Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

Filed pursuant to Rule 424(b)(5)

Registration No. 333-225370

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered

(1)

|

|

Proposed Maximum

Offering Price Per

Unit

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee

(2)

|

|

|

|

Ordinary Shares, nominal value of €0.10 per share

(3)

|

|

3,996,250

|

|

$86.50

|

|

$345,675,625

|

|

$43,037

|

|

|

-

(1)

-

Includes

521,250 ordinary shares, nominal value of €0.10 per share, in the form of American Depositary Shares, or ADSs, which may be purchased

by the underwriters upon exercise of the underwriters' option to purchase additional ADSs.

-

(2)

-

Calculated

in accordance with Rules 456(b) and 457(r) of the Securities Act of 1933, as amended.

-

(3)

-

All

ordinary shares will be represented by ADSs, with each ADS representing one ordinary share.

Table of Contents

Prospectus Supplement (To Prospectus Dated June 1, 2018)

3,475,000 American Depositary Shares

Representing 3,475,000 Ordinary Shares

$86.50 Per ADS

We are offering 3,475,000 American Depositary Shares, or the ADSs. Each ADS represents one ordinary share with a nominal value of

€0.10 per share.

The ADSs are listed on the Nasdaq Global Select Market under the symbol "ARGX." On September 18, 2018, the last reported sale price of the ADSs

was $87.30 per ADS.

Our ordinary shares are listed on Euronext Brussels under the symbol "ARGX." On September 18, 2018, the last reported sale price of our ordinary

shares on Euronext Brussels was €81.40 per share, equivalent to a price of $95.21 per share, based on an exchange rate of $1.1697 to €1.00.

Investing in the ADSs involves risk. See "Risk Factors" beginning on page S-15.

We are an "emerging growth company" under the applicable Securities and Exchange Commission rules and will be subject to reduced public

company reporting requirements for this prospectus and future filings. See "Prospectus Summary—Implications of Being an Emerging Growth Company."

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

Per ADS

|

|

Total

|

|

Public offering price

|

|

$86.50

|

|

$300,587,500.00

|

|

Underwriting discount

(1)

|

|

$4.7575

|

|

$16,532,312.50

|

|

Proceeds, before expenses, to argenx SE

|

|

$81.7425

|

|

$284,055,187.50

|

-

(1)

-

We refer you to "Underwriters" beginning on page S-103 of this prospectus supplement for additional information regarding total

underwriter compensation.

We have granted the underwriters an option to purchase up to an additional 521,250 ADSs at the public offering price, less underwriting discounts and commissions, within

30 days of the date of this prospectus supplement. See "Underwriters" for more information.

The underwriters expect to deliver the ADSs against payment on or about September 21, 2018.

Joint Book-Running Managers

|

|

|

|

|

|

|

MORGAN STANLEY

|

|

COWEN

|

|

EVERCORE ISI

|

Co-Managers

The date of this prospectus supplement is September 18, 2018.

Table of Contents

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of an automatic shelf registration statement that we filed with the U.S.

Securities and Exchange Commission, or the SEC, as a "well-known seasoned issuer" as defined in Rule 405 under the Securities Act utilizing a "shelf" registration process.

This

prospectus supplement adds to and updates information contained in and incorporated by reference into the accompanying prospectus dated June 1, 2018 relating to our ordinary

shares and ADSs. Neither we nor the underwriters have authorized any person to provide you with information different from that contained in or incorporated by reference into this prospectus

supplement, the accompanying prospectus or any free writing prospectus prepared by us or on our behalf or to which we may have referred you in connection with this offering. We take no responsibility

for, and can provide no assurance as to the reliability of, any other information others may give you. This prospectus supplement and the accompanying prospectus are not an offer to sell, nor are they

seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in, or incorporated by reference into this prospectus supplement or the accompanying

prospectus speaks only as of the date of the prospectus supplement or the accompanying prospectus unless the information specifically indicates that another date applies, regardless of the time of

delivery of this prospectus supplement or the accompanying prospectus or of any sale of the securities offered hereby. If the information in this prospectus supplement differs from the information

contained in the accompanying prospectus or the documents incorporated by reference herein or therein, you should rely on the information contained in this prospectus supplement. However, if any

statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus supplement

or the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

This

prospectus supplement and the accompanying prospectus contain or incorporate by reference market data and industry forecasts that were obtained from third parties and industry

publications. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified any third-party

information. While we believe the market position, market opportunity and market size information included in this prospectus supplement and the accompanying prospectus is generally reliable, such

information is inherently imprecise.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of the ADSs or possession or distribution of this prospectus supplement or the

accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement or the accompanying prospectus in jurisdictions outside the United States are required to

inform themselves about and to observe any restrictions as to this offering and the distribution of the prospectus supplement or the accompanying prospectus applicable to that jurisdiction.

The

representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement and

the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and

should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We

own various trademark registrations and applications, and unregistered trademarks, including SIMPLE Antibody™, NHance®, ABDEG™ and our corporate

logo and are authorized to use POTELLIGENT® by Kyowa Hakko Kirin Co. Ltd. We have a U.S. trademark registration for the arGEN-X name and a European Community Trademark for

the stylized arGEN-X name. The name is also the subject of a number of domain name registrations. All other trade names, trademarks and service

S-1

Table of Contents

marks

of other companies appearing in this prospectus supplement and the accompanying prospectus are the property of their respective holders. Solely for convenience, the trademarks and trade names in

this prospectus supplement or the accompanying prospectus may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that

their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies' trademarks and trade names to imply a

relationship with, or endorsement or sponsorship of us by, any other companies.

Unless

otherwise mentioned or unless the context requires otherwise, throughout this prospectus supplement, the words "argenx," "ARGX," "we," "us," "our," "the company," "our company" or

similar references refer to argenx SE and its consolidated subsidiaries.

Unless

otherwise indicated, all references to "U.S. dollars," "USD," "dollars," "US$" and "$" in this prospectus supplement are to the lawful currency of the United States of America and

references to "Euro," "EUR," and "€" are to the lawful currency of the Netherlands.

S-2

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus, including the documents incorporated herein and therein by reference, contain

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as

amended, or the Exchange Act, that are based on our management's beliefs and assumptions and on information currently available to our management. All statements other than present and historical

facts and conditions contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated herein and therein by reference, including statements regarding our

future results of operations and financial positions, business strategy, plans and our objectives for future operations, are forward-looking statements. When used in this prospectus supplement and the

accompanying prospectus, including the documents incorporated herein and therein by reference, the words "anticipate," "believe," "can," "could," "estimate," "expect," "intend," "is designed to,"

"may," "might," "will,\" "plan," "potential," "predict," "objective," "should," or the negative of these and similar expressions identify forward-looking statements. Forward-looking statements include,

but are not limited to, statements about:

-

•

-

the initiation, timing, progress and results of clinical trials of our product candidates, including statements regarding when results of the

trials will be made public;

-

•

-

the potential attributes and benefits of our product candidates and their competitive position with respect to other alternative treatments;

-

•

-

our ability to advance product candidates into, and successfully complete, clinical trials;

-

•

-

our plans related to the commercialization of our product candidates, if approved;

-

•

-

the anticipated pricing and reimbursement of our product candidates, if approved;

-

•

-

our regulatory strategy and the timing or likelihood of regulatory filings and approvals for any product candidates;

-

•

-

our ability to establish sales, marketing and distribution capabilities for any of our product candidates that achieve regulatory approval;

-

•

-

our ability to establish and maintain manufacturing arrangements for our product candidates;

-

•

-

the scope and duration of protection we are able to establish and maintain for intellectual property rights covering our product candidates,

platform and technology;

-

•

-

our plans regarding, and consequences of, our restructuring and potential redomiciliation;

-

•

-

our estimates regarding expenses, future revenues, capital requirements and our needs for additional financing;

-

•

-

the rate and degree of market acceptance of our product candidates, if approved;

-

•

-

the potential benefits of our current collaborations;

-

•

-

our plans and ability to enter into collaborations for additional programs or product candidates;

-

•

-

the impact of government laws and regulations on our business;

-

•

-

our expectations regarding the use of proceeds from this offering; and

-

•

-

other risks and uncertainties, including those listed under the section titled "Risk Factors" in this prospectus supplement and the

accompanying prospectus, and under the section titled "Item 3.D.—Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2017.

S-3

Table of Contents

You

should refer to the section titled "Risk Factors" in this prospectus supplement and the accompanying prospectus, and the section titled "Item 3.D.—Risk Factors" in

our Annual Report on Form 20-F for the year ended December 31, 2017 for a discussion of important factors that may cause our actual results to differ materially from those expressed or

implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking

statements in this prospectus supplement and the accompanying prospectus, including the documents incorporated herein and therein by reference, will prove to be accurate. Furthermore, if our

forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements

as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any

forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You

should read this prospectus supplement and the accompanying prospectus, including the documents incorporated herein and therein by reference, completely and with the understanding

that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Information

regarding market and industry statistics contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated herein and therein by

reference, is included based on information available to us that we believe is accurate. Forecasts and other forward looking information obtained from this available information is subject to the same

qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services.

S-4

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere in the prospectus supplement and the accompanying

prospectus and in the documents incorporated by reference herein and therein. It may not contain all of the information that you should consider in making your investment decision. Before investing in

the ADSs, you should read this entire prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein, and any related free writing

prospectus carefully for a more complete understanding of our business and this offering, including our consolidated financial statements, and the sections entitled "Risk Factors" and "Operating and

Financial Review and Prospects" incorporated by reference in this prospectus supplement and the accompanying prospectus.

COMPANY OVERVIEW

We are a clinical-stage biotechnology company developing a deep pipeline of differentiated antibody-based therapies for the treatment of severe

autoimmune diseases and cancer. Utilizing our suite of technologies, we are focused on developing product candidates with the potential to be either first-in-class against novel targets or

best-in-class against known, but complex, targets in order to treat diseases with a significant unmet medical need. Our SIMPLE Antibody Platform, based on the powerful llama immune system, allows us

to exploit novel and complex targets, and our three antibody Fc engineering technologies are designed to enable us to expand the therapeutic index of our product candidates. Together with our antibody

discovery and development expertise, this suite of technologies has enabled our pipeline of eight product candidates. Two of our product candidates are in Phase 2 and Phase 3 trials for

multiple indications, one of which has achieved clinical proof-of-concept in two indications and is in Phase 3 clinical development for the first indication.

The

following table summarizes key information on our product candidate portfolio as of the date of this prospectus supplement:

S-5

Table of Contents

In

September 2018, we announced chronic inflammatory demyelinating polyneuropathy, or CIDP, as the fourth potential indication for efgartigimod. We intend to initiate a Phase 2

proof-of-concept trial of efgartigimod (IV) in CIDP in the first half of 2019.

Overview of Chronic Inflammatory Demyelinating Polyneuropathy

CIDP is a chronic autoimmune disorder of peripheral nerves and nerve roots caused by an autoimmune-mediated destruction of the myelin sheath, or

myelin producing cells, insulating the axon of the nerves and enabling speed of signal transduction. The cause of CIDP is unknown, but abnormalities in both cellular and humoral immunity have been

shown. CIDP is a chronic and progressive disease: onset and progression occur over at least eight weeks in contrast with the more acute Guillain-Barré-syndrome. Demyelination and axonal

damage in CIDP lead to loss of sensory and/or motor neuron function, which can lead to weakness, sensory loss, imbalance and/or pain. CIDP affects approximately 16,000 patients in the United States.

Limitations of Current CIDP Treatments

Most CIDP patients require treatment and intravenous immunoglobulin, or IVIg, is the preferred first-line therapy. Glucocorticoids and plasma

exchange are used to a lesser extent as they are either limited by side effects upon chronic use, in the case of glucocorticoids, or invasiveness of the procedure and access, which is restricted to

specialized centers in case of plasma exchange.

Alternative immunosuppressant agents are typically reserved for patients ineligible for or refractory to IVIg, glucocorticoids or plasma exchange.

While

IVIg therapy can usually control CIDP, most patients require repeated treatments every two to six weeks for many years. This is due to the fact that IVIg monotherapy does not

usually lead to long-term remission. IVIg introduces high levels of exogenously added IgG antibodies to the blood stream that compete with the patient's auto-antibodies for various pathways, including

the FcRn-dependent antibody recycling pathway, thereby lowering the impact of the auto-antibodies. IVIg treatment for CIDP requires intravenous dosing of up to 2 g/kg per day of IVIg and is associated

with many of the adverse events seen with IVIg treatment of other autoimmune diseases, such as MG. Both IVIg and plasmapheresis, when used to treat CIDP, carry a high cost burden on the healthcare

system as they do when used to treat myasthenia gravis, or MG, or ITP. CIDP is the largest indication for IV/SC Ig in the United States.

Phase 2 Clinical Trial in ITP

We recently completed a randomized, double-blind, placebo-controlled Phase 2 clinical trial to evaluate the safety, efficacy and

pharmacokinetics of efgartigimod in 38 adult primary ITP patients, who have platelet counts lower than 30x10

9

/L while being on a stable dose of standard-of-care treatments consisting of

corticosteroids, permitted immunosuppressants or thrombopoietin receptor agonists, or after having undergone a splenectomy or while being monitored under a "watch & wait" approach. We conducted

the clinical trial at 19 clinical centers across eight countries in the European Union. Patients were randomly assigned to three arms of 12 or 13 patients for the placebo or efgartigimod arms,

respectively. All patients in this clinical trial on a drug standard-of-care treatment were to continue to receive their stable dose of standard-of-care treatment as per the protocol. One treatment

arm received 5 mg/kg efgartigimod, the second arm received 10 mg/kg efgartigimod and the third arm received placebo. Dosing took place in a three-week period, which included four weekly doses of

efgartigimid or placebo. Patient follow-up continued for 21 weeks after treatment. Patients from all three cohorts were eligible to enroll in a one-year open-label extension study at the

10mg/kg dose of efgartigimod, subject to meeting enrollment criteria, including platelet counts lower than 30x10

9

/L.

The

primary objectives of this Phase 2 clinical trial were to evaluate safety and tolerability of efgartigimod with primary endpoints evaluating the incidence and severity of

adverse events and serious

S-6

Table of Contents

adverse

events, and evaluating vital signs, electrocardiogram and laboratory assessments. Secondary objectives included evaluation of efficacy, based on platelet count, use of rescue treatment and

bleeding events, pharmacokinetics, pharmacodynamics, and immunogenicity.

We

announced topline data from this Phase 2 clinical trial in September 2018.

Primary

endpoint analysis showed efgartigimod was well-tolerated in all patients, with most adverse events observed characterized as mild and not deemed to be drug-related. The majority

of non-bleeding treatment emergent adverse events, or TEAEs, observed were considered as mild (

i.e.

, Grade 1). No non-bleeding TEAEs Grade 3 or higher

were reported. No clinically significant laboratory, vital signs or electrocardiogram findings were observed. No deaths or TEAEs leading to discontinuation of treatment were reported during the trial.

There was one non-study drug related SAE (acute bronchitis, requiring hospitalization) during the main study portion of the Phase 2 trial. The observed tolerability profile was consistent with

the Phase 1 healthy volunteer trial as well as our Phase 2 clinical trial in MG.

In

total, during the 24 week treatment and follow-up period, 23 (60.5%) patients reported at least one non-bleeding TEAE, and all non-bleeding TEAEs were considered mild or

moderate by the investigator. Eleven patients experienced a moderate adverse event. Two patients in the 10 mg/kg arm reported experiencing vomiting during the clinical trial, of which one mild event

was deemed temporally related to efgartigimod. We observed only one clinically significant increase in C-reactive protein in the clinical trial linked to the case of acute bronchitis. We did not

observe clinically significant decreases in white blood cell counts.

Only

five non-bleeding TEAEs were deemed to be drug-related by the investigator, of which four were recorded in two patients in the placebo group. For efgartigimod, only one non bleeding

TEAE was deemed related, namely vomiting in 7.7% of patients observed at the 10 mg/kg dose. Four cases of infection were observed, namely: cystitis in two patients receiving efgartigimod at 5 mg/kg

and 10 mg/kg respectively; acute bronchitis in one patient receiving efgartigimod at 10 mg/kg; and pneumonia in one patient receiving 10 mg/kg efgartigimod. All events were deemed unrelated by the

investigator. Three patients in the 10 mg/kg efgartigimod group received rescue therapy during the main study due to lack of efficacy at the discretion of the investigator, two of which therefore did

not complete dosing.

All

non-bleeding TEAEs reported, as well as non-bleeding TEAEs deemed to be drug-related by the investigator in at least two patients, are summarized in

Table 1.

The

frequency of bleeding related events, as defined in the protocol, was evaluated separately. This was done due to the nature of the disease, as low platelet levels in ITP patients may

induce bleeding events in a proportion of patients, and signs and symptoms vary widely. Twenty-eight bleeding events were reported in 12 patients (31.6%) across the treatment cohorts. Five patients

(38.5%) in each the efgartigimod 5 mg/kg arm and 10 mg/kg arm, experienced at least one bleeding TEAE, compared to two (16.7%) in the placebo cohort. Bleeding was measured according to the SMOG Index

of the ITP-BAT scale, a bleeding scale specific for ITP. Severity is graded from 0 to 4. No grade 4 bleeding events were observed in the study. Grade 2 and 3 events were observed, including events

recorded on the day of rescue, in six patients (23.1%) in the efgartigimod arms, compared to one patient (8.3%) in the placebo arm. Our analysis of this data regarding bleeding related events is

ongoing, but, to date, no bleeding events were considered related to the study drug. Further analysis of this data includes the relation with each patient's bleeding history and demographics of the

patients, and the relation with response to efgartigimod. We expect to report our conclusions in our full data release in December 2018.

S-7

Table of Contents

Table 1. Overview of TEAEs and drug-related TEAEs reported in at least two patients in efgartigimod Phase 2 Clinical Trial in ITP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of patients

|

|

|

(Non bleeding) TEAEs reported in at least two patients

|

|

Placebo

(n=12)

|

|

Efgartigimod 5mg/kg

(n=13)

|

|

Efgartigimod 10mg/kg

(n=13)

|

|

|

Most common TEAEs

|

|

|

|

|

|

|

|

|

|

|

|

Headache

|

|

|

2 (16.7

|

)%

|

|

1 ( 7.7

|

)%

|

|

—

|

|

|

Hypertension

|

|

|

1 ( 8.3

|

)%

|

|

—

|

|

|

2 (15.4

|

)%

|

|

Vomiting

|

|

|

—

|

|

|

—

|

|

|

2 (15.4

|

)%

|

|

Cystitis

|

|

|

—

|

|

|

1 (7.7

|

)%

|

|

1 (7.7

|

)%

|

|

Rash

|

|

|

—

|

|

|

1 (7.7

|

)%

|

|

1 (7.7

|

)%

|

|

Productive Cough

|

|

|

1 ( 8.3

|

)%

|

|

1 (7.7

|

)%

|

|

—

|

|

|

TEAEs deemed related to study intervention (any grade)

|

|

|

|

|

|

|

|

|

|

|

|

Headache

|

|

|

1 ( 8.3

|

)%

|

|

—

|

|

|

—

|

|

|

Vomiting

|

|

|

—

|

|

|

—

|

|

|

1 ( 7.7

|

)%

|

|

Pubic pain*

|

|

|

1 ( 8.3

|

)%

|

|

—

|

|

|

—

|

|

|

Vaginal discharge*

|

|

|

1 ( 8.3

|

)%

|

|

—

|

|

|

—

|

|

|

Amenorrhoea*

|

|

|

1 ( 8.3

|

)%

|

|

—

|

|

|

—

|

|

-

*

-

Observed

in the same patient

The

secondary endpoint measures relating to efficacy showed efgartigimod treatment was associated with a strong clinical improvement over placebo as measured by increases in platelet

counts. Patients in the treatment arms showed increases in their platelet counts.

Figure 1: Platelet levels for all patients per dosing group. Dotted lines represent measurements during the open label extension (treatment groups vs. placebo)

S-8

Table of Contents

The

proportion of increases in platelet counts at different thresholds were as follows: 73% and 54% of patients in the efgartigimod 5mg/kg and 10 mg/kg dosing arms, respectively,

achieved an increase of their platelet counts to

³

30.10^9/L and

³

50.10^9/L at least one time, respectively,

compared to 58% and 50% in the placebo group.

In

each of the 5mg/kg and 10 mg/kg dosing arms, 46% of efgartigimod patients achieved platelet counts of

³

50x10^9/L on two or more occasions

compared to 25% in the placebo arm. Based on analysis of the first dosing cycle, 58% of patients in the open label extension, which was open to patients from all dose cohorts, receiving 10 mg/kg

efgartigimod reached platelet response of

³

50x10^9/L during two or more visits.

Increasing

differentiation was observed between the two efgartigimod treatment groups versus placebo with increasing platelet count thresholds as shown in

Figure 2

showing both

durability and depth of platelet count increases by efgartigimod:

-

•

-

38% of patients in the efgartigimod arms exceeded 50x10^9/L more than 10 cumulative days compared to 0% in the placebo arm, which was

clinically meaningful and statistically significant (p=0.03).

-

•

-

42% of patients in the efgartigimod arms exceeded 100x10^9/L compared to 8% in the placebo group.

Platelet

counts reaching 50x10^9/L started as early as week 1 through week 10, consistent with disease heterogeneity. Duration of platelets exceeding 50x10^9/L ranged from one to

20 weeks. Both onset and duration varied on a patient-by-patient basis.

Figure 2: Post-hoc analysis of increasing thresholds of efficacy

Analysis

of the pharmacokinetic and pharmacodynamic endpoints was generally consistent with the findings from the Phase 1 clinical trial as well as the MG Phase 2 clinical

trial.

In

line with findings in the Phase 1 healthy volunteer trial and MG Phase 2 clinical trial, positive anti-drug antibody, or ADA, titers were detected in a number of

patients. In this Phase 2 clinical trial, positive post-dosing ADA titers were detected in 9 out of 26 patients receiving efgartigimod and in 2 out of 12 patients receiving placebo. Positive

post-dose ADA titers had no apparent effect on efgartigimod pharmacokinetics or pharmacodynamics in the main study.

S-9

Table of Contents

RISKS ASSOCIATED WITH OUR BUSINESS

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more

fully in the "Risk Factors" section of this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein and therein and under

"Item 3.D.—Risk Factors" in our Annual Report on Form 20-F for the year ended December 31, 2017. These risks include, but are not limited to, the

following:

-

•

-

We are a clinical-stage biopharmaceutical company and have incurred significant losses since our inception. We expect to incur losses for the

foreseeable future and may never achieve or maintain profitability.

-

•

-

We may need substantial additional funding in order to complete the development and commercialization of our product candidates.

-

•

-

The results of preclinical studies and early-stage clinical trials of our product candidates may not be predictive of the results of

later-stage clinical trials. Initial success in our ongoing clinical trials may not be indicative of results obtained when these trials are completed or in later stage trials.

-

•

-

Interim topline and preliminary data from our clinical trials that we announce or publish from time to time may change as more patient data

become available and are subject to audit and verification procedures that could result in material changes in the final data.

-

•

-

Our product candidates may have serious adverse, undesirable or unacceptable side effects, which may delay or prevent marketing approval.

-

•

-

The regulatory approval processes of the U.S. Food and Drug Administration, the European Medicines Agency and comparable foreign authorities

are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our product candidates, our business will be substantially harmed.

-

•

-

We rely and will continue to rely significantly on collaborative partners regarding the development of some of our research programs and

product candidates.

-

•

-

We rely on patents and other intellectual property rights to protect our product candidates and our suite of technologies—our

SIMPLE Antibody Platform, NHance and ABDEG—the enforcement, defense and maintenance of which may be challenging and costly. Failure to enforce or protect these rights adequately could harm

our ability to compete and impair our business.

-

•

-

We have never commercialized a product candidate before and may lack the necessary expertise, personnel and resources to successfully

commercialize our products on our own or together with suitable collaboration partners.

-

•

-

We are a Dutch European public company with limited liability, and shareholders of our company may have different and in some cases more

limited shareholder rights than shareholders of a U.S. corporation.

-

•

-

If we are classified as a passive foreign investment company in any taxable year, it may result in adverse U.S. federal income tax consequences

to U.S. holders of the ADSs.

-

•

-

As foreign private issuer, we are exempt from a number of rules under the U.S. securities laws and Nasdaq Stock Market corporate governance

rules and are permitted to file less information with the SEC than U.S. companies, which may limit the information available to holders of the ADSs.

S-10

Table of Contents

CORPORATE INFORMATION

Our legal and commercial name is argenx SE. We were incorporated under the laws of the Netherlands on April 25, 2008 as a private company

with limited liability (

besloten vennootschap met beperkte aansprakelijkheid

). On May 28, 2014, we converted to a Dutch public company with

limited liability (

naamloze vennootschap

). On April 26, 2017, we converted to a Dutch European public company with limited liability

(

Societas Europaea

or

SE

). Our official seat is in Rotterdam, the Netherlands, and our

registered office

is at Willemstraat 5, 4811 AH, Breda, the Netherlands. We are registered with the trade register of the Dutch Chamber of Commerce under number 24435214. Our telephone number is

+32 9 310 34 00. Our website address is

http://www.argenx.com

. The information on, or that can be accessed through,

our website does not constitute part of this prospectus supplement or the accompanying prospectus. We have included our website address as an inactive textual reference only. The registered agent for

service of process in the United States is C T Corporation System, with an address at 111 8

th

Avenue, New York, NY 10011.

Our

ordinary shares represented by ADSs have been listed on the Nasdaq Global Select Market under the symbol "ARGX" since May 18, 2017. Our ordinary shares have been trading on

Euronext Brussels under the symbol "ARGX" since July 2014.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

We qualify as an "emerging growth company" as defined in the U.S. Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging

growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions

include:

-

•

-

not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002;

-

•

-

the ability to include only two years of audited financial statements in addition to any required interim financial statements and

correspondingly reduced disclosure in management's discussion and analysis of financial condition and results of operations in the registration statement for the offering of which this prospectus

forms a part; and

-

•

-

to the extent that we no longer qualify as a foreign private issuer, (1) reduced disclosure obligations regarding executive compensation

in our periodic reports and proxy statements; and (2) exemptions from the requirements of holding a non-binding advisory vote on executive compensation, including golden parachute compensation.

We

may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon

the earliest to occur of (1) the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; (2) the date we qualify as a "large accelerated filer,"

with at least $700 million of equity securities held by non-affiliates; (3) the issuance, in any three-year period, by our company of more than $1.07 billion in non-convertible

debt securities; and (4) the last day of 2022. We may choose to take advantage of some but not all of these exemptions. For example, Section 107 of the JOBS Act provides that an emerging

growth company can use the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised

accounting standards. Given that we currently report and expect to continue to report under International Financial Reporting Standards as issued by the International Accounting Standards Board, or

IASB, we have irrevocably elected not to avail ourselves of this extended transition period and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption

of

such standards is required by the IASB. We have taken advantage of reduced reporting requirements in this prospectus supplement and the accompanying prospectus. Accordingly, the information contained

herein and therein may be different

S-11

Table of Contents

than

the information you receive from other public companies in which you hold equity securities. We currently expect that we will cease to be an emerging growth company on December 31, 2018.

IMPLICATIONS OF BEING A FOREIGN PRIVATE ISSUER

We are considered a "foreign private issuer." In our capacity as a foreign private issuer, we are exempt from certain rules under the U.S.

Securities Exchange Act of 1934, as amended, or the Exchange Act, that impose certain disclosure obligations and procedural requirements for proxy solicitations under Section 14 of the Exchange

Act. In addition, our officers, directors and principal shareholders are exempt from the reporting and "short-swing" profit recovery provisions of Section 16 of the Exchange Act and the rules

under the Exchange Act with respect to their purchases and sales of our ordinary shares or the ADSs. Moreover, we are not required to file periodic reports and financial statements with the SEC as

frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act, although we reported and intend to continue to report our results of operations voluntarily on a

quarterly basis. In addition, we are not required to comply with Regulation FD, which restricts the selective disclosure of material information.

We

may take advantage of these exemptions until such time as we are no longer foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our

outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (1) the majority of our executive officers or directors are U.S. citizens or

residents, (2) more than 50% of our assets are located in the United States or (3) our business is administered principally in the United States.

We

have taken advantage of certain reduced reporting and other requirements in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein

and therein. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold equity securities.

S-12

Table of Contents

THE OFFERING

|

|

|

|

|

ADSs offered by argenx

|

|

3,475,000 ADSs

|

|

Option to Purchase Additional ADSs

|

|

We have granted the underwriters an option to purchase up to an additional 521,250 ADSs

within 30 days of the date of this prospectus supplement.

|

|

American Depositary Shares

|

|

The ADSs being sold pursuant to this prospectus supplement represent ordinary shares of

argenx SE. Each ADS represents one ordinary share with a nominal value of €0.10 per share. As an ADS holder, we will not treat you as one of our shareholders. The depositary bank, The Bank of New York Mellon, will be the registered holder of the

ordinary shares underlying your ADSs. You will have ADS holder rights as provided in the deposit agreement. To better understand the terms of the ADSs, you should carefully read the section in this prospectus supplement titled "Description of

American Depositary Shares" and the section in the accompanying prospectus titled "Description of Securities," which is incorporated by reference into this prospectus supplement, and the deposit agreement referred to therein.

|

|

|

|

Investors in the ADSs will be able to trade our securities and receive distributions on them

to the extent described in the section in this prospectus supplement titled "Description of American Depositary Shares" and the section in the accompanying prospectus titled "Description of Securities."

|

|

Depositary bank

|

|

The Bank of New York Mellon

|

|

Ordinary shares to be outstanding immediately following this offering

|

|

35,925,775 ordinary shares (or 36,447,025 if the underwriters' option to purchase additional

ADSs is exercised in full).

|

|

Use of proceeds

|

|

We estimate that the net proceeds from this offering will be approximately $283.2

(€242.1) million (or approximately $325.8 (€278.5) million if the underwriters exercise their option to purchase additional ADSs in full), after deducting underwriting discounts and commissions and estimated offering expenses payable by

us.

|

|

|

|

We intend to use the net proceeds from this offering, together with cash, cash equivalents

and current financial assets on hand, to fund research and development efforts for our product candidates, to advance late stage clinical development and begin pre-commercial activities of efgartigimod in certain indications, for our other current

and future research and development activities and to progress technology development, to expand our corporate infrastructure and for working capital and other general corporate purposes. See "Use of Proceeds" for a more complete description of the

intended use of proceeds from this offering.

|

S-13

Table of Contents

|

|

|

|

|

Risk Factors

|

|

See "Risk Factors" beginning on page S-15 and the other information included in this prospectus

supplement and the accompanying prospectus, including our Annual Report on Form 20-F for the year ended December 31, 2017 and the other documents incorporated by reference herein and therein, for a discussion of risks you should carefully

consider before deciding to invest in the ADSs.

|

|

Nasdaq trading symbol

|

|

"ARGX"

|

|

Euronext Brussels trading symbol

|

|

"ARGX"

|

The

number of ordinary shares to be outstanding after this offering is based on 32,450,775 of our ordinary shares outstanding as of June 30, 2018, but excludes 2,743,995 ordinary

shares issuable upon the exercise of stock options outstanding as of June 30, 2018 at a weighted average exercise price of €16.52 per share.

Except

as otherwise noted, all information in this prospectus supplement assumes:

-

•

-

no exercise by the underwriters of their option to purchase additional ADSs; and

-

•

-

no exercise of the outstanding stock options described above.

S-14

Table of Contents

RISK FACTORS

Investing in the ADSs involves a high degree of risk. Before making a decision to invest in the ADSs, in addition to the

other information contained in or incorporated by reference into this prospectus supplement or the accompanying prospectus, you should carefully consider the risks described under "Risk Factors" in

our Annual Report on Form 20-F for the year ended December 31, 2017, as updated by the risks described under "Risk Factors" in the accompanying prospectus and as further updated by the

risks described below, as well as in other documents that we subsequently file with the SEC that are incorporated by reference into this prospectus supplement. See also "Where You Can Find More

Information."

Risks Related to this Offering and the ADSs

The price of the ADSs may be volatile and may fluctuate due to factors beyond our control. An active public

trading market may not be sustained following this offering, and you may not be able to resell the ADSs at or above the public offering price.

If you purchase ADSs in this offering, you may not be able to resell those ADSs at or above the public offering price. The trading price of the

ADSs and the ordinary shares has fluctuated, and is likely to continue to fluctuate, substantially. The trading price of those securities depends on a number of factors, including those described in

this "Risk Factors" section, many of which are beyond our control and may not be related to our operating performance. In addition, although the ADSs are listed on the Nasdaq Global Select Market and

our ordinary shares are listed on Euronext Brussels, we cannot assure you that a trading market for those securities will be maintained.

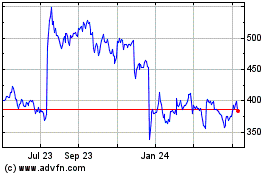

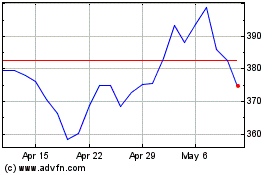

Since

the ADSs were sold at our initial U.S. public offering in May 2017 at a price of $17.00 per ADS, the price per ADS has ranged as low as $17.33 and as high as $103.00 through

September 18, 2018. During this same period, ordinary share prices have ranged from as low as €15.48 to as high as €88.60. The market price of the ADSs may

fluctuate significantly due to a variety of factors, many of which are beyond our control, including:

-

•

-

positive or negative results of testing and clinical trials by us, strategic partners or competitors;

-

•

-

delays in entering into strategic relationships with respect to development or commercialization of our product candidates or entry into

strategic relationships on terms that are not deemed to be favorable to us;

-

•

-

technological innovations or commercial product introductions by us or competitors;

-

•

-

changes in government regulations;

-

•

-

developments concerning proprietary rights, including patents and litigation matters;

-

•

-

public concern relating to the commercial value or safety of any of our product candidates;

-

•

-

financing or other corporate transactions;

-

•

-

publication of research reports or comments by securities or industry analysts;

-

•

-

general market conditions in the pharmaceutical industry or in the economy as a whole;

-

•

-

price and volume fluctuations attributable to inconsistent trading volume levels of the ADSs and/or ordinary shares; or

-

•

-

other events and factors, many of which are beyond our control.

These

and other market and industry factors may cause the market price and demand for the ADSs and ordinary shares to fluctuate substantially, regardless of our actual operating

performance, which may limit or prevent investors from readily selling their ADSs or ordinary shares and may otherwise negatively affect the liquidity of the ADSs and ordinary shares. In addition, the

stock market in general, and biopharmaceutical companies in particular, have experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating

performance of these companies.

S-15

Table of Contents

We will continue to incur, increased costs as a result of operating as a U.S.-listed public company, and our

board of directors will be required to devote substantial time to new compliance initiatives and corporate governance practices.

As a public company, and particularly after we no longer qualify as an emerging growth company, we will continue to incur significant legal,

accounting and other expenses that we did not incur as a public company listed on Euronext Brussels. We are a Dutch European public company with limited liability (

Societas

Europaea

or

SE

). If our potential redomiciliation is completed, we will be a Belgian European public company with limited

liability (

Societas Europaea

or

SE

). The Sarbanes-Oxley Act of 2002, the Dodd-Frank Wall

Street Reform

and Consumer Protection Act, the listing requirements of the Nasdaq Stock Market, or Nasdaq, and other applicable securities rules and regulations impose various requirements on non-U.S. reporting

public companies, including the establishment and maintenance of effective disclosure and financial controls and corporate governance practices. Our board of directors and other personnel are and will

continue to be required to devote a substantial amount of time to these compliance initiatives. Moreover, these rules and regulations will continue to increase our legal and financial compliance costs

and will make some activities more time-consuming and costly. For example, we expect that these rules and regulations may make it more difficult and more expensive for us to obtain director and

officer liability insurance, which in turn could make it more difficult for us to attract and retain qualified members of our board of directors.

However,

these rules and regulations are often subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may

evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing

revisions to disclosure and governance practices.

Pursuant

to Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, we are required to furnish a report by our board of directors on our internal control over

financial reporting. However, while we remain an emerging growth company, we will not be required to include an attestation report on internal control over financial reporting issued by our

independent registered public accounting firm. We currently expect that we will cease to be an emerging growth company on December 31, 2018. To achieve compliance with Section 404 within

the prescribed period, we are engaged in a process to document and evaluate our internal control over financial reporting, which is both costly and challenging. In this regard, we will need to

continue to dedicate internal resources, potentially engage outside consultants and adopt a detailed work plan to assess and document the adequacy of internal control over financial reporting,

continue steps to improve control processes as appropriate, validate through testing that controls are functioning as documented and implement a continuous reporting and improvement process for

internal control over financial reporting. Despite our efforts, there is a risk that we will not be able to conclude, within the prescribed timeframe or at all, that our internal control over

financial reporting is effective as required by Section 404. If we identify one or more material weaknesses, it could result in an adverse reaction in the financial markets due to a loss of

confidence in the reliability of our financial statements.

Future sales, or the possibility of future sales, of a substantial number of our securities could adversely

affect the price of ADSs and ordinary shares.

Sales of a substantial number of ADSs or ordinary shares in the public market, or the perception that these sales might occur, could depress the

market price of ADSs and ordinary shares and could impair our ability to raise capital through the sale of additional equity securities. We are also unable to predict the effect that such sales may

have on the prevailing market price of ADSs and ordinary shares.

S-16

Table of Contents

Provisions of our Articles of Association or Dutch corporate law, or, following our potential

redomiciliation, our Belgian Articles of Association or Belgian corporate law, might deter acquisition bids for us that might be considered favorable and prevent or frustrate any attempt to replace or

remove the then board of directors.

Provisions of our Articles of Association may make it more difficult for a third party to acquire control of us or effect a change in our board

of directors. We have adopted several provisions that may have the effect of making a takeover of our company more difficult or less attractive. These provisions include a requirement that certain

matters, including an amendment of our Articles of Association, may only be brought to our shareholders for a vote upon a proposal by our board of directors. We face a compliance burden from an

organizational and regulatory perspective as a European public company with limited liability under Dutch law with our shares listed on Euronext Brussels and with the majority of our operations in

Belgium. Accordingly, depending on the entry into force of major changes to Belgian corporate law, we may seek shareholder approval for our potential redomiciliation from the Netherlands to Belgium.

If we complete our redomiciliation, Belgian corporate law will allow for various protective measures. In addition, several provisions of Belgian corporate law and certain other provisions of Belgian

law, such as obligations to disclose significant shareholdings and merger control regulations, may apply to us following completion of our redomiciliation and may make an unsolicited tender offer,

merger, change in management or other change in control of our company more difficult. These provisions could discourage potential takeover attempts that other shareholders may consider to be in their

best interest and could adversely affect the market price of our securities. These provisions may also have the effect of depriving ADS holders of the opportunity to sell their ADSs at a premium. In

addition, the board of directors of Belgian companies may in certain instances, and subject to prior authorization by the shareholders, deter or frustrate public takeover bids through dilutive

issuances of equity securities (pursuant to the authorized capital) or through share buy-backs. Although the authorization of the board of directors to increase a company's share capital through

contributions in kind or in cash with restriction or limitation of the preferential subscription right of the existing shareholders is suspended upon the notification to the company by the FSMA of a

public takeover bid on the securities of the company, the company's shareholders at the General Meeting can, under certain conditions, expressly authorize the board of directors to increase the

capital of the company by issuing shares in an amount of not more than 10% of the existing shares of the company at the time of such a public takeover bid. If Belgian corporate law is amended, these

and/or other provisions may have a similar effect.

If you purchase ADSs in this offering, you will suffer immediate dilution of your investment.

The public offering price of the ADSs is substantially higher than the as adjusted net tangible book value per ADS/ordinary share after this

offering. Therefore, if you purchase ADSs in this offering, you will pay a price per ADS that substantially exceeds our as adjusted net tangible book value per ADS/ordinary share after this offering.

Based on the public offering price of $86.50 per ADS, you will experience immediate dilution of $67.78 per ADS/ordinary share, representing the difference between our as adjusted net tangible book

value per ADS/ordinary share after giving effect to this offering and the public offering price per ADS in this offering. See "Dilution." To the extent outstanding options are exercised, you will

incur further dilution.

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

We will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve

our results of operations or enhance the value of the ADSs. Our failure to apply these funds effectively could result in financial losses that could have a material adverse effect on our business,

cause the price of the ADSs to decline and delay the development of our product candidates. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce

income or that loses value.

S-17

Table of Contents

Fluctuations in exchange rates may increase the risk of holding ADSs and ordinary shares.

Due to the international scope of our operations, our assets, earnings and cash flows are influenced by movements in exchange rates of several

currencies, particularly the euro, U.S. dollar, British pound and Swiss franc. Our functional currency is the euro, and the majority of our operating expenses are paid in euros, but we also receive

payments from our main business partners AbbVie and Shire in U.S. dollars, and we regularly acquire services, consumables and materials in U.S. dollars, Swiss francs and British pounds. Further,

potential future revenue may be derived from abroad, particularly from the United States. As a result, our business and the price of the ADSs and ordinary shares may be affected by fluctuations in

foreign exchange rates between the euro and these other currencies, which may also have a significant impact on our reported results of operations and cash flows from period to period. Currently, we

do not have any exchange rate hedging arrangements in place.

Moreover,

because our ordinary shares currently trade on Euronext Brussels in euros, and the ADSs will trade on the Nasdaq Global Select Market in U.S. dollars, fluctuations in the

exchange rate between the U.S. dollar and the euro may result in temporary differences between the value of the ADSs and the value of our ordinary shares, which may result in heavy trading by

investors seeking to exploit such differences.

In

order to finance the growth of our activities in the United States, notably with the opening of our U.S. office in October 2017, we have invested in U.S. dollar denominated cash

deposit accounts and in current financial assets with a significant portion of the proceeds from our initial U.S. public offering

completed in May 2017. Depending on the exchange rate fluctuations of the U.S. dollar, this may result in unrealized exchange rate losses which may impact negatively the reporting of our cash, cash

equivalents and current financial assets at reporting dates when translating to euros these U.S. denominated cash deposits accounts and current financial assets. In addition, as a result of

fluctuations in the exchange rate between the U.S. dollar and the euro, the U.S. dollar equivalent of the proceeds that a holder of the ADSs would receive upon the sale on Euronext Brussels of any

ordinary shares withdrawn from the depositary and the U.S. dollar equivalent of any cash dividends paid in euros on our ordinary shares represented by the ADSs could also decline.

Holders of ADSs are not treated as holders of our ordinary shares.

By participating in this offering you will become a holder of ADSs with underlying ordinary shares in a Dutch European public company with

limited liability (

Societas Europaea

or

SE

). Holders of ADSs are not treated as holders of

our ordinary

shares, unless they withdraw the ordinary shares underlying their ADSs in accordance with the deposit agreement and applicable laws and regulations. The depositary is the holder of the ordinary shares

underlying the ADSs. Holders of ADSs therefore do not have any rights as holders of our ordinary shares, other than the rights that they have pursuant to the deposit agreement. See "Description of

American Depositary Shares."

Holders of ADSs may be subject to limitations on the transfer of their ADSs and the withdrawal of the

underlying ordinary shares.

ADSs are transferable on the books of the depositary. However, the depositary may close its books at any time or from time to time when it deems

expedient in connection with the performance of its duties. The depositary may refuse to deliver, transfer or register transfers of ADSs generally when our books or the books of the depositary are

closed, or at any time if we or the depositary think it is advisable to do so because of any requirement of law, government or governmental body, or under any provision of the deposit agreement, or

for any other reason, subject to the right of ADS holders to cancel their ADSs and withdraw the underlying ordinary shares. Temporary delays in the cancellation of your ADSs and withdrawal of the

underlying ordinary shares may arise because the depositary has closed its transfer books or we have closed our transfer books, the transfer of ordinary shares is blocked to permit voting at a

S-18

Table of Contents

shareholders'

meeting or we are paying a dividend on our ordinary shares. In addition, ADS holders may not be able to cancel their ADSs and withdraw the underlying ordinary shares when they owe money

for fees, taxes and similar charges and when it is necessary to prohibit withdrawals in order to comply with any laws or governmental regulations that apply to ADSs or to the withdrawal of ordinary

shares or other deposited securities. See "Description of American Depositary Shares—Your Right to Receive the Shares Underlying Your ADSs."

You will not have the same voting rights as the holders of our ordinary shares and may not receive voting

materials in time to be able to exercise your right to vote.

Except as described in this prospectus supplement, the accompanying prospectus and the deposit agreement, holders of the ADSs will not be able

to exercise voting rights attaching to the ordinary shares represented by the ADSs. Under the terms of the deposit agreement, holders of the ADSs may instruct the depositary to vote the ordinary

shares underlying their ADSs. Otherwise, holders of ADSs will not be able to exercise their right to vote unless they withdraw the ordinary shares underlying their ADSs to vote them in person or by

proxy in accordance with applicable laws and regulations and our Articles of Association. Even so, ADS holders may not know about a meeting far enough in advance to withdraw those ordinary shares. If

we ask for the instructions of holders of the ADSs, the depositary, upon timely notice from us, will notify ADS holders of the upcoming vote and arrange to deliver our voting materials to them. Upon

our request, the depositary will mail to holders a shareholder meeting notice that contains, among other things, a statement as to the manner in which voting instructions may be given. We cannot

guarantee that ADS holders will receive the voting materials in time to ensure that they can instruct the depositary to vote the ordinary shares underlying their ADSs. A shareholder is only entitled

to participate in, and vote at, the meeting of shareholders, provided that its shares are recorded in its name at midnight (Central European Time) at the end of the twenty-eighth day preceding the

date of the meeting of shareholders. In addition, the depositary's liability to ADS holders for failing to execute voting instructions or for the manner of executing voting instructions is limited by

the deposit agreement. As a result, holders of ADSs may not be able to exercise their right to give voting instructions or to vote in person or by proxy and they may not have any recourse against the

depositary or us if their ordinary shares are not voted as they have requested or if their shares cannot be voted.

We do not expect to pay cash dividends in the foreseeable future.

We have not paid any cash dividends since our incorporation. Even if future operations lead to significant levels of distributable profits, we

currently intend that any earnings will be reinvested in our business and that cash dividends will not be paid until we have an established revenue

stream to support continuing cash dividends. In addition, payment of any future dividends to shareholders would be subject to shareholder approval at our General Meeting, upon proposal of the board of

directors, which proposal would be subject to the approval of the majority of the non-executive directors after taking into account various factors including our business prospects, cash requirements,

financial performance and new product development. In addition, payment of future cash dividends may be made only if our shareholders' equity exceeds the sum of our paid-in and called-up share capital

plus the reserves required to be maintained by Dutch law or by our Articles of Association. If we complete our potential redomiciliation, under Belgian corporate law, we may pay dividends only up to

an amount equal to the excess of our shareholders' equity over the sum of (i) paid-up or called-up share capital, and (ii) reserves not available for distribution pursuant to law or our

Belgian Articles of Association, based on the most recent statutory audited financial statements, prepared in accordance with the generally accepted accounting principles in Belgium, or Belgian GAAP.

In addition, under Belgian law, prior to distributing dividends, we must allocate an amount of 5% of our annual net profit on an unconsolidated basis to a legal reserve in our unconsolidated financial

statements until such reserve equals 10% of our share capital. If Belgian corporate law is amended, these and/or other provisions may contain similar restrictions. Accordingly,

S-19

Table of Contents

investors

cannot rely on cash dividend income from ADSs and any returns on an investment in the ADSs will likely depend entirely upon any future appreciation in the price of the ADSs.

Holders of our ordinary shares outside the Netherlands, or, if we complete our potential redomiciliation,

Belgium, and ADS holders, may not be able to exercise preemptive rights or preferential subscription rights, respectively.

In the event of an increase in our share capital, holders of our ordinary shares are generally entitled under Dutch law to full preemptive

rights, unless these rights are excluded either by a resolution of the shareholders at the General Meeting, or by a resolution of the board of directors (if the board of directors has been designated

by the shareholders at the General Meeting for this purpose). See "Description of Share Capital—Preemptive Rights." If we complete our potential redomiciliation to Belgium, in the event of

a share capital increase for cash by way of the issue of new shares, or in the event of an issue of convertible bonds or warrants, all our shareholders will generally have a preferential subscription

right unless these rights are restricted or cancelled either by a resolution of the shareholders at the General Meeting or by a resolution of our board of directors in Belgium, or our Belgian Board,

(if the Belgian Board has been authorized by the shareholders at the General Meeting for this purpose). If Belgian corporate law is amended, these and/or similar provisions may contain similar rights.

However, making preemptive rights available to holders of ordinary shares or ADSs representing ordinary shares also requires compliance with applicable securities laws in the jurisdictions where

holders of those securities are located, which we may be unable or unwilling to do. In particular, holders of ordinary shares or ADSs located in the United States would not be able to participate in a

preemptive rights offering unless we registered the securities to which the rights relate under the Securities Act or an exemption from the registration requirements of that Act is available. In

addition, ADS holders would not be able to participate in a preemptive rights offering unless we made arrangements with the depositary to extend that offering to ADS holders, which we are not required

to do.

We are a Dutch European public company with limited liability (

Societas

Europaea

or SE). If we complete our potential redomiciliation, we will be a Belgian European public company with limited liability (

Societas

Europaea

or SE). The rights of our shareholders may be different from the rights of shareholders in companies governed by the laws of U.S. jurisdictions.

We are a Dutch European public company with limited liability (

Societas Europaea

or

SE

). If we complete our potential redomiciliation, we will be a Belgian European public company with limited liability (

Societas

Europaea

or

SE

). Our corporate affairs are, or will be, governed by our Articles of Association and by the laws governing

companies incorporated in the Netherlands, and if we complete our redomiciliation, by our Belgian Articles of Association and by the laws governing companies incorporated in Belgium, respectively. The

rights of shareholders and the responsibilities of members of our board of directors or if our redomiciliation is completed our Belgian Board may be different from the rights and obligations of

shareholders in companies governed by the laws of U.S. jurisdictions. In the performance of its duties, our board of directors is required by Dutch law to, and the Belgian Board may under Belgian law,

consider the interests of our company, our shareholders, our employees and other stakeholders, in all cases with due observation of the principles of reasonableness and fairness. It is possible that

some of these parties will have interests that are different from, or in addition to, your interests as a shareholder. See "Description of Share Capital—Comparison of Dutch Corporate Law,

our Articles of Association and Board By-Laws and U.S. Corporate Law."

We are not obligated to, and do not comply with, all the best practice provisions of the Dutch Corporate

Governance Code, and we do not expect to comply with all principles and provisions of the Belgian Corporate Governance Code if we complete our potential redomiciliation, which may affect your rights

as a shareholder.

As a Dutch European public company with limited liability (

Societas Europaea

or

SE

), we are subject to the Dutch Corporate Governance Code dated December 8, 2016, which is in force as of the financial

S-20

Table of Contents

year

starting on or after January 1, 2017, or the DCGC. The DCGC contains both principles and best practice provisions for board of directors, management boards, supervisory boards,

shareholders and general meetings of shareholders, financial reporting, auditors, disclosure, compliance and enforcement standards. The DCGC applies to all Dutch companies listed on a regulated

market, including Euronext Brussels. The principles and best practice provisions apply to our board of directors (in relation to role and composition, conflicts of interest and independency

requirements, board committees and remuneration), shareholders and the General Meeting (for example, regarding anti-takeover protection and our obligations to provide information to our shareholders)

and financial reporting (such as external auditor and internal audit requirements). We do not comply with all the best practice provisions of the DCGC. As a Dutch company, we are required to disclose

in our annual report, filed in the Netherlands, whether we comply with the provisions of the DCGC. If we do not comply with the provisions of the DCGC (for example, because of a conflicting Nasdaq

requirement or otherwise), we must list the reasons for any deviation from the DCGC in our annual report. See "Description of Share Capital—Comparison of Dutch Corporate Law, our Articles

of Association and Board By-Laws and U.S. Corporate Law—Dutch Corporate Governance Code."

If

we complete our redomiciliation, as a Belgian European public company with limited liability (

Societas Europaea

or

SE

), we will be subject to the Belgian Corporate Governance Code of March 12, 2009, or the Belgian Corporate Governance Code. The Belgian

Corporate Governance Code contains principles, provisions and guidelines for the management and control of companies. The Belgian Corporate Governance Code applies to all Belgian companies listed on a

regulated market, including Euronext Brussels. If we complete our redomiciliation, the principles, provisions and guidelines will apply to the Belgian Board (in relation to role and composition,

conflicts of interest and independency requirements, board committees and remuneration), our executive management (in relation to role and composition, conflicts of interest and remuneration) and

shareholders and the General Meeting (for example, regarding their role and our obligations to provide information to our shareholders). We do not expect to comply with all the provisions and

guidelines of the Belgian Corporate Governance Code. If we complete our redomiciliation, under the Belgian Corporate Governance Code, as a Belgian company, we will be required to include a corporate

governance statement in our annual report describing whether we comply with all provisions of the Belgian Corporate Governance Code. If we do not comply with the provisions of the Belgian Corporate

Governance Code (for example, because of a conflicting Nasdaq requirement or otherwise), we must explain our reasons for any deviation from the Belgian Corporate Governance Code in this corporate

governance statement. If the Belgian Corporate Governance Code is replaced, these and/or other provisions will apply.

This