The US investors surveyed trail all other

countries surveyed in adoption of sustainable investing in this

largest recurring study of High Net Worth Investors, although they

have the highest allocation into sustainable investments

- Significant generation divide among US

investors—72% of young investors have sustainable investments,

compared to only 6% of investors age 65+

- Adoption is low but growing—only 12% of

US investors have sustainable investments, compared to 39%

globally, but investors project an increase of 58% over the next

five years

- US investors who have made the foray

into sustainable investing are fully committed—49% of their

portfolio assets are dedicated to sustainable investments, the

highest of any country

- 51% of US investors surveyed expect

sustainable investment returns to match those of traditional

investments, compared to 50% of investors globally. Almost 1 in 5

US investors (19%) expect sustainable investments to outperform

traditional investments.

- Investors in China, Brazil and the UAE

are the most likely to hold some sustainable investments (60%, 53%

and 53% respectively)

- Confusion continues to hold US

investors back—66% of investors find the terminology around

sustainable investing perplexing, and 79% say gauging impact is

difficult

UBS today launched “Return on values,” the latest edition of its

UBS Investor Watch report. UBS Investor Watch is the world’s

largest recurring global study of High Net Worth Investors

(HNWIs).*

The study reveals stark differences in the sustainable investing

landscape. The US has the lowest rate of adoption at 12%, compared

to 39% of investors globally. China, Brazil and the UAE lead the

charge, with 60%, 53% and 53% of investors respectively indicating

they have sustainable investment holdings.

However, despite lower adoption, sustainable investors in the US

have the highest average allocation, with 49% of their portfolio

assets dedicated to sustainable investments. The average global

allocation is 36%.

“Investors see sustainable investing as the way of the future.

Across all ages, wealth levels and regions, many believe

sustainable investing will become a more mainstream approach over

time,” said Paula Polito, Global Client Strategy Officer, UBS

Global Wealth Management. “Many of the investors surveyed believe

that sustainable investments are wise investments and see no need

to compromise their personal values for financial returns.”

Young investors and those with the greatest wealth lead

momentum behind sustainable investing

While adoption today is low in the US, investors expect

sustainable investing to grow to 19% over the next five years, an

increase of 58% from today’s levels. In fact, almost a third (32%)

of US investors expect sustainable investing to become the “new

normal” in 10 years.

Younger investors and those with the greatest wealth are the

leading adopters of sustainable investing, both globally and in the

US. Seven in ten (72%) young American investors1 invest

sustainably, compared to only 6% of investors age 65+. Among the

ultra-rich,2 40% invest sustainably, compared to 8% of investors

with $1 million to $2 million of investable assets.

Confusion and comfort with their investment approach holds

investors back

The study finds that among non-adopters in the US, 85% are happy

with their existing investment approach, followed by 79% who say

that quantifying the impact of sustainable investments is a major

barrier.

Confusion about terminology is compounding the issue. Two-thirds

of US investors (66%) find the language of sustainable investing

perplexing, and less than a quarter (23%) are very familiar with

the term itself. Similarly, US investors make little distinction

among the three major sustainable investment approaches: exclusion,

integration and impact investing.

In the midst of this confusion, it is clear that advisors have

an important role to play, with sustainable investors listing their

financial advisors as the top influencers in their decision to

invest sustainably, followed by family and friends.

“The opportunity for growth in the US is vast, with young people

and wealthy investors leading the way and momentum growing,” said

Andrew Lee, Americas, Head of Sustainable and Impact Investing at

UBS Global Wealth Management’s Chief Investment Office. “Increasing

education on the benefits and establishing common conventions for

describing and measuring impact will help sustainable investing

become the new normal.”

No tradeoff between personal values and returns

The study shows that few investors expect to sacrifice returns

when investing sustainably. In fact, 70% of US investors believe

the returns from sustainable investments will match or surpass

those from traditional investments. They view sustainable companies

as more responsible, better managed and more forward-thinking—thus,

good investments.

To encourage further adoption of sustainable investing, UBS has

committed to raise at least $5bn in impact investments over five

years, in support of the UN Sustainable Development Goals. At Davos

2018, UBS announced the first 100% sustainable cross-asset

portfolios for private clients, targeting market rates of

risk-adjusted return as well as positive social and environmental

outcomes.

__________________________________

1 Aged 18 - 34 years. 2 With at least $50 million in investable

assets.

The key conclusions from all 10 markets can be found on the

main UBS Investor Watch website:

www.ubs.com/investorwatch

Notes to Editors:

About the research

* The cited research was conducted among more than 5,300

millionaires with at least $1 million in investable assets

(excluding property). The global sample was split across 10

markets: Brazil, China, Germany, Hong Kong, Italy, Singapore,

Switzerland, UAE, the UK and the US. The research was conducted

between June 2018 and August 2018.

About UBS

UBS provides financial advice and solutions to wealthy,

institutional and corporate clients worldwide, as well as private

clients in Switzerland. UBS' strategy is centered on our leading

global wealth management business and our premier universal bank in

Switzerland, enhanced by Asset Management and the Investment Bank.

The bank focuses on businesses that have a strong competitive

position in their targeted markets, are capital efficient, and have

an attractive long-term structural growth or profitability

outlook.

UBS is present in all major financial centers worldwide. It has

offices in 52 countries, with about 34% of its employees working in

the Americas, 34% in Switzerland, 18% in the rest of Europe, the

Middle East and Africa and 14% in Asia Pacific. UBS Group AG

employs approximately 61,000 people around the world. Its shares

are listed on the SIX Swiss Exchange and the New York Stock

Exchange (NYSE).

About UBS Global Wealth Management

As the world’s largest wealth manager, UBS Global Wealth

Management provides comprehensive advice, solutions and services to

wealthy families and individuals around the world. Clients who work

with UBS benefit from a fully integrated set of wealth management

capabilities and expertise, including wealth planning, investment

management, capital markets, banking, lending and institutional and

corporate financial advice.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180919005118/en/

UBSMaya DillonMedia Relations, UBS Global Wealth Management,

Americas212-713-3130 / 917-615-7094maya.dillon@ubs.com

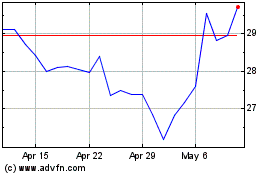

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

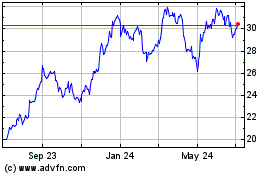

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024