Copart, Inc. (NASDAQ: CPRT) today reported financial results for

the quarter and year ended July 31, 2018.

For the three months ended July 31, 2018, revenue, gross profit,

and net income were $449.2 million, $188.4 million, and $109.7

million, respectively. These represent an increase in revenue of

$70.6 million, or 18.7%; an increase in gross profit of $21.0

million, or 12.5%; and an increase in net income of $39.4 million,

or 56.0%, respectively, from the same quarter last year. Fully

diluted earnings per share for the three months were $0.45 compared

to $0.30 last year, an increase of 50.0%.

For the year ended July 31, 2018, revenue, gross profit, and net

income were $1.8 billion, $762.4 million, and $417.9 million,

respectively. These represent an increase in revenue of $357.7

million, or 24.7%; an increase in gross profit of $130.3 million,

or 20.6%; and an increase in net income of $23.6 million, or 6.0%,

respectively, from the same period last year. Fully diluted

earnings per share for the year ended July 31, 2018 were $1.73

compared to $1.66 last year, an increase of 4.2%.

The operating results for the year ended July 31, 2018 were

adversely affected by abnormal costs of $79.7 million incurred as a

result of Hurricane Harvey. These costs included temporary storage

facilities; premiums for subhaulers; labor costs incurred from

overtime; travel and lodging due to the reassignment of employees

to the affected region; and equipment lease expenses to handle the

increased volume, as well as cost of vehicle sales. These costs,

net of the associated revenues of $66.9 million generated a pre-tax

loss of $12.8 million for the year ended July 31, 2018. The

operating results for the year ended July 31, 2018 were also

adversely impacted by the recording of a provisional tax liability

for the Transition Tax of $13.8 million for the deemed repatriation

of foreign earnings and profits under the Tax Cuts and Jobs Act of

2017 and by non-recurring depreciation and amortization charges of

$10.5 million, in the fourth quarter. Certain foreign tax credits

of $1.4 million were made available by incurring the Transition Tax

of $13.8 million, resulting in a net expense of $12.4 million for

the year ended July 31, 2018. This expense was offset by the Act’s

reduction of the federal corporate income tax rate. Because

Copart’s fiscal year includes periods before and after December 22,

2017, the effective date of the Act, during which the U.S. federal

corporate tax rate was 35% and 21%, respectively, our U.S. federal

corporate tax rate for fiscal year 2018 was 26.9%. The operating

results for the year ended July 31, 2018, include the benefit of

this rate reduction. In addition, the non-recurring depreciation

and amortization charges of $10.5 million result from depreciation

related to a combination of construction in progress placed in

service in the fourth quarter of fiscal 2018 and a change in our

estimate of the useful lives for certain fixed assets. The effect

of the non-recurring depreciation, net of income tax benefit of

$11.4 million, is an increase to net income of $0.9 million, as a

result of bonus tax depreciation provided for in the Tax Cuts and

Jobs Act of 2017.

Excluding the impact of income taxes on the deemed repatriation

of foreign earnings, net of deferred tax changes, disposals of

non-operating assets, impairment of long-lived assets, acquisition

related fees and integration charges, reserve for legacy sales tax

liabilities; foreign currency-related gains and losses, certain

income tax benefits and payroll taxes related to accounting for

stock option exercises, non-GAAP fully diluted earnings per share

for the three months ended July 31, 2018 and 2017, were $0.42

and $0.35, respectively. Non-GAAP fully diluted earnings per share

for the year ended July 31, 2018 and 2017, were $1.73 and

$1.29, respectively. A reconciliation of non-GAAP financial

measures to the most directly comparable financial measures

computed in accordance with U.S. generally accepted accounting

principles (GAAP) can be found in the tables attached to this press

release.

On Wednesday, September 19, 2018, at 11 a.m. Eastern time,

Copart will conduct a conference call to discuss the results for

the quarter. The call will be webcast live and can be accessed at

http://stream.conferenceamerica.com/copart091918. A replay of the

call will be available through November 18, 2018 by calling (877)

919-4059. Use confirmation code # 18189145.

About Copart

Copart, Inc., founded in 1982, is a global leader in online

vehicle auctions. Copart’s innovative technology and online auction

platform links sellers to more than 750,000 Members in over 170

countries. Copart offers services to process and sell salvage and

clean title vehicles to dealers, dismantlers, rebuilders,

exporters, and in some cases, to end users. Copart sells vehicles

on behalf of insurance companies, banks, finance companies,

charities, fleet operators, dealers and also sells vehicles sourced

from individual owners. With operations at over 200 locations in 11

countries, Copart has more than 125,000 vehicles available online

every day. Copart currently operates in the United States

(Copart.com), Canada (Copart.ca), the United Kingdom

(Copart.co.uk), Brazil (Copart.com.br), the Republic of Ireland

(Copart.ie), Germany (Copart.de), Finland (AVK.fi), the United Arab

Emirates, Oman and Bahrain (Copartmea.com), and Spain (Copart.es).

For more information, or to become a Member, visit

Copart.com/Register.

Use of Non-GAAP Financial Measures

Included in this release are certain non-GAAP financial

measures, including non-GAAP net income per diluted share, which

exclude the impact of income taxes on the deemed repatriation of

foreign earnings, net of deferred tax changes, disposals of

non-operating assets, impairment of long-lived assets, acquisition

related fees and integration charges, reserve for legacy sales tax

liabilities; foreign currency-related gains and losses, certain

income tax benefits and payroll taxes related to accounting for

stock option exercises. These non-GAAP financial measures do not

represent alternative financial measures under GAAP. In addition,

these non-GAAP financial measures may be different from non-GAAP

financial measures used by other companies. Furthermore, these

non-GAAP financial measures do not reflect a comprehensive view of

Copart’s operations in accordance with GAAP and should only be read

in conjunction with the corresponding GAAP financial measures. This

information constitutes non-GAAP financial measures within the

meaning of Regulation G adopted by the U.S. Securities and Exchange

Commission. Accordingly, Copart has presented herein, and will

present in other information it publishes that contains these

non-GAAP financial measures, a reconciliation of these non-GAAP

financial measures to the most directly comparable GAAP financial

measures.

Copart believes the presentation of non-GAAP net income per

diluted share included in this release in conjunction with the

corresponding GAAP financial measures provides meaningful

information for investors, analysts and management in assessing

Copart’s business trends and financial performance. From a

financial planning and analysis perspective, Copart management

analyzes its operating results with and without the impact of

income taxes on the deemed repatriation of foreign earnings, net of

deferred tax changes, disposals of non-operating assets, impairment

of long-lived assets, acquisition related fees and integration

charges, reserve for legacy sales tax liabilities; foreign

currency-related gains and losses, certain income tax benefits and

payroll taxes related to accounting for stock option exercises.

Cautionary Note About Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of federal securities laws, and these forward-looking

statements are subject to substantial risks and uncertainties.

These forward-looking statements are subject to certain risks,

trends and uncertainties that could cause actual results to differ

materially from those projected or implied by our statements and

comments. For a more complete discussion of the risks that could

affect our business, please review the “Management’s Discussion and

Analysis” and the other risks identified in Copart’s latest Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K, as filed with the Securities and Exchange

Commission. We encourage investors to review these disclosures

carefully. We do not undertake to update any forward-looking

statement that may be made from time to time on our behalf.

Copart, Inc.

Consolidated Statements of

Income

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended July 31,

Twelve Months Ended July 31, 2018

2017 2018 2017 Service revenues and

vehicle sales: Service revenues $ 391,661 $ 336,795 $ 1,578,502 $

1,286,252 Vehicle sales 57,562 41,801 227,193

161,729 Total service revenues and vehicle sales 449,223

378,596 1,805,695 1,447,981 Operating expenses: Yard operations

185,914 163,449 785,768 635,160 Cost of vehicle sales 50,313 35,994

196,461 137,552 Yard depreciation and amortization 23,613 10,839

57,230 39,955 Yard stock-based payment compensation 958 849

3,870 3,286 Gross profit 188,425 167,465

762,366 632,028 General and administrative 42,794 29,818 136,171

116,697 General and administrative depreciation and amortization

4,639 3,029 21,368 17,045 General and administrative stock-based

payment compensation 5,024 4,446 19,351 17,622 Impairment of

long-lived assets 1,131 19,365 1,131 19,365

Total operating expenses 314,386 267,789

1,221,350 986,682 Operating income 134,837 110,807

584,345 461,299 Other (expense) income: Interest expense, net

(3,982 ) (5,485 ) (19,075 ) (22,373 ) Other income (expense), net

1,874 1,057 (2,759 ) 1,174 Total other expense

(2,108 ) (4,428 ) (21,834 ) (21,199 ) Income before income tax

expense 132,729 106,379 562,511 440,100 Income tax expense 22,988

36,010 144,504 45,839 Net income

109,741 70,369 418,007 394,261 Net (loss) income attributable to

noncontrolling interest (7 ) 34 140 34 Net

income attributable to Copart, Inc. $ 109,748 $ 70,335

$ 417,867 $ 394,227 Basic net income

per common share $ 0.47 $ 0.31 $ 1.80 $ 1.72

Weighted average common shares outstanding 232,995

230,286 231,793 228,686 Diluted net

income per common share $ 0.45 $ 0.30 $ 1.73 $

1.66 Diluted weighted average common shares outstanding

244,406 237,634 241,877 237,019

Copart, Inc.

Consolidated Balance Sheets

(In thousands)

(Unaudited)

July 31, 2018 July 31, 2017

ASSETS

Current assets: Cash and cash equivalents $ 274,520 $ 210,100

Accounts receivable, net 351,601 311,846 Vehicle pooling costs and

inventories 51,018 41,281 Income taxes receivable 15,312 6,418

Prepaid expenses and other assets 16,665 17,616 Total

current assets 709,116 587,261 Property and equipment, net

1,163,425 944,056 Intangibles, net 64,892 75,938 Goodwill 337,235

340,243 Deferred income taxes 470 1,287 Other assets 32,560

33,716 Total assets $ 2,307,698 $ 1,982,501

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities: Accounts payable and accrued liabilities $

270,944 $ 208,415 Deferred revenue 4,488 5,019 Income taxes payable

673 6,472 Deferred income taxes — 92 Current portion of revolving

loan facility and capital lease obligations 1,151 82,155

Total current liabilities 277,256 302,153 Deferred income

taxes 19,733 3,192 Income taxes payable 27,277 24,573 Long-term

debt, revolving loan facility, and capital lease obligations, net

of discount 398,747 550,883 Other liabilities 3,586 3,100

Total liabilities 726,599 883,901 Commitments and

contingencies Stockholders’ equity: Preferred stock — — Common

stock 23 23 Additional paid-in capital 526,858 453,349 Accumulated

other comprehensive loss (107,928 ) (100,676 ) Retained earnings

1,162,146 745,370 Noncontrolling interest — 534 Total

stockholders’ equity 1,581,099 1,098,600 Total

liabilities and stockholders’ equity $ 2,307,698 $ 1,982,501

Copart, Inc.

Consolidated Statements of Cash

Flows

(In thousands)

(Unaudited)

Year Ended July 31, 2018

2017

Cash flows from operating

activities:

Net income $ 418,007 $ 394,261 Adjustments to reconcile net income

to net cash provided by operating activities: Depreciation and

amortization, including debt cost 79,040 57,441 Allowance for

doubtful accounts 1,142 187 Impairment of long-lived assets 1,157

19,365 Equity in losses of unconsolidated affiliates 750 671

Stock-based payment compensation 23,221 20,840 Loss on sale of

property and equipment 3,240 184 Deferred income taxes 16,717

19,901 Changes in operating assets and liabilities, net of effects

from acquisitions: Accounts receivable (40,335 ) (38,542 ) Vehicle

pooling costs and inventories (7,312 ) (621 ) Prepaid expenses and

other current assets (776 ) 1,760 Other assets 70 1,085 Accounts

payable and accrued liabilities 53,320 4,269 Deferred revenue (520

) 392 Income taxes receivable (8,916 ) 12,343 Income taxes payable

(3,149 ) (333 ) Other liabilities (587 ) (1,145 ) Net cash provided

by operating activities 535,069 492,058

Cash flows from

investing activities: Purchases of property and equipment,

including acquisitions (296,697 ) (332,990 ) Proceeds from sale of

property and equipment 6,425 765 Proceeds from sale of

majority-owned subsidiary 1,796 — Investment in unconsolidated

affiliate — (3,566 ) Net cash used in investing activities

(288,476 ) (335,791 )

Cash flows from financing

activities: Proceeds from the exercise of stock options 44,459

31,188 Proceeds from the issuance of Employee Stock Purchase Plan

shares 5,853 4,270 Payments for employee stock-based tax

withholdings (1,115 ) (135,433 ) Net (repayments) proceeds on

revolving loan facility (231,000 ) (7,000 ) Distributions to

noncontrolling interest (235 ) — Net cash used in financing

activities (182,038 ) (106,975 ) Effect of foreign currency

translation (135 ) 4,959 Net increase in cash and cash

equivalents 64,420 54,251 Cash and cash equivalents at beginning of

period 210,100 155,849 Cash and cash equivalents at

end of period $ 274,520 $ 210,100

Supplemental

disclosure of cash flow information: Interest paid $ 20,343

$ 23,221 Income taxes paid, net of refunds $ 142,161

$ 14,011

Copart, Inc.

Additional Financial

Information

Reconciliation of GAAP to Non-GAAP

Financial Measures

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended July 31,

Twelve Months Ended July 31, 2018

2017 2018 2017 GAAP net income

attributable to Copart, Inc. $ 109,748 $ 70,335 $ 417,867 $ 394,227

Effect of deemed repatriation of foreign earnings, net of deferred

tax changes (2,870 ) — 8,131 — Effect of disposal of non-operating

assets, net of tax — — 2,994 — Effect of impairment of long-lived

assets, net of tax 916 12,339 916 12,339 Effect of acquisition

related fees and integration charges, net of tax 1,521 1,241 1,521

1,241 Effect of reserve for legacy sales tax liabilities, net of

tax 1,017 — 1,017 — Effect of foreign currency-related (gains)

losses, net of tax (415 ) (585 ) 452 (880 ) Effect of income tax

benefit of ASU 2016-09 adoption, net of tax (1) (11,821 ) (898 )

(21,269 ) (107,647 ) Effect of payroll taxes on certain executive

stock compensation, net of tax 4,514 — 4,514

3,307 Non-GAAP net income attributable to Copart, Inc. $

102,610 $ 82,432 $ 416,143 $ 302,587

GAAP diluted net income per common share $ 0.45 $

0.30 $ 1.73 $ 1.66 Non-GAAP diluted net income

per common share $ 0.42 $ 0.35 $ 1.73 $ 1.29

GAAP diluted weighted average common shares

outstanding 244,406 237,634 241,877 237,019 Effect on common

equivalent shares from ASU 2016-09 adoption(1) (2,586 ) (1,771 )

(646 ) (1,992 ) Non-GAAP diluted weighted average common shares

outstanding 241,820 235,863 241,231 235,027

(1) In March 2016, the FASB issued ASU

No. 2016-09, Improvements to Employee Share-Based Payment

Accounting. Under this standard, all excess tax benefits and tax

deficiencies related to exercises of stock options are recognized

as income tax expense or benefit in the income statement as

discrete items in the reporting period in which they occur. For a

more complete discussion, please review the Company’s Annual Report

on Form 10-K, filed with the Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180919005430/en/

Copart, Inc.Melissa Perry, 972-391-5090Executive Support

Manager, Office of the Chief Financial

Officermelissa.perry@copart.com

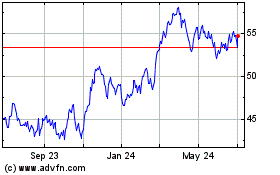

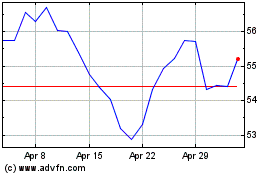

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Apr 2023 to Apr 2024