|

|

|

|

|

|

|

/s/

William Marth

|

|

Director

|

|

September 20, 2018

|

|

William Marth

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Prof. Ran Oren, M.D.

|

|

Director

|

|

September 20, 2018

|

|

Yehezkel (Chezy) Ofir

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Carol L. Brosgart, M.D.

|

|

Director

|

|

September 20, 2018

|

|

Carol L. Brosgart, M.D.

|

|

|

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE OF THE REGISTRANT

Pursuant to the requirements

of the Securities Act of 1933, as amended, the undersigned, the duly authorized representative in the United States of Galmed

Pharmaceuticals Ltd. has signed this Registration Statement on this 20

th

day of September, 2018.

|

|

Puglisi & Associates

|

|

|

|

|

|

|

Authorized U.S. Representative

|

|

|

|

|

|

|

By:

|

/s/ Donald J. Puglisi

|

|

|

|

Name: Donald J. Puglisi

|

|

|

|

Title: Authorized Representative

|

EXHIBIT INDEX

* Filed herewith

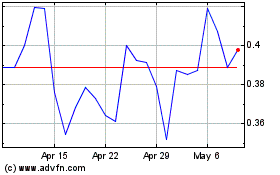

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

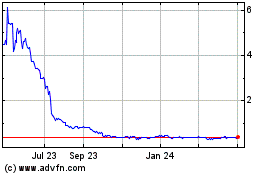

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Apr 2023 to Apr 2024